Amended Current Report Filing (8-k/a)

08 Junho 2021 - 6:28PM

Edgar (US Regulatory)

0000353184trueATM Agreement00003531842021-05-142021-05-140000353184airt:AIRTFundingMember2021-05-142021-05-140000353184us-gaap:CommonStockMember2021-05-142021-05-140000353184airt:CumulativeCapitalSecuritiesMember2021-05-142021-05-140000353184us-gaap:WarrantMember2021-05-142021-05-14

______________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________________________________________________________________

FORM 8-K/A

______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 14, 2021

______________________________________________________________________________

AIR T, INC.

AIR T FUNDING

(Exact Name of Registrant as Specified in Charter)

______________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35476

001-38928

|

|

52-1206400

83-6651478

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

5930 Balsom Ridge Road

Denver, North Carolina 28037

(Address of Principal Executive Offices, and Zip Code)

________________(828) 464-8741__________________

Registrant’s Telephone Number, Including Area Code

Not applicable___

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

AIRT

|

NASDAQ Global Market

|

|

Alpha Income Preferred Securities (also referred to as 8% Cumulative Capital Securities) (“AIP”)

|

AIRTP

|

NASDAQ Global Market

|

|

Warrant to purchase AIP

|

AIRTW

|

NASDAQ Global Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

|

|

|

|

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

|

|

☐

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 1.01 Entry into a Material Definitive Agreement

On May 14, 2021, Air T, Inc. (the “Company”) and Air T Funding (the “Trust”) filed a Form 8-K reporting execution of an At the Market Offering Agreement (the “ATM Agreement”) with Ascendiant Capital Markets, LLC (the “sales agent” or “Ascendiant”), pursuant to which the Trust may sell and issue its Alpha Income Preferred Securities having an aggregate offering price of up to $8,000,000 (the “Capital Securities”) from time to time through Ascendiant, as the Trust’s sales agent (the “ATM Offering”). The Form 8-K indicated that the legal opinion relating to the Capital Securities being offered pursuant to the ATM Agreement would be filed by amendment to the Current Report on Form 8-K. The legal opinion is filed as Exhibit 5.1 attached hereto.

This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy the securities discussed herein, nor shall there be any offer, solicitation, or sale of the securities in any state in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

Item 9.01 Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

5.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 8, 2021

AIR T, INC.

By: /s/ Brian Ochocki

Brian Ochocki, Chief Financial Officer

21923008v1

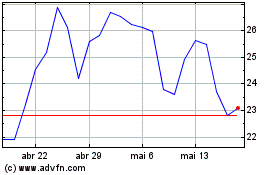

Air T (NASDAQ:AIRT)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Air T (NASDAQ:AIRT)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024