By David Benoit

ROSELAND, N.J. -- William Ackman lost his bid for three seats on

the board of Automatic Data Processing Inc., a resounding rebuke of

the struggling activist investor as shareholders sided with

management at the human-resources software company.

ADP investors on Tuesday re-elected the entire 10-person board

at its annual meeting in Roseland, N.J., with Mr. Ackman winning

less than 25% of the shares that were voted, ADP said. The tally

gives the company room to continue on its path of improving its

margins and technology, and it deals another blow to a battered Mr.

Ackman, who had sought a quicker pace of improvement.

"We came in peace," Mr. Ackman said after the defeat. "The point

I would like to make is we believe it's a very significant amount

of shareholder support."

But ADP Chief Executive Carlos Rodriguez disagreed, closing the

meeting with a parting shot from the stage:

"Bill...despite your characterization of the result as close,

what I was told was this was an 'ass-whooping,'" he said.

For Mr. Ackman, the magnitude of Tuesday's loss raises new

questions about his ability to win support during a period of

turmoil for his fund, which has struggled in recent years and

suffered a $4 billion loss after a bad bet on Valeant

Pharmaceuticals International Inc.

Mr. Ackman's Pershing Square Capital Management LP has

underperformed for nearly three years, largely because of the

bruising loss on Valeant. Its main fund has lost 24% since 2014,

compared with a one-third climb in the S&P 500. The fund is

roughly flat this year through October, while the S&P 500 rose

17%, including dividends. He also recently restructured his

five-year bet against Herbalife Ltd., limiting potential losses as

his position had continued to lose money.

Mr. Ackman points instead to his long-term record, saying

Pershing Square has returned more than 500% since its January 2004

start, compared with the S&P 500's roughly 200%.

In Tuesday's vote, large ADP shareholders Vanguard Group and

State Street Global Advisors threw their weight behind the company,

according to people familiar with the matter. But BlackRock Inc.,

ADP's second-biggest investor, voted its shares in favor of Mr.

Ackman, a key vote of confidence for him, the people said.

Several investors, including one in the top 10, had told The

Wall Street Journal that they believed ADP needed to improve but

also trusted management and Mr. Rodriguez to execute.

Mr. Ackman's defeat Tuesday was worse than in a typical proxy

fight where the activist lost, according to Proxy Insight. ADP's

margin of victory was higher than 30 percentage points, compared

with an average management win of 23 percentage points in six

similar votes this year.

ADP is the third major company this year to beat back an

activist, along with General Motors Co. and Procter & Gamble

Co., although P&G's result last month was so close that it is

in dispute. While activists have continued to shake up giant

companies through brokered settlements, the companies have won

high-profile fights at the polls, reaffirming to some that a

company whose stock hasn't plunged and which has a set plan to

improve can win some time with shareholders.

The ADP fight has been a heated one between Mr. Ackman, one of

Wall Street's most powerful and polarizing investors, and Mr.

Rodriguez. Mr. Ackman had said the company fell behind

technology-heavy startups and needed to improve its margins. Mr.

Rodriguez countered that ADP was already improving technology and

was on a path to improve margins.

In an interview after the meeting, Mr. Rodriguez continued on

the offensive. He admitted he had lost his cool with his closing

comment, but he said Mr. Ackman's campaign had been insulting to

his employees and he rejected the idea that management was under

any more pressure than normal.

"Frankly what Pershing Square and Bill Ackman have to say are a

very small part of the pressure on my day-to-day life," Mr.

Rodriguez said. "Yes, this battle's over. We won."

Mr. Ackman said it wasn't over and that the CEO's comment wasn't

respectful of ADP shareholders. He also questioned whether Mr.

Rodriguez was dismissive of sizable votes, including

BlackRock's.

"We are going to hold them accountable," Mr. Ackman said,

raising the likelihood of further tension, particularly if ADP

slips at all with the promises it made. "We are rooting for ADP."

He said he would be judged as an investor on the stock performance,

not on whether he won this proxy fight.

The two sides even argued about the final tally of votes, a

dispute that echoed several earlier dust-ups the companies had over

numbers. Mr. Ackman said the tally was closer than it appeared,

citing that he won about 81 million votes while ADP director Eric

Fast, who received the lowest tally on the board, had gotten about

180 million. If the contest was just between those two, Mr. Ackman

said, he would only have lost 69% to 31%. A total of about 326

million shares were cast in the election.

Mr. Ackman said his campaign was hurt by Institutional

Shareholder Services Inc.'s recommendation that shareholders

withhold votes from Mr. Fast -- a move that prevented them from

voting in favor of Mr. Ackman instead. About 60 million shares were

withheld from Mr. Fast. Even if the those shares were cast for Mr.

Ackman, he still would have lost, and it is unclear how much impact

ISS had on voters.

Even Mr. Ackman's efforts to address the meeting didn't go

smoothly. He sat in the middle of the pack in the meeting in the

basement at ADP's headquarters and was offered a chance to comment

toward the start of the meeting. He stood up and said he had hoped

to speak at the end instead. He was told no. He said he was

"delighted to be here" and sat down.

At the end of the meeting, the sides quickly debated before he

was given a chance to speak, with Mr. Rodriguez winning a laugh by

forcing Mr. Ackman to form his remark as a question in order to

follow meeting procedures.

ADP's stock has performed well compared with the S&P 500,

and some had questioned why Mr. Ackman had sought to target it in

the first place. ADP shares rose 0.6% to $112.02 in afternoon

trading.

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

November 07, 2017 14:27 ET (19:27 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

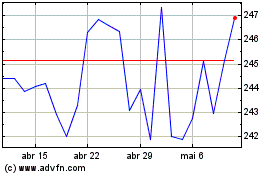

Automatic Data Processing (NASDAQ:ADP)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Automatic Data Processing (NASDAQ:ADP)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024