Avalo Therapeutics, Inc. (Nasdaq: AVTX), today announced business

updates and year-end financial results for 2023.

“We are very excited about the acquisition of

AVTX-009 and concurrent financing of up to $185 million, $115.6

million of which we received upfront. The progress we made in 2023

to strengthen our balance sheet helped enable these transactions. I

am proud of the team’s efforts and continued dedication in

executing our strategy focused on the treatment of inflammatory

conditions,” said Dr. Garry Neil, Chief Executive Officer and

Chairman of the Board. “Our focus in 2024 is executing

operationally on the development of AVTX-009 for the treatment of

hidradenitis suppurativa. Our experienced team is ready to hit the

ground running on progressing the drug candidate and is motivated

by the potential of developing a meaningful treatment for patients

suffering from hidradenitis suppurativa, many of whom are searching

for improved treatment options.”

Corporate Updates

- On March 27, 2024, Avalo acquired

AVTX-009, a Phase 2 ready anti-IL-1β mAb, through an acquisition of

AlmataBio, Inc. The consideration included stock valued at $15

million, as well as a $7.5 million payment due upon closing of the

private placement investment. Avalo is also required to pay

development milestones to the former AlmataBio stockholders

including $5 million due upon the first patient dosed in a Phase 2

trial in patients with hidradenitis suppurativa (HS) and $15

million due upon the first patient dosed in a Phase 3 trial, both

of which are payable in cash, Avalo stock, or a combination thereof

at the election of the former AlmataBio stockholders.

- On March 28, 2024, Avalo closed a

private placement led by Commodore Capital and TCGX, with

participation from BVF Partners, Deep Track Capital, OrbiMed,

Petrichor, and RA Capital Management for gross proceeds of up to

$185 million, including $115.6 million of initial upfront funding

received at close. The upfront investment is expected to fund

operations through Avalo’s planned Phase 2 data readout in

hidradenitis suppurativa and into 2027.

- As part of the private placement,

the Company issued (i) an aggregate of $115.6 million of non-voting

convertible preferred stock and (ii) warrants to purchase Avalo’s

common stock or an equivalent amount (as converted to common stock)

of non-voting convertible preferred stock for an aggregate exercise

price of $69.4 million. The warrants are exercisable for

approximately $5.80 per underlying share of common stock until the

earlier of five years from the date of issuance or 30 days after

the public announcement of the first patient dosed in a Phase 2

trial of AVTX-009 in HS. On an as-converted basis and after

accounting for the financing and acquisition (excluding the

exercise of the warrants), the total number of shares of Avalo

common stock outstanding would be approximately 23.4 million

immediately after the closing of the transactions.

Program Updates and

Milestones:

- AVTX-009: Anti-IL-1β

monoclonal antibody (mAb) targeting inflammatory diseases.

- Avalo intends to pursue the

development of AVTX-009 in hidradenitis suppurativa and expects

topline data from its planned Phase 2 trial in hidradenitis

suppurativa in 2026.

- In addition to hidradenitis

suppurativa, Avalo intends to develop AVTX-009 in at least one

other chronic inflammatory indication.

- Quisovalimab (AVTX-002):

Anti-LIGHT mAb targeting immune-inflammatory diseases.

- Avalo is conducting a strategic

review of the quisovalimab program.

- AVTX-008: B and T

Lymphocyte Attenuator (BTLA) agonist fusion protein targeting

immune dysregulation disorders.

- Avalo is conducting a strategic

review of the AVTX-008 program.

2023 Financial Update:

As of December 31, 2023, Avalo had $7.4 million

in cash and cash equivalents. We raised approximately

$46.2 million of net proceeds from equity financings in 2023

and fully retired our original $35 million of debt with principal

payments of $21.2 million, inclusive of the full payoff of the loan

in September 2023.

The decrease in net loss was primarily

attributable to a $26.2 million decrease in operating expenses

driven by significantly reduced research and development expenses

and selling, general and administrative expenses partially offset

by a decrease of $14.2 million in license and other revenue.

The significant reduction of research and development expenses was

driven by fewer development programs ongoing during 2023 (due to

divestitures in both 2022 and 2023), the AVTX-002 trial reading out

in June of 2023 with no new trials initiated in the second half of

the year, and a reduction of manufacturing costs due to the timing

of manufacturing runs. Selling, general and administrative expenses

decreased due to a smaller infrastructure to support the focused

pipeline, severance in 2022 that did not repeat, as well as cost

savings initiatives. Net loss per share decreased as a result of

the decrease in net loss and due to an increase in the shares

outstanding.

In March 2024, we closed a private placement

financing for gross upfront proceeds of $115.6 million. Avalo

estimates upfront net proceeds of approximately $105 million after

deducting estimated transaction fees and expenses from both the

private placement financing and the acquisition of AlmataBio. We

expect future research and development expenses and cash used in

operating activities to increase in 2024 as a result of our

development plans to initiate and progress a Phase 2 trial in

hidradenitis suppurativa. Topline results from this planned Phase 2

trial are expected in 2026 and the upfront funding is expected to

fund operations through this data readout and into 2027.

Consolidated Balance Sheets(In

thousands, except share and per share data)

| |

December 31, |

| |

2023 |

|

2022 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

7,415 |

|

|

$ |

13,172 |

|

|

Other receivables |

|

136 |

|

|

|

1,919 |

|

|

Inventory, net |

|

— |

|

|

|

20 |

|

|

Prepaid expenses and other current assets |

|

843 |

|

|

|

1,290 |

|

|

Restricted cash, current portion |

|

1 |

|

|

|

15 |

|

| Total current assets |

|

8,395 |

|

|

|

16,416 |

|

| Property and equipment,

net |

|

1,965 |

|

|

|

2,411 |

|

| Goodwill |

|

10,502 |

|

|

|

14,409 |

|

| Restricted cash, net of

current portion |

|

131 |

|

|

|

131 |

|

| Total assets |

$ |

20,993 |

|

|

$ |

33,367 |

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

446 |

|

|

$ |

2,882 |

|

|

Deferred revenue |

|

— |

|

|

|

88 |

|

|

Accrued expenses and other current liabilities |

|

4,172 |

|

|

|

13,214 |

|

|

Notes payable, current |

|

— |

|

|

|

5,930 |

|

| Total current liabilities |

|

4,618 |

|

|

|

22,114 |

|

| Notes payable,

non-current |

|

— |

|

|

|

13,486 |

|

| Royalty obligation |

|

2,000 |

|

|

|

2,000 |

|

| Deferred tax liability,

net |

|

155 |

|

|

|

141 |

|

| Derivative liability |

|

5,550 |

|

|

|

4,830 |

|

| Other long-term

liabilities |

|

1,366 |

|

|

|

1,711 |

|

| Total liabilities |

|

13,689 |

|

|

|

44,282 |

|

| Stockholders’ equity (deficit)

: |

|

|

|

|

Common stock—$0.001 par value; 200,000,000 shares authorized at

December 31, 2023 and 2022; 801,7461 and

39,2941 shares issued and outstanding at December 31,

2023 and 2022, respectively |

|

1 |

|

|

|

— |

|

|

Additional paid-in capital1 |

|

342,437 |

|

|

|

292,909 |

|

|

Accumulated deficit |

|

(335,134 |

) |

|

|

(303,824 |

) |

| Total stockholders’ equity

(deficit) |

|

7,304 |

|

|

|

(10,915 |

) |

| Total liabilities and

stockholders’ equity (deficit) |

$ |

20,993 |

|

|

$ |

33,367 |

|

| |

|

|

|

|

|

|

|

1Amounts for prior periods presented have been

retroactively adjusted to reflect the 1-for-240 reverse stock split

effected on December 28, 2023.

The consolidated balance sheets as of December

31, 2023 and 2022 have been derived from the audited financial

statements, but do not include all of the information and footnotes

required by accounting principles accepted in the United States for

complete financial statements.

Consolidated Statements of

Operations

(In thousands, except per share data)

| |

Year Ended December 31, |

| |

2023 |

|

2022 |

| Revenues: |

|

|

|

|

Product revenue, net |

$ |

1,408 |

|

|

$ |

3,364 |

|

|

License and other revenue |

|

516 |

|

|

|

14,687 |

|

|

Total revenues, net |

|

1,924 |

|

|

|

18,051 |

|

| |

|

|

|

| Operating expenses: |

|

|

|

|

Cost of product sales |

|

1,284 |

|

|

|

3,434 |

|

|

Research and development |

|

13,784 |

|

|

|

31,308 |

|

|

Selling, general and administrative |

|

10,300 |

|

|

|

20,711 |

|

|

Goodwill impairment |

|

3,907 |

|

|

|

— |

|

|

Amortization expense |

|

— |

|

|

|

38 |

|

|

Total operating expenses |

|

29,275 |

|

|

|

55,491 |

|

| |

|

(27,351 |

) |

|

|

(37,440 |

) |

| Other expense: |

|

|

|

|

Interest expense, net |

|

(3,417 |

) |

|

|

(4,170 |

) |

|

Change in fair value of derivative liability |

|

(720 |

) |

|

|

— |

|

|

Other expense, net |

|

(42 |

) |

|

|

(20 |

) |

| Total other expense, net |

|

(4,179 |

) |

|

|

(4,190 |

) |

| Loss before income taxes |

|

(31,530 |

) |

|

|

(41,630 |

) |

| Income tax expense |

|

14 |

|

|

|

28 |

|

| Net loss |

$ |

(31,544 |

) |

|

$ |

(41,658 |

) |

| |

|

|

|

| Net loss per share of common

stock, basic and diluted1 |

$ |

(114 |

) |

|

$ |

(1,063 |

) |

| |

|

|

|

|

|

|

|

1 Amounts for prior periods presented have been

retroactively adjusted to reflect the 1-for-240 reverse stock split

effected on December 28, 2023.

The consolidated statements of operations for

the year ended December 31, 2023 and 2022 have been derived from

the audited financial statements, but do not include all of the

information and footnotes required by accounting principles

generally accepted in the United States for complete financial

statements.

About AVTX-009AVTX-009 is a

humanized monoclonal antibody (IgG4) that binds to interleukin-1β

(IL-1β) with high affinity and neutralizes its activity. IL-1β is a

central driver in the inflammatory process. Overproduction or

dysregulation of IL-1β is implicated in many autoimmune and

inflammatory diseases. IL-1β is a major, validated target for

therapeutic intervention. There is evidence that inhibition of

IL-1β could be effective in hidradenitis suppurativa and a variety

of inflammatory diseases in dermatology, gastroenterology, and

rheumatology.

About quisovalimab

(AVTX-002)Quisovalimab is a fully human monoclonal

antibody (mAb), directed against human LIGHT

(Lymphotoxin-like, exhibits

Inducible expression, and competes with Herpes

Virus Glycoprotein D for

Herpesvirus Entry Mediator (HVEM), a receptor

expressed by T lymphocytes). There is increasing

evidence that the dysregulation of the LIGHT-signaling network

which includes LIGHT, its receptors HVEM and LTβR and the

downstream checkpoint BTLA, is a disease-driving mechanism in

autoimmune and inflammatory reactions in barrier organs. Therefore,

we believe reducing LIGHT levels can moderate immune dysregulation

in many acute and chronic inflammatory disorders. Quisovalimab

previously demonstrated proof of concept in COVID-19 induced acute

respiratory distress syndrome including reduction in mortality and

respiratory failure, as well as a positive signal in patients with

Crohn’s Disease.

About AVTX-008AVTX-008 is a

fully human B and T Lymphocyte Attenuator (BTLA) agonist fusion

protein in the IND-enabling stage. AVTX-008 is differentiated by

having specific binding to BTLA, with no binding to LIGHT or CD160.

AVTX-008 also has high-serum stability and solubility.

About Avalo Therapeutics Avalo

Therapeutics is a clinical stage biotechnology company focused on

the treatment of immune dysregulation. Avalo’s lead asset is

AVTX-009, an anti-IL-1β mAb, targeting inflammatory diseases.

Avalo’s pipeline also includes quisovalimab (anti-LIGHT mAb) and

AVTX-008 (BTLA agonist fusion protein).

For more information about Avalo, please visit

www.avalotx.com.

Forward-Looking Statements

This press release may include forward-looking

statements made pursuant to the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are statements that

are not historical facts. Such forward-looking statements are

subject to significant risks and uncertainties that are subject to

change based on various factors (many of which are beyond Avalo’s

control), which could cause actual results to differ from the

forward-looking statements. Such statements may include, without

limitation, statements with respect to Avalo’s plans, objectives,

projections, expectations and intentions and other statements

identified by words such as “projects,” “may,” “might,” “will,”

“could,” “would,” “should,” “continue,” “seeks,” “aims,”

“predicts,” “believes,” “expects,” “anticipates,” “estimates,”

“intends,” “plans,” “potential,” or similar expressions (including

their use in the negative), or by discussions of future matters

such as: the intended use of the proceeds from the private

placement; integration of AVTX-009 into our operations; drug

development costs, timing of trial results and other risks,

including reliance on investigators and enrollment of patients in

clinical trials; reliance on key personnel; regulatory risks;

general economic and market risks and uncertainties, including

those caused by the war in Ukraine and the Middle East; and those

other risks detailed in Avalo’s filings with the Securities and

Exchange Commission, available at www.sec.gov. Actual

results may differ from those set forth in the forward-looking

statements. Except as required by applicable law, Avalo expressly

disclaims any obligations or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in Avalo’s expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based.

For media and investor inquiries

Christopher Sullivan, CFO Avalo Therapeutics,

Inc. ir@avalotx.com410-803-6793

or

Chris BrinzeyICR

WestwickeChris.brinzey@westwicke.com339-970-2843

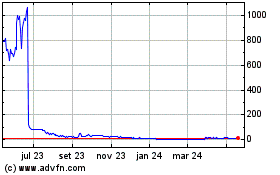

Avalo Therapeutics (NASDAQ:AVTX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

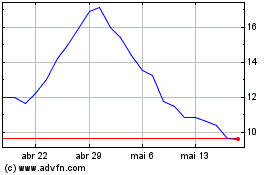

Avalo Therapeutics (NASDAQ:AVTX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024