Skyworks Beats by a Penny - Analyst Blog

20 Janeiro 2012 - 8:30AM

Zacks

Skyworks Solutions,

Inc. (SWKS) posted a net income of $57.1 million or

30 cents per share in the first quarter of fiscal 2012 compared to

a net income of $60.8 million or 32 cents per share in the year-ago

quarter and a net income of $64.2 million or 34 cents per diluted

share in the fourth quarter of fiscal 2011.

Excluding acquisition-related

charges but including stock-based compensation expense, Skyworks

reported a net income of 43 cents per share, beating the Zacks

Consensus Estimate by a penny.

Skyworks reported revenues of

$393.7 million in the first quarter, up 17% year over year and

surpassed management’s guidance of $390.0 million.

Skyworks continues to weather the

turbulent economic conditions well. The company has strategically

positioned itself as a diversified company. Skyworks continues to

benefit from strong underlying demand in the mobile Internet market

driven by market share gains and new product ramps. Skyworks saw a

healthy holiday season demand across all categories of mobile

Internet devices, including smartphones, e-readers and tablets.

Margins

Gross margin came in at 44.3%, down from 44.7% both in the year-ago

quarter and previous quarter. Operating margin came in at 26.7%

versus 27.7% in the year-ago quarter and 27.2% in the previous

quarter.

Skyworks generated $77.2 million in

cash flow from operations and invested $6.4 million in capital

expenditures. During the quarter, Skyworks repurchased 750,000

shares of its common stock and retired $9 million of debt. After

December, Skyworks retired the remaining $17 million of its

outstanding debt. The company does not have any debt on its balance

sheet as of now.

Skyworks recently completed the

acquisition of Advanced Analogic Technologies Incorporated for

roughly $200 million in net cash. The company ended the quarter

with cash and equivalents of $446.5 million, up from $410.8 million

at the end of the previous quarter.

Guidance

Ericsson recently projected a

tenfold increase in wireless network data traffic over the next 5

years as the mobile Internet supplants the wired Internet. The

ubiquitous use of smartphones is expected to drive growth further

as analysts’ forecast that cumulative smartphone unit shipments

will range around 4 billion between 2011 and 2015.

Another strong area of growth is

tablets, which continues to replace PCs. Approximately 100 million

tablets are expected to be shipped in 2012. Skyworks added that the

adoption rate of tablets and similar devices like ultrabooks should

accelerate as applications like cloud computing and digital

textbooks become mainstream.

The advent of cloud computing is

expected to take the trend further with the ever-growing need for

wireless connectivity. The number of wireless radios shipped

into non-mobile segments like gaming, PCs, televisions, set-top

boxes is expected to grow at a compounded growth rate of 27%

through 2015.

Meanwhile, high performance analog

products also continue to see increase traction across a wide range

of end markets. Management expects to see further growth in this

segment with the acquisition of Advanced Analogic Technologies,

which provides Skyworks with an entry into an incremental $2

billion in total available market with power management ICs, with

display and backlighting solutions.

Going forward, management expects

revenues of approximately $360 million in the second quarter of

fiscal 2012. This includes roughly a $14 million contribution from

the acquisition of Advanced Analogic Technologies. Gross margin is

projected at around 43.0% – 43.5%. Management expects gross margins

to improve in the third quarter as sequential revenue growth

resumes and the company realizes synergies associated with the AATI

acquisition. Skyworks expects EPS of 40 cents in the third

quarter.

The better-than-expected results

and guidance drove a 6.34% increase in share price in after-market

hours trading to close at $20.45.

SKYWORKS SOLUTN (SWKS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

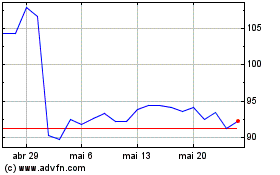

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

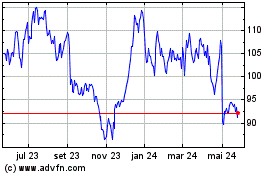

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024