Altisource Announces Pricing of $17.5 Million Public Offering of Common Stock

08 Setembro 2023 - 7:59AM

Altisource Portfolio Solutions S.A. (“Altisource” or the “Company”)

(NASDAQ: ASPS), a leading provider and marketplace for the real

estate and mortgage industries, today announced the pricing of an

underwritten public offering of 4,861,111 shares of its common

stock at a price to the public of $3.60 per share. The gross

proceeds of the offering to Altisource are expected to be

approximately $17.5 million, before deducting the underwriting

discounts and commissions and other estimated offering expenses. In

addition, the Company granted the underwriters a thirty-day option

to purchase up to an additional 729,166 shares of common stock at

the public offering price, less underwriting discounts and

commissions. All of the shares of common stock in the offering are

being sold by Altisource.

B. Riley Securities is acting as the sole

book-running manager for the offering.

Altisource intends to use the net proceeds from

the offering for general corporate purposes, including repayment of

$10 million of indebtedness under its credit agreement. The

offering is expected to close on or about September 12, 2023,

subject to the satisfaction of customary closing conditions.

The securities described above are being offered

by the Company pursuant to an effective shelf registration

statement on Form S-3 (File No. 333-268761) initially filed with

the Securities and Exchange Commission (“SEC”) on December 12, 2022

and declared effective by the SEC on January 4, 2023. The

securities may be offered by means of a prospectus. A final

prospectus supplement and the accompanying prospectus relating to

and describing the offering will be filed with the SEC. Electronic

copies of the final prospectus supplement and the accompanying

prospectus may be obtained by vising the SEC’s website at

www.sec.gov or by contacting B. Riley Securities, 1300 17th Street

North, Suite 1300, Arlington, VA 22209 or by telephone at (703)

312-9580 or by email at prospectuses@brileyfin.com.

Disclaimer

This press release does not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

Forward-Looking Statements

This press release contains forward-looking

statements that involve a number of risks and uncertainties. These

forward-looking statements include all statements that are not

historical fact, including statements that relate to, among other

things, future events or our future performance or financial

condition. These statements may be identified by words such as

“anticipate,” “intend,” “expect,” “may,” “could,” “should,”

“would,” “plan,” “estimate,” “seek,” “believe,” “potential” or

“continue” or the negative of these terms and comparable

terminology. Such statements are based on expectations as to the

future and are not statements of historical fact. Furthermore,

forward-looking statements are not guarantees of future performance

and involve a number of assumptions, risks and uncertainties that

could cause actual results to differ materially. Important factors

that could cause actual results to differ materially from those

suggested by the forward-looking statements include, but are not

limited to, the risks discussed in Item 1A of Part I “Risk Factors”

in our Form 10-K filing with the Securities and Exchange

Commission, as the same may be updated from time to time in our

Form 10-Q filings. We caution you not to place undue reliance on

these forward-looking statements which reflect our view only as of

the date of this report. We are under no obligation (and expressly

disclaim any obligation) to update or alter any forward-looking

statements contained herein to reflect any change in our

expectations with regard thereto or change in events, conditions or

circumstances on which any such statement is based. The risks and

uncertainties to which forward-looking statements are subject

include, but are not limited to, risks related to the COVID-19

pandemic, customer concentration, the timing of the anticipated

increase in default related referrals following the expiration of

foreclosure and eviction moratoriums and forbearance programs, the

timing of the expiration of such moratoriums and programs, and any

other delays occasioned by government, investor or servicer

actions, the use and success of our products and services, our

ability to retain existing customers and attract new customers and

the potential for expansion or changes in our customer

relationships, technology disruptions, our compliance with

applicable data requirements, our use of third party vendors and

contractors, our ability to effectively manage potential conflicts

of interest, macro-economic and industry specific conditions, our

ability to effectively manage our regulatory and contractual

obligations, the adequacy of our financial resources, including our

sources of liquidity and ability to repay borrowings and comply

with our credit agreements, including the financial and other

covenants contained therein, as well as Altisource’s ability to

retain key executives or employees, behavior of customers,

suppliers and/or competitors, technological developments,

governmental regulations, taxes and policies. The financial

projections and scenarios contained in this press release are

expressly qualified as forward-looking statements and, as with

other forward-looking statements, should not be unduly relied upon.

We undertake no obligation to update these statements, scenarios

and projections as a result of a change in circumstances, new

information or future events.

About Altisource

Altisource Portfolio Solutions S.A. is an

integrated service provider and marketplace for the real estate and

mortgage industries. Combining operational excellence with a suite

of innovative services and technologies, Altisource helps solve the

demands of the ever-changing markets we serve. Additional

information is available at www.altisource.com.

| FOR FURTHER

INFORMATION CONTACT: |

| |

| Michelle D. Esterman |

| Chief Financial Officer |

| T: (770) 612-7007 |

|

E: Michelle.Esterman@altisource.com |

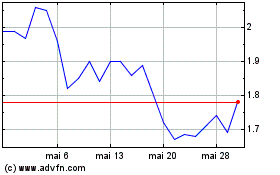

Altisource Portfolio Sol... (NASDAQ:ASPS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Altisource Portfolio Sol... (NASDAQ:ASPS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024