Earnings Preview: AutoZone Inc. - Analyst Blog

23 Maio 2011 - 8:15AM

Zacks

AutoZone Inc. (AZO) is expected to release its

results for third quarter fiscal 2011 before the market opens on

May 24, 2011. Tennessee-based AutoZone earned a profit of $3.34

cents per share in the second quarter, significantly above the

Zacks Consensus Estimate of $3.07 per share.

In the upcoming quarter, the Zacks Consensus Estimate for

AutoZone is pegged at a profit of $4.97 per share, reflecting an

annualized growth of 21%. The upside potential of the estimate,

essentially a proxy for future earnings surprises, is

2.21%.

With respect to earnings surprises, the company posted an

average earnings surprise of 6.98% in the trailing four quarters,

which reflects that the company has beaten the Zacks Consensus

Estimate by the same magnitude during the same period.

Second Quarter Review

Net sales for the company grew 10.3% to $1.66 billion, which was

higher than the Zacks Consensus Estimate of $1.63 billion. The

improvement in results was attributable to higher sales volume on

the back of an aggressive store expansion strategy.

Total auto parts sales scaled up 10.3% to $1.62 billion,

reflecting sales per average store of $349,000, an increase of

$20,000 from the prior-year level. Domestic commercial sales

escalated 21.2% to $213.8 million while all other (ALLDATA and

e-commerce) sales increased 11.2% to $37.0 million.

Gross margin expanded marginally to 50.9% from 50.0% in the

prior-year quarter. The increase in gross margin was attributable

to increased penetration of the company’s Duralast product and

lower product acquisition costs. Further, operating margin improved

to 16.4% from 15.3% in the fiscal 2010-quarter.

During the quarter, AutoZone opened 21 stores in the U.S. and 8

stores in Mexico. As of February 12, 2011, the company had 4,425

stores in 48 states, including the District of Columbia and Puerto

Rico in the U.S. and 249 stores in Mexico. The company's inventory

rose 7% to $2.42 million as of February 12, 2011, driven by new

store openings and continued strategic investments in hard parts

assortment.

AutoZone repurchased 1.5 million shares of its common stock for

$394 million, at an average price of $257 per share during the

quarter. At the end of the quarter, the company had $491 million

remaining under its current share repurchase authorization.

Estimate Revisions Trend

The third quarter of fiscal 2011 estimate remained more or less

unchanged at $4.97 per share. The analysts, though cautious on the

stock, expect the company to improve its performance over time.

Agreement of Estimate Revisions

Out of the 20 analysts covering the stock, only has made a

downward revision to the stock in the last 30 days. However, none

has made an upward revision to the stock understudy. The analysts

seem to be cautious on the stock given the macroeconomic conditions

in the U.S. and the growing competition in the industry.

Magnitude of Estimate Revisions

Following the second quarter earnings release in March, the

third quarter earnings per share were projected at $4.86 per share.

However, in the last 60 days, the estimate had been revised upward

to $4.97 per share.

Our Take

AutoZone is focused on expansion of its Hub store, acceleration

of store maintenance and strengthening of its commercial sales

force. Besides, its aggressive share repurchase policy supported by

a strong cash flow is also worth mentioning.

However, AutoZone relies heavily on its private label brands,

which could hinder its business should they falter. Vendor

consolidation and appreciation in gas prices coupled with fierce

competition from O’Reilly Automotive Inc. (ORLY)

and Advance Auto Parts Inc. (AAP), both of which

have delivered impressive results during their recent most

quarters, are primary headwinds for the company.

Hence, the company retains a Zacks #3 Rank, which translates

into a short-term (1 to 3 months) Hold rating and we have

reiterated our long-term Neutral recommendation on the shares of

the company.

ADVANCE AUTO PT (AAP): Free Stock Analysis Report

AUTOZONE INC (AZO): Free Stock Analysis Report

O REILLY AUTO (ORLY): Free Stock Analysis Report

Zacks Investment Research

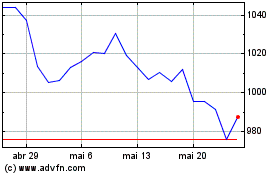

O Reilly Automotive (NASDAQ:ORLY)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

O Reilly Automotive (NASDAQ:ORLY)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024