Stronghold Digital Mining, Inc. (NASDAQ:

SDIG) (“Stronghold”, or the “Company”) today reported

preliminary unaudited financial results for the first quarter ended

March 31, 2024:

First Quarter 2024 Financial

Performance

Stronghold generated an estimated $27.5 million

of revenue, an estimated $5.8 million of GAAP Net Income, and an

estimated $8.7 million of adjusted EBITDA1 during the first quarter

of 2024. Revenue comprised an estimated $26.7 million from

cryptocurrency mining, an estimated $0.7 million from the sale of

energy, and an estimated $0.1 million of other revenue during the

quarter. The period featured two extremes: improving Bitcoin mining

economics from January through March and depressed PJM power prices

to end the winter in January and February. In addition to the

improved Bitcoin mining economics experienced during the first

quarter, Stronghold’s improved operational execution in the first

quarter led to improved hash rate utilization compared to prior

quarters.

Conference Call

Stronghold has scheduled its first quarter 2024

earnings conference call on Thursday, May 2nd at 11:00 a.m. Eastern

Time to discuss its operations and financial results from the first

quarter ended March 31, 2024. A press release detailing these

results will be issued before the market opens on the same day.

Stronghold management will provide prepared

remarks, followed by a question-and-answer period.

A live webcast of the call will be available on

the Investor Relations page of the Company’s website at

ir.strongholddigitalmining.com. To access the call by phone, please

use the following link Stronghold Digital Mining First Quarter 2024

Earnings Call. After registering, an email will be sent, including

dial-in details and a unique conference call access code required

to join the live call. To ensure you are connected prior to the

beginning of the call, please register a minimum of 15 minutes

before the start of the call.

A replay will be available on the Company's

Investor Relations website shortly after the event at

ir.strongholddigitalmining.com.

Use and Reconciliation of Non-GAAP

Financial Measures

This press release contains certain non-GAAP

financial measures, including Adjusted EBITDA, as a measure of our

operating performance. Adjusted EBITDA is a non-GAAP financial

measure. We define Adjusted EBITDA as net income (loss) before

interest, taxes, depreciation and amortization, further adjusted by

the removal of one-time transaction costs, non-recurring expenses,

realized gains and losses on the sale of long-term assets, expenses

related to stock-based compensation, gains or losses on derivative

contracts, gain or losses on extinguishment of debt, commissions on

the sale of ash, or changes in the fair value of warrant

liabilities in the period presented. See reconciliation below.

Our board of directors and management team use

Adjusted EBITDA to assess our financial performance because they

believe it allows them to compare our operating performance on a

consistent basis across periods by removing the effects of our

capital structure (such as varying levels of interest expense and

income), asset base (such as depreciation, amortization,

impairment, and realized gains and losses on the sale of long-term

assets) and other items (such as one-time transaction costs,

expenses related to stock-based compensation, and gains and losses

on derivative contracts) that impact the comparability of financial

results from period to period. We present Adjusted EBITDA because

we believe it provides useful information regarding the factors and

trends affecting our business in addition to measures calculated

under GAAP. Adjusted EBITDA is not a financial measure presented in

accordance with GAAP. We believe that the presentation of this

non-GAAP financial measure will provide useful information to

investors and analysts in assessing our financial performance and

results of operations across reporting periods by excluding items

we do not believe are indicative of our core operating performance.

Net income (loss) is the GAAP measure most directly comparable to

Adjusted EBITDA. Our non-GAAP financial measure should not be

considered an alternative to the most directly comparable GAAP

financial measure. You are encouraged to evaluate each of these

adjustments and the reasons we consider them appropriate for

supplemental analysis. In evaluating Adjusted EBITDA, you should be

aware that in the future we may incur expenses that are the same as

or similar to some of the adjustments in such presentation. Our

presentation of Adjusted EBITDA should not be construed as an

inference that our future results will be unaffected by unusual or

non-recurring items. There can be no assurance that we will not

modify the presentation of Adjusted EBITDA in the future, and any

such modifications may be material. Adjusted EBITDA has important

limitations as an analytical tool. You should not consider Adjusted

EBITDA in isolation or as a substitute for analysis of our results

as reported under GAAP, and it should be read in conjunction with

the financial statements contained in our filings with the

Securities and Exchange Commission. Because Adjusted EBITDA may be

defined differently by other companies in our industry, our

definition of this non-GAAP financial measure may not be comparable

to similarly titled measures of other companies, thereby

diminishing its utility.

Preliminary Non-GAAP

Reconciliations:

A reconciliation of the Company’s net income

(loss), the closest GAAP measure, to Adjusted EBITDA is presented

in the following table:

|

|

Three Months Ended |

|

(in thousands) |

March 31, 2024 |

|

March 31, 2023 |

|

Net Income (Loss)—GAAP |

$ |

5,842 |

|

|

$ |

(46,661 |

) |

|

Plus: |

|

|

|

|

Interest expense |

|

2,263 |

|

|

|

2,384 |

|

|

Depreciation and amortization |

|

9,515 |

|

|

|

7,723 |

|

|

Loss on debt extinguishment |

|

- |

|

|

|

28,961 |

|

|

Impairments on digital currencies |

|

- |

|

|

|

71 |

|

|

Non-recurring expenses1 |

|

837 |

|

|

|

682 |

|

|

Stock-based compensation |

|

1,939 |

|

|

|

2,449 |

|

|

Loss on disposal of fixed assets |

|

- |

|

|

|

91 |

|

|

Realized gain on sale of miner assets |

|

(36 |

) |

|

|

- |

|

|

Realized gain on sale of digital currencies2 |

|

- |

|

|

|

(327 |

) |

|

Changes in fair value of warrant liabilities |

|

(11,678 |

) |

|

|

715 |

|

|

Accretion of asset retirement obligation |

|

14 |

|

|

|

13 |

|

|

Adjusted EBITDA—Non-GAAP |

$ |

8,696 |

|

|

$ |

(3,898 |

) |

| |

|

|

|

| 1 Includes the

following non-recurring expenses: One-time legal fees,

out-of-the-ordinary major repairs and upgrades to the power plant,

and other one-time items.2 As previously disclosed, the Company

adopted ASU 2023-08 effective January 1, 2024, using a modified

retrospective transition method, with a cumulative-effect

adjustment of approximately $0.1 million recorded to the opening

balance of retained earnings. For 2024 and beyond, in conjunction

with this accounting change, realized gains and losses on the sale

of digital currencies will no longer be excluded from Adjusted

EBITDA. Following the adoption of ASU 2023-08, realized gains (net

of realized losses) on the sale of digital currencies were

approximately $0.6 million and unrealized gains (net of unrealized

losses) on digital currencies were insignificant for the three

months ended March 31, 2024. |

| |

About Stronghold Digital Mining, Inc.

Stronghold is a vertically integrated Bitcoin

mining company with an emphasis on environmentally beneficial

operations. Stronghold houses its miners at its wholly owned and

operated Scrubgrass Plant and Panther Creek Plant, both of which

are low-cost, environmentally beneficial coal refuse power

generation facilities in Pennsylvania.

Investor Contact:Matt Glover or

Alex KovtunGateway Group,

Inc.SDIG@gateway-grp.com1-949-574-3860

Media Contact:

contact@strongholddigitalmining.com

Forward Looking Statements:

The information, financial projections and other

estimates contained herein contain “forward-looking statements” as

that term is defined in Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended by the Private Securities Litigation Reform Act of 1995,

including, but not limited to statements regarding the anticipated

performance of the Company and its assets. Such projections and

estimates are as to future events and are not to be viewed as

facts, and reflect various assumptions of management of the Company

concerning the future performance of the Company and are subject to

significant business, financial, economic, operating, competitive

and other risks and uncertainties and contingencies (many of which

are difficult to predict and beyond the control of the Company)

that could cause actual results to differ materially from the

statements and information included herein. Forward-looking

statements concern future circumstances and results and other

statements that are not historical facts and are sometimes

identified by the words “may,” “will,” “should,” “potential,”

“intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,”

“overestimate,” “underestimate,” “believe,” “could,” “project,”

“predict,” “continue,” “target” or other similar words or

expressions. Forward-looking statements are based upon current

plans, estimates and expectations that are subject to risks,

uncertainties and assumptions. Forward-looking statements may

include statements about various risks and uncertainties, including

those described under the heading "Risk Factors" as detailed from

time to time in Stronghold’s reports filed with the SEC, including

Stronghold’s annual report on Form 10-K filed on March 8, 2024,

periodic quarterly reports on Form 10-Q, current reports on Form

8-K and other documents filed with the SEC. Such risk and

uncertainties are not exclusive. Any forward-looking statements

speak only as of the date of this communication. The Company does

not undertake any obligation to update any forward-looking

statements, whether as a result of new information or development,

future events or otherwise, except as required by law. Readers are

cautioned not to place undue reliance on any of these

forward-looking statements. Additionally, descriptions herein of

market conditions and opportunities are presented for informational

purposes only; there can be no assurance that such conditions will

actually occur or result in positive returns. Recipients of this

communication should make their own investigations and evaluations

of any information referenced herein.

1 See preliminary non-GAAP reconciliations.

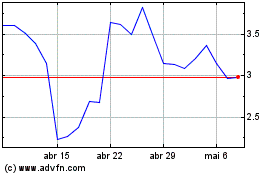

Stronghold Digital Mining (NASDAQ:SDIG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Stronghold Digital Mining (NASDAQ:SDIG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025