Plexus Corp. (NASDAQ: PLXS) today announced financial results for

our fiscal second quarter ended March 30, 2024, and guidance

for our fiscal third quarter ending June 29, 2024.

-

Reports fiscal second quarter 2024 revenue of $967 million, GAAP

operating margin of 3.0% and GAAP diluted EPS of $0.58, including

$0.25 of stock-based compensation expense and $0.36 of

restructuring and other charges, net

-

Reports fiscal second quarter 2024 non-GAAP operating margin of

4.2% and non-GAAP diluted EPS of $0.94, including $0.25 of

stock-based compensation expense

-

Initiates fiscal third quarter 2024 revenue guidance of $960

million to $1.00 billion with GAAP diluted EPS of $0.80 to $0.95,

including $0.21 of stock-based compensation expense and $0.21 of

restructuring charges. Fiscal third quarter 2024 non-GAAP EPS

guidance of $1.22 to $1.37 excludes both stock-based compensation

expense and restructuring charges.

|

|

| |

|

Three Months Ended |

| |

|

Mar 30, 2024 |

|

Mar 30, 2024 |

|

Jun 29, 2024 |

| |

|

Q2F24 Results |

|

Q2F24 Guidance |

|

Q3F24 Guidance (1) |

| Summary

GAAP Items |

|

|

|

|

|

| Revenue (in

millions) |

$967 |

|

|

$930 to $970 |

|

$960 to $1,000 |

| Operating margin

(2) |

3.0 |

% |

|

3.0% to 3.4% |

|

3.9% to 4.3% |

| Diluted EPS

(3) |

$0.58 |

|

|

$0.48 to $0.63 |

|

$0.80 to $0.95 |

| |

|

|

|

|

|

|

| Summary

Non-GAAP Items (4) |

|

|

|

|

|

| Adjusted operating

margin (5) |

4.2 |

% |

|

4.0% to 4.4% |

|

|

| Adjusted EPS

(6) |

$0.94 |

|

|

$0.80 to $0.95 |

|

|

| Adjusted operating

margin, prospectively (7) |

|

|

|

|

5.2% to 5.6% |

| Adjusted EPS,

prospectively (8) |

|

|

|

|

$1.22 to $1.37 |

| Return on invested

capital (ROIC) |

9.9 |

% |

|

|

|

|

| Economic

return |

1.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Historically, Plexus

has included stock-based compensation expense in adjusted operating

margin and adjusted EPS. Beginning in the fiscal third quarter,

Plexus will issue guidance and present adjusted operating margin

and adjusted EPS excluding stock-based compensation expense. Refer

to the Non-GAAP Supplemental Information Table 3 for a

reconciliation between the historic presentation and prospective

presentation. |

|

(2) |

Includes

restructuring and other charges, net, of 120 bps for Q2F24 results,

100 bps for Q2F24 guidance and 70 bps for Q3F24 guidance. Includes

stock-based compensation expense of 73 bps for Q2F24 results, 72

bps for Q2F24 guidance and 60 bps for Q3F24 guidance. |

|

(3) |

Includes stock-based

compensation expense of $0.25 for Q2F24 results, $0.25 for Q2F24

guidance and $0.21 for Q3F24 guidance. Includes, net of tax,

restructuring and other charges, net, of $0.36 for Q2F24 results,

$0.32 for Q2F24 guidance and $0.21 for Q3F24 guidance. |

|

(4) |

Refer to Non-GAAP

Supplemental Information in Tables 1 and 2 for additional

information regarding non-GAAP financial measures. |

|

(5) |

Excludes

restructuring and other charges, net, of 120 bps for Q2F24 results

and 100 bps for Q2F24 guidance. Excludes stock-based compensation

expense of 73 bps for Q2F24 results and 72 bps for Q2F24

guidance. |

|

(6) |

Q2F24 results

excludes, net of tax, $0.36 per share related to restructuring and

other charges, net, but includes stock-based compensation expense

of $0.25. Q2F24 guidance excludes $0.32 per share related to

restructuring and other charges, net, but includes stock-based

compensation expense of $0.25. |

|

(7) |

Excludes 70 bps for

restructuring charges and 60 bps related to stock-based

compensation expense. |

|

(8) |

Excludes $0.21 per

share related to restructuring charges and $0.21 per share related

to stock-based compensation expense. |

|

|

|

Fiscal Second

Quarter 2024

Information

- Won 32

manufacturing programs during the quarter representing $255 million

in annualized revenue when fully ramped into production.

- Purchased $17.6

million of our shares at an average price of $94.39 per share under

our repurchase programs, leaving $38.1 million available under

our current $50.0 million authorization.

Todd Kelsey, Chief Executive Officer, commented,

“Plexus delivered fiscal second quarter revenue of $967 million and

non-GAAP EPS of $0.94, each of which met the top end of our

guidance. Non-GAAP operating margin of 4.2% met our expectation

entering the quarter. In addition, we generated free cash flow of

$65 million, a particularly strong result.”

Mr. Kelsey continued, “For the fiscal second

quarter, our team won 32 new manufacturing programs worth $255

million in annualized revenue. Capitalizing on the value created by

our differentiated service offering and superior execution, our

go-to-market organization is winning significant new outsourcing

opportunities and capturing market share in support of sustaining

our industry-leading revenue growth.”

Mr. Kelsey commented, “We are guiding fiscal

third quarter revenue of $960 million to $1.00 billion, non-GAAP

operating margin of 5.2% to 5.6% and non-GAAP EPS of $1.22 to

$1.37. We believe our revenue growth is in the early stages of

inflecting higher, benefiting from robust demand within our

Aerospace and Defense market sector, gradually recovering

semiconductor capital equipment demand and new program ramps that

are mitigating inventory correction headwinds in our

Healthcare/Lifesciences and Industrial market sectors. For the

fiscal third quarter, our non-GAAP operating margin excludes

approximately $6.5 million of restructuring charges associated with

realigning manufacturing capabilities to best support long-term

customer needs and also excludes approximately $6.2 million of

stock-based compensation expense.”

Patrick Jermain, Executive Vice President and

Chief Financial Officer, commented, “The $65 million of free cash

flow generated during the fiscal second quarter significantly

exceeded our net income and our expectations. Continued progress on

our working capital initiatives contributed to this strong

performance, resulting in fiscal second quarter cash cycle of 91

days, 10 days favorable to our expectations and sequentially lower

by four days. Aided by the improvements in our cash cycle, return

on invested capital for the fiscal second quarter was 9.9%, or 170

basis points above our weighted average cost of capital. We have

generated $33 million of free cash flow through the first six

months of fiscal 2024 and, with further progress expected on our

working capital initiatives, we now anticipate delivering

approximately $100 million of free cash flow in fiscal 2024.

Finally, we repurchased $17.6 million of our shares during the

fiscal second quarter. We expect to execute the remaining $38.1

million of our current authorization during the second half of

fiscal 2024, creating additional shareholder value.”

Mr. Kelsey concluded, “We continue to anticipate

a strong finish to fiscal 2024 with expansion in revenue and

non-GAAP operating margin each quarter as well as robust free cash

flow generation, positioning us for further momentum into fiscal

2025. Supporting this outlook is the previously highlighted

strength in certain market sectors and subsectors, new program

ramps, improving utilization of our engineering team and the

benefits from recent restructuring actions.”

| Quarterly

Comparison |

Three Months Ended |

| (in thousands, except

EPS) |

Mar 30, 2024 |

|

Dec 30, 2023 |

|

Apr 1, 2023 |

|

Revenue |

$ |

966,900 |

|

|

$ |

982,607 |

|

|

$ |

1,070,823 |

|

| Gross profit |

|

88,063 |

|

|

|

88,140 |

|

|

|

102,993 |

|

| Operating income |

|

29,470 |

|

|

|

45,158 |

|

|

|

56,942 |

|

| Net income |

|

16,239 |

|

|

|

29,215 |

|

|

|

40,844 |

|

| Diluted EPS |

$ |

0.58 |

|

|

$ |

1.04 |

|

|

$ |

1.45 |

|

| |

|

|

|

|

|

| Gross margin |

|

9.1 |

% |

|

|

9.0 |

% |

|

|

9.6 |

% |

| Operating margin |

|

3.0 |

% |

|

|

4.6 |

% |

|

|

5.3 |

% |

| |

|

|

|

|

|

| ROIC (1) |

|

9.9 |

% |

|

|

10.3 |

% |

|

|

13.8 |

% |

| Economic return (1) |

|

1.7 |

% |

|

|

2.1 |

% |

|

|

4.8 |

% |

| |

|

|

|

|

|

|

(1) Refer to Non-GAAP Supplemental Information in Tables 1 and 2

for non-GAAP financial measures discussed and/or disclosed in this

release, such as adjusted operating margin, adjusted net income,

adjusted diluted EPS, ROIC and economic return. |

|

|

Business Segment and Market Sector

Revenue

Plexus measures operational performance and

allocates resources on a geographic segment basis. Plexus also

reports revenue based on the market sector breakout set forth in

the table below, which reflects Plexus’ market sector focused

strategy. Top 10 customers comprised 48% of revenue during both the

first and second quarter of fiscal 2024. This is down three

percentage points from the second quarter of fiscal 2023.

| Business Segments ($

in millions) |

Three Months Ended |

| |

Mar 30, 2024 |

|

Dec 30, 2023 |

|

Apr 1, 2023 |

|

Americas |

$ |

322 |

|

|

$ |

334 |

|

|

$ |

408 |

|

| Asia-Pacific |

|

521 |

|

|

|

552 |

|

|

|

587 |

|

| Europe, Middle East and

Africa |

|

155 |

|

|

|

122 |

|

|

|

102 |

|

| Elimination of inter-segment

sales |

|

(31 |

) |

|

|

(25 |

) |

|

|

(26 |

) |

|

Total Revenue |

$ |

967 |

|

|

$ |

983 |

|

|

$ |

1,071 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Market Sectors ($ in

millions) |

Three Months Ended |

| |

Mar 30, 2024 |

|

Dec 30, 2023 |

|

Apr 1, 2023 |

|

Healthcare/Life Sciences |

$ |

379 |

39 |

% |

|

$ |

381 |

39 |

% |

|

$ |

488 |

46 |

% |

| Industrial |

|

418 |

43 |

% |

|

|

435 |

44 |

% |

|

|

439 |

41 |

% |

| Aerospace/Defense |

|

170 |

18 |

% |

|

|

167 |

17 |

% |

|

|

144 |

13 |

% |

|

Total Revenue |

$ |

967 |

|

|

$ |

983 |

|

|

$ |

1,071 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Supplemental

Information

Plexus provides non-GAAP supplemental

information, such as ROIC, economic return and free cash flow

because such measures are used for internal management goals and

decision-making, and because they provide management and investors

with additional insight into financial performance. In addition,

management uses these and other non-GAAP measures, such as adjusted

operating income, adjusted operating margin, adjusted net income

and adjusted diluted EPS, to provide a better understanding of core

performance for purposes of period-to-period comparisons. Plexus

believes that these measures are also useful to investors because

they provide further insight by eliminating the effect of

non-recurring items that are not reflective of continuing

operations. For additional information on non-GAAP measures, please

refer to the attached Non-GAAP Supplemental Information tables.

ROIC and Economic Return

ROIC for the second quarter of fiscal 2024 was

9.9%. Plexus defines ROIC as tax-effected annualized adjusted

operating income divided by average invested capital over a

three-quarter period for the second fiscal quarter. Invested

capital is defined as equity plus debt and operating lease

obligations, less cash and cash equivalents. Our weighted average

cost of capital for fiscal 2024 is 8.2%. ROIC for the second

quarter of fiscal 2024 less our weighted average cost of capital

resulted in an economic return of 1.7%.

Free Cash Flow

Plexus defines free cash flow as cash flows

provided by operations less capital expenditures. For the three

months ended March 30, 2024, cash flows provided by operations

were $87.8 million and capital expenditures were $22.9 million,

which resulted in free cash flow of $64.9 million.

| Cash Cycle

Days |

Three Months Ended |

|

|

|

Mar 30, 2024 |

|

Dec 30, 2023 |

|

Apr 1, 2023 |

| Days in

Accounts Receivable |

61 |

|

61 |

|

56 |

| Days in Contract

Assets |

12 |

|

12 |

|

11 |

| Days in

Inventory |

158 |

|

161 |

|

156 |

| Days in Accounts

Payable |

(65) |

|

(66) |

|

(69) |

| Days in Advanced

Payments (1) |

(75) |

|

(73) |

|

(72) |

|

Annualized Cash Cycle (2) |

91 |

|

95 |

|

82 |

|

|

|

|

|

|

|

|

|

(1) |

Includes a reclassification in the presentation of advanced

payments from customers reflected in prior period amounts. As of

April 1, 2023, the impact of this reclassification was an increase

in the Company's days in advanced payments and a reduction in

annualized cash cycle by 22 days. |

|

(2) |

Plexus calculates cash cycle as the sum of days in accounts

receivable, days in contract assets and days in inventory, less

days in accounts payable and days in advanced payments. |

|

|

|

|

|

|

|

|

Conference Call and Webcast

Information

|

What: |

Plexus Fiscal 2024 Q2 Earnings Conference Call and Webcast |

| When: |

Thursday, April 25, 2024 at

8:30 a.m. Eastern Time |

| Where: |

Participants are encouraged to join the live webcast at the

investor relations section of the Plexus website,

plexus.com. Participants can also join utilizing the links

below:Audio conferencing

link:https://register.vevent.com/register/BI408fb95be3e440b981d3e0808adddf91Webcast

link:https://edge.media-server.com/mmc/p/wrgz2xex |

| Replay: |

The webcast will be archived on the Plexus website and will be

available as on-demand for 12 months |

| |

|

Investor and Media ContactShawn

Harrison+1.920.969.6325shawn.harrison@plexus.com

About PlexusSince 1979, Plexus

has been partnering with companies to create the products that

build a better world. We are a team of over 20,000 individuals who

are dedicated to providing Design and Development, Supply Chain

Solutions, New Product Introduction, Manufacturing and Sustaining

Services. Plexus is a global leader that specializes in serving

customers in industries with highly complex products and demanding

regulatory environments. Plexus delivers customer service

excellence to leading companies by providing innovative,

comprehensive solutions throughout a product’s lifecycle. For more

information about Plexus, visit our website at www.plexus.com.

Safe Harbor and Fair Disclosure

Statement The statements contained in this press release

that are guidance or which are not historical facts (such as

statements in the future tense and statements including believe,

expect, intend, plan, anticipate, goal, target and similar terms

and concepts), including all discussions of periods which are not

yet completed, are forward-looking statements that involve risks

and uncertainties. These risks and uncertainties include the

ability to realize anticipated savings from restructuring or

similar actions, as well as the adequacy of related charges as

compared to actual expenses; the effect of inflationary pressures

on our costs of production, profitability, and on the economic

outlook of our markets; the effects of shortages and delays in

obtaining components as a result of economic cycles, natural

disasters or otherwise; the risk of customer delays, changes,

cancellations or forecast inaccuracies in both ongoing and new

programs; the lack of visibility of future orders, particularly in

view of changing economic conditions; the economic performance of

the industries, sectors and customers we serve; the outcome of

litigation and regulatory investigations and proceedings, including

the results of any challenges with regard to such outcomes; the

effects of tariffs, trade disputes, trade agreements and other

trade protection measures; the effects of the volume of revenue

from certain sectors or programs on our margins in particular

periods; our ability to secure new customers, maintain our current

customer base and deliver product on a timely basis; the risks of

concentration of work for certain customers; the particular risks

relative to new or recent customers, programs or services, which

risks include customer and other delays, start-up costs, potential

inability to execute, the establishment of appropriate terms of

agreements, and the lack of a track record of order volume and

timing; the effects of start-up costs of new programs and

facilities or the costs associated with the closure or

consolidation of facilities; possible unexpected costs and

operating disruption in transitioning programs, including

transitions between Company facilities; the risk that new program

wins and/or customer demand may not result in the expected revenue

or profitability; the fact that customer orders may not lead to

long-term relationships; our ability to manage successfully and

execute a complex business model characterized by high product mix

and demanding quality, regulatory, and other requirements; the

risks associated with excess and obsolete inventory, including the

risk that inventory purchased on behalf of our customers may not be

consumed or otherwise paid for by the customer, resulting in an

inventory write-off; risks related to information technology

systems and data security; increasing regulatory and compliance

requirements; any tax law changes and related foreign jurisdiction

tax developments; current or potential future barriers to the

repatriation of funds that are currently held outside of the United

States as a result of actions taken by other countries or

otherwise; the potential effects of jurisdictional results on our

taxes, tax rates, and our ability to use deferred tax assets and

net operating losses; the weakness of areas of the global economy;

the effect of changes in the pricing and margins of products; raw

materials and component cost fluctuations; the potential effect of

fluctuations in the value of the currencies in which we transact

business; the effects of changes in economic conditions, political

conditions and tax matters in the United States and in the other

countries in which we do business; the potential effect of other

world or local events or other events outside our control (such as

the conflict between Russia and Ukraine, conflict in the Middle

East, escalating tensions between China and Taiwan or China and the

United States, changes in energy prices, terrorism, global health

epidemics and weather events); the impact of increased competition;

an inability to successfully manage human capital; changes in

financial accounting standards; and other risks detailed herein and

in our other Securities and Exchange Commission filings,

particularly in Risk Factors contained in our fiscal 2023 Form

10-K.

|

|

|

PLEXUS CORP. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(in thousands, except per share data) |

|

(unaudited) |

| |

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

Mar 30, |

|

Apr 1, |

|

Mar 30, |

|

Apr 1, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net sales |

$ |

966,900 |

|

|

$ |

1,070,823 |

|

|

$ |

1,949,507 |

|

|

$ |

2,164,748 |

|

| Cost of sales |

|

878,837 |

|

|

|

967,830 |

|

|

|

1,773,304 |

|

|

|

1,960,556 |

|

|

Gross profit |

|

88,063 |

|

|

|

102,993 |

|

|

|

176,203 |

|

|

|

204,192 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling and administrative expenses |

|

47,555 |

|

|

|

46,051 |

|

|

|

90,537 |

|

|

|

89,909 |

|

|

Restructuring and other charges, net |

|

11,038 |

|

|

|

— |

|

|

|

11,038 |

|

|

|

— |

|

|

Operating income |

|

29,470 |

|

|

|

56,942 |

|

|

|

74,628 |

|

|

|

114,283 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest expense |

|

(8,293 |

) |

|

|

(8,287 |

) |

|

|

(15,910 |

) |

|

|

(15,181 |

) |

|

Interest income |

|

817 |

|

|

|

759 |

|

|

|

1,625 |

|

|

|

1,693 |

|

|

Miscellaneous, net |

|

(3,027 |

) |

|

|

(1,612 |

) |

|

|

(6,529 |

) |

|

|

(3,556 |

) |

|

Income before income taxes |

|

18,967 |

|

|

|

47,802 |

|

|

|

53,814 |

|

|

|

97,239 |

|

| Income tax expense |

|

2,728 |

|

|

|

6,958 |

|

|

|

8,360 |

|

|

|

14,205 |

|

|

Net income |

$ |

16,239 |

|

|

$ |

40,844 |

|

|

$ |

45,454 |

|

|

$ |

83,034 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.59 |

|

|

$ |

1.48 |

|

|

$ |

1.65 |

|

|

$ |

3.00 |

|

|

Diluted |

$ |

0.58 |

|

|

$ |

1.45 |

|

|

$ |

1.62 |

|

|

$ |

2.94 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

27,542 |

|

|

|

27,661 |

|

|

|

27,513 |

|

|

|

27,650 |

|

|

Diluted |

|

27,929 |

|

|

|

28,184 |

|

|

|

27,982 |

|

|

|

28,273 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEXUS CORP. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(in thousands, except per share data) |

|

(unaudited) |

| |

Mar 30, |

|

Sep 30, |

|

|

2024 |

|

2023 |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

265,053 |

|

|

$ |

256,233 |

|

|

Restricted cash |

|

41 |

|

|

|

421 |

|

|

Accounts receivable |

|

645,523 |

|

|

|

661,542 |

|

|

Contract assets |

|

131,174 |

|

|

|

142,297 |

|

|

Inventories |

|

1,518,729 |

|

|

|

1,562,037 |

|

|

Prepaid expenses and other |

|

70,531 |

|

|

|

49,693 |

|

|

Total current assets |

|

2,631,051 |

|

|

|

2,672,223 |

|

| Property, plant and equipment,

net |

|

493,803 |

|

|

|

492,036 |

|

| Operating lease right-of-use

assets |

|

63,106 |

|

|

|

69,363 |

|

| Deferred income taxes |

|

62,665 |

|

|

|

62,590 |

|

|

Other assets |

|

26,032 |

|

|

|

24,960 |

|

|

Total non-current assets |

|

645,606 |

|

|

|

648,949 |

|

|

Total assets |

$ |

3,276,657 |

|

|

$ |

3,321,172 |

|

| |

|

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Current portion of long-term debt and finance lease

obligations |

$ |

245,964 |

|

|

$ |

240,205 |

|

|

Accounts payable |

|

627,427 |

|

|

|

646,610 |

|

|

Advanced payments from customers |

|

716,172 |

|

|

|

760,351 |

|

|

Accrued salaries and wages |

|

72,880 |

|

|

|

94,099 |

|

|

Other accrued liabilities |

|

74,392 |

|

|

|

71,402 |

|

|

Total current liabilities |

|

1,736,835 |

|

|

|

1,812,667 |

|

| Long-term debt and finance

lease obligations, net of current portion |

|

192,025 |

|

|

|

190,853 |

|

|

Accrued income taxes payable |

|

17,198 |

|

|

|

31,382 |

|

|

Long-term operating lease liabilities |

|

33,915 |

|

|

|

38,552 |

|

|

Deferred income taxes |

|

4,429 |

|

|

|

4,350 |

|

|

Other liabilities |

|

32,493 |

|

|

|

28,986 |

|

|

Total non-current liabilities |

|

280,060 |

|

|

|

294,123 |

|

|

Total liabilities |

|

2,016,895 |

|

|

|

2,106,790 |

|

|

Shareholders’ equity: |

|

|

|

|

Common stock |

|

545 |

|

|

|

543 |

|

|

Additional paid-in-capital |

|

663,130 |

|

|

|

661,270 |

|

|

Common stock held in treasury |

|

(1,151,997 |

) |

|

|

(1,134,429 |

) |

|

Retained earnings |

|

1,756,782 |

|

|

|

1,711,328 |

|

|

Accumulated other comprehensive loss |

|

(8,698 |

) |

|

|

(24,330 |

) |

|

Total shareholders’ equity |

|

1,259,762 |

|

|

|

1,214,382 |

|

|

Total liabilities and shareholders’ equity |

$ |

3,276,657 |

|

|

$ |

3,321,172 |

|

| |

|

|

|

|

PLEXUS CORP. AND SUBSIDIARIES |

|

NON-GAAP SUPPLEMENTAL INFORMATION Table 1 |

|

(in thousands, except per share data) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

Mar 30, |

|

Dec 30, |

|

Apr 1, |

|

Mar 30, |

|

Apr 1, |

|

|

|

2024 |

|

2023 |

|

2023 |

|

2024 |

|

2023 |

| Operating income,

as reported |

$ |

29,470 |

|

|

$ |

45,158 |

|

|

$ |

56,942 |

|

|

$ |

74,628 |

|

|

$ |

114,283 |

|

| Operating margin,

as reported |

|

3.0 |

% |

|

|

4.6 |

% |

|

|

5.3 |

% |

|

|

3.8 |

% |

|

|

5.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

adjustments: |

|

|

|

|

|

|

|

|

|

|

Restructuring costs (1) |

|

13,288 |

|

|

|

— |

|

|

|

— |

|

|

|

13,288 |

|

|

|

— |

|

|

Other non-recurring income (2) |

|

(2,250 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,250 |

) |

|

|

— |

|

| Non-GAAP operating

income |

$ |

40,508 |

|

|

$ |

45,158 |

|

|

$ |

56,942 |

|

|

$ |

85,666 |

|

|

$ |

114,283 |

|

| Non-GAAP operating

margin |

|

4.2 |

% |

|

|

4.6 |

% |

|

|

5.3 |

% |

|

|

4.4 |

% |

|

|

5.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Net income, as

reported |

$ |

16,239 |

|

|

$ |

29,215 |

|

|

$ |

40,844 |

|

|

$ |

45,454 |

|

|

$ |

83,034 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

adjustments: |

|

|

|

|

|

|

|

|

|

|

Restructuring costs, net of tax (1) |

|

11,893 |

|

|

|

— |

|

|

|

— |

|

|

|

11,893 |

|

|

|

— |

|

|

Other non-recurring income, net of tax (2) |

|

(2,014 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,014 |

) |

|

|

— |

|

| Adjusted net

income |

$ |

26,118 |

|

|

$ |

29,215 |

|

|

$ |

40,844 |

|

|

$ |

55,333 |

|

|

$ |

83,034 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Diluted earnings

per share, as reported |

$ |

0.58 |

|

|

$ |

1.04 |

|

|

$ |

1.45 |

|

|

$ |

1.62 |

|

|

$ |

2.94 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP per share

adjustments: |

|

|

|

|

|

|

|

|

|

|

Restructuring costs, net of tax (1) |

|

0.43 |

|

|

|

— |

|

|

|

— |

|

|

|

0.43 |

|

|

|

— |

|

|

Other non-recurring income, net of tax (2) |

|

(0.07 |

) |

|

|

— |

|

|

|

— |

|

|

|

(0.07 |

) |

|

|

— |

|

| Adjusted diluted

earnings per share |

$ |

0.94 |

|

|

$ |

1.04 |

|

|

$ |

1.45 |

|

|

$ |

1.98 |

|

|

$ |

2.94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

During the three and six months ended March 30, 2024, restructuring

and impairment charges of $13.3 million, or $11.9 million net of

taxes, were incurred for employee severance costs associated with a

reduction in the Company's workforce as well as closure costs

associated with a site in the Company's EMEA region. |

|

(2) |

During the three and six months ended March 30, 2024, insurance

proceeds of $2.3 million, or $2.0 million net of taxes, were

received related to an arbitration decision associated with a

contractual matter that occurred in the Company's EMEA region in

fiscal 2023. |

|

|

|

|

PLEXUS CORP. AND SUBSIDIARIES |

|

NON-GAAP SUPPLEMENTAL INFORMATION Table 2 |

|

(in thousands) |

|

(unaudited) |

| |

|

|

|

|

|

| ROIC and Economic Return

Calculations |

Six Months Ended |

|

Three Months Ended |

|

Six Months Ended |

| |

Mar 30, |

|

Dec 30, |

|

Apr 1, |

| |

2024 |

|

2023 |

|

2023 |

|

Operating income, as reported |

|

$ |

74,628 |

|

|

|

$ |

45,158 |

|

|

|

$ |

114,283 |

|

|

Restructuring and other charges, net |

+ |

|

11,038 |

|

|

+ |

|

— |

|

|

+ |

|

— |

|

| Adjusted operating income |

|

$ |

85,666 |

|

|

|

$ |

45,158 |

|

|

|

$ |

114,283 |

|

| |

x |

|

2 |

|

|

x |

|

4 |

|

|

x |

|

2 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Adjusted annualized operating

income |

|

$ |

171,332 |

|

|

|

$ |

180,632 |

|

|

|

$ |

228,566 |

|

| Adjusted effective tax

rate |

x |

|

15 |

% |

|

x |

|

16 |

% |

|

x |

|

15 |

% |

| Tax impact |

|

|

25,700 |

|

|

|

|

28,901 |

|

|

|

|

34,285 |

|

| Adjusted operating income

(tax-effected) |

|

$ |

145,632 |

|

|

|

$ |

151,731 |

|

|

|

$ |

194,281 |

|

| |

|

|

|

|

|

|

|

|

| Average invested capital |

÷ |

$ |

1,478,062 |

|

|

÷ |

$ |

1,479,647 |

|

|

÷ |

$ |

1,406,359 |

|

| ROIC |

|

|

9.9 |

% |

|

|

|

10.3 |

% |

|

|

|

13.8 |

% |

| Weighted average cost of

capital |

- |

|

8.2 |

% |

|

- |

|

8.2 |

% |

|

- |

|

9.0 |

% |

| Economic return |

|

|

1.7 |

% |

|

|

|

2.1 |

% |

|

|

|

4.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Invested Capital

Calculations |

Mar 30, |

|

Dec 30, |

|

Sep 30, |

|

Jul 1, |

|

Apr 1, |

|

Dec 31, |

|

Oct 1, |

|

|

2024 |

|

2023 |

|

2023 |

|

2023 |

|

2023 |

|

2022 |

|

2022 |

|

Equity |

$ |

1,259,762 |

|

|

$ |

1,266,755 |

|

|

$ |

1,214,382 |

|

|

$ |

1,184,362 |

|

|

$ |

1,182,382 |

|

|

$ |

1,150,259 |

|

|

$ |

1,095,731 |

|

| Plus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt and finance lease obligations - current |

|

245,964 |

|

|

|

251,119 |

|

|

|

240,205 |

|

|

|

304,781 |

|

|

|

294,011 |

|

|

|

329,076 |

|

|

|

273,971 |

|

|

Operating lease obligations - current (1) |

|

8,281 |

|

|

|

9,172 |

|

|

|

8,363 |

|

|

|

8,772 |

|

|

|

8,358 |

|

|

|

8,878 |

|

|

|

7,948 |

|

|

Debt and finance lease obligations - long-term |

|

192,025 |

|

|

|

192,118 |

|

|

|

190,853 |

|

|

|

187,468 |

|

|

|

188,730 |

|

|

|

187,272 |

|

|

|

187,776 |

|

|

Operating lease obligations - long-term |

|

33,915 |

|

|

|

35,989 |

|

|

|

38,552 |

|

|

|

40,515 |

|

|

|

31,257 |

|

|

|

32,149 |

|

|

|

33,628 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

(265,053 |

) |

|

|

(231,982 |

) |

|

|

(256,233 |

) |

|

|

(252,965 |

) |

|

|

(269,664 |

) |

|

|

(247,880 |

) |

|

|

(274,805 |

) |

| |

$ |

1,474,894 |

|

|

$ |

1,523,171 |

|

|

$ |

1,436,122 |

|

|

$ |

1,472,933 |

|

|

$ |

1,435,074 |

|

|

$ |

1,459,754 |

|

|

$ |

1,324,249 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Included in other accrued liabilities on the Condensed Consolidated

Balance Sheets. |

|

|

|

|

PLEXUS CORP. AND SUBSIDIARIES |

|

NON-GAAP SUPPLEMENTAL INFORMATION Table 3 |

|

(in thousands, except per share data) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

Dec 31, |

|

Apr 1, |

|

Jul 1, |

|

Sep 30, |

|

Dec 30, |

|

Mar 30, |

|

|

2022 |

|

2023 |

|

2023 |

|

2023 |

|

2023 |

|

2024 |

|

Net sales |

$ |

1,093,925 |

|

|

$ |

1,070,823 |

|

|

$ |

1,021,610 |

|

|

$ |

1,023,947 |

|

|

$ |

982,607 |

|

|

$ |

966,900 |

|

| Operating income,

as reported |

|

57,341 |

|

|

|

56,942 |

|

|

|

28,204 |

|

|

|

53,333 |

|

|

|

45,158 |

|

|

|

29,470 |

|

| Operating margin,

as reported |

|

5.2 |

% |

|

|

5.3 |

% |

|

|

2.8 |

% |

|

|

5.2 |

% |

|

|

4.6 |

% |

|

|

3.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring costs |

|

— |

|

|

|

— |

|

|

|

8,865 |

|

|

|

— |

|

|

|

— |

|

|

|

13,288 |

|

|

Other non-recurring charges, net of tax |

|

— |

|

|

|

— |

|

|

|

14,229 |

|

|

|

— |

|

|

|

— |

|

|

|

(2,250 |

) |

|

Non-GAAP operating income, previously reported |

|

57,341 |

|

|

|

56,942 |

|

|

|

51,298 |

|

|

|

53,333 |

|

|

|

45,158 |

|

|

|

40,508 |

|

|

Non-GAAP operating margin, previously reported |

|

5.2 |

% |

|

|

5.3 |

% |

|

|

5.0 |

% |

|

|

5.2 |

% |

|

|

4.6 |

% |

|

|

4.2 |

% |

|

Stock-based compensation |

|

5,819 |

|

|

|

5,907 |

|

|

|

3,829 |

|

|

|

5,824 |

|

|

|

5,335 |

|

|

|

7,096 |

|

| Non-GAAP operating

income |

$ |

63,160 |

|

|

$ |

62,849 |

|

|

$ |

55,127 |

|

|

$ |

59,157 |

|

|

$ |

50,493 |

|

|

$ |

47,604 |

|

| Non-GAAP operating

margin |

|

5.8 |

% |

|

|

5.9 |

% |

|

|

5.4 |

% |

|

|

5.8 |

% |

|

|

5.1 |

% |

|

|

4.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income, as

reported |

$ |

42,190 |

|

|

$ |

40,844 |

|

|

$ |

15,799 |

|

|

$ |

40,261 |

|

|

$ |

29,215 |

|

|

$ |

16,239 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring costs, net of tax |

|

— |

|

|

|

— |

|

|

|

7,920 |

|

|

|

— |

|

|

|

— |

|

|

|

11,893 |

|

|

Other non-recurring charges, net of tax |

|

— |

|

|

|

— |

|

|

|

13,346 |

|

|

|

— |

|

|

|

— |

|

|

|

(2,014 |

) |

|

Adjusted net income, previously reported |

|

42,190 |

|

|

|

40,844 |

|

|

|

37,065 |

|

|

|

40,261 |

|

|

|

29,215 |

|

|

|

26,118 |

|

|

Stock-based compensation |

|

5,819 |

|

|

|

5,907 |

|

|

|

3,829 |

|

|

|

5,824 |

|

|

|

5,335 |

|

|

|

7,096 |

|

| Adjusted net

income |

$ |

48,009 |

|

|

$ |

46,751 |

|

|

$ |

40,894 |

|

|

$ |

46,085 |

|

|

$ |

34,550 |

|

|

$ |

33,214 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted weighted

average shares outstanding |

|

28,305 |

|

|

|

28,184 |

|

|

|

27,992 |

|

|

|

27,972 |

|

|

|

28,013 |

|

|

|

27,929 |

|

| Diluted earnings

per share, as previously reported |

$ |

1.49 |

|

|

$ |

1.45 |

|

|

$ |

0.56 |

|

|

$ |

1.44 |

|

|

$ |

1.04 |

|

|

$ |

0.58 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP per share

adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring costs, net of tax |

|

— |

|

|

|

— |

|

|

|

0.28 |

|

|

|

— |

|

|

|

— |

|

|

|

0.43 |

|

|

Other non-recurring charges, net of tax |

|

— |

|

|

|

— |

|

|

|

0.48 |

|

|

|

— |

|

|

|

— |

|

|

|

(0.07 |

) |

|

Adjusted diluted earnings per share, previously reported |

|

1.49 |

|

|

|

1.45 |

|

|

|

1.32 |

|

|

|

1.44 |

|

|

|

1.04 |

|

|

|

0.94 |

|

|

Stock-based compensation |

|

0.21 |

|

|

|

0.21 |

|

|

|

0.14 |

|

|

|

0.21 |

|

|

|

0.19 |

|

|

|

0.25 |

|

| Adjusted diluted

earnings per share |

$ |

1.70 |

|

|

$ |

1.66 |

|

|

$ |

1.46 |

|

|

$ |

1.65 |

|

|

$ |

1.23 |

|

|

$ |

1.19 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

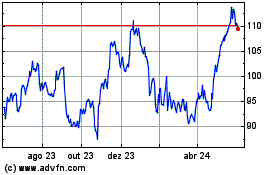

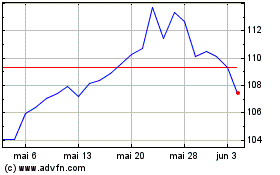

Plexus (NASDAQ:PLXS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Plexus (NASDAQ:PLXS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025