Skyworks Solutions, Inc. (NASDAQ:SWKS), an industry leader in radio

solutions and precision analog semiconductors, today announced

revenue of $198.3 million for the first fiscal quarter ended

December 30, 2005, compared to $190.2 million in the previous

quarter and $220.2 million in the same period a year ago. Revenue

from the company's RF solutions and linear products portfolio was

$180.5 million, up 10 percent when compared to $163.7 million last

quarter. As anticipated, revenue within the cellular baseband

product area was $17.8 million, a decline from $26.5 million in the

fourth fiscal quarter, reflecting a shift from tier-three suppliers

to leading cellular handset OEMs. Operating income computed in

accordance with U.S. Generally Accepted Accounting Principles

(GAAP) for the first fiscal quarter was $8.5 million compared to

$7.1 million in the fourth fiscal quarter of 2005. GAAP operating

income in the corresponding period a year ago was $22.9 million. On

a pro forma basis, operating income for the first fiscal quarter

was $13.9 million, a 56 percent sequential increase against

guidance of a 50 percent improvement, and versus $23.7 million in

the same period a year ago. GAAP diluted earnings per share during

the quarter was $0.03, while pro forma diluted earnings per share

was $0.07, in line with consensus estimates. Pro forma results,

which are a supplement to financial results based on GAAP, exclude

certain charges including share-based compensation, amortization of

intangible assets and non-recurring items. The company believes

these non-GAAP financial measures provide useful information to

both management and investors by excluding certain charges and

non-recurring items that may not be indicative of Skyworks' ongoing

operations and economic performance. For the first time, GAAP

operating income includes a $3.0 million charge related to the

expensing of equity-based incentives in accordance with FASB

Statement No. 123(R), which requires that the company account for

all share-based compensation in its statement of operations. "Ten

percent sequential revenue growth across our RF solutions and

linear products portfolio signals growing demand for our newest

semiconductor solutions. At the same time, we strengthened our

balance sheet through the generation of $22 million in cash flow

from operations," said David J. Aldrich, Skyworks' president and

chief executive officer. "Our Helios(TM) EDGE radios are now

supporting the majority of top tier OEMs, with aggressive ramps

ongoing at LG, beginning at Samsung, and to be followed later this

year at Motorola. Our WCDMA front-end module and multimode radio

traction, coupled with the launch of our newest precision analog

solutions, are setting the stage for a strong second half of 2006,"

concluded Aldrich. First Fiscal Quarter 2006 Product Highlights

Mobile Platforms -- Signed a strategic agreement with Motorola for

the supply of Helios(TM) DigRF radios in support of next generation

EDGE platforms -- Initiated volume production of Helios(TM) Mini

radios at Samsung for integration within nine forthcoming EDGE

models -- Powered LG Electronics' EDGE handsets with Helios(TM)

radios -- Introduced the world's smallest and lowest cost GPRS

radio at LG Electronics as they target emerging markets --

Supported Sony Ericsson's highly successful suite of GPRS/EDGE

Walkman handsets with highly customized power amplifier modules

Linear Products -- Commenced volume production of our newly

released innovative CMOS switch solutions for satellite receivers

-- Ramped front-end modules as part of Broadcom's 54g(TM) WLAN

reference design -- Secured amplifier sockets at Alcatel in support

of 3G base stations -- Launched ultra-low power transmit chain

solutions for cellular infrastructure applications Business Outlook

"Despite traditional handset market seasonality of a 10 to 15

percent sequential unit decline, we are forecasting better

performance with March quarterly revenue down only nine percent

sequentially to approximately $180 million, driven by our ability

to capture increasing semiconductor content per platform," said

Allan M. Kline, Skyworks' vice president and chief financial

officer. Skyworks will discuss its business outlook in more detail

on its conference call to be held with investors and analysts today

at 5 p.m. Skyworks' First Fiscal Quarter 2006 Conference Call

Skyworks will host a conference call at 5 p.m. Eastern time today

to discuss results for the first fiscal quarter of 2006. To listen

to the conference call via the Internet, please visit the Investor

Relations section of Skyworks' Web site at www.skyworksinc.com. To

listen to the conference call via telephone, please call

800-819-9193 (domestic) or 913-981-4911 (international), security

code: Skyworks. Playback of the conference call will begin at 9

p.m. ET on Wednesday, Jan. 25, and end at 9 p.m. ET on Wednesday,

Feb. 1, 2006. The replay will be available on Skyworks' Web site or

by calling 888-203-1112 (domestic) or 719-457-0820 (international);

access code: 5044277#. About Skyworks Skyworks Solutions, Inc. is

an industry leader in radio solutions and precision analog

semiconductors servicing a diversified set of mobile communications

applications. The company's power amplifiers, front-end modules and

direct conversion transceivers are at the heart of many of today's

leading-edge multimedia handsets, cellular base stations and

wireless networking platforms. Skyworks also offers a portfolio of

highly innovative linear products, supporting a diverse set of

automotive, broadband, industrial and medical customers.

Headquartered in Woburn, Mass., Skyworks is worldwide with

engineering, manufacturing, sales and service facilities throughout

Asia, Europe and North America. For more information, please visit

the Skyworks Web site at: www.skyworksinc.com. Safe Harbor

Statement This news release includes "forward-looking statements"

intended to qualify for the safe harbor from liability established

by the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include information relating to future

results of Skyworks (including certain projections and business

trends). Forward-looking statements can often be identified by

words such as "anticipates," "expects," "intends," "believes,"

"plans," "may," "will," "continue," similar expressions, and

variations or negatives of these words. All such statements are

subject to certain risks and uncertainties that could cause actual

results to differ materially and adversely from those projected,

and may affect our future operating results, financial position and

cash flows. These risks and uncertainties include, but are not

limited to: global economic and market conditions, such as the

cyclical nature of the semiconductor industry and the markets

addressed by the company's and its customers' products; demand for

and market acceptance of new and existing products; the ability to

develop, manufacture and market innovative products in a rapidly

changing technological environment; the ability to compete with

products and prices in an intensely competitive industry; product

obsolescence; losses or curtailments of purchases from key

customers or the timing of customer inventory adjustments; the

timing of new product introductions; the availability and extent of

utilization of raw materials, critical manufacturing equipment and

manufacturing capacity; pricing pressures and other competitive

factors; changes in product mix; fluctuations in manufacturing

yields; the ability to continue to grow and maintain an

intellectual property portfolio and obtain needed licenses from

third parties; the ability to attract and retain qualified

personnel; labor relations of the company, its customers and

suppliers; economic, social and political conditions in the

countries in which Skyworks, its customers or its suppliers

operate, including security and health risks, possible disruptions

in transportation networks and fluctuations in foreign currency

exchange rates; and the uncertainties of litigation, as well as

other risks and uncertainties, including but not limited to those

detailed from time to time in the company's filings with the

Securities and Exchange Commission. These forward-looking

statements are made only as of the date hereof, and the company

undertakes no obligation to update or revise the forward-looking

statements, whether as a result of new information, future events

or otherwise. Note to Editors: Skyworks and Skyworks Solutions are

trademarks or registered trademarks of Skyworks Solutions, Inc. or

its subsidiaries in the United States and in other countries. All

other brands and names listed are trademarks of their respective

companies. -0- *T SKYWORKS SOLUTIONS, INC. UNAUDITED GAAP

CONSOLIDATED STATEMENT OF OPERATIONS Quarter Ended

------------------- Dec. 30, Dec. 31, (in thousands) 2005 2004

--------- --------- Net revenues $198,325 $220,160 Cost of goods

sold 123,602 132,141 --------- --------- Gross profit 74,723 88,019

Operating expenses: Research and development 42,430 37,113 Selling,

general and administrative 23,253 27,224 Amortization of

intangibles 536 737 --------- --------- Total operating expenses

66,219 65,074 Operating income 8,504 22,945 Interest expense

(3,812) (3,533) Other income, net 2,319 1,121 --------- ---------

Income before income taxes 7,011 20,533 Provision for income taxes

2,724 6,616 --------- --------- --------- --------- Net income

$4,287 $13,917 ========= ========= Earnings per share: Basic $0.03

$0.09 Diluted $0.03 $0.09 Weighted average shares: Basic 158,573

156,440 Diluted 158,827 158,905 SKYWORKS SOLUTIONS, INC. UNAUDITED

RECONCILIATION OF PRO FORMA NON-GAAP MEASURES Quarter Ended

----------------- Dec. 30, Dec. 31, (in thousands) 2005 2004

-------- -------- GAAP operating income $8,504 $22,945 Stock-based

compensation expense (a) 3,031 - Restructuring charges (b) 1,796 -

Amortization of intangible assets 536 737 -------- -------- Pro

forma operating income $13,867 $23,682 ======== ======== Quarter

Ended ----------------- Dec. 30, Dec. 31, (in thousands) 2005 2004

-------- -------- GAAP net income $4,287 $13,917 Stock-based

compensation expense (a) 3,031 - Restructuring charges (b) 1,796 -

Amortization of intangible assets 536 737 Tax adjustments (c) 1,167

5,890 -------- -------- Pro forma net income $10,817 $20,544

======== ======== Quarter Ended ----------------- Dec. 30, Dec. 31,

2005 2004 -------- -------- GAAP net income per share, diluted

$0.03 $0.09 Stock-based compensation expense (a) 0.02 -

Restructuring charges (b) 0.01 - Amortization of intangible assets

- 0.01 Tax adjustments (c) 0.01 0.03 -------- -------- Pro forma

net income per share, diluted $0.07 $0.13 ======== ======== (a)

These charges represent expense recognized in accordance with FASB

Statement No. 123(R), Share-Based Payment. Approximately $0.3

million, $1.4 million and $1.3 million were included in cost of

goods sold, research and development expense and selling, general

and administrative expense, respectively. (b) The charges recorded

during the first quarter of fiscal 2006 primarily related to a

continued reduction in the level of activity within the Company's

cellular baseband product area. Approximately $0.4 million, $1.2

million and $0.2 million were included in cost of goods sold,

research and development expense and selling, general and

administrative expense, respectively. (c) During the first quarter

of fiscal 2006, these charges primarily represented a non-cash tax

charge related to the utilization of pre-merger deferred tax

assets. During the first quarter of fiscal 2005, these charges

primarily represented a non-cash tax charge related to the

utilization of pre-merger deferred tax assets and a reduction in

the expected benefit of foreign deferred tax assets resulting from

a change in regulated foreign tax rates. The above pro forma

non-GAAP measures are based upon our unaudited consolidated

statements of operations for the periods shown. These non-GAAP

financial measures are provided to enhance the user's overall

understanding of our current financial performance and our

prospects for the future. Specifically, we believe the non-GAAP

financial measures provide useful information to both management

and investors by excluding certain charges and non-recurring items

that we believe are not indicative of our ongoing operations and

economic performance. Additionally, since we have historically

reported non-GAAP results to the investment community, the

inclusion of non-GAAP financial measures provides consistency in

our financial reporting. Further, these non-GAAP financial measures

are one of the primary indicators management uses for planning and

forecasting in future periods. The presentation of this additional

information should not be considered in isolation or as a

substitute for results prepared in accordance with accounting

principles generally accepted in the United States. SKYWORKS

SOLUTIONS, INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET Dec.

30, Sept. 30, (in thousands) 2005 2005 ----------- -----------

Assets Current assets: Cash and cash equivalents $129,505 $122,535

Short-term investments 114,970 113,325 Accounts receivable, net

171,065 171,454 Inventories 79,031 77,400 Prepaid expenses and

other current assets 10,482 11,268 Property, plant and equipment,

net 155,331 150,838 Goodwill and intangible assets, net 509,166

511,119 Other assets 30,390 29,904 ----------- ----------- Total

assets $1,199,940 $1,187,843 =========== =========== Liabilities

and Equity Current liabilities: Short-term debt $50,000 $50,000

Accounts payable 72,296 72,276 Accrued liabilities and other

current liabilities 39,416 35,959 Long-term debt 230,000 230,000

Other long-term liabilities 7,115 7,044 Stockholders' equity

801,113 792,564 ----------- ----------- Total liabilities and

equity $1,199,940 $1,187,843 =========== =========== *T

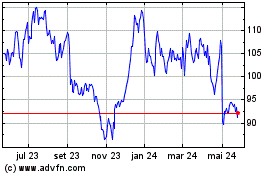

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

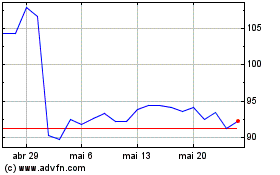

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024