- Earnings per diluted share of $0.19 ($0.44 excluding certain

items, non-GAAP) for the first quarter of 2023

- Completed the acquisition and systems integration of

Emclaire Financial Corp.

- 161 consecutive quarters of profitability

- Repurchased 850,799 shares of FMNB common stock during the

quarter, or 2.2% of shares outstanding

- Additional FHLB borrowing capacity of $656.1 million as of

March 31, 2023

- Uninsured deposits are approximately 19.2% of customer

deposit base

- Available for sale securities not pledged totaled $539.9

million at March 31, 2023

- Efficiency ratio, (excluding certain items, non-GAAP), of

53.5% for the first quarter of 2023

- Return on average assets, (excluding certain items,

non-GAAP), was 1.30% for the first quarter of 2023

- ROAE and ROATE (excluding certain items, non-GAAP) 18.0% and

38.1%, respectively, for first quarter of 2023

Farmers National Banc Corp. (“Farmers” or the “Company”)

(NASDAQ: FMNB) today announced net income of $7.1 million for the

three months ended March 31, 2023 compared to $15.8 million for the

three months ended March 31, 2022. Diluted earnings per share were

$0.19 for the first quarter of 2023 compared to $0.47 for the first

quarter of 2022. The results for the first quarter of 2023 included

pretax items for acquisition related provision for credit loss

expense of $7.7 million, $4.3 million for acquisition related costs

and combined net gains of $91,000 on the sale of securities and the

sale of other assets. Excluding these items (non-GAAP), net income

for the first quarter of 2023 would have been $16.5 million, or

$0.44 per diluted share.

Kevin J. Helmick, President and CEO, commented, “For over 136

years, Farmers has been dedicated to serving its local communities,

while adhering to safe and sound banking principals. This has

driven our legacy of financial success, allowing us to continually

support our customers during both good and bad economic periods. As

volatility within the macro-economic environment has increased, we

have remained focused on serving our retail, commercial and wealth

customers, controlling expenses, and managing capital levels. In

addition, we continue to allocate capital to support our dividend

policy and share repurchase program.”

“We remain well positioned to navigate the current challenges in

the banking industry and interest rate environment, as a result of

our experienced leadership team, diverse revenue streams, enhanced

scale, and legendary customer service. I am proud of our team’s

performance during the first quarter, and encouraged by the

direction Farmers is headed,” concluded Mr. Helmick.

As previously announced, Farmers entered into an agreement and

plan of merger with Emclaire Financial Corp. (formerly NASDAQ:

EMCF), a Pennsylvania corporation (“Emclaire”), and the parent

company of The Farmers National Bank of Emlenton (“Emlenton”) on

March 23, 2022, the transaction was approved by Emclaire’s

shareholders on July 20, 2022, received final regulatory approvals

on December 2, 2022, and closed on January 1, 2023.

At the closing of the merger, Farmers issued 4.2 million shares

of its common stock along with cash of $33.4 million, which

represents a transaction value of approximately $92.6 million based

on Farmers closing price of $14.12 on December 31, 2022. The

transaction value has been allocated to assets acquired and

liabilities assumed, including $741.7 million in gross loans,

$216.2 million in other tangible assets, $875.8 million in

deposits, $75.0 million in FHLB advances, $7.1 million in other

liabilities and $92.6 million in goodwill and other intangible

assets. Prior to closing, Emlenton incurred $4.6 million of

merger-related costs.

Balance Sheet

The Company’s total assets increased to $5.11 billion at March

31, 2023 compared to $4.08 billion at December 31, 2022. The

increase was primarily due to the acquisition of Emlenton which

added $1.05 billion in assets to the balance sheet. Gross loans

(excluding loans held for sale) increased by $747.6 million in the

first quarter of 2023. This figure included $741.7 million in gross

loans added from Emlenton and $5.9 million in organic loan

growth.

Securities available for sale increased to $1.36 billion at

March 31, 2023 from $1.27 billion at December 31, 2022. This

increase was due to the addition of $127.0 million in available for

sale securities from Emlenton and a reduction in the gross amount

of unrealized losses which totaled $266.5 million at December 31,

2022 compared to a gross unrealized loss of $223.7 million at March

31, 2023. Offsetting these increases, the Company also had sales

and runoff from the portfolio that totaled approximately $82.4

million in the first three months of 2023. The Company will

continue to look to opportunistically shrink the size of the

securities portfolio to increase liquidity and optimize

profitability. The volatility in the bond market, however, is

expected to continue in 2023, which may result in increased

volatility in the fair value of the Company’s available for sale

securities.

During the first quarter of 2023, total customer deposits

(excluding brokered time deposits) increased to $4.31 billion from

$3.42 billion at December 31, 2022. The increase was driven by the

$875.8 million in deposits assumed in the acquisition of Emlenton

along with $14.5 million in organic growth during the quarter. The

Company continues to experience heightened competition from other

banks, money market funds and the treasury market itself. In

addition, it appears that some customers are utilizing deposit

balances to counter the higher cost of living or running a business

brought on by the higher inflationary environment. The Company

expects competition for deposits to remain highly elevated for the

foreseeable future which will continue to place pressure on funding

costs.

Total stockholders’ equity increased from $292.3 million at

December 31, 2022 to $374.6 million at March 31, 2023. The increase

was primarily driven by the acquisition of Emlenton along with a

decrease in the loss from accumulated other comprehensive income

offset by increased treasury stock activity. The Company

repurchased 850,799 shares of its common stock during the quarter.

The accumulated other comprehensive loss declined $33.8 million

between December 31, 2022 and March 31, 2023 as rates on U.S.

treasury securities declined during the first quarter of 2023 and

pricing on available for sale securities improved. The Company’s

tangible book value per share (non-GAAP) was $4.84 at March 31,

2023 compared to $5.60 at December 31, 2022.

Liquidity

With the turmoil that the banking industry experienced in the

first quarter of 2023, the Company has continued to monitor its

deposit base and balance sheet composition as well as its access to

other sources of liquidity. The Company continues to run a modest

loan to customer deposit ratio of approximately 73.1% and the

Company’s average deposit balance per account is only $28,918. In

addition, the Company’s ratio of uninsured deposits is

approximately 19.2% which is low compared to the banking

institutions that experienced difficulty in the first quarter.

The Company also has access to an additional $656.1 million of

FHLB borrowing capacity at March 31, 2023 along with $539.9 million

of available for sale securities that are not pledged. With a deep

and diverse deposit base and access to a large amount of additional

funding capacity, the Company is well positioned to handle any

future liquidity stress.

Credit Quality

During the first quarter of 2023, the Company recorded a

provision for credit losses and unfunded commitments of $8.6

million. Of this figure, $7.7 million was due to the Emlenton

acquisition. In connection with the acquisition, the Company

recorded a provision for credit losses related to non-purchased

credit deteriorated loans of $7.5 million along with a provision

for unfunded commitments of $235,000. The Company also experienced

net charge-offs of $271,000 during the first quarter of 2023. Net

charge-offs as a percentage of average loans was 3 basis points for

the quarter ended March 31, 2023.

The allowance for credit losses to total loans increased to

1.14% at March 31, 2023 compared to 1.12% at December 31, 2022. The

Company recorded $1.0 million in the allowance for credit losses

for Emlenton’s purchase credit deteriorated loans.

Non-performing loans (NPLs) were $18.0 million at March 31, 2023

compared to $14.8 million at December 31, 2022. This increase was

primarily due to the addition of Emlenton. The NPL to loans ratio

was 0.57% at March 31, 2023 compared to 0.62% at December 31, 2022.

Non-performing assets to assets was 0.35% at March 31, 2023, down

slightly from 0.36% at December 31, 2022. Early stage

delinquencies, defined as 30-89 days delinquent, were $10.2

million, or 0.32% at March 31, 2023, compared to $9.6 million, or

0.40% of total loans, at December 31, 2022.

Net Interest Income

Net interest income totaled $36.6 million in the first quarter

of 2023 compared to $31.2 million for the first quarter of 2022. A

larger earning asset base due to the acquisition of Emlenton was

the primary driver of this increase offset by a 20 basis point

decline in the net interest margin. The net interest margin was

3.07% in the first quarter of 2023 compared to 2.99% in the fourth

quarter of 2022 and 3.27% for the first quarter of 2022. The

increase in net interest margin during the first quarter of 2023

compared to the prior quarter was due to the acquisition of

Emlenton. The decline in net interest margin between the first

quarter of 2023 and the first quarter of 2022 was due to increases

in funding costs outstripping the increase in yields on earning

assets. This increase in funding costs has been due to the rapid

increase in deposit rates due to intense competition for deposits,

the continued Federal Reserve rate hiking cycle and runoff of

deposit balances which are being replaced by much costlier

wholesale funding. Excluding the impact of acquisition marks and

related accretion and PPP interest and fees, the net interest

margin (non-GAAP) for the first quarter of 2023 was 2.86% compared

to 2.97% for the fourth quarter of 2022 and 3.12% for the first

quarter of 2022.

Noninterest Income

For the three months ended March 31, 2023, noninterest income

totaled $10.4 million compared to $17.7 million for the first

quarter of 2022. The primary reason for the decrease in 2023 was

the recognition of $8.4 million in income in 2022 for a legal

settlement. Several categories of noninterest income increased year

over year due to growth including trust fees and insurance

commissions while other categories grew due to growth and the

acquisition of Emlenton. Categories that increased year over year

due to both reasons included service charges on deposit accounts,

bank owned life insurance income, debit card income and other

noninterest income. Net gains on the sale of loans dropped from

$1.1 million in the first quarter of 2022 to $310,000 for the first

quarter of 2023. This drop was caused by lower mortgage production

compared to the prior year due to the dramatic increase in interest

rates in the last year. The Company also recognized $121,000 in

gains on the sale of securities for the first three months of 2023

compared to a loss on the sale of securities of $11,000 for the

first quarter of 2022.

Noninterest Expense

Noninterest expense increased from $30.5 million during the

three months ended March 31, 2022, to $30.7 million for the same

period in 2023. During the first quarter of 2022, the Company made

a charitable contribution of $6.0 million to the Farmers Charitable

Foundation and incurred $2.1 million in legal costs associated with

the legal settlement discussed above. Excluding these two items in

2022, noninterest expense increased $8.3 million in the first

quarter of 2023 compared to the first quarter of 2022.

Salaries and employee benefits increased $2.8 million to $14.7

million in the first quarter of 2023 compared to the same period in

2022. The acquisition of Emlenton along with normal raise activity

was the primary reason for the increase. Occupancy and equipment,

FDIC and state and local taxes, intangible amortization and core

processing charges all saw increases year over year primarily as a

result of the Emlenton acquisition. Merger related costs were $4.3

million in the first quarter of 2023 compared to $1.9 million in

the first quarter of 2022. Professional fees were $2.0 million

lower in the first quarter of 2023 compared to the first quarter of

2022 due to the legal costs discussed previously while other

noninterest expense was down $5.3 million for the first three

months of 2023 due primarily to the charitable contribution.

About Farmers National Banc Corp.

Founded in 1887, Farmers National Banc Corp. is a diversified

financial services company headquartered in Canfield, Ohio, with

$5.1 billion in banking assets. Farmers National Banc Corp.’s

wholly-owned subsidiaries are comprised of The Farmers National

Bank of Canfield, a full-service national bank engaged in

commercial and retail banking with 65 banking locations in

Mahoning, Trumbull, Columbiana, Portage, Stark, Wayne, Medina,

Geauga and Cuyahoga Counties in Ohio and Beaver, Butler, Allegheny,

Jefferson, Clarion, Venango, Clearfield, Mercer, Elk and Crawford

Counties in Pennsylvania, and Farmers Trust Company, which operates

five trust offices and offers services in the same geographic

markets. Total wealth management assets under care at March 31,

2023 are $3.1 billion. Farmers National Insurance, LLC, a

wholly-owned subsidiary of The Farmers National Bank of Canfield,

offers a variety of insurance products.

Non-GAAP Disclosure

This press release includes disclosures of Farmers’ tangible

common equity ratio, return on average tangible assets, return on

average tangible equity, net income excluding costs related to

acquisition activities and certain items, return on average assets

excluding merger costs and certain items, return on average equity

excluding merger costs and certain items, net interest margin

excluding acquisition marks and related accretion and PPP interest

and fees, efficiency ratio less one-time expenses, and allowance

for credit losses to gross loans, excluding PPP loans and acquired

loans, which are financial measures not prepared in accordance with

generally accepted accounting principles in the United States

(GAAP). A non-GAAP financial measure is a numerical measure of

historical or future financial performance, financial position or

cash flows that excludes or includes amounts that are required to

be disclosed by GAAP. Farmers believes that these non-GAAP

financial measures provide both management and investors a more

complete understanding of the underlying operational results and

trends and Farmers’ marketplace performance. The presentation of

this additional information is not meant to be considered in

isolation or as a substitute for the numbers prepared in accordance

with GAAP. The reconciliations of non-GAAP financial measures to

their GAAP equivalents are included in the tables following

Consolidated Financial Highlights below.

Cautionary Statements Regarding Forward-Looking

Statements

We make statements in this news release and our related investor

conference call, and we may from time to time make other

statements, that are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, including

statements about Farmers’ financial condition, results of

operations, asset quality trends and profitability. Forward-looking

statements are not historical facts but instead represent only

management’s current expectations and forecasts regarding future

events, many of which, by their nature, are inherently uncertain

and outside of Farmers’ control. Forward-looking statements are

preceded by terms such as “expects,” “believes,” “anticipates,”

“intends” and similar expressions, as well as any statements

related to future expectations of performance or conditional verbs,

such as “will,” “would,” “should,” “could” or “may.” Farmers’

actual results and financial condition may differ, possibly

materially, from the anticipated results and financial condition

indicated in these forward-looking statements. Factors that could

cause Farmers’ actual results to differ materially from those

described in certain forward-looking statements include significant

changes in near-term local, regional, and U.S. economic conditions

including those resulting from continued high rates of inflation,

tightening monetary policy of the Board of Governors of the Federal

Reserve, and possibility of a recession; Farmers’ failure to

integrate Emclaire and Emlenton with Farmers in accordance with

expectations; deviations from performance expectations related to

Emclaire and Emlenton; continuing impacts from the length and

extent of the economic impacts of the COVID-19 pandemic; and the

other factors contained in Farmers’ Annual Report on Form 10-K for

the year ended December 31, 2022 and subsequent Quarterly Reports

on Form 10-Q filed with the Securities and Exchange Commission

(SEC) and available on Farmers’ website (www.farmersbankgroup.com)

and on the SEC’s website (www.sec.gov). Forward-looking statements

are not guarantees of future performance and should not be relied

upon as representing management’s views as of any subsequent date.

Farmers does not undertake any obligation to update the

forward-looking statements to reflect the impact of circumstances

or events that may arise after the date of the forward-looking

statements.

Farmers National Banc Corp. and Subsidiaries

Consolidated Financial Highlights (Amounts in thousands,

except per share results) Unaudited

Consolidated

Statements of Income

For the Three Months

Ended

March 31,

Dec. 31,

Sept. 30,

June 30,

March 31,

2023

2022

2022

2022

2022

Total interest income

$51,233

$38,111

$36,410

$34,286

$33,279

Total interest expense

14,623

8,679

4,629

2,575

2,037

Net interest income

36,610

29,432

31,781

31,711

31,242

Provision (credit) for credit losses

8,599

416

448

616

(358)

Noninterest income

10,425

8,200

8,827

9,477

17,698

Acquisition related costs

4,313

584

872

674

1,940

Other expense

26,409

20,511

20,527

20,787

28,516

Income before income taxes

7,714

16,121

18,761

19,111

18,842

Income taxes

639

2,765

3,315

3,160

2,998

Net income

$7,075

$13,356

$15,446

$15,951

$15,844

Average diluted shares outstanding

37,933

33,962

33,932

33,923

33,937

Basic earnings per share

0.19

0.39

0.46

0.47

0.47

Diluted earnings per share

0.19

0.39

0.46

0.47

0.47

Cash dividends per share

0.17

0.17

0.16

0.16

0.16

Performance Ratios Net Interest Margin (Annualized)

3.07%

2.99%

3.21%

3.25%

3.27%

Efficiency Ratio (Tax equivalent basis)

62.53%

52.59%

50.55%

49.95%

61.36%

Return on Average Assets (Annualized)

0.56%

1.31%

1.48%

1.54%

1.52%

Return on Average Equity (Annualized)

7.71%

20.16%

18.71%

17.97%

13.89%

Dividends to Net Income

90.50%

43.10%

35.06%

33.95%

34.18%

Other Performance Ratios (Non-GAAP) Return on Average

Tangible Assets

0.58%

1.34%

1.52%

1.57%

1.55%

Return on Average Tangible Equity

16.31%

32.81%

27.06%

25.23%

17.92%

Consolidated Statements of Financial Condition

March 31,

Dec. 31,

Sept. 30,

June 30,

March 31,

2023

2022

2022

2022

2022

Assets Cash and cash equivalents

$128,001

$75,551

$79,981

$65,458

$137,627

Securities available for sale

1,355,449

1,268,025

1,295,133

1,361,682

1,463,626

Other investments

39,670

33,444

34,399

34,451

34,019

Loans held for sale

1,703

858

2,142

2,714

1,904

Loans

3,152,339

2,404,750

2,399,981

2,374,485

2,304,971

Less allowance for credit losses

36,011

26,978

27,282

27,454

27,015

Net Loans

3,116,328

2,377,772

2,372,699

2,347,031

2,277,956

Other assets

468,735

326,550

335,668

303,028

290,723

Total Assets

$5,109,886

$4,082,200

$4,120,022

$4,114,364

$4,205,855

Liabilities and Stockholders' Equity Deposits

Noninterest-bearing

$1,106,870

$896,957

$934,638

$983,713

$963,143

Interest-bearing

3,207,121

2,526,760

2,590,054

2,586,829

2,690,668

Brokered time deposits

82,169

138,051

42,459

54,996

40,000

Total deposits

4,396,160

3,561,768

3,567,151

3,625,538

3,693,811

Other interest-bearing liabilities

292,324

183,211

243,098

137,985

87,872

Other liabilities

46,760

44,926

44,154

29,392

30,286

Total liabilities

4,735,244

3,789,905

3,854,403

3,792,915

3,811,969

Stockholders' Equity

374,642

292,295

265,619

321,449

393,886

Total Liabilities and Stockholders' Equity

$5,109,886

$4,082,200

$4,120,022

$4,114,364

$4,205,855

Period-end shares outstanding

37,439

34,055

34,060

34,032

34,008

Book value per share

$10.01

$8.58

$7.80

$9.45

$11.58

Tangible book value per share (Non-GAAP)*

4.84

5.60

4.79

6.46

8.58

* Tangible book value per share is calculated by dividing

tangible common equity by outstanding shares

Capital and

Liquidity Common Equity Tier 1 Capital Ratio (a)

10.19%

13.71%

13.36%

13.30%

13.31%

Total Risk Based Capital Ratio (a)

13.80%

17.79%

17.44%

17.46%

17.59%

Tier 1 Risk Based Capital Ratio (a)

10.70%

14.32%

13.97%

13.92%

13.95%

Tier 1 Leverage Ratio (a)

7.38%

9.84%

10.24%

9.56%

9.56%

Equity to Asset Ratio

7.33%

7.16%

6.45%

7.81%

9.37%

Tangible Common Equity Ratio (b)

3.69%

4.79%

4.06%

5.47%

7.11%

Net Loans to Assets

60.99%

58.25%

57.59%

57.04%

54.16%

Loans to Deposits

71.71%

67.52%

67.28%

65.49%

62.40%

Asset Quality Non-performing loans

$17,959

$14,803

$12,976

$14,107

$14,046

Non-performing assets

18,053

14,876

13,042

14,107

14,046

Loans 30 - 89 days delinquent

10,219

9,605

6,659

8,716

7,304

Charged-off loans

469

754

783

177

1,590

Recoveries

198

184

178

135

149

Net Charge-offs

271

570

605

42

1,441

Annualized Net Charge-offs to Average Net Loans

0.03%

0.10%

0.10%

0.01%

0.25%

Allowance for Credit Losses to Total Loans

1.14%

1.12%

1.14%

1.16%

1.17%

Non-performing Loans to Total Loans

0.57%

0.62%

0.54%

0.59%

0.61%

Allowance to Non-performing Loans

200.52%

182.25%

210.25%

194.61%

192.33%

Non-performing Assets to Total Assets

0.35%

0.36%

0.32%

0.34%

0.33%

(a) March 31, 2023 ratio is estimated (b) This is a non-GAAP

financial measure. A reconciliation to GAAP is shown below

For the Three Months

Ended

March 31,

Dec. 31,

Sept. 30,

June 30,

March 31,

End of Period Loan Balances

2023

2022

2022

2022

2022

Commercial real estate

$1,286,830

$1,028,050

$1,028,484

$1,040,243

$1,000,972

Commercial

361,845

293,643

296,932

285,981

298,903

Residential real estate

853,074

475,791

474,014

464,489

455,501

HELOC

137,319

132,179

132,267

129,392

128,221

Consumer

260,596

221,260

222,706

218,219

192,586

Agricultural loans

244,938

246,937

239,081

230,477

224,845

Total, excluding net deferred loan costs

$3,144,602

$2,397,860

$2,393,484

$2,368,801

$2,301,028

For the Three Months

Ended

March 31,

Dec. 31,

Sept. 30,

June 30,

March 31,

End of Period Customer Deposit Balances

2023

2022

2022

2022

2022

Noninterest-bearing demand

$1,106,870

$896,957

$934,638

$983,713

$963,143

Interest-bearing demand

1,473,001

1,224,884

1,399,227

1,416,129

1,476,092

Money market

599,037

435,369

393,005

372,723

389,375

Savings

535,321

441,978

460,709

455,555

455,353

Certificate of deposit

599,762

424,529

337,113

342,422

369,848

Total customer deposits

$4,313,991

$3,423,717

$3,524,692

$3,570,542

$3,653,811

For the Three Months

Ended

March 31,

Dec. 31,

Sept. 30,

June 30,

March 31,

Noninterest Income

2023

2022

2022

2022

2022

Service charges on deposit accounts

$1,432

$1,203

$1,229

$1,139

$1,145

Bank owned life insurance income, including death benefits

547

590

406

405

409

Trust fees

2,587

2,373

2,370

2,376

2,519

Insurance agency commissions

1,456

1,133

1,136

1,086

1,047

Security gains (losses), including fair value changes for equity

securities

121

(366)

(17)

(60)

(11)

Retirement plan consulting fees

307

337

332

323

397

Investment commissions

393

508

424

557

694

Net gains on sale of loans

310

242

326

365

1,129

Other mortgage banking fee income (loss), net

153

98

94

39

60

Debit card and EFT fees

1,789

1,407

1,463

1,528

1,416

Other noninterest income

1,330

675

1,064

1,719

8,893

Total Noninterest Income

$10,425

$8,200

$8,827

$9,477

$17,698

For the Three Months

Ended

March 31,

Dec. 31,

Sept. 30,

June 30,

March 31,

Noninterest Expense

2023

2022

2022

2022

2022

Salaries and employee benefits

$14,645

$11,385

$10,724

$11,073

$11,831

Occupancy and equipment

3,869

2,753

3,028

2,918

2,680

FDIC insurance and state and local taxes

1,222

1,010

1,017

979

945

Professional fees

1,114

938

985

1,056

3,135

Merger related costs

4,313

584

872

674

1,940

Advertising

409

472

596

487

392

Intangible amortization

909

702

432

419

420

Core processing charges

1,164

742

738

1,123

745

Other noninterest expenses

3,077

2,509

3,007

2,732

8,368

Total Noninterest Expense

$30,722

$21,095

$21,399

$21,461

$30,456

Business Combination Consideration Cash

$

33,440

Stock

59,202

Fair value of total consideration transferred

$

92,642

Fair value of assets acquired Cash and cash equivalents

$

20,265

Securities available for sale

126,970

Other investments

7,795

Loans, net

740,659

Premises and equipment

16,103

Bank owned life insurance

22,485

Core deposit intangible

19,249

Current and deferred taxes

17,246

Other assets

6,387

Total assets acquired

977,159

Fair value of liabilities assumed Deposits

875,813

Short-term borrowings

75,000

Accrued interest payable and other liabilities

7,104

Total liabilities

957,917

Net assets acquired

$

19,242

Goodwill created

73,400

Total net assets acquired

$

92,642

Average Balance Sheets and

Related Yields and Rates

(Dollar Amounts in Thousands)

Three Months Ended

Three Months Ended

March 31, 2023

March 31, 2022

AVERAGE

YIELD/

AVERAGE

YIELD/

BALANCE

INTEREST (1)

RATE (1)

BALANCE

INTEREST (1)

RATE (1)

EARNING ASSETS Loans (2)

$3,136,494

$40,942

5.22%

$2,312,712

$25,646

4.44%

Taxable securities

1,171,596

6,550

2.24

1,007,963

4,587

1.82

Tax-exempt securities (2)

438,614

3,519

3.21

461,793

3,726

3.23

Other investments

36,564

376

4.11

31,122

130

1.67

Federal funds sold and other

82,995

610

2.94

117,916

48

0.16

Total earning assets

4,866,263

51,997

4.27

3,931,506

34,137

3.47

Nonearning assets

218,746

247,112

Total assets

$5,085,009

$4,178,618

INTEREST-BEARING LIABILITIES Time deposits

$590,412

$3,339

2.26%

$378,675

$643

0.68%

Brokered time deposits

231,040

2,321

4.02

15,555

15

0.39

Savings deposits

1,153,588

1,954

0.68

843,371

167

0.08

Demand deposits - interest bearing

1,417,955

5,093

1.44

1,412,291

418

0.12

Short term borrowings

80,589

921

4.57

2,222

1

0.18

Long term borrowings

88,269

995

4.51

87,798

793

3.61

Total interest-bearing liabilities

$3,561,853

14,623

1.64

$2,739,912

2,037

0.30

NONINTEREST-BEARING LIABILITIES AND STOCKHOLDERS' EQUITY Demand

deposits - noninterest bearing

1,107,422

956,499

Other liabilities

48,883

26,001

Stockholders' equity

366,851

456,206

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

$5,085,009

$4,178,618

Net interest income and interest rate spread

$37,374

2.63%

$32,100

3.17%

Net interest margin

3.07%

3.27%

(1) Interest and yields are calculated on a tax-equivalent

basis where applicable. (2) For 2023, adjustments of $86 thousand

and $678 thousand, respectively, were made to tax equate income on

tax exempt loans and tax exempt securities. For 2022, adjustments

of $84 thousand and $774 thousand, respectively, were made to tax

equate income on tax exempt loans and tax exempt securities. These

adjustments were based on a marginal federal income tax rate of

21%, less disallowances.

Reconciliation of Total Assets to

Tangible Assets

For the Three Months

Ended

March 31,

Dec. 31,

Sept. 30,

June 30,

March 31,

2023

2022

2022

2022

2022

Total Assets

$5,109,886

$4,082,200

$4,120,022

$4,114,364

$4,205,855

Less Goodwill and other intangibles

193,273

101,666

102,368

101,767

102,187

Tangible Assets

$4,916,613

$3,980,534

$4,017,654

$4,012,597

$4,103,668

Average Assets

5,085,009

4,080,497

4,164,855

4,155,719

4,178,618

Less average Goodwill and other intangibles

193,368

102,126

101,981

102,042

102,462

Average Tangible Assets

$4,891,641

$3,978,371

$4,062,874

$4,053,677

$4,076,156

Reconciliation of Common Stockholders' Equity to

Tangible Common Equity

For the Three Months

Ended

March 31,

Dec. 31,

Sept. 30,

June 30,

March 31,

2023

2022

2022

2022

2022

Stockholders' Equity

$374,642

$292,295

$265,619

$321,449

$393,886

Less Goodwill and other intangibles

193,273

101,666

102,368

101,767

102,187

Tangible Common Equity

$181,369

$190,629

$163,251

$219,682

$291,699

Average Stockholders' Equity

366,851

264,939

330,300

354,981

456,206

Less average Goodwill and other intangibles

193,368

102,126

101,981

102,042

102,462

Average Tangible Common Equity

$173,483

$162,813

$228,319

$252,939

$353,744

Reconciliation of Net Income, Less Merger and

Certain Items

For the Three Months

Ended

March 31,

Dec. 31,

Sept. 30,

June 30,

March 31,

2023

2022

2022

2022

2022

Net income

$7,075

$13,356

$15,446

$15,951

$15,844

Acquisition related costs - after tax

3,449

475

711

564

1,540

Acquisition related provision - after tax

6,077

0

0

0

0

Lawsuit settlement income - after tax

0

0

0

0

(6,616)

Lawsuit settlement contingent legal expense - after tax

0

0

0

0

1,639

Charitable donation - after tax

0

0

0

0

4,740

Net loss (gain) on asset/security sales - after tax

(72)

268

4

(25)

97

Net income - Adjusted

$16,529

$14,099

$16,161

$16,490

$17,244

Diluted EPS excluding merger and one-time items

$0.44

$0.42

$0.48

$0.49

$0.51

Return on Average Assets excluding merger and certain items

(Annualized)

1.30%

1.36%

1.55%

1.59%

1.65%

Return on Average Equity excluding merger and certain items

(Annualized)

18.02%

21.29%

19.57%

18.58%

15.12%

Return on Average Tangible Equity excluding acquisition costs and

certain items (Annualized)

38.11%

34.64%

28.31%

26.08%

19.50%

Efficiency ratio excluding certain items

For the Three Months

Ended

March 31,

Dec. 31,

Sept. 30,

June 30,

March 31,

2023

2022

2022

2022

2022

Net interest income, tax equated

$37,374

$30,212

$32,636

$32,583

$32,100

Noninterest income

10,425

8,200

8,827

9,477

17,698

Legal settlement income

0

0

0

0

(8,375)

Net loss (gain) on asset/security sales

(91)

338

6

(32)

123

Net interest income and noninterest income adjusted

47,708

38,750

41,469

42,028

41,546

Noninterest expense less intangible amortization

29,813

20,393

20,967

21,042

30,036

Charitable donation

0

0

0

0

6,000

Contingent legal settlement expense

0

0

0

0

2,075

Acquisition related costs

4,313

584

872

674

1,940

Noninterest expense adjusted

25,500

19,809

20,095

20,368

20,021

Efficiency ratio excluding one-time items

53.45%

51.12%

48.46%

48.46%

48.19%

Net interest margin excluding acquisition marks

and PPP interest and fees

For the Three Months

Ended

March 31,

Dec. 31,

Sept. 30,

June 30,

March 31,

2023

2022

2022

2022

2022

Net interest income, tax equated

$ 37,374

$ 30,212

$ 32,636

$ 32,583

$ 32,100

Acquisition marks

2,597

174

215

349

926

PPP interest and fees

0

10

62

634

686

Adjusted and annualized net interest income

139,108

120,112

129,436

126,400

121,828

Average earning assets

4,866,263

4,047,343

4,065,085

4,015,385

3,931,506

Less PPP average balances

310

485

1,586

16,019

30,003

Adjusted average earning assets

4,865,953

4,046,858

4,063,499

3,999,366

3,901,503

Net interest margin excluding marks and PPP interest and fees

2.86%

2.97%

3.19%

3.16%

3.12%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230425005855/en/

Kevin J. Helmick, President and CEO 330.533.3341 Email:

exec@farmersbankgroup.com

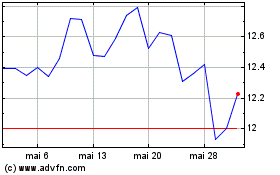

Farmers National Banc (NASDAQ:FMNB)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Farmers National Banc (NASDAQ:FMNB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024