Skyworks is Neutral - Analyst Blog

18 Abril 2011 - 3:15PM

Zacks

We recently reiterated our Neutral recommendation of

Skyworks Solutions (SWKS).

Skyworks continues to capitalize on three business segments −

mobile Internet, vertical markets and analog components. Skyworks

Solutions continues to consolidate its share across the mobile

Internet spectrum.

This covers everything from net books and data cards to

smartphones, and even entry level handsets. Demand for mobile

Internet applications is exploding with the broad proliferation of

smartphones, net books, note books, caplets and other forms of

embedded wireless devices.

The colossal demand for smartphones continues to drive momentum

for Skyworks, particularly at Nokia Corporation

(NOK) and Apple (APPL). Skyworks has partnerships

with all leading smartphone vendors such as Motorola

Mobility (MMI), Research In Motion

(RIMM) and Samsung. The market for smartphones is growing four

times the growth rate of the traditional cellular handset.

Skyworks Solutions continues to benefit from the rising tide of

increasing radio frequency (RF) content associated with

the 3G

and 4G Platforms. The company has partnerships with major OEMs that

underscore the company’s success in gaining market share.

Beyond smartphones, growth will be propelled by high resolution

tablets, USB modems, home networks and yet-to-be-introduced

Internet connective devices. Skyworks Solutions stated that the

tablet market can surpass 200 million units by the year 2014,

creating an incremental billion dollar target market for the

company.

Another area of focus for Skyworks Solutions going forward

continues to be home networking and automation solutions, which

extends several of the company’s smart energy solutions into home

and enables connectivity across a range of products including

gaming consoles, set top boxes, printers, appliances, HDTVs,

Blu-ray players and home security and monitoring systems. Skyworks

aims to diversify its focus on new vertical markets and an expanded

customer base.

Although we remain encouraged by the company’s recent

performance, estimates have been static in the last sixty days. As

of now, we maintain our Neutral recommendation ahead of the second

quarter results (expected on April 28). However, we currently have

a Zacks #2 Rank on Skyworks which translates into a short-term

rating of Buy as we expect the company to deliver solid results in

the upcoming quarter.

MOTOROLA SOLUTN (MSI): Free Stock Analysis Report

NOKIA CP-ADR A (NOK): Free Stock Analysis Report

RESEARCH IN MOT (RIMM): Free Stock Analysis Report

SKYWORKS SOLUTN (SWKS): Free Stock Analysis Report

Zacks Investment Research

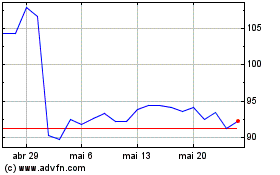

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

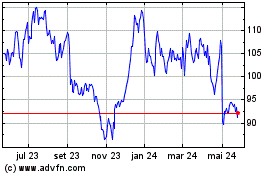

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024