Atrion Reports Fourth Quarter and Full Year 2022 Results

27 Fevereiro 2023 - 6:00PM

Atrion Corporation (NASDAQ: ATRI) today announced its results for

the fourth quarter ended December 31, 2022 and the full year 2022.

Revenues for the fourth quarter of 2022 totaled

$42.9 million compared to $40.3 million for the same period in

2021. For the quarter ended December 31, 2022, operating income was

$8.8 million, up $967 thousand over the comparable 2021 period, and

net income was $8.3 million, up $195 thousand over the same period

in 2021. Fourth quarter 2022 diluted earnings per share were $4.70

compared to $4.50 for the fourth quarter of 2021. For the full year

2022 compared to the full year 2021, revenues increased to $183.5

million from $165.0 million, net income was $35.0 million versus

$33.1 million, and diluted earnings per share were $19.56 compared

to $18.18.

Commenting on the results of the quarter and the

full year compared to prior year periods, David Battat, President

and CEO, stated, “We are very pleased with the results of the

quarter when, despite supply disruptions, revenues were up 6% to an

all-time record amount for a fourth quarter. For the full year

2022, revenues increased 11%, also to a new record level for the

Company.” Mr. Battat continued, “Progressively higher costs for

labor and raw materials resulted in a 1% drop in gross profit

margin, with 2022 concluding at 41% compared to 42% in 2021.

Nevertheless, operating income was up 12% for the just-ended

quarter and 10% for the year. Net income was up by 2% in the fourth

quarter and 6% for the year, adversely impacted by weaker

performance in our investment portfolio. Earnings per share were up

8% for the full year, with fewer outstanding shares following the

repurchase of 18,828 shares in the fourth quarter at an average

cost per share of $603.19 and total repurchases during the full

year of 42,568 shares at an average cost per share of $605.78. We

remain debt free, despite investing heavily in our future growth.

In addition to our ongoing program of aggressive investment in new

products and automation, over the last few years we committed $41

million for a new company-wide ERP system and a significant

expansion of our Florida facility to meet anticipated future

demand.”

Atrion Corporation develops and manufactures

products primarily for medical applications. The Company’s website

is www.atrioncorp.com.

Contact:Jeffery StricklandVice President and

Chief Financial Officer(972) 390-9800

ATRION

CORPORATIONUNAUDITED CONSOLIDATED STATEMENTS OF

INCOME(In thousands, except per share

data)

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenues |

$ |

42,855 |

|

|

$ |

40,293 |

|

|

$ |

183,506 |

|

|

$ |

165,009 |

|

| Cost of goods sold |

|

24,681 |

|

|

|

22,917 |

|

|

|

107,602 |

|

|

|

95,637 |

|

|

Gross profit |

|

18,174 |

|

|

|

17,376 |

|

|

|

75,904 |

|

|

|

69,372 |

|

| Operating expenses |

|

9,369 |

|

|

|

9,538 |

|

|

|

36,217 |

|

|

|

33,330 |

|

|

Operating income |

|

8,805 |

|

|

|

7,838 |

|

|

|

39,687 |

|

|

|

36,042 |

|

| |

|

|

|

|

|

|

|

| Interest and dividend

income |

|

349 |

|

|

|

163 |

|

|

|

988 |

|

|

|

843 |

|

| Other investment income

(loss) |

|

(366 |

) |

|

|

625 |

|

|

|

(150 |

) |

|

|

1,477 |

|

| Other income |

|

-- |

|

|

|

-- |

|

|

|

92 |

|

|

|

67 |

|

|

Income before income taxes |

|

8,788 |

|

|

|

8,626 |

|

|

|

40,617 |

|

|

|

38,429 |

|

| Income tax provision |

|

(466 |

) |

|

|

(499 |

) |

|

|

(5,609 |

) |

|

|

(5,374 |

) |

|

Net income |

$ |

8,322 |

|

|

$ |

8,127 |

|

|

$ |

35,008 |

|

|

$ |

33,055 |

|

| |

|

|

|

|

|

|

|

| Income per basic share |

$ |

4.70 |

|

|

$ |

4.51 |

|

|

$ |

19.59 |

|

|

$ |

18.22 |

|

|

|

|

|

|

|

|

|

|

| Weighted average basic shares

outstanding |

|

1,770 |

|

|

|

1,801 |

|

|

|

1,787 |

|

|

|

1,814 |

|

| |

|

|

|

|

|

|

|

| Income per diluted share |

$ |

4.70 |

|

|

$ |

4.50 |

|

|

$ |

19.56 |

|

|

$ |

18.18 |

|

|

|

|

|

|

|

|

|

|

| Weighted average diluted

shares outstanding |

|

1,771 |

|

|

|

1,806 |

|

|

|

1,790 |

|

|

|

1,818 |

|

ATRION

CORPORATIONCONSOLIDATED BALANCE

SHEETS(In thousands)

| |

Dec. 31, |

|

Dec. 31, |

|

ASSETS |

|

2022 |

|

|

|

2021 |

|

| |

(Unaudited) |

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

4,731 |

|

|

$ |

32,264 |

|

|

Short-term investments |

|

21,152 |

|

|

|

29,059 |

|

|

Total cash and short-term investments |

|

25,883 |

|

|

|

61,323 |

|

|

Accounts receivable |

|

23,951 |

|

|

|

21,023 |

|

|

Inventories |

|

65,793 |

|

|

|

50,778 |

|

|

Prepaid expenses and other |

|

3,770 |

|

|

|

3,447 |

|

|

Total current assets |

|

119,397 |

|

|

|

136,571 |

|

| Long-term investments |

|

8,669 |

|

|

|

19,423 |

|

| Property, plant and equipment,

net |

|

123,754 |

|

|

|

97,972 |

|

|

Other assets |

|

12,892 |

|

|

|

13,298 |

|

| |

|

|

|

| |

$ |

264,712 |

|

|

$ |

267,264 |

|

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| |

|

|

|

| Current liabilities |

|

18,098 |

|

|

|

13,346 |

|

| Line of credit |

|

-- |

|

|

|

-- |

|

| Other non-current

liabilities |

|

7,073 |

|

|

|

9,622 |

|

| Stockholders’ equity |

|

239,541 |

|

|

|

244,296 |

|

| |

|

|

|

| |

$ |

264,712 |

|

|

$ |

267,264 |

|

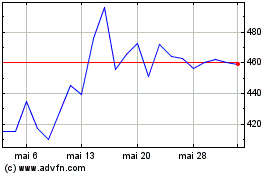

ATRION (NASDAQ:ATRI)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

ATRION (NASDAQ:ATRI)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024