AlTi continues to execute strategy to expand

scale and reach of its global ultra-high-net-worth (“UHNW”) wealth

management business in existing and new markets.

AlTi Global, Inc. (NASDAQ: ALTI) (“AlTi” or the “Company”), a

leading independent global wealth manager with over $70 billion in

combined assets, announces the acquisition of Envoi, LLC (“Envoi”),

a leading family office focused on multi-generational family wealth

with assets under management (AUM) of approximately $3.0

billion.

This follows AlTi’s recent acquisition of US-based independent

advisory firm East End Advisors, as AlTi accelerates its strategy

to become the leading global independent wealth management platform

for the UHNW segment, with targeted expertise in alternatives.

In line with this strategic goal, AlTi is using funding of up to

$450 million from Allianz X and Constellation Wealth Capital to

fund its mergers and acquisitions pipeline and organic growth

activities.

Based in Minneapolis, Minnesota, Envoi is a well-established

management-owned family office with a service offering and client

base that is strongly aligned with AlTi’s. This follows AlTi’s

recent growth in Dallas, with the hiring of Richard Joyner as Head

of Central US, to lead expansion in this key US region.

Michael Tiedemann, Chief Executive Officer of AlTi Tiedemann

Global, said:

“I am delighted to announce that Envoi is joining AlTi as we

continue to execute our strategy to become the destination of

choice for families, family offices and foundations looking for

best-in-class wealth management solutions and services. Envoi’s

Principals have worked together for decades and have built a firm

with similar values to AlTi, catering to entrepreneurial and

multi-generational families looking to preserve, safeguard and grow

their wealth.”

Ryan Steensland, Principal of Envoi, said:

“As we contemplated the next phase in our evolution, AlTi

Tiedemann Global emerged as the best partner to deliver a permanent

family office solution to our 35 client families. They share our

commitment to represent the best interests of clients and seek

excellence in providing customized and innovative strategies to

grow wealth. Combining with a firm of AlTi Tiedemann’s global

stature will enhance opportunities for our Minneapolis-based staff

and support our commitment to growing our Midwest presence.”

The transaction is subject to customary closing conditions and

is expected to close early in the third quarter.

Advisors

Houlihan Lokey, Inc. is serving as AlTi’s financial and tax

diligence advisor. Seward and Kissel LLP is acting as AlTi’s legal

advisor. Piper Sandler & Co. and Stinson LLP are serving as

financial advisor and legal advisor, respectively, to Envoi.

About AlTi

AlTi is a leading independent global wealth and alternatives

manager providing entrepreneurs, multi-generational families,

institutions, and emerging next-generation leaders with fiduciary

capabilities as well as alternative investment strategies and

advisory services. AlTi’s comprehensive offering is underscored by

a commitment to impact or values-aligned investing. The firm

currently manages or advises on over $70 billion in combined assets

and has an expansive network with approximately 480 professionals

across three continents. For more information, please visit us at

www.alti-global.com.

Forward-Looking Statements

Some of the statements in this press release may constitute

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 (the “Securities Act”), Section 21E of

the Securities Exchange Act of 1934 and the Private Securities

Litigation Reform Act of 1995. All statements other than statements

of historical fact are forward-looking. Words such as “anticipate,”

“believe,” “continue,” “estimate,” “expect,” “future,” “intend,”

“may,” “plan” and “will” and similar expressions identify

forward-looking statements. Forward-looking statements reflect

management’s current plans, estimates and expectations and are

inherently uncertain. The inclusion of any forward-looking

information in this press release should not be regarded as a

representation that the future plans, estimates or expectations

contemplated will be achieved. Forward-looking statements are

subject to various risks, uncertainties and assumptions. Important

factors that could cause actual results to differ materially from

those in forward-looking statements include, but are not limited

to, global and domestic market and business conditions, successful

execution of business and growth strategies and regulatory factors

relevant to our business, as well as assumptions relating to our

operations, financial results, financial condition, business

prospects, growth strategy and liquidity and the risks and

uncertainties described in greater detail under “Risk Factors”

included in AlTi’s registration statement on Form 10-K filed March

22, 2024, and in the subsequent reports filed with the Securities

and Exchange Commission (the “SEC”), as such factors may be updated

from time to time. We undertake no obligation to revise or update

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by law.

Additional Information and Where to Find It

The Company has filed a preliminary proxy statement on Schedule

14A with the SEC and intends to file a definitive proxy statement

for the 2024 annual meeting of stockholders (the “definitive proxy

statement”) and other relevant materials in connection with the

investment transactions described in this presentation and the

Company’s solicitation of proxies for use at either the 2024 annual

meeting of stockholders of the Company (“stockholders”) or a

special meeting of stockholders, or at any adjournment or

postponement thereof, to vote in favor of approval of amendments to

the Company’s amended and restated certificate of incorporation and

the issuance of an amount of shares of Class A Common Stock to

Allianz equal to 20% or more of the pre-transactions issued and

outstanding shares of Class A Common Stock and Class B Common

Stock, taken together and, in the case of the 2024 annual meeting

of stockholders, to vote on any other matters that shall be voted

upon at the Company’s 2024 annual meeting of stockholders, such as

the election of directors. The definitive proxy statement will be

mailed to the stockholders of record as of May 1, 2024 (the “record

date”). Before making any voting or investment decision with

respect to the transactions, investors and stockholders are urged

to read the preliminary proxy statement and, when available,

definitive proxy statement and the other relevant materials when

they become available because they will contain important

information about the transactions. The preliminary proxy

statement, definitive proxy statement and other relevant materials

(when they become available), and any other documents filed by the

Company with the SEC, may be obtained free of charge at the SEC’s

website at www.sec.gov. In addition, investors and stockholders of

the Company may obtain free copies of the documents filed with the

SEC from

https://ir.alti-global.com/financial-information/sec-filings.

The Company and its executive officers and directors may be

deemed to be participants in the solicitation of proxies in

connection with the transactions. Information about those executive

officers and directors of the Company and their ownership of the

Company’s common stock and other equity securities is set forth in

the Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, which was filed with the SEC on March 22, 2024,

and amended by the Form 10-K/A filed with the SEC on April 5, 2024.

Investors and security holders may obtain additional information

regarding direct and indirect interests of the Company and its

executive officers and directors in the transactions by reading the

definitive proxy statement and prospectus when it becomes

available.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509011198/en/

Investor Relations: Lily

Arteaga, Head of Investor Relations

investor@alti-global.com

Media Relations: Alex Jorgensen,

pro-alti@prosek.com

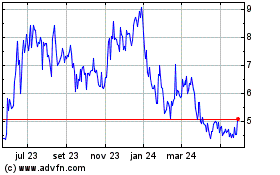

AITi Global (NASDAQ:ALTI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

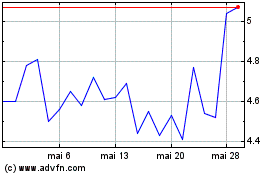

AITi Global (NASDAQ:ALTI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025