AlTi Global, Inc. (NASDAQ: ALTI) (“AlTi” or the “Company”), a

leading independent global wealth and alternatives manager with

over $70 billion in combined assets, today announced the closing of

a strategic investment of up to $300 million by Allianz X. Allianz

X, an investment arm of Allianz SE (XETRA: ALV), one of the world’s

leading insurers and asset managers with around 125 million private

and corporate customers in almost 70 countries, has made an

investment of $250 million, through one of its affiliates, and has

the option to invest up to an additional $50 million.

This investment is part of the previously announced strategic

investment of up to $450 million from Allianz X and Constellation

Wealth Capital (“CWC”). The $150 million investment from CWC, an

alternative asset management platform specializing in making

tailored investments in well-positioned wealth management firms,

closed earlier this year and was used to fund the acquisitions of

East End Advisors and Envoi, LLC in April and July,

respectively.

AlTi expects to use the capital principally to continue to fund

its mergers and acquisitions pipeline and organic growth

activities. This will expand the scale and reach of AlTi’s global

ultra-high-net-worth wealth management and strategic alternatives

business in existing and new markets, leveraging the industry

expertise and relationships of both Allianz and CWC. The

partnership with Allianz offers opportunities to provide additional

solutions to service both companies’ clients more holistically.

In connection with the closing of the investment, Andreas

Wimmer, Member of Board of Management of Allianz SE, Asset

Management, US Life Insurance, and Nazim Cetin, Chief Executive

Officer of Allianz X, will be appointed to the AlTi board.

Under the terms of the agreement AlTi sold 140,000 shares of

newly created Series A Cumulative Convertible Preferred Stock and

19,318,580.96 shares of AlTi’s Class A common stock, for a purchase

price equal to $250 million, and issued warrants for 5,000,000

shares of Class A common stock. Further details are included in the

Company’s current report on Form 8-K filed with the Securities and

Exchange Commission.

About AlTi

AlTi Tiedemann Global is a leading independent global wealth

manager providing entrepreneurs, multi-generational families,

institutions, and emerging next-generation leaders with fiduciary

capabilities as well as alternative investment strategies and

advisory services. AlTi’s comprehensive offering is underscored by

a commitment to impact or values-aligned investing. The firm

currently manages or advises on over $70 billion in combined assets

and has an expansive network with approximately 400 professionals

across three continents. For more information, please visit us at

www.Alti-global.com.

About Allianz X

Allianz X invests in innovative growth companies in ecosystems

relevant to insurance and asset management. It has a global

portfolio of over 25 companies and assets under management of more

than 1.7 billion euros. Allianz X has counted 12 unicorns among its

portfolio so far. The heart, brains, and drive behind it all are a

talented team of around 40 people in Munich and New York.

On behalf of leading global insurer and asset manager Allianz

Group, Allianz X provides an interface between Allianz companies

and the broader ecosystem, enabling collaborative partnerships in

insurtech, fintech, wealth, and beyond.

As an investor, Allianz X supports growth companies to take the

next bold steps and realize their full potential.

Keep up with the latest at Allianz X on Medium, LinkedIn, and X

(formerly Twitter).

About Allianz

The Allianz Group is one of the world's leading insurers and

asset managers with around 125 million* private and corporate

customers in nearly 70 countries. Allianz customers benefit from a

broad range of personal and corporate insurance services, ranging

from property, life and health insurance to assistance services to

credit insurance and global business insurance. Allianz is one of

the world’s largest investors, managing around 746 billion euros**

on behalf of its insurance customers. Furthermore, our asset

managers PIMCO and Allianz Global Investors manage about 1.8

trillion euros** of third-party assets. Thanks to our systematic

integration of ecological and social criteria in our business

processes and investment decisions, we are among the leaders in the

insurance industry in the Dow Jones Sustainability Index. In 2023,

over 157,000 employees achieved total business volume of 161.7

billion euros and an operating profit of 14.7 billion euros for the

group.

* Including non-consolidated entities with Allianz customers. **

As of March 31, 2024

Forward-Looking Statements

Some of the statements in this press release may constitute

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 (the “Securities Act”), Section 21E of

the Securities Exchange Act of 1934 and the Private Securities

Litigation Reform Act of 1995. All statements other than statements

of historical fact are forward-looking. Words such as “anticipate,”

“believe,” “continue,” “estimate,” “expect,” “future,” “intend,”

“may,” “plan” and “will” and similar expressions identify

forward-looking statements. Forward-looking statements reflect

management’s current plans, estimates and expectations and are

inherently uncertain. The inclusion of any forward-looking

information in this press release should not be regarded as a

representation that the future plans, estimates or expectations

contemplated will be achieved. Forward-looking statements are

subject to various risks, uncertainties and assumptions. Important

factors that could cause actual results to differ materially from

those in forward-looking statements include, but are not limited

to, global and domestic market and business conditions, successful

execution of business and growth strategies and regulatory factors

relevant to our business, as well as assumptions relating to our

operations, financial results, financial condition, business

prospects, growth strategy and liquidity and the risks and

uncertainties described in greater detail under “Risk Factors”

included in AlTi’s registration statement on Form 10-K filed March

22, 2024, as amended on April 5, 2024, and in the subsequent

reports filed with the SEC, as such factors may be updated from

time to time. We undertake no obligation to revise or update any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731842155/en/

AlTi Global Investor Relations: Lily Arteaga, Head

of Investor Relations, investor@alti-global.com AlTi Global

Media Relations: Alex Jorgensen, pro-alti@prosek.com Allianz

X Media Relations: Gregor Wills, Head of PR &

Communications, gregor.wills@allianz.com

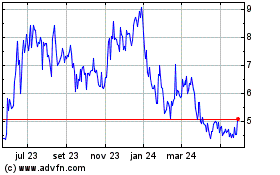

AITi Global (NASDAQ:ALTI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

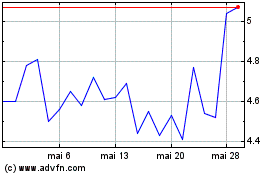

AITi Global (NASDAQ:ALTI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024