Provident Financial Services, Inc. (NYSE:PFS) (“Provident”), the

parent company of Provident Bank, and Lakeland Bancorp, Inc.

(Nasdaq: LBAI) (“Lakeland”), the parent company of Lakeland Bank,

today announced that the two companies have agreed to extend their

merger agreement to March 31, 2024, to provide additional time to

obtain the required regulatory approvals.

Both parties remain committed to the merger and to obtaining

regulatory approvals.

When completed, the combined company will operate under the

Provident name and will benefit from enhanced scale, opportunities

for growth and profitability, and Provident’s and Lakeland’s

complementary strengths will provide exceptional service to

customers and communities served.

About Provident

Provident Financial Services, Inc. is the holding company for

Provident Bank, a community-oriented bank offering “commitment you

can count on” since 1839. Provident Bank provides a comprehensive

array of financial products and services through its network of

branches throughout northern and central New Jersey, Bucks, Lehigh

and Northampton counties in Pennsylvania, as well as Queens and

Nassau Counties in New York. The Bank also provides fiduciary and

wealth management services through its wholly owned subsidiary,

Beacon Trust Company and insurance services through its wholly

owned subsidiary, Provident Protection Plus, Inc.

About Lakeland

Lakeland Bank is the wholly-owned subsidiary of Lakeland

Bancorp, Inc., which had $11.18 billion in total assets at

September 30, 2023. With an extensive branch network and commercial

lending centers throughout New Jersey and Highland Mills, New York,

the Bank offers business and retail banking products and services.

Business services include commercial loans and lines of credit,

commercial real estate loans, loans for healthcare services,

asset-based lending, equipment financing, small business loans and

lines and cash management services. Consumer services include

online and mobile banking, home equity loans and lines, mortgage

options and wealth management solutions. Lakeland is proud to be

recognized as New Jersey’s Best-In-State Bank by Forbes and

Statista for the fifth consecutive year, Best Banks to Work For by

American Banker, rated a 5-Star Bank by Bauer Financial and named

one of New Jersey’s 50 Fastest Growing Companies by NJBIZ.

Forward Looking Statements

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended,

with respect to Provident’s and Lakeland’s beliefs, goals,

intentions, and expectations regarding the proposed transaction,

revenues, earnings, earnings per share, loan production, asset

quality, and capital levels, among other matters; our estimates of

future costs and benefits of the actions we may take; our

assessments of probable losses on loans; our assessments of

interest rate and other market risks; our ability to achieve our

financial and other strategic goals; the expected timing of

completion of the proposed transaction; the expected cost savings,

synergies and other anticipated benefits from the proposed

transaction; and other statements that are not historical

facts.

Forward‐looking statements are typically identified by such

words as “believe,” “expect,” “anticipate,” “intend,” “outlook,”

“estimate,” “forecast,” “project,” “should,” and other similar

words and expressions, and are subject to numerous assumptions,

risks, and uncertainties, which change over time. These

forward-looking statements include, without limitation, those

relating to the terms, timing and closing of the proposed

transaction.

Additionally, forward‐looking statements speak only as of the

date they are made; Provident and Lakeland do not assume any duty,

and do not undertake, to update such forward‐looking statements,

whether written or oral, that may be made from time to time,

whether as a result of new information, future events or otherwise.

Furthermore, because forward‐looking statements are subject to

assumptions and uncertainties, actual results or future events

could differ, possibly materially, from those indicated in such

forward-looking statements as a result of a variety of factors,

many of which are beyond the control of Provident and Lakeland.

Such statements are based upon the current beliefs and expectations

of the management of Provident and Lakeland and are subject to

significant risks and uncertainties outside of the control of the

parties. Caution should be exercised against placing undue reliance

on forward-looking statements. The factors that could cause actual

results to differ materially include the following: the occurrence

of any event, change or other circumstances that could give rise to

the right of one or both of the parties to terminate the Merger

Agreement; the outcome of any legal proceedings that may be

instituted against Provident or Lakeland; the possibility that the

proposed transaction will not close when expected or at all because

required regulatory or other approvals are not received or other

conditions to the closing are not satisfied on a timely basis or at

all, or are obtained subject to conditions that are not anticipated

(and the risk that required regulatory approvals may result in the

imposition of conditions that could adversely affect the combined

company or the expected benefits of the proposed transaction); the

ability of Provident and Lakeland to meet expectations regarding

the timing, completion and accounting and tax treatments of the

proposed transaction; the risk that any announcements relating to

the proposed transaction could have adverse effects on the market

price of the common stock of either or both parties to the proposed

transaction; the possibility that the anticipated benefits of the

proposed transaction will not be realized when expected or at all,

including as a result of the impact of, or problems arising from,

the integration of the two companies or as a result of the strength

of the economy and competitive factors in the areas where Provident

and Lakeland do business; certain restrictions during the pendency

of the proposed transaction that may impact the parties’ ability to

pursue certain business opportunities or strategic transactions;

the possibility that the transaction may be more expensive to

complete than anticipated, including as a result of unexpected

factors or events; diversion of management’s attention from ongoing

business operations and opportunities; the possibility that the

parties may be unable to achieve expected synergies and operating

efficiencies in the merger within the expected timeframes or at all

and to successfully integrate Lakeland’s operations and those of

Provident; such integration may be more difficult, time consuming

or costly than expected; revenues following the proposed

transaction may be lower than expected; Provident’s and Lakeland’s

success in executing their respective business plans and strategies

and managing the risks involved in the foregoing; the dilution

caused by Provident’s issuance of additional shares of its capital

stock in connection with the proposed transaction; effects of the

announcement, pendency or completion of the proposed transaction on

the ability of Provident and Lakeland to retain customers and

retain and hire key personnel and maintain relationships with their

suppliers, and on their operating results and businesses generally;

and risks related to the potential impact of general economic,

political and market factors on the companies or the proposed

transaction and other factors that may affect future results of

Provident and Lakeland; uncertainty as to the impacts of natural

disasters or health epidemics, including the COVID-19 pandemic, on

Provident, Lakeland and the proposed transaction; and the other

factors discussed in the “Risk Factors” section of each of

Provident’s and Lakeland’s Annual Report on Form 10‐K for the year

ended December 31, 2022, in the “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” sections of each of Provident’s and Lakeland’s

Quarterly Report on Form 10‐Q for the quarter ended September 30,

2023, and other reports Provident and Lakeland file with the

Securities and Exchange Commission.

Provident Financial Services, Inc.

Investor Relations Contact: Thomas LyonsSEVP

& Chief Financial Officer(732) 590-9348

Lakeland Bancorp, Inc.

Investor Relations Contacts: Thomas J.

SharaPresident & Chief Executive Officer(973) 697-2000

Thomas F. SplaineEVP & Chief Financial Officer(973)

697-2000

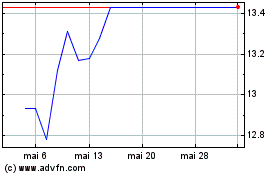

Lakeland Bancorp (NASDAQ:LBAI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Lakeland Bancorp (NASDAQ:LBAI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025