Care.com’s 2024 Cost of Care Report, released today,

found that on average, parents who responded spend 24% of their

household income on childcare with nearly half (47%) spending more

than $18,000 in 2023. While this represents a slight drop from 27%

in last year’s report, it remains more than three times the 7%

deemed affordable by the U.S. Department of Health and Human

Services. Additionally, and meaningfully, household income is not

the only source of funding parents are using to pay for childcare.

More than one-third (35%) of respondents are dipping into their

savings, on average exhausting a staggering 42% of their savings in

2023, leaving them with little financial flexibility.

The 11th annual report, which comprises survey results of 2,000

parent respondents, also provides some of the first public data on

the impact of the childcare cliff, which marked the expiration of

pandemic-related federal subsidies for childcare in September 2023.

The findings reveal that nearly 40% of respondents (39%) are

already paying more because their care provider has been impacted

by the loss of funds. Additionally, nearly 80% of respondents (79%)

anticipate being impacted by the childcare cliff in 2024 with 54%

of those concerned expecting their childcare expenses to increase

by more than $7,000 this year as a result.

With financial pressure continuing to mount on parents while the

availability of childcare shrinks, it is not surprising that

childcare is a top priority for parents in the upcoming

Presidential Election, with an overwhelming 88% of respondents

saying a political candidate’s position on childcare access and

affordability will influence their vote.

“Within the first five years of their child’s life, parents are

being forced into a financial hole that is nearly impossible to

climb out of,” said Brad Wilson, CEO of Care.com. “A healthy

economy depends upon the ability for people to save and spend, but

given the crushing weight of childcare costs, those pillars are

crumbling. The childcare crisis should be a major red flag for

everyone, not just parents. It is a systemic failure that will

impact our nation’s economic growth, and that affects us all.”

Highlights from the 2024 Cost of Care

Report:

Care.com National Average Weekly Rates in 2023*

- Weekly nanny cost: $766 (up 4% from $736 in 2022).

- Weekly daycare cost: $321 (up 13% from $284 in

2022).

- Weekly family care center cost: $230 (up 0.4% from $229

in 2022).

- Weekly babysitter cost: $192 (up 7% from $179 in

2022).

* Infant rates except for babysitter, which is not age limited.

Rates for toddlers, after school sitters, as well as multiple

children, can be found within the report.

Childcare Costs Are Depleting Household Finances:

On average, parents who responded spend 24% of their household

income on childcare with nearly half of respondents (47%) spending

more than $18,000 in 2023. While the 24% represents a slight drop

from the prior year’s 27%, income is not the only major source of

money parents are using to pay for childcare. More than one-third

of parents who responded (35%) are also using hard-earned savings,

on average spending up to nearly half of their savings (42%) on

childcare and 25% using more than two-thirds of their savings.

Given the reliance on savings to pay for childcare, it is alarming

that a staggering 68% of respondents have only six months or less

until their savings run out. Not surprisingly 37% of parents who

responded cite the cost of childcare among their top three

financial stressors.

The Childcare Cliff Impact:

More than three-quarters of parents who responded (79%)

anticipate they’ll be impacted this year by fallout from the

childcare cliff. For the majority (54%) of those concerned,

childcare costs are anticipated to increase by $600 or more per

month, which translates into an additional $7,000 or more spent on

childcare in 2024. In fact, nearly 40% of respondents (39%) are

already paying more because their daycare was impacted at the end

of 2023 by the loss of federal funding.

Cost is not the only issue with which parents are wrestling. The

cliff has also impacted availability of childcare with 43% of

respondents having a harder time finding a childcare provider

versus prior years.

The Limbo of Waitlists:

Irrespective of the cliff, in general, 65% of respondents have

spent time on a daycare center waitlist with 81% of them juggling

multiple waitlists simultaneously and 43% waiting four months or

longer. Since the cliff in September, 62% of waitlisted respondents

say centers have closed while they sat on their waitlists and 54%

have experienced waitlist extensions. The cost of waiting? More

than half of waitlisted respondents (59%) are dishing out an

additional $200 or more a week on care.

Parents Demand Solutions From 2024 Presidential

Candidates:

With rising costs and shrinking availability, it’s not

surprising that childcare is top of mind for parents this election

year. A majority of respondents (59%) say childcare access and

affordability policy is a top 3 priority issue that will impact

their 2024 voting decision with 22% saying it is their #1

priority. A staggering 88% of respondents say a candidate’s

position on childcare policy will influence their vote with 37%

saying these policy positions are very influential.

And families want answers. A whopping 91% say it is important to

them that childcare is discussed during the 2024 Presidential

Debates. In fact, childcare ranked second as the topic respondents

most wanted addressed during the debates, behind the economy and

ahead of healthcare, climate change, racial and social justice, and

immigration.

The full results of The 2024 Cost of Care Report,

including a state-by-state ranking of the most and least expensive

states for childcare, can be found here.

2024 Cost of Care Report Methodology

This sample of 2000 U.S. adults was surveyed between November 9,

2023 and November 12, 2023. All respondents are parents of children

14 years or younger and currently pay for professional child care,

confirmed by both consumer-matched data and self-confirmation. DKC

Analytics conducted and analyzed this survey with a sample procured

using the Pollfish survey delivery platform, which delivers online

surveys globally through mobile apps and the mobile web along with

the desktop web. Response completion rate was 75%, and only fully

completed responses were considered valid. No post-stratification

has been applied to the results.

Weekly rates for nanny, babysitter, after-school sitter, daycare

center, and family care center are based on 2023 advertised rates

by families posting jobs for caregivers on Care.com.

About Care.com

Available in more than 17 countries, Care.com is the largest

online platform for finding and managing family care, spanning

in-home and in-center care solutions. Since 2007, families have

relied on Care.com for an array of care for children, seniors,

pets, and the home. Designed to meet the evolving needs of today’s

families and caregivers, the Company also offers customized

corporate benefits packages to support working families at more

than 700 global clients, household tax and payroll services, and

innovations for caregivers to find and book jobs. Care.com is an

IAC company (NASDAQ: IAC).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240117644606/en/

Media: Mackenzie Nintzel Public Relations Associate,

Care.com mackenzie.nintzel@care.com

Jamie Gentges Public Relations Associate, Care.com

jamie.gentges@care.com

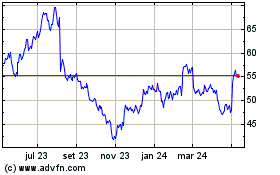

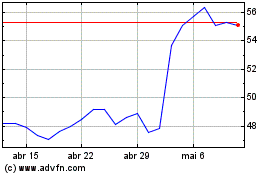

IAC (NASDAQ:IAC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

IAC (NASDAQ:IAC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024