Skyworks Beats Expectations - Analyst Blog

25 Julho 2011 - 9:35AM

Zacks

Skyworks Solutions, Inc. (SWKS) reported

revenues of $356.1 million, which surpassed management’s guidance

of $345 million. The reported figure includes $6.5 million of

revenue from the acquisition of SiGe semiconductor (which closed on

June 10, 2011).

Excluding the SiGe contribution, revenue would've been $350

million, up 27% year-over-year organically.

Skyworks posted a net income of $51.5 million or $0.27 per

diluted share compared to a net income of $34.7 million or $0.19

per diluted share in the year-ago quarter. Excluding

acquisition-related charges but including stock-based compensation

expense, Skyworks reported a net income of $0.41 per share, beating

the Zacks Consensus Estimate by a penny.

Margins

Gross margin (excluding stock-based compensation expenses) improved

to 44.9% from 43.3% in the year-ago quarter. Operating margin came

in at 27.4% compared to 23.1% in the year-ago quarter. During the

quarter, Skyworks generated $86 million of cash from operations and

used $20 million in capital expenditures.

Skyworks repurchased approximately 700,000 shares at an average

price of $31.86 per share. Skyworks exited the fourth quarter with

cash and cash equivalents of $310.357 million, down from $503.8

million at the end of the previous quarter.

Guidance

Going forward, Skyworks projects revenues of $400 million, with

a $20 million – $25 million from the SiGe acquisition. Gross margin

is expected around 44.6% – 45.0%. Excluding stock-based

compensation expenses and restructuring charges, EPS is expected at

$0.53.

Skyworks continues to benefit from strong underlying demand in

the mobile Internet market driven by market share gains and new

product ramps. Broadband mobile subscriptions continue to grow in

leaps and bounds.

The advent of cloud computing is expected to take the trend

further with the ever-growing need for wireless connectivity. The

products from Skyworks support all smartphone and tablet operating

systems, including Android, Symbian, Windows Mobile and others.

Skyworks continues to gain traction on the network

infrastructure side of the mobile Internet connection as operators

install new base stations, new routers, and back-haul equipment to

expand coverage of data services and prepare for next generation

LTE deployments.

As carriers like Verizon (VZ) and

AT&T (T) accelerate their LTE plans, Skyworks

expects a solid opportunity for growth in the coming years with its

broad product portfolio.

SKYWORKS SOLUTN (SWKS): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

Zacks Investment Research

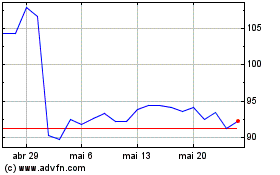

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

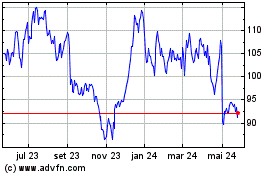

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024