Altisource Portfolio Solutions S.A. (“Altisource” or the “Company”)

(NASDAQ: ASPS), a leading provider and marketplace for the real

estate and mortgage industries, today reported financial results

for the third quarter 2023.

“I am pleased with our third quarter

performance. We generated $874 thousand of Adjusted

EBITDA(2), a $4.4 million improvement over the second quarter of

2023 and a $7.3 million improvement over the same quarter in

2022. For the first nine months of 2023, we improved Adjusted

EBITDA by $16.1 million compared to the same period last

year. We also generated $18.4 million in net proceeds from

the September sale of equity and used $10 million of the proceeds

to reduce the principal balance of our term loan. As a

result of the debt reduction, we eliminated 966,038 penny warrants,

can exercise an option to extend the maturity date of our term loan

and revolver by one year to April 2026(4), and estimate we will

save approximately $3.4 million per year in interest expense(5),”

said Chairman and Chief Executive Officer William B. Shepro.

Mr. Shepro further commented, “We are

positioning Altisource to take advantage of what we see as

significant potential opportunities with existing and new customers

in both of our segments over the coming years as the default market

continues to normalize and we gain traction with our newer

solutions that strengthen loan originators’ performance. Our sales

pipeline and wins remain strong, and we are aggressively managing

our expenses. We believe the strength of our sales wins and

pipeline, cost savings initiatives, normalization of the default

market and increasing consumer stress, position Altisource for

positive adjusted EBITDA in the fourth quarter and full year and

attractive growth as we look to 2024 with potential upside if

mortgage delinquency rates rise.”

Third Quarter

2023

Highlights(1)

Corporate and Financial:

- Third quarter

Adjusted earnings before interest, tax, depreciation and

amortization (“EBITDA”)(2) of $0.9 million and year-to-date

September 2023 Adjusted EBITDA(2) of $(1.1) million was $7.3

million and $16.1 million, respectively, better than the same

periods in 2022

- Generated $18.4

million in net proceeds from the September sale of equity and used

$10 million of the proceeds to reduce the principal balance of our

term loans

- Ended the third

quarter 2023 with $36.6 million of cash and cash equivalents and

$15.0 million available under a revolving credit facility

- Ended the third

quarter 2023 with $185.3 million of net debt(2)

- In July 2023,

the Company began to implement a company-wide cost reduction plan

which is estimated to reduce annual cash operating expenses by

$13.5 million once complete, which is estimated to be the second

half of 2024. The Company believes it is on track to achieve the

plan with September 2023 adjusted compensation costs approximately

$0.9 million ($10.5 million annualized) lower than the average

second quarter costs

Business and Industry:

- Industrywide

foreclosure initiations were 10% higher for the three months ended

September 30, 2023 and 7% lower for the nine months ended September

30, 2023 compared to the same periods in 2022 (and 28% and 30%

lower than the same pre-COVID-19 periods in 2019)(3)

- Industrywide

foreclosure sales were 8% lower for the three months ended

September 30, 2023 and 11% higher for the nine months ended

September 30, 2023 compared to the same periods in 2022 (although

still 46% and 46% lower than the same pre-COVID-19 periods in

2019)(3)

- Industrywide

early-stage mortgage delinquencies (30-days late) increased by 9.4%

and borrowers who’ve missed two payments (60-days past due)

increased by 10.7% in September 2023 compared to June 2023(3)

- The weighted

average sales pipeline in the Servicer and Real Estate segment

represents $23 million to $28 million of estimated annual revenue

on a stabilized basis based upon our forecasted probability of

closing

- The weighted

average sales pipeline in the Origination segment represents $18

million to $23 million of estimated annual revenue on a stabilized

basis based upon our forecasted probability of closing

- The Servicer and

Real Estate segment and Origination segment had sales wins which we

estimate represent $15.3 million and $1.7 million,

respectively, of annualized revenue on a stabilized basis

- In July 2023,

the Servicer and Real Estate segment won business from a new

reverse mortgage servicer customer that we estimate will generate

$12.8 million in annual revenue and $3 million to $5 million per

year in Adjusted EBITDA across the default solutions; referrals

began in the third quarter of 2023 with revenue and earnings

stabilization anticipated by the middle of 2024, if not sooner

Third Quarter

2023 Financial Results

- Service revenue of $34.1

million

- Loss before income taxes and

non-controlling interests of $(10.9) million

- Net loss attributable to Altisource

of $(11.3) million

- Adjusted

EBITDA(2) of $0.9 million

Third Quarter

2023 Results Compared to the

Third Quarter 2022

(unaudited):

| (in thousands, except per

share data) |

Third Quarter 2023 |

|

Third Quarter 2022 |

|

% Change |

|

Year-to-Date September 30, 2023 |

|

Year-to-Date September 30, 2022 |

|

% Change |

|

Service revenue |

$ |

34,112 |

|

|

$ |

36,290 |

|

|

(6 |

) |

|

$ |

104,356 |

|

|

$ |

111,691 |

|

|

(7 |

) |

| Loss from operations |

|

(3,545 |

) |

|

|

(10,563 |

) |

|

66 |

|

|

|

(13,944 |

) |

|

|

(29,349 |

) |

|

52 |

|

| Adjusted operating

loss(2) |

|

(1,954 |

) |

|

|

(7,422 |

) |

|

74 |

|

|

|

(2,013 |

) |

|

|

(20,514 |

) |

|

90 |

|

| Loss before income taxes and

non-controlling interests |

|

(10,862 |

) |

|

|

(14,453 |

) |

|

25 |

|

|

|

(40,398 |

) |

|

|

(39,396 |

) |

|

(3 |

) |

| Pretax loss attributable to

Altisource(2) |

|

(10,924 |

) |

|

|

(14,586 |

) |

|

25 |

|

|

|

(40,553 |

) |

|

|

(39,864 |

) |

|

(2 |

) |

| Adjusted pretax loss

attributable to Altisource(2) |

|

(9,333 |

) |

|

|

(11,445 |

) |

|

18 |

|

|

|

(28,622 |

) |

|

|

(31,029 |

) |

|

8 |

|

| Adjusted EBITDA(2) |

|

874 |

|

|

|

(6,454 |

) |

|

114 |

|

|

|

(1,146 |

) |

|

|

(17,208 |

) |

|

93 |

|

| Net loss attributable to

Altisource |

|

(11,342 |

) |

|

|

(14,389 |

) |

|

21 |

|

|

|

(43,139 |

) |

|

|

(42,074 |

) |

|

(3 |

) |

| Adjusted net loss attributable

to Altisource(2) |

|

(9,838 |

) |

|

|

(11,303 |

) |

|

13 |

|

|

|

(31,066 |

) |

|

|

(31,823 |

) |

|

2 |

|

| Diluted loss per share |

|

(0.51 |

) |

|

|

(0.89 |

) |

|

43 |

|

|

|

(2.10 |

) |

|

|

(2.62 |

) |

|

20 |

|

| Adjusted diluted loss per

share(2) |

|

(0.44 |

) |

|

|

(0.70 |

) |

|

37 |

|

|

|

(1.51 |

) |

|

|

(1.98 |

) |

|

24 |

|

| Net cash used in operating

activities |

|

(6,655 |

) |

|

|

(6,509 |

) |

|

(2 |

) |

|

|

(17,595 |

) |

|

|

(32,293 |

) |

|

46 |

|

| Net cash used in operating

activities less additions to premises and equipment(2) |

|

(6,655 |

) |

|

|

(6,738 |

) |

|

1 |

|

|

|

(17,595 |

) |

|

|

(33,156 |

) |

|

47 |

|

- Third quarter and

year-to-date September 30, 2023 loss before income taxes and

non-controlling interests includes $0.1 million and $3.4 million,

respectively, of debt amendment costs (no comparative amount for

the third quarter and year-to-date 2022). Third quarter and

year-to-date September 30, 2023 loss before income taxes and

non-controlling interests includes $2.2 million and $1.1 million,

respectively, of other income related to the change in fair value

of warrant liability (no comparative amount for the third quarter

and year-to-date 2022)

________________________

(1) Applies to 2023

unless otherwise indicated(2) This is a non-GAAP measure that is

defined and reconciled to the corresponding GAAP measure herein(3)

Based on data from Black Knight’s Mortgage Monitor and First Look

reports with data through September 2023(4) Such extension is (1)

subject to the representations and warranties being true and

correct as of such date and there being no default, or event of

default, being in existence as of such date and (2) conditioned

upon the Company’s payment of a 2% PIK extension fee on or before

April 30, 2025(5) This estimate is based on interest rates in

effect during the third quarter of 2023

Forward-Looking Statements

This press release contains forward-looking

statements that involve a number of risks and uncertainties. These

forward-looking statements include all statements that are not

historical fact, including statements that relate to, among other

things, future events or our future performance or financial

condition. These statements may be identified by words such as

“anticipate,” “intend,” “expect,” “may,” “could,” “should,”

“would,” “plan,” “estimate,” “seek,” “believe,” “potential” or

“continue” or the negative of these terms and comparable

terminology. Such statements are based on expectations as to the

future and are not statements of historical fact. Furthermore,

forward-looking statements are not guarantees of future performance

and involve a number of assumptions, risks and uncertainties that

could cause actual results to differ materially. Important factors

that could cause actual results to differ materially from those

suggested by the forward-looking statements include, but are not

limited to, the risks discussed in Item 1A of Part I “Risk Factors”

in our Form 10-K filing with the Securities and Exchange

Commission, as the same may be updated from time to time in our

Form 10-Q filings. We caution you not to place undue reliance on

these forward-looking statements which reflect our view only as of

the date of this report. We are under no obligation (and expressly

disclaim any obligation) to update or alter any forward-looking

statements contained herein to reflect any change in our

expectations with regard thereto or change in events, conditions or

circumstances on which any such statement is based. The risks and

uncertainties to which forward-looking statements are subject

include, but are not limited to, risks related to the COVID-19

pandemic, customer concentration, the timing of the anticipated

increase in default related referrals following the expiration of

foreclosure and eviction moratoriums and forbearance programs, the

timing of the expiration of such moratoriums and programs, and any

other delays occasioned by government, investor or servicer

actions, the use and success of our products and services, our

ability to retain existing customers and attract new customers and

the potential for expansion or changes in our customer

relationships, technology disruptions, our compliance with

applicable data requirements, our use of third party vendors and

contractors, our ability to effectively manage potential conflicts

of interest, macro-economic and industry specific conditions, our

ability to effectively manage our regulatory and contractual

obligations, the adequacy of our financial resources, including our

sources of liquidity and ability to repay borrowings and comply

with our Credit Agreement, including the financial and other

covenants contained therein, as well as Altisource’s ability to

retain key executives or employees, behavior of customers,

suppliers and/or competitors, technological developments,

governmental regulations, taxes and policies. The financial

projections and scenarios contained in this press release are

expressly qualified as forward-looking statements and, as with

other forward-looking statements, should not be unduly relied upon.

We undertake no obligation to update these statements, scenarios

and projections as a result of a change in circumstances, new

information or future events.

Webcast

Altisource will host a webcast at 08:30 a.m. EDT

today to discuss our third quarter. A link to the live audio

webcast will be available on Altisource’s website in the Investor

Relations section. Those who want to listen to the call should go

to the website at least fifteen minutes prior to the call to

register, download and install any necessary audio software. A

replay of the conference call will be available via the website

approximately two hours after the conclusion of the call and will

remain available for approximately 30 days.

About Altisource

Altisource Portfolio Solutions S.A. is an

integrated service provider and marketplace for the real estate and

mortgage industries. Combining operational excellence with a suite

of innovative services and technologies, Altisource helps solve the

demands of the ever-changing markets we serve. Additional

information is available at www.Altisource.com.

|

FOR FURTHER INFORMATION CONTACT: |

| |

|

Michelle D. Esterman |

|

Chief Financial Officer |

|

T: (770) 612-7007 |

|

E: Michelle.Esterman@altisource.com |

|

|

|

ALTISOURCE PORTFOLIO SOLUTIONS S.A.CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS(in

thousands, except per share

data)(unaudited) |

|

|

| |

|

Three months endedSeptember

30, |

|

Nine months endedSeptember

30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

Service revenue |

|

$ |

34,112 |

|

|

$ |

36,290 |

|

|

$ |

104,356 |

|

|

$ |

111,691 |

|

|

Reimbursable expenses |

|

|

2,039 |

|

|

|

1,957 |

|

|

|

6,398 |

|

|

|

6,158 |

|

|

Non-controlling interests |

|

|

62 |

|

|

|

133 |

|

|

|

155 |

|

|

|

468 |

|

|

Total revenue |

|

|

36,213 |

|

|

|

38,380 |

|

|

|

110,909 |

|

|

|

118,317 |

|

|

Cost of revenue |

|

|

29,024 |

|

|

|

34,387 |

|

|

|

89,684 |

|

|

|

104,611 |

|

|

Gross profit |

|

|

7,189 |

|

|

|

3,993 |

|

|

|

21,225 |

|

|

|

13,706 |

|

|

Selling, general and administrative expenses |

|

|

10,734 |

|

|

|

14,556 |

|

|

|

35,169 |

|

|

|

43,055 |

|

| |

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(3,545 |

) |

|

|

(10,563 |

) |

|

|

(13,944 |

) |

|

|

(29,349 |

) |

|

Other income (expense), net: |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(9,890 |

) |

|

|

(4,349 |

) |

|

|

(26,554 |

) |

|

|

(11,439 |

) |

|

Change in fair value of warrant liability |

|

|

2,225 |

|

|

|

— |

|

|

|

1,145 |

|

|

|

— |

|

|

Debt amendment costs |

|

|

(59 |

) |

|

|

— |

|

|

|

(3,402 |

) |

|

|

— |

|

|

Other income (expense), net |

|

|

407 |

|

|

|

459 |

|

|

|

2,357 |

|

|

|

1,392 |

|

|

Total other income (expense), net |

|

|

(7,317 |

) |

|

|

(3,890 |

) |

|

|

(26,454 |

) |

|

|

(10,047 |

) |

| |

|

|

|

|

|

|

|

|

| Loss before income taxes and

non-controlling interests |

|

|

(10,862 |

) |

|

|

(14,453 |

) |

|

|

(40,398 |

) |

|

|

(39,396 |

) |

|

Income tax (provision) benefit |

|

|

(418 |

) |

|

|

197 |

|

|

|

(2,586 |

) |

|

|

(2,210 |

) |

| |

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(11,280 |

) |

|

|

(14,256 |

) |

|

|

(42,984 |

) |

|

|

(41,606 |

) |

| Net income attributable to

non-controlling interests |

|

|

(62 |

) |

|

|

(133 |

) |

|

|

(155 |

) |

|

|

(468 |

) |

| |

|

|

|

|

|

|

|

|

|

Net loss attributable to Altisource |

|

$ |

(11,342 |

) |

|

$ |

(14,389 |

) |

|

$ |

(43,139 |

) |

|

$ |

(42,074 |

) |

| |

|

|

|

|

|

|

|

|

|

Loss per share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.51 |

) |

|

$ |

(0.89 |

) |

|

$ |

(2.10 |

) |

|

$ |

(2.62 |

) |

|

Diluted |

|

$ |

(0.51 |

) |

|

$ |

(0.89 |

) |

|

$ |

(2.10 |

) |

|

$ |

(2.62 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

22,181 |

|

|

|

16,087 |

|

|

|

20,538 |

|

|

|

16,051 |

|

|

Diluted |

|

|

22,181 |

|

|

|

16,087 |

|

|

|

20,538 |

|

|

|

16,051 |

|

| |

|

|

|

|

|

|

|

|

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

Comprehensive loss, net of tax |

|

$ |

(11,280 |

) |

|

$ |

(14,256 |

) |

|

$ |

(42,984 |

) |

|

$ |

(41,606 |

) |

|

Comprehensive income attributable to non-controlling interests |

|

|

(62 |

) |

|

|

(133 |

) |

|

|

(155 |

) |

|

|

(468 |

) |

| |

|

|

|

|

|

|

|

|

|

Comprehensive loss attributable to Altisource |

|

$ |

(11,342 |

) |

|

$ |

(14,389 |

) |

|

$ |

(43,139 |

) |

|

$ |

(42,074 |

) |

|

ALTISOURCE PORTFOLIO SOLUTIONS S.A.CONSOLIDATED BALANCE

SHEETS(in thousands, except for per share

data)(unaudited) |

| |

September 30,2023 |

|

December 31,2022 |

| |

|

|

|

|

ASSETS |

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

36,640 |

|

|

$ |

51,025 |

|

|

Accounts receivable, net of allowance for doubtful accounts of

$3,379 and $4,363, respectively |

|

12,981 |

|

|

|

12,989 |

|

|

Prepaid expenses and other current assets |

|

11,217 |

|

|

|

23,544 |

|

|

Total current assets |

|

60,838 |

|

|

|

87,558 |

|

| |

|

|

|

|

Premises and equipment, net |

|

2,168 |

|

|

|

4,222 |

|

|

Right-of-use assets under operating leases |

|

3,628 |

|

|

|

5,321 |

|

|

Goodwill |

|

55,960 |

|

|

|

55,960 |

|

|

Intangible assets, net |

|

27,818 |

|

|

|

31,730 |

|

|

Deferred tax assets, net |

|

4,982 |

|

|

|

5,048 |

|

|

Other assets |

|

7,242 |

|

|

|

5,429 |

|

| |

|

|

|

|

Total assets |

$ |

162,636 |

|

|

$ |

195,268 |

|

| |

|

|

|

|

LIABILITIES AND DEFICIT |

|

Current liabilities: |

|

|

|

|

Accounts payable and accrued expenses |

$ |

31,032 |

|

|

$ |

33,507 |

|

|

Deferred revenue |

|

3,303 |

|

|

|

3,711 |

|

|

Other current liabilities |

|

2,299 |

|

|

|

2,867 |

|

|

Total current liabilities |

|

36,634 |

|

|

|

40,085 |

|

| |

|

|

|

|

Long-term debt |

|

211,980 |

|

|

|

245,493 |

|

|

Deferred tax liabilities, net |

|

8,724 |

|

|

|

9,028 |

|

|

Other non-current liabilities |

|

18,232 |

|

|

|

19,536 |

|

| |

|

|

|

|

Commitments, contingencies and regulatory matters |

|

|

|

| |

|

|

|

|

Equity (deficit): |

|

|

|

|

Common stock ($1.00 par value; 100,000 shares authorized, 29,963

issued and 26,482 outstanding as of September 30, 2023; 16,129

outstanding as of December 31, 2022) |

|

29,963 |

|

|

|

25,413 |

|

|

Additional paid-in capital |

|

176,128 |

|

|

|

149,348 |

|

|

Retained earnings |

|

(166,125 |

) |

|

|

118,948 |

|

|

Treasury stock, at cost (3,481 shares as of September 30, 2023

and 9,284 shares as of December 31, 2022) |

|

(153,561 |

) |

|

|

(413,358 |

) |

|

Altisource deficit |

|

(113,595 |

) |

|

|

(119,649 |

) |

| |

|

|

|

|

Non-controlling interests |

|

661 |

|

|

|

775 |

|

|

Total deficit |

|

(112,934 |

) |

|

|

(118,874 |

) |

| |

|

|

|

|

Total liabilities and deficit |

$ |

162,636 |

|

|

$ |

195,268 |

|

|

ALTISOURCE PORTFOLIO SOLUTIONS S.A.CONSOLIDATED STATEMENTS

OF CASH FLOWS(in thousands)(unaudited) |

|

|

| |

Nine months endedSeptember

30, |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

Net loss |

$ |

(42,984 |

) |

|

$ |

(41,606 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation and amortization |

|

1,933 |

|

|

|

2,700 |

|

|

Amortization of right-of-use assets under operating leases |

|

1,351 |

|

|

|

2,254 |

|

|

Amortization of intangible assets |

|

3,912 |

|

|

|

3,849 |

|

|

PIK accrual |

|

4,777 |

|

|

|

— |

|

|

Share-based compensation expense |

|

3,918 |

|

|

|

3,899 |

|

|

Bad debt expense |

|

319 |

|

|

|

578 |

|

|

Amortization of debt discount |

|

2,846 |

|

|

|

495 |

|

|

Amortization of debt issuance costs |

|

1,846 |

|

|

|

712 |

|

|

Deferred income taxes |

|

(224 |

) |

|

|

(329 |

) |

|

Loss on disposal of fixed assets |

|

121 |

|

|

|

1 |

|

|

Change in fair value of warrant liability |

|

(1,145 |

) |

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(311 |

) |

|

|

3,095 |

|

|

Prepaid expenses and other current assets |

|

12,350 |

|

|

|

160 |

|

|

Other assets |

|

(1,891 |

) |

|

|

363 |

|

|

Accounts payable and accrued expenses |

|

(2,475 |

) |

|

|

(5,014 |

) |

|

Current and non-current operating lease liabilities |

|

(1,351 |

) |

|

|

(2,444 |

) |

|

Other current and non-current liabilities |

|

(587 |

) |

|

|

(1,006 |

) |

|

Net cash used in operating activities |

|

(17,595 |

) |

|

|

(32,293 |

) |

| |

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

Additions to premises and equipment |

|

— |

|

|

|

(863 |

) |

|

Proceeds from the sale of business |

|

— |

|

|

|

346 |

|

|

Net cash used in investing activities |

|

— |

|

|

|

(517 |

) |

| |

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

Proceeds from issuance of common stock, net of issuance costs |

|

20,461 |

|

|

|

— |

|

|

Proceeds from sale of treasury stock, net of transaction costs |

|

18,374 |

|

|

|

— |

|

|

Debt issuance and amendment costs |

|

(4,886 |

) |

|

|

— |

|

|

Repayments of long-term debt |

|

(30,000 |

) |

|

|

— |

|

|

Distributions to non-controlling interests |

|

(269 |

) |

|

|

(892 |

) |

|

Payments of tax withholding on issuance of restricted share units

and restricted shares |

|

(511 |

) |

|

|

(1,051 |

) |

|

Net cash provided by (used in) financing activities |

|

3,169 |

|

|

|

(1,943 |

) |

| |

|

|

|

|

Net decrease in cash, cash equivalents and restricted cash |

|

(14,426 |

) |

|

|

(34,753 |

) |

|

Cash, cash equivalents and restricted cash at the beginning of the

period |

|

54,273 |

|

|

|

102,149 |

|

| |

|

|

|

|

Cash, cash equivalents and restricted cash at the end of the

period |

$ |

39,847 |

|

|

$ |

67,396 |

|

| |

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

Interest paid |

$ |

16,989 |

|

|

$ |

10,167 |

|

|

Income taxes (refunded) paid, net |

|

(4,034 |

) |

|

|

2,556 |

|

|

Acquisition of right-of-use assets with operating lease

liabilities |

|

329 |

|

|

|

797 |

|

|

Reduction of right-of-use assets from operating lease modifications

or reassessments |

|

(671 |

) |

|

|

(172 |

) |

| |

|

|

|

|

Non-cash investing and financing activities: |

|

|

|

|

Net decrease in payables for purchases of premises and

equipment |

$ |

— |

|

|

$ |

(65 |

) |

|

Warrants issued in connection with Amended Credit Agreement |

|

8,096 |

|

|

|

— |

|

ALTISOURCE PORTFOLIO SOLUTIONS

S.A.NON-GAAP MEASURES(in

thousands, except per share

data)(unaudited)

Adjusted operating loss, pretax loss

attributable to Altisource, adjusted pretax loss attributable to

Altisource, adjusted EBITDA, adjusted net loss attributable to

Altisource, adjusted diluted loss per share, net cash used in

operating activities less additions to premises and equipment and

net debt, which are presented elsewhere in this earnings release,

are non-GAAP measures used by management, existing shareholders,

potential shareholders and other users of our financial information

to measure Altisource’s performance and do not purport to be

alternatives to loss from operations, loss before income taxes and

non-controlling interests, net loss attributable to Altisource,

diluted loss per share, net cash used in operating activities and

long-term debt, including current portion, as measures of

Altisource’s performance. We believe these measures are useful to

management, existing shareholders, potential shareholders and other

users of our financial information in evaluating operating

profitability and cash flow generation more on the basis of

continuing cost and cash flows as they exclude amortization expense

related to acquisitions that occurred in prior periods and non-cash

share-based compensation, as well as the effect of more significant

non-operational items from earnings, cash flows from operating

activities and long-term debt net of cash on-hand. We believe these

measures are also useful in evaluating the effectiveness of our

operations and underlying business trends in a manner that is

consistent with management’s evaluation of business performance.

Furthermore, we believe the exclusion of more significant

non-operational items enables comparability to prior period

performance and trend analysis. Specifically, management uses

adjusted net loss attributable to Altisource to measure the

on-going after tax performance of the Company because the measure

adjusts for the after tax impact of more significant non-recurring

items, amortization expense relating to prior acquisitions (some of

which fluctuates with revenue from certain customers and some of

which is amortized on a straight-line basis) and non-cash

share-based compensation expense which can fluctuate based on

vesting schedules, grant date timing and the value attributable to

awards. We believe adjusted net loss attributable to Altisource is

useful to existing shareholders, potential shareholders and other

users of our financial information because it provides an after-tax

measure of Altisource’s on-going performance that enables these

users to perform trend analysis using comparable data. Management

uses adjusted diluted loss per share to further evaluate adjusted

net loss attributable to Altisource while taking into account

changes in the number of diluted shares over the comparable

periods. We believe adjusted diluted loss per share is useful to

existing shareholders, potential shareholders and other users of

our financial information because it also enables these users to

evaluate adjusted net loss attributable to Altisource on a per

share basis. Management uses Adjusted EBITDA to measure the

Company’s overall performance (with the adjustments discussed

earlier with regard to adjusted net loss attributable to

Altisource) without regard to its capitalization (debt vs. equity)

or its income taxes and to perform trend analysis of the Company’s

performance over time. Our effective income tax rate can vary based

on the jurisdictional mix of our income. Additionally, as the

Company’s capital expenditures have significantly declined over

time, it provides a measure for management to evaluate the

Company’s performance without regard to prior capital expenditures.

Management also uses Adjusted EBITDA as one of the measures in

determining bonus compensation for certain employees. We believe

Adjusted EBITDA is useful to existing shareholders, potential

shareholders and other users of our financial information for the

same reasons that management finds the measure useful. Management

uses net debt in evaluating the amount of debt the Company has that

is in excess of cash and cash equivalents. We believe net debt is

useful to existing shareholders, potential shareholders and other

users of our financial information for the same reasons management

finds the measure useful.

Altisource operates in several countries,

including Luxembourg, India, the United States and Uruguay. The

Company has differing effective tax rates in each country and these

rates may change from year to year. In determining the tax effects

related to the adjustments in calculating adjusted net loss

attributable to Altisource and adjusted diluted loss per share, we

use the tax rate in the country in which the adjustment applies or,

if the adjustment is recognized in more than one country, we

separate the adjustment by country, apply the relevant tax rate for

each country to the applicable adjustment, and then sum the result

to arrive at the total adjustment, net of tax. In 2019, the Company

recognized a full valuation allowance on its net deferred tax

assets in Luxembourg. Accordingly, for 2023 and 2022, the Company

has an effective tax rate of close to 0% in Luxembourg.

It is management’s intent to provide non-GAAP

financial information to enhance the understanding of Altisource’s

GAAP financial information, and it should be considered by the

reader in addition to, but not instead of, the financial statements

prepared in accordance with GAAP. Each non-GAAP financial measure

is presented along with the corresponding GAAP measure so as not to

imply that more emphasis should be placed on the non-GAAP measure.

The non-GAAP financial information presented may be determined or

calculated differently by other companies. The non-GAAP financial

information should not be unduly relied upon.

Adjusted operating loss is calculated by

removing intangible asset amortization expense, share-based

compensation expense, cost of cost savings initiatives and other,

debt amendment costs and Unrealized gain on warrant liability from

loss from operations. Pretax loss attributable to Altisource is

calculated by removing non-controlling interests from loss before

income taxes and non-controlling interests. Adjusted pretax loss

attributable to Altisource is calculated by removing

non-controlling interests, intangible asset amortization expense,

share-based compensation expense, cost of cost savings initiatives

and other, debt amendment costs and unrealized gain on warrant

liability from loss before income taxes and non-controlling

interests. Adjusted EBITDA is calculated by removing the income tax

provision, interest expense (net of interest income), depreciation

and amortization, share-based compensation expense, cost of cost

savings initiatives and other, debt amendment costs and unrealized

gain on warrant liability from net loss attributable to Altisource.

Adjusted net loss attributable to Altisource is calculated by

removing intangible asset amortization expense (net of tax),

share-based compensation expense (net of tax), cost of cost savings

initiatives and other (net of tax), debt amendment costs,

unrealized gain on warrant liability and certain income tax related

items from net loss attributable to Altisource. Adjusted diluted

loss per share is calculated by dividing net loss attributable to

Altisource after removing intangible asset amortization expense

(net of tax), share-based compensation expense (net of tax), cost

of cost savings initiatives and other (net of tax), debt amendment

costs (net of tax), unrealized gain on warrant liability (net of

tax) and certain income tax related items by the weighted average

number of diluted shares. Net cash used in operating activities

less additions to premises and equipment is calculated by removing

additions to premises and equipment from net cash used in operating

activities. Net debt is calculated as long-term debt, including

current portion, minus cash and cash equivalents.

Reconciliations of the non-GAAP measures to the

corresponding GAAP measures are as follows:

| |

Three months endedSeptember

30, |

|

Nine months endedSeptember

30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

Loss from operations |

$ |

(3,545 |

) |

|

$ |

(10,563 |

) |

|

$ |

(13,944 |

) |

|

$ |

(29,349 |

) |

| |

|

|

|

|

|

|

|

|

Intangible asset amortization expense |

|

1,352 |

|

|

|

1,281 |

|

|

|

3,912 |

|

|

|

3,849 |

|

|

Share-based compensation expense |

|

1,231 |

|

|

|

1,320 |

|

|

|

3,918 |

|

|

|

3,899 |

|

|

Cost of cost savings initiatives and other |

|

1,174 |

|

|

|

540 |

|

|

|

1,844 |

|

|

|

1,087 |

|

|

Debt amendment costs |

|

59 |

|

|

|

— |

|

|

|

3,402 |

|

|

|

— |

|

|

Unrealized gain on warrant liability |

|

(2,225 |

) |

|

|

— |

|

|

|

(1,145 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

Adjusted operating loss |

$ |

(1,954 |

) |

|

$ |

(7,422 |

) |

|

$ |

(2,013 |

) |

|

$ |

(20,514 |

) |

| |

|

|

|

|

|

|

|

|

Loss before income taxes and non-controlling interests |

$ |

(10,862 |

) |

|

$ |

(14,453 |

) |

|

$ |

(40,398 |

) |

|

$ |

(39,396 |

) |

| |

|

|

|

|

|

|

|

|

Non-controlling interests |

|

(62 |

) |

|

|

(133 |

) |

|

|

(155 |

) |

|

|

(468 |

) |

|

Pretax loss attributable to Altisource |

|

(10,924 |

) |

|

|

(14,586 |

) |

|

|

(40,553 |

) |

|

|

(39,864 |

) |

|

Intangible asset amortization expense |

|

1,352 |

|

|

|

1,281 |

|

|

|

3,912 |

|

|

|

3,849 |

|

|

Share-based compensation expense |

|

1,231 |

|

|

|

1,320 |

|

|

|

3,918 |

|

|

|

3,899 |

|

|

Cost of cost savings initiatives and other |

|

1,174 |

|

|

|

540 |

|

|

|

1,844 |

|

|

|

1,087 |

|

|

Debt amendment costs |

|

59 |

|

|

|

— |

|

|

|

3,402 |

|

|

|

— |

|

|

Unrealized gain on warrant liability |

|

(2,225 |

) |

|

|

— |

|

|

|

(1,145 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

Adjusted pretax loss attributable to Altisource |

$ |

(9,333 |

) |

|

$ |

(11,445 |

) |

|

$ |

(28,622 |

) |

|

$ |

(31,029 |

) |

| |

|

|

|

|

|

|

|

|

Net loss attributable to Altisource |

$ |

(11,342 |

) |

|

$ |

(14,389 |

) |

|

$ |

(43,139 |

) |

|

$ |

(42,074 |

) |

| |

|

|

|

|

|

|

|

|

Income tax provision (benefit) |

|

418 |

|

|

|

(197 |

) |

|

|

2,586 |

|

|

|

2,210 |

|

|

Interest expense (net of interest income) |

|

9,628 |

|

|

|

4,137 |

|

|

|

25,543 |

|

|

|

11,121 |

|

|

Depreciation and amortization |

|

1,931 |

|

|

|

2,135 |

|

|

|

5,845 |

|

|

|

6,549 |

|

|

Share-based compensation expense |

|

1,231 |

|

|

|

1,320 |

|

|

|

3,918 |

|

|

|

3,899 |

|

|

Cost of cost savings initiatives and other |

|

1,174 |

|

|

|

540 |

|

|

|

1,844 |

|

|

|

1,087 |

|

|

Debt amendment costs |

|

59 |

|

|

|

— |

|

|

|

3,402 |

|

|

|

— |

|

|

Unrealized gain on warrant liability |

|

(2,225 |

) |

|

|

— |

|

|

|

(1,145 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

874 |

|

|

$ |

(6,454 |

) |

|

$ |

(1,146 |

) |

|

$ |

(17,208 |

) |

| |

|

|

|

|

|

|

|

|

Net loss attributable to Altisource |

$ |

(11,342 |

) |

|

$ |

(14,389 |

) |

|

$ |

(43,139 |

) |

|

$ |

(42,074 |

) |

| |

|

|

|

|

|

|

|

|

Intangible asset amortization expense, net of tax |

|

1,332 |

|

|

|

1,279 |

|

|

|

3,887 |

|

|

|

3,842 |

|

|

Share-based compensation expense, net of tax |

|

1,089 |

|

|

|

1,148 |

|

|

|

3,365 |

|

|

|

3,446 |

|

|

Cost of cost savings initiatives and other, net of tax |

|

898 |

|

|

|

449 |

|

|

|

1,454 |

|

|

|

937 |

|

|

Debt amendment costs, net of tax |

|

59 |

|

|

|

— |

|

|

|

3,402 |

|

|

|

— |

|

|

Unrealized gain on warrant liability |

|

(2,225 |

) |

|

|

— |

|

|

|

(1,145 |

) |

|

|

— |

|

|

Certain income tax related items |

|

351 |

|

|

|

210 |

|

|

|

1,110 |

|

|

|

2,026 |

|

| |

|

|

|

|

|

|

|

|

Adjusted net loss attributable to Altisource |

$ |

(9,838 |

) |

|

$ |

(11,303 |

) |

|

$ |

(31,066 |

) |

|

$ |

(31,823 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Diluted loss per share |

$ |

(0.51 |

) |

|

$ |

(0.89 |

) |

|

$ |

(2.10 |

) |

|

$ |

(2.62 |

) |

| |

|

|

|

|

|

|

|

|

Intangible asset amortization expense, net of tax, per diluted

share |

|

0.06 |

|

|

|

0.08 |

|

|

|

0.19 |

|

|

|

0.24 |

|

|

Share-based compensation expense, net of tax, per diluted

share |

|

0.05 |

|

|

|

0.07 |

|

|

|

0.16 |

|

|

|

0.21 |

|

|

Cost of cost savings initiatives and other, net of tax, per diluted

share |

|

0.04 |

|

|

|

0.03 |

|

|

|

0.07 |

|

|

|

0.06 |

|

|

Debt amendment costs, net of tax, per diluted share |

|

— |

|

|

|

— |

|

|

|

0.17 |

|

|

|

— |

|

|

Unrealized gain on warrant liability, net of tax, per diluted

share |

|

(0.10 |

) |

|

|

— |

|

|

|

(0.06 |

) |

|

|

— |

|

|

Certain income tax related items per diluted share |

|

0.02 |

|

|

|

0.01 |

|

|

|

0.05 |

|

|

|

0.13 |

|

| |

|

|

|

|

|

|

|

|

Adjusted diluted loss per share |

$ |

(0.44 |

) |

|

$ |

(0.70 |

) |

|

$ |

(1.51 |

) |

|

$ |

(1.98 |

) |

| |

|

|

|

|

|

|

|

| Calculation of the impact of

intangible asset amortization expense, net of tax |

|

|

|

|

|

|

|

|

Intangible asset amortization expense |

$ |

1,352 |

|

|

$ |

1,281 |

|

|

$ |

3,912 |

|

|

$ |

3,849 |

|

|

Tax benefit from intangible asset amortization |

|

(20 |

) |

|

|

(2 |

) |

|

|

(25 |

) |

|

|

(7 |

) |

|

Intangible asset amortization expense, net of tax |

|

1,332 |

|

|

|

1,279 |

|

|

|

3,887 |

|

|

|

3,842 |

|

|

Diluted share count |

|

22,181 |

|

|

|

16,087 |

|

|

|

20,538 |

|

|

|

16,051 |

|

| |

|

|

|

|

|

|

|

| Intangible asset amortization

expense, net of tax, per diluted share |

$ |

0.06 |

|

|

$ |

0.08 |

|

|

$ |

0.19 |

|

|

$ |

0.24 |

|

| |

|

|

|

|

|

|

|

| Calculation of the impact of

share-based compensation expense, net of tax |

|

|

|

|

|

|

|

|

Share-based compensation expense |

$ |

1,231 |

|

|

$ |

1,320 |

|

|

$ |

3,918 |

|

|

$ |

3,899 |

|

|

Tax benefit from share-based compensation expense |

|

(142 |

) |

|

|

(172 |

) |

|

|

(553 |

) |

|

|

(453 |

) |

|

Share-based compensation expense, net of tax |

|

1,089 |

|

|

|

1,148 |

|

|

|

3,365 |

|

|

|

3,446 |

|

|

Diluted share count |

|

22,181 |

|

|

|

16,087 |

|

|

|

20,538 |

|

|

|

16,051 |

|

| |

|

|

|

|

|

|

|

| Share-based compensation

expense, net of tax, per diluted share |

$ |

0.05 |

|

|

$ |

0.07 |

|

|

$ |

0.16 |

|

|

$ |

0.21 |

|

| |

|

|

|

|

|

|

|

| Calculation of the impact of

cost of cost savings initiatives and other, net of tax |

|

|

|

|

|

|

|

|

Cost of cost savings initiatives and other |

$ |

1,174 |

|

|

$ |

540 |

|

|

$ |

1,844 |

|

|

$ |

1,087 |

|

|

Tax benefit from cost of cost savings initiatives and other |

|

(276 |

) |

|

|

(91 |

) |

|

|

(390 |

) |

|

|

(150 |

) |

|

Cost of cost savings initiatives and other, net of tax |

|

898 |

|

|

|

449 |

|

|

|

1,454 |

|

|

|

937 |

|

|

Diluted share count |

|

22,181 |

|

|

|

16,087 |

|

|

|

20,538 |

|

|

|

16,051 |

|

| |

|

|

|

|

|

|

|

| Cost of cost savings

initiatives and other, net of tax, per diluted share |

$ |

0.04 |

|

|

$ |

0.03 |

|

|

$ |

0.07 |

|

|

$ |

0.06 |

|

| |

|

|

|

|

|

|

|

| Calculation of the impact of

debt amendment costs, net of tax |

|

|

|

|

|

|

|

|

Debt amendment costs |

$ |

59 |

|

|

$ |

— |

|

|

$ |

3,402 |

|

|

$ |

— |

|

|

Tax benefit from debt amendment costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Debt amendment costs, net of tax |

|

59 |

|

|

|

— |

|

|

|

3,402 |

|

|

|

— |

|

|

Diluted share count |

|

22,181 |

|

|

|

16,087 |

|

|

|

20,538 |

|

|

|

16,051 |

|

| |

|

|

|

|

|

|

|

|

Debt amendment costs, net of tax, per diluted share |

$ |

0.00 |

|

|

$ |

— |

|

|

$ |

0.17 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

| Calculation of the impact of

unrealized gain on warrant liability, net of tax |

|

|

|

|

|

|

|

|

Unrealized gain on warrant liability |

$ |

(2,225 |

) |

|

$ |

— |

|

|

$ |

(1,145 |

) |

|

$ |

— |

|

|

Tax benefit from unrealized gain on warrant liability |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Unrealized gain on warrant liability, net of tax |

|

(2,225 |

) |

|

|

— |

|

|

|

(1,145 |

) |

|

|

— |

|

|

Diluted share count |

|

22,181 |

|

|

|

16,087 |

|

|

|

20,538 |

|

|

|

16,051 |

|

| |

|

|

|

|

|

|

|

| Unrealized gain on warrant

liability, net of tax, per diluted share |

$ |

(0.10 |

) |

|

$ |

— |

|

|

$ |

(0.06 |

) |

|

$ |

— |

|

| |

|

|

|

|

|

|

|

| Certain income tax related

items resulting from: |

|

|

|

|

|

|

|

|

Foreign income tax reserves / other |

$ |

351 |

|

|

$ |

210 |

|

|

$ |

1,110 |

|

|

$ |

2,026 |

|

|

Certain income tax related items |

|

351 |

|

|

|

210 |

|

|

|

1,110 |

|

|

|

2,026 |

|

|

Diluted share count |

|

22,181 |

|

|

|

16,087 |

|

|

|

20,538 |

|

|

|

16,051 |

|

| |

|

|

|

|

|

|

|

| Certain income tax related

items per diluted share |

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.05 |

|

|

$ |

0.13 |

|

| |

|

|

|

|

|

|

|

| Net cash used in operating

activities |

$ |

(6,655 |

) |

|

$ |

(6,509 |

) |

|

$ |

(17,595 |

) |

|

$ |

(32,293 |

) |

|

Less: additions to premises and equipment |

|

— |

|

|

|

(229 |

) |

|

|

— |

|

|

|

(863 |

) |

| |

|

|

|

|

|

|

|

| Net cash used in operating

activities less additions to premises and equipment |

$ |

(6,655 |

) |

|

$ |

(6,738 |

) |

|

$ |

(17,595 |

) |

|

$ |

(33,156 |

) |

| |

September 30, 2023 |

|

September 30, 2022 |

| |

|

|

|

|

Senior Secured Term Loans |

$ |

221,981 |

|

|

$ |

247,204 |

|

|

Less: Cash and cash equivalents |

|

(36,640 |

) |

|

|

(63,812 |

) |

| |

|

|

|

|

Net debt |

$ |

185,341 |

|

|

$ |

183,392 |

|

_______________________

Note: Amounts may not add to the total due to

rounding.

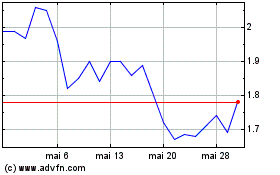

Altisource Portfolio Sol... (NASDAQ:ASPS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Altisource Portfolio Sol... (NASDAQ:ASPS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024