Farmers National Banc Corp. Announces New 1,000,000 Share Repurchase Program

01 Março 2023 - 10:30AM

Business Wire

Farmers National Banc Corp., (NASDAQ: FMNB) Canfield, Ohio,

announced today that its Board of Directors has approved a share

repurchase program under which the Company is authorized to

repurchase up to 1,000,000 shares of its common stock exclusive of

any fees, commissions or other expenses (the “Program”).

Repurchases under the Program will be made periodically depending

on market conditions and other factors.

Kevin J. Helmick, President and CEO, stated, “We remain focused

on allocating capital to support our growth strategies, dividend

policy, and share repurchase programs. To date in 2023, we have

repurchased approximately $5.0 million of our common stock. In

addition, since 2018, when we paid out $0.38 per share in annual

dividends, our annual dividend per share has grown to an annualized

amount of $0.68. The repurchases and growth in our dividend reflect

our strong financial position and performance, and our longstanding

commitment to creating sustained value for our shareholders.”

The Program may be modified, suspended, or terminated by the

Company at any time. The Program supersedes the Company’s prior

share repurchase program approved in 2019, which authorized the

purchase of up to 1,500,000 shares of Common Stock, 198,336 of

which remained available for repurchase as of February 28, 2023.

The Company had repurchased approximately 1,301,664 shares under

the prior program.

About Farmers National Banc Corp.

Founded in 1887, Farmers National Banc Corp. is a diversified

financial services company headquartered in Canfield, Ohio, with

over $5.0 billion in banking assets. Farmers National Banc Corp.’s

wholly-owned subsidiaries are comprised of The Farmers National

Bank of Canfield, a full-service national bank engaged in

commercial and retail banking with 65 banking locations throughout

Ohio and Pennsylvania; Farmers Trust Company, which operates five

trust offices and offers services in the same geographic markets

and Farmers National Insurance, LLC. Total wealth management assets

under care at December 31, 2022 were $3.0 billion.

Cautionary Statements Regarding Forward-Looking

Statements

We make statements in this news release and our related investor

conference call, and we may from time to time make other

statements, that are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, including

statements about Farmers’ financial condition, results of

operations, asset quality trends and profitability. Forward-looking

statements are not historical facts but instead represent only

management’s current expectations and forecasts regarding future

events, many of which, by their nature, are inherently uncertain

and outside of Farmers’ control. Forward-looking statements are

preceded by terms such as “expects,” “believes,” “anticipates,”

“intends” and similar expressions, as well as any statements

related to future expectations of performance or conditional verbs,

such as “will,” “would,” “should,” “could” or “may.” Farmers’

actual results and financial condition may differ, possibly

materially, from the anticipated results and financial condition

indicated in these forward-looking statements. Factors that could

cause Farmers’ actual results to differ materially from those

described in certain forward-looking statements include impacts

from the length and extent of the economic impacts of the COVID-19

pandemic; significant changes in near-term local, regional, and

U.S. economic conditions including those resulting from continued

high rates of inflation, tightening monetary policy of the Board of

Governors of the Federal Reserve, and possibility of a recession;

Farmers’ failure to integrate Emclaire and Emlenton with Farmers in

accordance with expectations; deviations from performance

expectations related to Emclaire and Emlenton; and the other

factors contained in Farmers’ Annual Report on Form 10-K for the

year ended December 31, 2021 and subsequent Quarterly Reports on

Form 10-Q filed with the Securities and Exchange Commission (SEC)

and available on Farmers’ website (www.farmersbankgroup.com) and on

the SEC’s website (www.sec.gov). Forward-looking statements are not

guarantees of future performance and should not be relied upon as

representing management’s views as of any subsequent date. Farmers

does not undertake any obligation to update the forward-looking

statements to reflect the impact of circumstances or events that

may arise after the date of the forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230228006128/en/

Amber Wallace EVP, Chief Retail & Marketing Officer

330-702-8427 awallace@farmersbankgroup.com

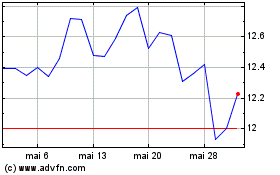

Farmers National Banc (NASDAQ:FMNB)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Farmers National Banc (NASDAQ:FMNB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024