Skyworks & QLogic Face High Expectations

24 Janeiro 2011 - 2:25PM

Marketwired

Shares throughout the Semiconductor- Integrated Circuits industry

have been hit hard of late following a string of disappointing

earnings reports. Companies focused on cell phone chips had been on

a tear the past year, and investors had come to expect

"beat-and-raise" quarterly earnings reports -- as in beat analyst

estimates, and raise guidance. When this doesn't materialize,

carnage can break out on the trading floor. The Bedford Report

examines the outlook for companies in the Semiconductor -

Integrated Circuits Industry and provides research reports on

Skyworks Solutions, Inc. (NASDAQ: SWKS) and QLogic Corporation

(NASDAQ: QLGC). Access to the full company reports can be found at:

www.bedfordreport.com/2011-01-SWKS

www.bedfordreport.com/2011-01-QLGC

Cell phone chipmaker Skyworks solutions saw its share price dip

last week after the company said its fiscal first quarter net

income totaled $60.9 million, or 32 cents per share, compared with

year-earlier earnings of $28 million, or 16 cents per share.

Adjusted earnings came in at 45 cents a share, while revenues rose

37 percent to $335.1 million from $245.1 million.

For the next quarter Skyworks predicts a 30 to 34 percent

year-over-year jump in sales due to surging demand for its chips

found in popular tablet computers and smart phones.

The Bedford Report releases regular market updates on the

Semiconductor - Integrated Circuits Industry so investors can stay

ahead of the crowd and make the best investment decisions to

maximize their returns. Take a few minutes to register with us free

at www.bedfordreport.com and get exclusive access to our numerous

analyst reports and industry newsletters.

Skyworks' industry peer QLogic will report earnings this

Thursday. The supplier of high performance network infrastructure

solutions has already reported "preliminary" third quarter

earnings, saying that it expects revenues in the range of $155

million to $156 million as compared with the previous expectation

of $148 million to 156 million. On a non-GAAP basis QLogic expects

net income of 48 cents to 49 cents per share, up from the

previously projected range of 34 cents to 38 cents.

The Bedford Report provides Analyst Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

http://www.bedfordreport.com/disclaimer.

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

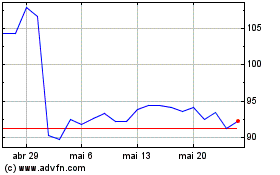

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

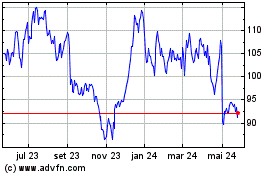

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024