Advance Auto Meets but Profits Fall - Analyst Blog

09 Novembro 2012 - 8:20AM

Zacks

Advance Auto Parts Inc. (AAP) posted a 14.2%

fall in earnings per share to $1.21 in the third quarter of the

year from $1.41 in the same quarter a year-ago due to weak sales in

the cold weather markets,. However, the EPS tallied the Zacks

Consensus Estimate during the quarter. Net income dipped 15.2% to

$89.5 million from $105.6 million a year ago.

Revenues in the quarter slid $7.5 million or 0.5% to $1.5 billion,

reflecting a 1.8% decrease in comparable store versus a comparable

store sales increase of 2.2% during the third quarter of 2011,

offset partially by the positive impact of net addition of 82

stores during the past 12 months.

Gross margin increased marginally by 31 basis points to 49.8% from

49.5% in the third quarter of 2011. The improvement in margin was

attributable to increased shrink, cost deflation and supply chain

efficiencies, offset partially by enhanced promotional activity.

However, operating margin shrank 180 basis points to 10.3% from

12.1% in the fiscal 2011 quarter.

During the quarter, Advance Auto Parts opened 35 stores, including

7 Autopart International stores. With this, the company has opened

70 stores, including 13 Autopart International stores,

year-to-date. As of October 6, 2012, the company’s total store

count stood at 3,727, including 210 Autopart International stores.

The company is close to reaching the goal of 120 to 140 store

openings in fiscal 2012.

During the quarter, Advance Auto Parts repurchased shares worth

$25.2 million compared with the year-ago level of $629.2 million.

At the end of the quarter, the company had nearly $500 million

shares remaining under its share repurchase authorization.

Advance Auto Parts had cash and cash equivalents of $479.4 million

as of October 6, 2012, significantly up from $65.9 million as of

October 8, 2011. Long-term debt remained flat at $600.2 million as

of October 6, 2012 compared with $600.4 million as of October 8,

2011. However, long-term debt-to-capitalization ratio improved to

34.3% from 43.6% a year ago due to a rise in shareholder’s

equity.

In the 40-week period ended October 6, 2012, the company’s

operating cash flow declined to $504.8 million from $611.0 million

in the year-ago period mainly due to lower profits and higher

receivables. Meanwhile, capital expenditures (net) decreased

marginally to $200.9 million from $206.4 million a year ago.

Advance Auto Parts lowered its earnings outlook for 2012 due to the

short-term softness in sales. The company now expects to earn

between $5.05 and $5.15 per share for the year, down from the prior

guidance of $5.25 to $5.35.

Advance Auto Parts, Inc. operates in the U.S. automotive

aftermarket industry and is primarily engaged in selling

replacement parts (excluding tires), accessories, maintenance

items, batteries and automotive fluids for cars and light trucks.

The company is the second leading retailer catering to the DIY and

DIFM (or commercial) customers.

There are unconfirmed published reports claiming that Advanced Auto

Parts was exploring to sell the company. It competes with

AutoZone Inc. (AZO), O’Reilly Automotive

Inc. (ORLY) and Pep Boys-Manny, Moe &

Jack (PBY) and currently retains a Zacks #4 Rank on its

stock, which translates to a short-term (1 to 3 months) rating of

Sell.

ADVANCE AUTO PT (AAP): Free Stock Analysis Report

AUTOZONE INC (AZO): Free Stock Analysis Report

O REILLY AUTO (ORLY): Free Stock Analysis Report

PEP BOYS M M &J (PBY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

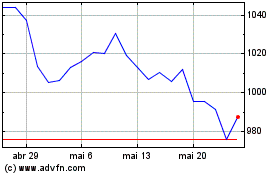

O Reilly Automotive (NASDAQ:ORLY)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

O Reilly Automotive (NASDAQ:ORLY)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024