NI Technology Previews Earnings for Nvidia, Atmel, International Rectifier, Semitool and Skyworks Solutions

05 Novembro 2009 - 12:39PM

PR Newswire (US)

PRINCETON, N.J., Nov. 5 /PRNewswire/ -- Next Inning Technology

Research (http://www.nextinning.com/), an online investment

newsletter focused on semiconductor and technology stocks,

announced it has updated outlooks for Nvidia (NASDAQ:NVDA), Atmel

(NASDAQ:ATML), International Rectifier (NYSE: IRF), Semitool

(NASDAQ:SMTL) and Skyworks Solutions (NASDAQ:SWKS). In a repeat of

his July performance, Editor Paul McWilliams was spot on during the

October earnings season. Not only did he peg the numbers at Intel,

SanDisk and Apple again, his accuracy has been so uncanny it led

one of his readers to comment, "It's almost as though Paul wrote

the scripts." Investors who are serious about maximizing returns

and minimizing risks will find McWilliams' ongoing earnings season

coverage, which began with his highly acclaimed State of Tech

series and is now focusing on real-time earnings analysis,

invaluable. To get the inside scoop and his detailed previews for

the companies reporting this week, investors have the opportunity

to take a free 21-day test drive with Next Inning. With this,

investors will see firsthand how McWilliams has delivered a

year-to-date return of 47% and will receive real-time access to his

commentary. To take advantage of this offer, please visit the

following link:

https://www.nextinning.com/subscribe/index.php?refer=prn906

McWilliams covers these topics and more in his recent reports: --

What emerging story in the graphics processor space could lead to

short-term upside for Nvidia? Is the stock likely to be a long-term

winner? -- Based on the solid earnings reported by competitor

Microchip, is it likely that Atmel will beat analyst estimates when

it reports earnings? -- Semitool is up over 250% since McWilliams

alerted Next Inning subscribers to an opportunity in the stock in

March. Could the stock continue to move sharply higher from current

prices on the heels of its upcoming earnings report? What is

McWilliams targeted fair value price for Semitool? -- What are the

likeliest outcomes for International Rectifier stock following the

company's upcoming earnings report? Is the company well positioned

to leverage its positioning as a provider of "green" technology? --

McWilliams suggested that Next Inning readers buy shares of

Skyworks last December when the stock was trading under $5 and then

to hedge profits this fall by selling covered calls when the price

surged into the teens. Based on the performance of its peers, does

McWilliams think it's a good time to cover short call positions or

possibly even add some new shares of Skyworks? Founded in September

2002, Next Inning's model portfolio has returned 196% since its

inception versus 16% for the S&P 500. About Next Inning: Next

Inning is a subscription-based investment newsletter that provides

regular coverage on more than 150 technology and semiconductor

stocks. Subscribers receive intra-day analysis, commentary and

recommendations, as well as access to monthly semiconductor sales

analysis, regular Special Reports, and the Next Inning model

portfolio. Editor Paul McWilliams is a 30+ year semiconductor

industry veteran. NOTE: This release was published by Indie

Research Advisors, LLC, a registered investment advisor with CRD

#131926. Interested parties may visit adviserinfo.sec.gov for

additional information. Past performance does not guarantee future

results. Investors should always research companies and securities

before making any investments. Nothing herein should be construed

as an offer or solicitation to buy or sell any security. CONTACT:

Marcia Martin, Next Inning Technology Research, +1-888-278-5515

DATASOURCE: Indie Research Advisors, LLC CONTACT: Marcia Martin of

Next Inning Technology Research, +1-888-278-5515 Web Site:

http://www.nextinning.com/

Copyright

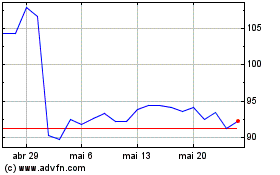

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

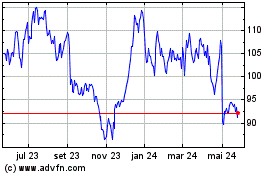

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024