Plexus Provides Update on Unverified List Designation

20 Dezembro 2023 - 11:25AM

On December 19, 2023, Plexus Corp. (NASDAQ: PLXS) learned that the

U.S Department of Commerce placed its Xiamen, China subsidiary

(“Plexus Xiamen”) on the Bureau of Industry and Security’s (“BIS”)

Unverified List. Companies appearing on the Unverified List are not

barred from conducting business with the United States and their

U.S. customers and suppliers.

Plexus maintains a robust export compliance

program across all of its international operations and is not

currently aware of any facts or circumstances meriting the

designation. We are also working to understand and address BIS’s

questions and expedite Plexus Xiamen's removal from the Unverified

List. Plexus remains committed to compliance with all applicable

U.S. export control laws, and to working with BIS in a transparent,

collaborative manner.

Investor and Media Contact

Shawn

Harrison+1.920.969.6325shawn.harrison@plexus.com

About PlexusSince 1979, Plexus

has been partnering with companies to create the products that

build a better world. We are a team of nearly 25,000 individuals

who are dedicated to providing Design and Development, Supply Chain

Solutions, New Product Introduction, Manufacturing and Sustaining

Services. Plexus is a global leader that specializes in serving

customers in industries with highly complex products and demanding

regulatory environments. Plexus delivers customer service

excellence to leading companies by providing innovative,

comprehensive solutions throughout a product’s lifecycle. For more

information about Plexus, visit our website at www.plexus.com.

Safe Harbor and Fair Disclosure

Statement The statements contained in this press release

that are guidance or which are not historical facts (such as

statements in the future tense and statements including believe,

expect, intend, plan, anticipate, goal, target and similar terms

and concepts), including all discussions of periods which are not

yet completed, are forward-looking statements that involve risks

and uncertainties. These risks and uncertainties include the effect

of inflationary pressures on our costs of production,

profitability, and on the economic outlook of our markets; the

effects of shortages and delays in obtaining components as a result

of economic cycles, natural disasters or otherwise; the risk of

customer delays, changes, cancellations or forecast inaccuracies in

both ongoing and new programs; the effects of our Xiamen, China

subsidiary being placed on the Bureau of Industry and Security’s

Unverified List; the ability to realize anticipated savings from

restructuring or similar actions, as well as the adequacy of

related charges as compared to actual expenses; the lack of

visibility of future orders, particularly in view of changing

economic conditions; the economic performance of the industries,

sectors and customers we serve; the outcome of litigation and

regulatory investigations and proceedings, including the results of

any challenges with regard to such outcomes; the effects of

tariffs, trade disputes, trade agreements and other trade

protection measures; the effects of the volume of revenue from

certain sectors or programs on our margins in particular periods;

our ability to secure new customers, maintain our current customer

base and deliver product on a timely basis; the risks of

concentration of work for certain customers; the particular risks

relative to new or recent customers, programs or services, which

risks include customer and other delays, start-up costs, potential

inability to execute, the establishment of appropriate terms of

agreements, and the lack of a track record of order volume and

timing; the effects of start-up costs of new programs and

facilities or the costs associated with the closure or

consolidation of facilities; possible unexpected costs and

operating disruption in transitioning programs, including

transitions between Company facilities; the risk that new program

wins and/or customer demand may not result in the expected revenue

or profitability; the fact that customer orders may not lead to

long-term relationships; our ability to manage successfully and

execute a complex business model characterized by high product mix

and demanding quality, regulatory, and other requirements; the

risks associated with excess and obsolete inventory, including the

risk that inventory purchased on behalf of our customers may not be

consumed or otherwise paid for by the customer, resulting in an

inventory write-off; risks related to information technology

systems and data security; increasing regulatory and compliance

requirements; any tax law changes and related foreign jurisdiction

tax developments; current or potential future barriers to the

repatriation of funds that are currently held outside of the United

States as a result of actions taken by other countries or

otherwise; the potential effects of jurisdictional results on our

taxes, tax rates, and our ability to use deferred tax assets and

net operating losses; the weakness of areas of the global economy;

the effect of changes in the pricing and margins of products; raw

materials and component cost fluctuations; the potential effect of

fluctuations in the value of the currencies in which we transact

business; the effects of changes in economic conditions, political

conditions and tax matters in the United States and in the other

countries in which we do business; the potential effect of other

world or local events or other events outside our control (such as

the conflict between Russia and Ukraine, conflict in the Middle

East, escalating tensions between China and Taiwan or China and the

United States, changes in energy prices, terrorism, global health

epidemics and weather events); the impact of increased competition;

an inability to successfully manage human capital; changes in

financial accounting standards; and other risks detailed herein and

in our other Securities and Exchange Commission filings,

particularly in Risk Factors contained in our fiscal 2023 Form

10-K.

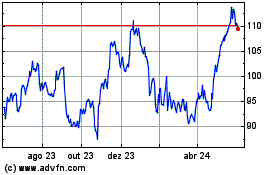

Plexus (NASDAQ:PLXS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

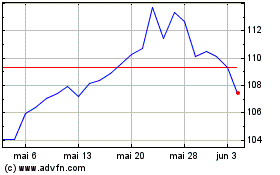

Plexus (NASDAQ:PLXS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025