MORNING UPDATE: brokersXpress, LLC issues alerts for QCOM, SWKS, OSIP, ATVI, and KMX

20 Junho 2005 - 12:02PM

PR Newswire (US)

MORNING UPDATE: brokersXpress, LLC issues alerts for QCOM, SWKS,

OSIP, ATVI, and KMX CHICAGO, June 20 /PRNewswire/ -- brokersXpress,

LLC issues the following Morning Update at 8:30 AM EDT with new

PriceWatch Alerts for key stocks. Before the open... PriceWatch

Alerts for QCOM, SWKS, OSIP, ATVI, and KMX, Market Overview,

Today's Economic Calendar, and the Quote Of The Day. QUOTE OF THE

DAY "We all know that earnings growth is slowing. We're not going

to grow earnings at 20 percent like last year." -- John Caldwell,

chief investment strategist, McDonald Financial Group New

PriceWatch Alerts for QCOM, SWKS, OSIP, ATVI, and KMX... PRICEWATCH

ALERTS -- HIGH RETURN COVERED CALL OPTIONS ----------- -- QualComm

Inc. (NASDAQ:QCOM) Last Price 34.90 -- OCT 32.50 CALL OPTION@ $3.80

-> 4.5 % Return assigned* -- SkyWorks Solutions Inc.

(NASDAQ:SWKS) Last Price 7.94 -- JUL 7.50 CALL OPTION@ $0.75 ->

4.3 % Return assigned* -- OSI Pharmaceulticals Inc. (NASDAQ:OSIP)

Last Price 43.00 -- OCT 35.00 CALL OPTION@ $9.80 -> 5.4 % Return

assigned* -- Activision Inc. (NASDAQ:ATVI) Last Price 17.56 -- AUG

17.50 CALL OPTION@ $1.10 -> 6.3 % Return assigned* -- Carmax

Inc. (NYSE:KMX) Last Price 25.85 -- OCT 22.50 CALL OPTION@ $4.30

-> 4.4 % Return assigned* * To learn more about how to use these

alerts and for our FREE report, "The 18 Warning Signs That Tell You

When To Dump A Stock", go to: http://www.investorsobserver.com/mu18

(Note: You may need to copy the link above into your browser then

press the [ENTER] key) ** FREE Access to the Market Intelligence

Center where you will find the news, insight and intelligence that

can make a difference in the way you invest, go to:

http://www.investorsobserver.com/FreeMIC NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. NEWS LEADERS AND LAGGARDS So far today,

Cablevision Systems Corp, Carmax, and Goodyear Tire & Rubber

lead the list of companies with the most news stories while

Crescent Real Estate Equities Co and ChevronTexaco are showing a

spike in news. Lehman Brothers, Wal-Mart Stores, and Merck & Co

have the highest srtIndex scores to top the list of companies with

positive news while Boeing Co and Viacom lead the list of companies

with negative news reports. Best BUY Co Inc has popped up with a

high positive news sraIndex score. For the FREE article titled,

"Earnings Season Decoded -- An Essential 15 Point Checklist For

Finding Winning Stocks." go to:

http://www.wallstreetsecretsplus.com/go/freemu/ MARKET OVERVIEW

Overseas markets are struggling this morning, as only two of the 15

foreign indices that we track are currently in positive territory.

Asian markets were pressured lower by a fresh rise in crude prices,

as the July- dated contract on crude oil held above $59 per barrel

in overseas trading. In Hong Kong, however, stocks gained as

China's fifth-largest lender, Bank of Communications, set the price

for its initial public offering at the high end of its anticipated

range, raising $1.9 billion. The stock is scheduled to begin

trading on June 23. Futures are headed lower this morning, as

$60-per-barrel crude has quickly gone from a rumor to a very

possible occurrence. The July crude contract reached as high as

$59.23 in electronic trading, as traders speculated on fears of

possible terrorism in Nigeria. In the equity market, Cablevision

Systems was offered a buy-out offer to go private by the Dolan

Family Group. The deal is valued at $7.9 billion, or $33.50 per

share, with stockholders to receive $21 in cash and $12.50 per

share in Rainbow Media Holdings' stock. The Dolan Family expects

Cablevision Systems to form a special committee to evaluate the

proposal. Be prepared for the investing week ahead with Bernie

Schaeffer's FREE Monday Morning Outlook. For more details and to

sign up, go to: http://www.investorsobserver.com/freemo DYNAMIC

MARKET OPPORTUNITIES European Bank member and Bundesbank president

Axel Weber made sure that last week ended on a rather sour note,

stating that Italy, Portugal and Greece are all wobbling on the

fiscal precipice again. Weber said that judging by the countries'

respective budgets, they're again set to flirt close to the

European Union's fiscal rules. And these are amended rules that are

supposedly looser than the previous ones. Under the new framework,

countries that breach the mandated deficit allowance (which states

that they cannot run up debt that is more than 3% of national GDP)

can avoid EU budget sanctions if their economic growth is lower

than projected, or so-called "external factors" are involved.

Germany is set to breach the limit for the fourth successive year,

citing higher spending costs associated with rebuilding the former

East Germany. Italy will break the rules for the third straight

year in 2005 and the European Commission recently ordered finance

ministers to get Italy to reduce its budget shortfall. Meanwhile,

Greece will probably miss the target to get its deficit back under

the limit by next year and the Portuguese government is forecasting

a whopping 6.4% budget gap this year -- well over double the legal

limit. But in typically odd EU fashion, no country has yet been

fined for breaking the rules -- despite the rules saying that they

should be. The European Central Bank isn't helping foster much

growth by stubbornly ignoring ever louder calls from national

leaders and finance ministers to cut interest rates for the first

time in two years from the current 2% level. But with manufacturing

activity contracting by the biggest amount in two years in May,

Weber and the ECB apparently believe it is "asking too much" of the

bank to boost GDP growth by doing anything. So it continues to

leave rates unchanged. Read more analysis from the 247Profits Group

every trading day with the FREE 247Profits e-Dispatch, featuring

insightful economic commentary, profitable investment

recommendations, and full access to a leading team of financial

experts. Register for free here:

http://www.247profits.com/enter.html TODAY'S ECONOMIC CALENDAR

10:00 AM May Conference Board Leading Economic Indicators The

Mankus-Lavelle Group is an independent brokerage branch of

brokersXpress, LLC, a wholly owned subsidiary of optionsXpress

Holdings, Inc. The Mankus-Lavelle Group has some of the most

experienced, respected options professionals in the industry. Both

novice option investors and experienced traders are attracted to

MLG. Less experienced investors appreciate Mankus- Lavelle Group's

friendly expert guidance while more seasoned investors value

Mankus-Lavelle Group's highly trained staff of option experts. To

improve your understanding of options get a free option kit at:

http://www.mlgos.com/ . If you are familiar with stock investing

but not sure what options can do for you, call 1-800-230-5570 for a

FREE 3-point portfolio check up. Securities offered through

brokersXpress, LLC Member NASD/SPIC. Corporate Office: 39 South

LaSalle Street, Suite 220, Chicago, Illinois 60603-1608

brokersXpressSM is the online broker-dealer for independent reps

and advisors. Powered by the award-winning technology of

optionsXpress(R), its parent company, brokersXpress provides a

leading-edge trading platform particularly powerful for reps and

advisors who employ option strategies. For more information on how

partnering with brokersXpress can empower your business to new

levels, contact us confidentially by e-mail at . Member NASD/SPIC.

CRD# 127081 This Morning Update was prepared with data and

information provided by: InvestorsObserver.com -- Better Strategies

for Making Money -> For Investors With a Sense of Humor. Only $1

for your first month plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must Quote.com QCharts -- Real

time quotes and streaming technical charts to keep you up with the

market. Analyze, predict, and stay ahead. For a Free 30 day trial

go to: http://www.investorsobserver.com/MUQuote2 247profits.com --

You'll get exclusive financial commentary, access to a global

network of experts and undiscovered stock alerts. Register NOW for

the FREE 247profits e-Dispatch. Go to:

http://www.investorsobserver.com/TPA Schaeffer's Investment

Research -- Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus -- The

Best Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.investorsobserver.com/poweropt All stocks and options

shown are examples only. These are not recommendations to buy or

sell any security and they do not represent in any way a positive

or negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Michael at 800-230-5570 or

at http://www.cboe.com/Resources/Intro.asp . Privacy policy

available upon request. DATASOURCE: brokersXpress, LLC CONTACT:

Mike Lavelle, of brokersXpress, LLC, +1-800-230-5570

Copyright

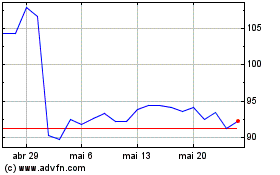

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

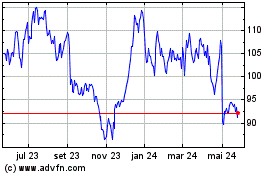

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024