Farmers National Banc Corp. (“Farmers” or the “Company”)

(NASDAQ: FMNB), the holding company for The Farmers National Bank

of Canfield (“Farmers National Bank”), and Emclaire Financial Corp.

(“Emclaire”) (NASDAQ: EMCF), the holding company for The Farmers

National Bank of Emlenton (“Emlenton Bank”), jointly announced

today that they have received regulatory approvals, including

approval from the Board of Governors of the Federal Reserve System

and the Office of the Comptroller of the Currency, necessary to

complete the proposed merger of Emclaire Financial Corp. with and

into FMNB Merger Subsidiary V, LLC, a newly-formed wholly-owned

subsidiary of Farmers (the “Merger”) pursuant to the Agreement and

Plan of Merger dated as of March 23, 2023 by and between Farmers

and Emclaire (the “Merger Agreement”), and the related merger of

Emlenton Bank with and into Farmers National Bank. The Merger is

expected to be completed in January of 2023.

ABOUT FARMERS NATIONAL BANC CORP.

Founded in 1887, Farmers National Banc Corp. is a diversified

financial services company headquartered in Canfield, Ohio, with

$4.1 billion in banking assets. Farmers National Banc Corp.’s

wholly-owned subsidiaries are comprised of The Farmers National

Bank of Canfield, a full-service national bank engaged in

commercial and retail banking with 46 banking locations in

Mahoning, Trumbull, Columbiana, Stark, Summit, Portage, Wayne,

Medina, Geauga and Cuyahoga counties in Ohio and Beaver County in

Pennsylvania; Farmers Trust Company, which operates five trust

offices and offers services in the same geographic markets and

Farmers National Insurance, LLC. Total wealth management assets

under care at September 30, 2022 were $2.9 billion.

ABOUT EMCLAIRE FINANCIAL CORP.

Emclaire Financial Corp. is the parent company of the Farmers

National Bank of Emlenton, an independent, nationally chartered,

FDIC-insured community commercial bank headquartered in Emlenton,

Pennsylvania, operating 19 full service offices in Venango,

Allegheny, Butler, Clarion, Clearfield, Crawford, Elk, Jefferson

and Mercer Counties, Pennsylvania. The Corporation’s common stock

is quoted on and traded through NASDAQ under the symbol “EMCF”. For

more information visit Emclaire’s website at

www.emclairefinancial.com.

FORWARD LOOKING STATEMENTS

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements are not historical facts, but rather

statements based on Farmers’ and Emclaire’s current expectations

regarding its business strategies and its intended results and

future performance. Forward-looking statements are preceded by

terms such as “expects,” “believes,” “anticipates,” “intends” and

similar expressions, as well as any statements related to future

expectations of performance or conditional verbs, such as “will,”

“would,” “should,” “could” or “may.”

Forward-looking statements are not a guarantee of future

performance and actual future results could differ materially from

those contained in forward-looking information. Because

forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that

are difficult to predict and many of which are outside of Farmers’

and Emclaire’s control. Numerous uncertainties, risks, and changes

could cause or contribute to Farmers’ or Emclaire’s actual results,

performance, and achievements to be materially different from those

expressed or implied by the forward-looking statements. Factors

that may cause or contribute to these differences include, without

limitation, the possibility that the closing of the proposed

transaction is delayed or does not occur at all because required

regulatory approvals or other conditions to the transaction are not

obtained or satisfied on a timely basis or at all; the possibility

that the anticipated benefits of the transaction are not realized

when expected or at all; Farmers’ and Emclaire’s failure to

integrate Emclaire and Emlenton Bank with Farmers and Farmers Bank

in accordance with expectations; deviations from performance

expectations related to Emclaire and Emlenton Bank; diversion of

management’s attention on the proposed transaction; general

economic conditions in markets where Farmers and Emclaire conduct

business, which could materially impact credit quality trends;

effects of the COVID-19 pandemic on the local, national, and

international economy, Farmers’ or Emclaire’s organization and

employees, and Farmers’ and Emclaire’s customers and suppliers and

their business operations and financial condition; disruptions in

the mortgage and lending markets and significant or unexpected

fluctuations in interest rates related to COVID-19 and governmental

responses, including financial stimulus packages; general business

conditions in the banking industry; the regulatory environment;

general fluctuations in interest rates; demand for loans in the

market areas where Farmers and Emclaire conduct business; rapidly

changing technology and evolving banking industry standards;

competitive factors, including increased competition with regional

and national financial institutions; and new service and product

offerings by competitors and price pressures; and other factors

disclosed periodically in Farmers’ and Emclaire’s filings with the

Securities and Exchange Commission (the “SEC”).

Because of the risks and uncertainties inherent in

forward-looking statements, readers are cautioned not to place

undue reliance on them, whether included in this release or made

elsewhere from time to time by Farmers, Emclaire or on Farmers’ or

Emclaire’s behalf, respectively. Forward-looking statements speak

only as of the date made, and neither Farmers nor Emclaire assumes

any duty and does not undertake to update forward-looking

statements.

Farmers and Emclaire provide further detail regarding these

risks and uncertainties in their respective latest Annual Reports

on Form 10-K, including in the risk factors section of Farmers’

latest Annual Report on Form 10-K, as well as in subsequent SEC

filings, available on the SEC’s website at www.sec.gov.

Important Additional

Information.

Additional information about the Merger and the Merger Agreement

is available in a Current Report on Form 8-K filed by Farmers with

the SEC on March 24, 2022, as well as in the proxy

statement/prospectus filed by each of Farmers and Emclaire on June

15, 2022.

Investors and security holders may obtain free copies of the

documents filed with the SEC by Farmers or Emclaire through the

website maintained by the SEC at http://www.sec.gov. Copies of the

documents filed with the SEC by Farmers are available free of

charge by accessing the “Investor Relations” section of Farmers’

website at www.farmersbankgroup.com or, alternatively, by directing

a request to Farmers Investor Relations, Farmers National Banc

Corp., 20 South Broad Street, Canfield, Ohio 44406, (330) 533-3341.

Copies of the documents filed or to be filed with the SEC by

Emclaire may be obtained without charge from Emclaire by written

request to Emclaire Financial Corp., 612 Main Street, Emlenton,

Pennsylvania 16373, Attention: Jennifer A. Poulsen, Secretary.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221205005213/en/

Amber Wallace Senior Vice President, Chief Retail/Marketing

Officer 330-720-6441 awallace@farmersbankgroup.com

William C. Marsh Chairman of the Board, President and Chief

Executive Officer 844-767-2311 investor.relations@farmersnb.com

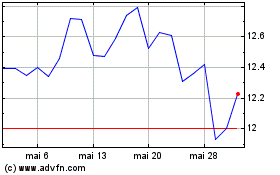

Farmers National Banc (NASDAQ:FMNB)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Farmers National Banc (NASDAQ:FMNB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024