Avalo Therapeutics, Inc. (Nasdaq: AVTX) today announced it has

acquired a Phase 2-ready anti-IL-1β mAb, which it refers to as

AVTX-009, through the acquisition of privately held AlmataBio, Inc.

Concurrent with the acquisition, Avalo entered into a definitive

agreement for the sale of preferred stock and warrants in a private

placement led by Commodore Capital and TCGX, with participation

from BVF Partners, Deep Track Capital, OrbiMed, Petrichor, and RA

Capital Management. The private placement will provide up to $185

million in gross proceeds, including an initial gross upfront

investment of $115.6 million. After deducting estimated transaction

costs from both the private placement financing and the acquisition

of AlmataBio, Avalo expects net upfront proceeds to be

approximately $105 million. The private placement is expected to

close on March 28, 2024, subject to the satisfaction of customary

closing conditions. Avalo intends to pursue the development of

AVTX-009 in hidradenitis suppurativa (HS). Topline results from a

planned Phase 2 trial in HS are expected in 2026 and the upfront

funding is expected to fund operations through this data readout

and into 2027. In addition to HS, Avalo intends to develop AVTX-009

in at least one other chronic inflammatory indication.

“We are thrilled to announce the acquisition of

AVTX-009 and concurrent financing of up to $185 million. Avalo

remains focused on the treatment of inflammatory conditions, and we

are excited to prepare to initiate a Phase 2 trial in HS, a severe

autoimmune disease with significant unmet needs. We believe

AVTX-009, which was originally developed by Eli Lilly, has a high

probability of success for the treatment of HS as evidenced by

recent data readouts validating inhibition of IL-1β in this

disease. We believe that HS is a multi-billion-dollar commercial

opportunity and that AVTX-009 has the potential to be best-in-class

and best-in-indication because of its target, half-life, and

potency, which may allow for strong efficacy and convenient

dosing,” said Garry A. Neil, MD, CEO, and Chairman of the Board at

Avalo. “We are excited to be fully funded through our expected data

readout and we appreciate the support of this outstanding

investment syndicate.”

Dr. Neil continued, “I want to thank Patrick

Crutcher and his team at AlmataBio for their great work in

identifying and bringing this potentially best-in-class molecule

forward. Mr. Crutcher has a long history of successful biotech

entrepreneurship and identifying high quality opportunities. We

greatly value his partnership and expertise.”

Patrick J. Crutcher, former CEO of AlmataBio,

added, "We are pleased that Avalo recognizes the promise of

AVTX-009, an important potential treatment option for patients with

inflammatory diseases. AlmataBio was founded to identify, acquire,

and accelerate the development of clinically meaningful therapies,

and we are proud of the contribution of the talented AlmataBio team

to this mission. We look forward to the advancement of AVTX-009

into a Phase 2 trial in HS under Dr. Neil’s stewardship."

Management and

OrganizationAvalo’s current leadership team will continue

to lead Avalo and no person affiliated with AlmataBio will become

an officer or employee of Avalo. Pursuant to the acquisition,

Jonathan Goldman, M.D. was appointed to Avalo’s Board of Directors

effective on the closing of the transaction. Prior to the closing

of the financing transaction, Samantha Truex and Aaron Kantoff are

expected to be appointed to Avalo’s Board of Directors. The five

existing Avalo directors will continue in their roles.

About the Acquisition and Financing

TransactionAvalo’s acquisition of AlmataBio, Inc. was

structured as a stock-for-stock transaction whereby all outstanding

equity interests in AlmataBio were exchanged in a merger for a

combination of Avalo common stock and shares of Avalo non-voting

convertible preferred stock, valued at approximately $15 million in

the aggregate, resulting in the issuance of approximately 0.2

million shares of Avalo common stock and approximately 2,400 shares

of non-voting convertible preferred stock. In addition, a cash

payment of $7.5 million is due to the former AlmataBio stockholders

upon the initial closing of the private placement investment. Avalo

is also required to pay development milestones to the former

AlmataBio stockholders, including $5 million due upon the first

patient dosed in a Phase 2 trial in patients with HS for AVTX-009

and $15 million due upon the first patient dosed in a Phase 3 trial

for AVTX-009, both of which are payable in cash, Avalo stock, or a

combination thereof at the election of the former AlmataBio

stockholders, subject to the terms and conditions of the definitive

merger agreement.

Concurrently, Avalo entered into a definitive

agreement for a private placement investment with institutional

investors to raise up to $185 million in which the

investors will be issued (i) an aggregate of $115.6 million of

non-voting convertible preferred stock, resulting in the issuance

of approximately 19,900 shares of non-voting convertible preferred

stock and (ii) warrants to purchase up to an aggregate of

approximately 12.0 million shares of Avalo’s common stock or an

equivalent amount (as converted to common stock) of non-voting

convertible preferred stock, subject to the terms and conditions

set forth in the warrant agreement, for an aggregate exercise price

of $69.4 million. The warrants are exercisable for approximately

$5.80 per underlying share of common stock until the earlier of

five years from the date of issuance or 30 days after the public

announcement of the first patient dosed in a Phase 2 trial of

AVTX-009 in HS. After deducting estimated transaction costs from

both the private placement financing and the acquisition of

AlmataBio, Avalo expects net upfront proceeds to be approximately

$105 million. The estimated transaction costs do not include the

$7.5 million cash payment due to former AlmataBio stockholders upon

the initial closing of the private placement investment. The

private placement is expected to close on March 28, 2024, subject

to the satisfaction of customary closing conditions.

Subject to and upon Avalo stockholder approval,

each share of Avalo non-voting convertible preferred stock (i)

issued to former AlmataBio stockholders and (ii) issued pursuant to

the private placement investment will automatically convert to

1,000 shares of Avalo common stock, subject to certain beneficial

ownership limitations. The non-voting convertible preferred stock

holds no voting rights.

The acquisition was approved by the Board of

Directors of Avalo and by the Board of Directors and stockholders

of AlmataBio, Inc. The closings of the transactions are not subject

to the approval of Avalo stockholders. On an as-converted basis and

after accounting for these transactions (excluding the exercise of

the warrants), the total number of shares of Avalo common stock

outstanding would be approximately 23.4 million immediately after

the closing of the transactions.

Oppenheimer & Co. is serving as sole

placement agent to Avalo. Wyrick Robbins Yates & Ponton LLP is

serving as legal counsel to Avalo. Goodwin Procter LLP is serving

as legal counsel to AlmataBio, Inc. Schulte Roth & Zabel, LLP

is serving as legal counsel to Commodore Capital and Gunderson

Dettmer Stough Villeneuve Franklin & Hachigian, LLP is serving

as legal counsel to TCGX.

Webcast DetailsAvalo will host

a webcast presentation to discuss the acquisition tomorrow, March

28, 2024, at 8:30 a.m. ET. Listeners can register for the webcast

via this link. A copy of the slides being presented will be

available via Avalo’s website. Those who plan on participating are

advised to join 15 minutes prior to the start time. A replay of the

webcast will also be available via under the “News/Events” page in

the Investors section of the Avalo’s website approximately two

hours after the call’s conclusion.

About AVTX-009

AVTX-009 is a humanized monoclonal antibody

(IgG4) that binds to interleukin-1β (IL-1β) with high affinity and

neutralizes its activity. IL-1β is a central driver in the

inflammatory process. Overproduction or dysregulation of IL-1β is

implicated in many autoimmune and inflammatory diseases.

IL-1β is a major, validated target for therapeutic intervention.

There is evidence that inhibition of IL-1β could be effective in HS

and a variety of inflammatory diseases in dermatology,

gastroenterology, and rheumatology.

About Avalo Therapeutics

Avalo Therapeutics is a clinical stage

biotechnology company focused on the treatment of immune

dysregulation. Avalo’s lead asset is AVTX-009, an anti-IL-1β mAb,

targeting inflammatory diseases. Avalo’s pipeline also includes

quisovalimab (anti-LIGHT mAb) and AVTX-008 (BTLA agonist fusion

protein). For more information about Avalo, please visit

www.avalotx.com.

About AlmataBio, Inc.

AlmataBio, Inc. was formed in April 2023 and its

primary operations were largely limited to identifying and

in-licensing the anti-IL-1β asset. AlmataBio was led by its former

CEO, Patrick J. Crutcher. Mr. Crutcher previously served as the

Co-Founder and CEO of ValenzaBio, which was acquired by Acelyrin,

Inc. (Nasdaq: SLRN). AlmataBio is now a wholly owned subsidiary of

Avalo.

Forward-Looking Statements

This press release may include forward-looking

statements made pursuant to the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are statements that

are not historical facts. Such forward-looking statements are

subject to significant risks and uncertainties that are subject to

change based on various factors (many of which are beyond Avalo’s

control), which could cause actual results to differ from the

forward-looking statements. Such statements may include, without

limitation, statements with respect to Avalo’s plans, objectives,

projections, expectations and intentions and other statements

identified by words such as “projects,” “may,” “might,” “will,”

“could,” “would,” “should,” “continue,” “seeks,” “aims,”

“predicts,” “believes,” “expects,” “anticipates,” “estimates,”

“intends,” “plans,” “potential,” or similar expressions (including

their use in the negative), or by discussions of future matters

such as: satisfaction of customary closing conditions related to

the private placement; the intended use of the proceeds from the

private placement; integration of AVTX-009 into our operations,

including trial design and IND preparation and filing for the

planned Phase 2 trial; drug development costs, timing of trials and

trial results, and other risks, particularly for AVTX-009,

including reliance on investigators and enrollment of patients in

clinical trials; reliance on key personnel; regulatory risks;

general economic and market risks and uncertainties, including

those caused the war in Ukraine and the Middle East; and those

other risks detailed in Avalo’s filings with the Securities and

Exchange Commission, available at www.sec.gov. Actual results may

differ from those set forth in the forward-looking statements.

Except as required by applicable law, Avalo expressly disclaims any

obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in Avalo’s expectations with respect thereto or

any change in events, conditions or circumstances on which any

statement is based.

For media and investor inquiries

Christopher Sullivan, CFO Avalo Therapeutics,

Inc. ir@avalotx.com410-803-6793

or

Chris BrinzeyICR

WestwickeChris.brinzey@westwicke.com339-970-2843

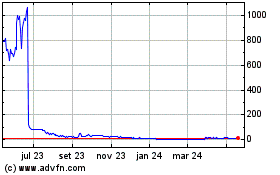

Avalo Therapeutics (NASDAQ:AVTX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

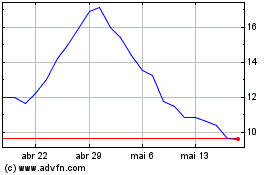

Avalo Therapeutics (NASDAQ:AVTX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024