MORNING UPDATE: Man Securities Inc. Issues Alerts for YHOO, AMTD, LLTC, SWKS, and AMR

19 Janeiro 2005 - 1:46PM

PR Newswire (US)

MORNING UPDATE: Man Securities Inc. Issues Alerts for YHOO, AMTD,

LLTC, SWKS, and AMR CHICAGO, Jan. 19 /PRNewswire/ -- Man Securities

issues the following Morning Update at 8:30 AM EST with new

PriceWatch Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for YHOO, AMTD, LLTC, SWKS, and AMR,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "The continuing net equity outflows from the

US is a worry for the sustainability of dollar strength." --

Mustafa Caglayan, currency strategist, JPMorgan Chase and Co. New

PriceWatch Alerts for YHOO, AMTD, LLTC, SWKS, and AMR... PRICEWATCH

ALERTS - HIGH RETURN COVERED CALL OPTIONS -- Yahoo Inc.

(NASDAQ:YHOO) Last Price 37.18 - JAN 37.50 CALL OPTION@ $1.15 ->

4.1 % Return assigned* -- Ameritrade Holding Corp. (NASDAQ:AMTD)

Last Price 12.85 - MAY 12.50 CALL OPTION@ $1.30 -> 8.2 % Return

assigned* -- Linear Technology Corp. (NASDAQ:LLTC) Last Price 37.04

- FEB 37.50 CALL OPTION@ $1.05 -> 4.2 % Return assigned* --

SkyWorks Solutions Inc. (NASDAQ:SWKS) Last Price 8.24 - MAY 7.50

CALL OPTION@ $1.40 -> 9.6 % Return assigned* -- AMR Corp.

(NYSE:AMR) Last Price 8.87 - FEB 8.00 CALL OPTION@ $1.25 -> 5.0

% Return assigned* * To learn more about how to use these alerts

and for our FREE report, "The 18 Warning Signs That Tell You When

To Dump A Stock ", go to: http://www.investorsobserver.com/mu18

(Note: You may need to copy the link above into your browser then

press the [ENTER] key) ** For the FREE report, "Is Your Investment

Portfolio Disaster Proof? - Insights, Stocks, And Strategies." go

to: http://www.investorsobserver.com/FREEDP NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. NEWS LEADERS AND LAGGARDS So far today,

Southwest Airlines Inc., International Business Machines Corp., and

Mellon Financial Corp. lead the list of companies with the most

news stories while Range Resources Corp. and Alaska Communications

Systems Group Inc. are showing a spike in news. ExpressJet Holdings

Inc., Yahoo! Inc., and ValueClick Inc. have the highest srtIndex

scores to top the list of companies with positive news, while

Parker Hannifin Corp. and Advanced Micro Devices Inc. lead the list

of companies with negative news reports. Google Inc. has popped up

with a high positive news sraIndex score. For the FREE article

titled, "Earnings Season Decoded - An Essential 15 Point Checklist

For Finding Winning Stocks." go to:

http://www.wallstreetsecretsplus.com/go/freemu/ MARKET OVERVIEW

Overseas markets are pretty much mixed, as seven of the 15 markets

that we follow are higher with the cumulative average return

standing at plus 0.069 percent. Overnight, Japan was higher after

positive tech news out of the U.S. but eventually sold-off by the

end of the session. At 8:30 a.m., the December Consumer Price Index

(CPI) is expected to show no change for the month of December. Also

at 8:30 a.m., we should see housing starts for December to come in

at an annualized rate of 1.91 million, above last period's 1.77

million. Earnings are in full swing, as in the morning we have

General Motors, J.P. Morgan Chase, and Pfizer all scheduled to

release quarterly results. Then after the bell the big names are

eBay and Washington Mutual. Be prepared for the investing week

ahead with Bernie Schaeffer's FREE Monday Morning Outlook. For more

details and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES Now that the holiday period has gone for another

year, what's next for the US retail sector? After economic

commentators gloomily forecast sluggish sales in November and

December, the resilient American consumer promptly turned around

and proved the forecasts wrong in a major way. From an initial

projection of 4.5% sales growth, the National Retail Federation's

(NRF) outlook appeared very pessimistic when November-December

sales raced in 5.7% higher than in 2003. But the picture became

clearer last week when a Federal Reserve report showed US consumer

debt plunged by US$8.7 billion in November -- the largest monthly

fall since January 1943. It seemed Americans were simply saving

some extra money. Not to be deterred, however, the NRF boldly

declares that retail sales will slide substantially this year

compared with 2004. The group cites weak wage growth, an absence of

tax breaks to tempt consumers to spend, and rising energy costs.

Specifically, it says retail sales will rise only 3.5%, compared

with last year's solid 6.7% growth rate, which was the highest

since 1999. Regarding rising energy costs, the International Energy

Agency (IEA) says that, even with economic growth projected to slow

in several regions and countries this year, the oil market is

likely to stay under substantial pressure because demand remains

strong while supplies remain tight. The group said global oil

demand climbed 3.3% last year -- the fastest pace since 1976 and

well above average estimates. And while demand this year isn't

expected to be as strong as in 2004, it should be enough to ensure

that the market endures another uncertain year -- more so

considering the geopolitical instability in countries like Iraq and

Nigeria, where any trouble affecting oil supplies would likely

place additional strain on reserves and upward pressure on oil

prices. Receive incisive economic/market commentary, profitable

advice and access to a network of leading investment exports.

Simply follow this link: http://www.investorsobserver.com/agora2

TODAY'S ECONOMIC CALENDAR 7:00 a.m.: MBA Refinancing Index week

ended January 15 (last plus 1.1 percent) 7:45 a.m.: ICSC-UBS Store

Sales Index week ended January 15 (last minus 0.6 percent) 8:00

a.m.: Fed Gov Bernanke speaks on productivity in New York 8:30

a.m.: Initial Jobless Claims week ended January 15 (last plus

10,000) 8:30 a.m.: December Housing Starts (last minus 13.1

percent) 8:30 a.m.: December CPI (last plus 0.2 percent) 8:30 a.m.:

December CPI, ex-food and energy (last plus 0.2 percent) 8:55 a.m.:

Redbook Retail Sales Index week ended January 15 (last plus 1.1

percent) 2:00 p.m.: Federal Reserve Beige Book Man Securities Inc.

is one of the world's leading option order execution firms. Man's

in-house broker team offers a level of personal service and

experience unavailable from no-frills discount brokers. To improve

your understanding of option pricing get Man's FREE "Margin/Option

Wizard software at: http://www.investorsobserver.com/mancd. Member

CBOE/NASD/SPIC. This Morning Update was prepared with data and

information provided by: InvestorsObserver.com - Better Strategies

for Making Money -> For Investors With a Sense of Humor. Only $1

for your first month plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must 247profits.com: You'll get

exclusive financial commentary, access to a global network of

experts and undiscovered stock alerts. Register NOW for the FREE

247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.poweroptionsplus.com/ All stocks and options shown are

examples only. These are not recommendations to buy or sell any

security and they do not represent in any way a positive or

negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp. Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

John Gannon of Man Securities Inc., +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

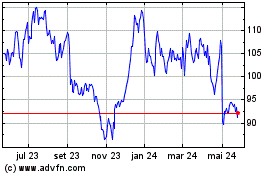

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

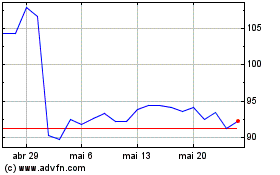

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024