Deciphera Shareholders to Receive $25.60 per

Share in Cash

Deciphera’s Kinase Inhibitor Expertise and

Established Commercialization Platform in Key Markets Will

Reinforce ONO Pharmaceutical’s Pipeline and Accelerate Global

Reach

Deciphera Pharmaceuticals, Inc. (NASDAQ: DCPH), a

biopharmaceutical company focused on discovering, developing, and

commercializing important new medicines to improve the lives of

people with cancer, today announced that it has entered into a

definitive merger agreement with ONO Pharmaceutical Co., Ltd.

(ONO), under which ONO will acquire all outstanding shares of

Deciphera common stock for $25.60 per share in cash through a

tender offer followed by a merger of Deciphera with a wholly-owned

subsidiary of ONO (the “Acquisition”), for a total equity value of

$2.4 billion. The boards of directors of both companies have

unanimously approved the transaction.

Together, ONO and Deciphera will accelerate their shared vision

to deliver innovative new drugs and serve patients around the

world. Deciphera brings specialized research and development

capabilities in kinase drug discovery, well-established commercial

and sales platforms in the United States and Europe, and global

clinical development capabilities. In addition to QINLOCK® -

Deciphera’s switch-control inhibitor for the treatment of

fourth-line gastrointestinal stromal tumor (GIST), which is

approved in the United States and over 40 other countries,

Deciphera also brings a mature, diverse pipeline of best-or-first

in class potential medicines, including vimseltinib, DCC-3116 (an

ULK inhibitor) and multiple additional oncology candidates.

Vimseltinib is a highly selective switch-control kinase inhibitor

with successful pivotal clinical data for the potential to be a

best-in-class and first-in-class agent for the treatment of

tenosynovial giant cell tumor (TGCT), and potentially other

indications. The Acquisition is expected to enable ONO to build a

robust presence in oncology, one of its key priority areas, and

also support ONO’s efforts to become a Global Specialty Pharma

company.

Steven L. Hoerter, President and Chief Executive Officer of

Deciphera, said, “Deciphera and ONO share a deep commitment to

improve the lives of people living with cancer, and the transaction

announced today enables us to make even greater impact for

patients. Together, we expect to advance and accelerate each

organization’s important work through combined research and

development capabilities and a global commercial footprint.

Importantly, this acquisition delivers for all of Deciphera’s

stakeholders. It provides immediate, compelling value for our

shareholders, provides greater opportunities for our world-class

team, and ultimately, greater hope for patients. I am excited about

the future of the combined organization, and we are honored to

contribute to the continued growth of ONO in the U.S. and around

the world."

Gyo Sagara, Representative Director, Chairman of the Board and

Chief Executive Officer of ONO, said, "We expect that this

acquisition of Deciphera will not only expand ONO's target oncology

portfolio, but also accelerate ONO's business development in the

United States and Europe, and strengthen kinase drug discovery

research. Deciphera's mission statement ‘Inspired by Patients:

Defeat Cancer’ is aligned with ONO’s corporate philosophy

‘Dedicated to the Fight against Disease and Pain.’ We respect the

innovative culture of Deciphera and look forward to working

together to drive further growth for both ONO and Deciphera.”

Transaction Details

The Acquisition is structured as a tender offer and subsequent

merger of Deciphera with a wholly-owned subsidiary of ONO. Under

the terms of the definitive merger agreement, ONO will acquire all

outstanding shares of Deciphera for $25.60 per share in cash for a

total equity value of approximately $2.4 billion. The purchase

price represents a premium of 74.7% to Deciphera’s closing share

price of $14.65 on April 26, 2024, and a premium of 68.8% to

Deciphera’s 30-trading-day volume weighted average price as of

April 26, 2024.

ONO will promptly commence the tender offer, and it will expire

20 business days after its commencement, unless otherwise extended.

If the tender offer conditions are not satisfied, ONO may be

required to extend the tender offer under certain circumstances.

Upon the successful completion of the tender offer, ONO’s

wholly-owned subsidiary will merge with and into Deciphera, with

Deciphera continuing as the surviving corporation and a

wholly-owned subsidiary of ONO, and any shares of common stock of

Deciphera not tendered into the offer will receive the same USD per

share price payable in the tender offer. The Acquisition is

expected to close in the third quarter of 2024, subject to

customary closing conditions, including U.S. antitrust clearance

and the tender of a majority of Deciphera’s outstanding shares of

common stock.

In connection with the execution of the merger agreement,

certain stockholders of the Company owning approximately 28% of the

outstanding shares of Deciphera Common Stock have entered into

Tender and Support Agreements pursuant to which they will tender

all of their owned shares in the offer.

Upon completion of the Acquisition, Deciphera will operate as a

standalone business of ONO Group, from its headquarters in Waltham,

Massachusetts.

In light of the Acquisition, Deciphera will not host a first

quarter 2024 earnings call. The Company will file a Form 10-Q in

the ordinary course.

Advisors

J.P. Morgan Securities LLC is serving as exclusive financial

advisor to Deciphera and Goodwin Procter LLP is serving as legal

counsel. BofA Securities is serving as financial advisor to ONO and

Greenberg Traurig is serving as legal counsel.

About Deciphera Pharmaceuticals

Deciphera is a biopharmaceutical company focused on discovering,

developing, and commercializing important new medicines to improve

the lives of people with cancer. We are leveraging our proprietary

switch-control kinase inhibitor platform and deep expertise in

kinase biology to develop a broad portfolio of innovative

medicines. In addition to advancing multiple product candidates

from our platform in clinical studies, QINLOCK® is Deciphera’s

switch-control inhibitor for the treatment of fourth-line GIST.

QINLOCK is approved in Australia, Canada, China, the European

Union, Hong Kong, Iceland, Israel, Liechtenstein, Macau, New

Zealand, Norway, Singapore, Switzerland, Taiwan, the United

Kingdom, and the United States. For more information, visit

www.deciphera.com and follow us on LinkedIn and X (@Deciphera).

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended, including, without limitation, statements

regarding the proposed acquisition of Deciphera by Ono, the

expected timetable for completing the transaction, Deciphera’s

future financial or operating performance, the expectations and

timing regarding the potential for Deciphera’s preclinical and/or

clinical stage pipeline assets to be first-in-class and/or

best-in-class treatments, and the ability of Deciphera to become a

company with multiple approved medicines. The words “may,” “will,”

“could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “believe,” “estimate,” “predict,” “project,” “potential,”

“continue,” “seek,” “target” and similar expressions are intended

to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Any

forward-looking statements in this press release are based on

management’s current expectations and beliefs and are subject to a

number of risks, uncertainties and important factors that may cause

actual events or results to differ materially from those expressed

or implied by any forward-looking statements contained in this

press release, including, without limitation: (i) risks associated

with the timing of the closing of the proposed transaction,

including the risks that a condition to closing would not be

satisfied within the expected timeframe or at all or that the

closing of the proposed transaction will not occur; (ii)

uncertainties as to how many of Deciphera’s stockholders will

tender their shares in the offer; (iii) the possibility that a

governmental entity may prohibit, delay or refuse to grant approval

for the consummation of the transaction; (iv) the possibility that

competing offers will be made; (v) the outcome of any legal

proceedings that may be instituted against the parties and others

related to the merger agreement; (vi) unanticipated difficulties or

expenditures relating to the proposed transaction, the response of

business partners and competitors to the announcement of the

proposed transaction, and/or potential difficulties in employee

retention as a result of the announcement and pendency of the

proposed transaction; (vii) Deciphera’s ability to successfully

demonstrate the efficacy and safety of its drug or drug candidates,

and the preclinical or clinical results for its product candidates,

which may not support further development of such product

candidates; (viii) comments, feedback and actions of regulatory

agencies; (ix) Deciphera’s ability to commercialize QINLOCK® and

execute on its marketing plans for any drugs or indications that

may be approved in the future; (x) the inherent uncertainty in

estimates of patient populations, competition from other products,

Deciphera’s ability to obtain and maintain reimbursement for any

approved product and the extent to which patient assistance

programs are utilized; and (xi) other risks identified in our

Securities and Exchange Commission (SEC) filings, including our

Annual Report on Form 10-K for the year ended December 31, 2023,

and subsequent filings with the SEC. We caution you not to place

undue reliance on any forward-looking statements, which speak only

as of the date they are made. We disclaim any obligation to

publicly update or revise any such statements to reflect any change

in expectations or in events, conditions or circumstances on which

any such statements may be based, or that may affect the likelihood

that actual results will differ from those set forth in the

forward-looking statements.

The Deciphera logo and the QINLOCK® word mark and logo are

registered trademarks and the Deciphera word mark is a trademark of

Deciphera Pharmaceuticals, LLC.

Additional Information about the Proposed Transaction and

Where to Find It

The tender offer referred to in this press release has not yet

commenced. This communication is for informational purposes only

and is neither an offer to purchase nor a solicitation of an offer

to sell shares, nor is it a substitute for the tender offer

materials that Ono and its acquisition subsidiary will file with

the SEC upon commencement of the tender offer. At the time the

tender offer is commenced, Ono and its acquisition subsidiary will

cause to be filed a tender offer statement on Schedule TO with the

SEC, and Deciphera will file a solicitation/recommendation

statement on Schedule 14D-9 with respect to the tender offer. THE

TENDER OFFER STATEMENT (INCLUDING AN OFFER TO PURCHASE, A RELATED

LETTER OF TRANSMITTAL AND OTHER OFFER DOCUMENTS) AND THE

SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT

INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY

DECIPHERA STOCKHOLDERS BEFORE ANY DECISION IS MADE WITH RESPECT TO

THE TENDER OFFER. Both the tender offer statement and the

solicitation/recommendation statement will be mailed to Deciphera’s

stockholders free of charge. A free copy of the tender offer

statement and the solicitation/recommendation statement will also

be made available to all stockholders of Deciphera by accessing the

“Investors & News” section of www.deciphera.com or by

contacting Investor Relations at deciphera@argotpartners.com. In

addition, the tender offer statement and the

solicitation/recommendation statement (and all other documents

filed with the SEC) will be available at no charge on the SEC’s

website, www.sec.gov, upon filing with the SEC.

DECIPHERA STOCKHOLDERS ARE ADVISED TO READ THE SCHEDULE TO AND

THE SCHEDULE 14D-9, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM

TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC

WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH

RESPECT TO THE TENDER OFFER, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES

THERETO.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240429316382/en/

Investor Relations: Maghan Meyers Argot Partners

Deciphera@argotpartners.com 212-600-1902

Media: David Rosen Argot Partners

david.rosen@argotpartners.com 212-600-1902

Or

Dan Katcher / Leigh Parrish / Sophie Throsby Joele Frank,

Wilkinson Brimmer Katcher 212-355-4449

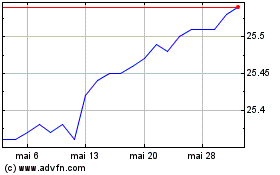

Deciphera Pharmaceuticals (NASDAQ:DCPH)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Deciphera Pharmaceuticals (NASDAQ:DCPH)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025