Skyworks Solutions, Inc. (NASDAQ:SWKS), an innovator of high

reliability analog semiconductors enabling a broad range of end

markets, today reported second fiscal quarter 2012 results. Revenue

for the quarter was $364.7 million, up 12 percent when compared to

revenue of $325.4 million in the second fiscal quarter of 2011 and

exceeding the Company’s guidance of $360.0 million.

On a non-GAAP basis, operating income for the second fiscal

quarter was $83.9 million and diluted earnings per share was $0.42

vs. guidance of $0.40. On a GAAP basis, operating income for the

second fiscal quarter of 2012 was $43.8 million and diluted

earnings per share was $0.18.

“Skyworks continues to outperform our addressable markets

through diversification, content growth and market share gains,”

said David J. Aldrich, president and chief executive officer of

Skyworks. “At the highest level, we’re capitalizing on the mobile

Internet and demand for ubiquitous connectivity by solving our

customers’ size, performance, complexity and battery life

challenges. As a result, Skyworks is at the heart of the world’s

most popular smartphones, tablets, ultrabooks and e-readers as well

as within the supporting network infrastructure. Looking forward,

based on recent design win momentum and the depth of our product

pipeline, we’re well positioned to deliver accelerating

growth.”

Q2 Business Highlights

- Released family of LTE SkyHi™ front-end

modules with the world’s best power efficiency

- Captured connectivity sockets in next

generation Sony PlayStations

- Supported Delphi with automotive

satellite radio receiver ICs

- Launched breakthrough 802.11ac wireless

networking solutions with the industry’s leading chipset

provider

- Won remote gas meter reading platforms

at Aclara

- Introduced innovative GPS solutions

enabling navigation functionality insmartphones, tablets and

ultrabooks for a second half 2012 ramp

- Enabled implantable defibrillator

applications with optocoupler portfolio

- Commenced volume shipments of custom

camera flash drivers for multiple smartphone ramps at Samsung and

other OEMs

- Secured RF subsystem design wins at

Alcatel-Lucent, Ericsson, Huawei, Nokia Siemens and ZTE for 4G

network infrastructure upgrades

Third Fiscal Quarter 2012 Outlook

“We expect both top and bottom line sequential growth in the

current quarter driven by LTE and smartphone program ramps as well

as increasing traction in adjacent high performance analog

applications,” said Donald W. Palette, vice president and chief

financial officer of Skyworks. “Specifically, we expect revenue of

$383 million with $0.44 of non-GAAP diluted earnings per

share.”

For further information regarding use of non-GAAP financial

measures in this press release, please refer to the Discussion

Regarding the Use of Non-GAAP Financial Measures set forth

below.

Skyworks' Second Fiscal Quarter 2012 Conference Call

Skyworks will host a conference call with analysts to discuss

its second fiscal quarter 2012 results and business outlook today

at 5:00 p.m. Eastern time. To listen to the conference call via the

Internet, please visit the investor relations section of Skyworks'

website. To listen to the conference call via telephone, please

call 877-857-6144 (domestic) or 719-325-4819 (international),

confirmation code: 7714870.

Playback of the conference call will begin at 9:00 p.m. Eastern

time on April 26, and end at 9:00 p.m. Eastern time on May 3. The

replay will be available on Skyworks' Web site or by calling

888-203-1112 (domestic) or 719-457-0820 (international), pass code:

7714870.

About Skyworks

Skyworks Solutions, Inc. is an innovator of high reliability

analog semiconductors. Leveraging core technologies, Skyworks

offers high performance analog products supporting automotive,

broadband, cellular infrastructure, energy management, industrial,

medical, military, networking, smartphone and tablet applications.

The Company’s portfolio includes amplifiers, attenuators,

circulators, detectors, diodes, directional couplers, front-end

modules, hybrids, infrastructure RF subsystems, isolators, lighting

and display solutions, mixers/demodulators, optocouplers,

optoisolators, phase shifters, PLLs/synthesizers/VCOs, power

dividers/combiners, power management devices, receivers, switches

and technical ceramics.

Headquartered in Woburn, Mass., Skyworks is worldwide with

engineering, manufacturing, sales and service facilities throughout

Asia, Europe and North America. For more information, please visit

Skyworks’ Web site at: www.skyworksinc.com

Safe Harbor Statement

This news release includes "forward-looking statements" intended

to qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include without limitation information

relating to future results and expectations of Skyworks (including

without limitation certain projections and business trends).

Forward-looking statements can often be identified by words such as

"anticipates," "expects," "forecasts," "intends," "believes,"

"plans," "may," "will," or "continue," and similar expressions and

variations or negatives of these words. All such statements are

subject to certain risks, uncertainties and other important factors

that could cause actual results to differ materially and adversely

from those projected, and may affect our future operating results,

financial position and cash flows.

These risks, uncertainties and other important factors include,

but are not limited to: uncertainty regarding global economic and

financial market conditions; the susceptibility of the wireless

semiconductor industry and the markets addressed by our, and our

customers', products to economic downturns; the timing,

rescheduling or cancellation of significant customer orders and our

ability, as well as the ability of our customers, to manage

inventory; losses or curtailments of purchases or payments from key

customers, or the timing of customer inventory adjustments; the

availability and pricing of third party semiconductor foundry,

assembly and test capacity, raw materials and supplier components;

changes in laws, regulations and/or policies in the United States

that could adversely affect financial markets and our ability to

raise capital; our ability to develop, manufacture and market

innovative products in a highly price competitive and rapidly

changing technological environment; whether we are able to

successfully integrate Advanced Analogic Technologies’ operations;

economic, social and political conditions in the countries in which

we, our customers or our suppliers operate, including security and

health risks, possible disruptions in transportation networks and

fluctuations in foreign currency exchange rates; fluctuations in

our manufacturing yields due to our complex and specialized

manufacturing processes; delays or disruptions in production due to

equipment maintenance, repairs and/or upgrades; our reliance on

several key customers for a large percentage of our sales;

fluctuations in the manufacturing yields of our third party

semiconductor foundries and other problems or delays in the

fabrication, assembly, testing or delivery of our products; our

ability to timely and accurately predict market requirements and

evolving industry standards, and to identify opportunities in new

markets; uncertainties of litigation, including potential disputes

over intellectual property infringement and rights, as well as

payments related to the licensing and/or sale of such rights; our

ability to rapidly develop new products and avoid product

obsolescence; our ability to retain, recruit and hire key

executives, technical personnel and other employees in the

positions and numbers, with the experience and capabilities, and at

the compensation levels needed to implement our business and

product plans; lengthy product development cycles that impact the

timing of new product introductions; unfavorable changes in product

mix; the quality of our products and any remediation costs; shorter

than expected product life cycles; problems or delays that we may

face in shifting our products to smaller geometry process

technologies and in achieving higher levels of design integration;

and our ability to continue to grow and maintain an intellectual

property portfolio and obtain needed licenses from third parties,

as well as other risks and uncertainties, including, but not

limited to, those detailed from time to time in our filings with

the Securities and Exchange Commission.

These forward-looking statements are made only as of the date

hereof, and we undertake no obligation to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise.

Note to Editors: Skyworks and Skyworks Solutions are trademarks

or registered trademarks of Skyworks Solutions, Inc. or its

subsidiaries in the United States and in other countries. All other

brands and names listed are trademarks of their respective

companies.

SKYWORKS SOLUTIONS, INC. UNAUDITED CONSOLIDATED STATEMENT

OF OPERATIONS

Three Months Ended Six Months Ended March 30, April

1, March 30, April 1, (in thousands, except per share amounts) 2012

2011 2012 2011 Net revenue $

364,690 $ 325,411 $ 758,430 $ 660,531 Cost of goods sold 212,418

184,430 434,308 371,012 Gross profit

152,272 140,981 324,122 289,519 Operating expenses: Research

and development 52,986 39,618 99,927 78,161 Selling, general and

administrative 40,237 31,665 83,146 62,716 Amortization of

intangibles 9,340 1,638 15,652 3,240 Restructuring and other

charges 5,895 - 6,615 - Total operating

expenses 108,458 72,921 205,340 144,117 Operating income

43,814 68,060 118,782 145,402 Interest expense (107 ) (461 )

(588 ) (998 ) Gain on early retirement of convertible debt 63 - 139

- Other loss, net (310 ) (114 ) (211 ) (183 ) Income before income

taxes 43,460 67,485 118,122 144,221 Provision for income taxes

9,427 17,525 26,963 33,393 Net income $

34,033 $ 49,960 $ 91,159 $ 110,828

Earnings per share: Basic $ 0.18 $ 0.27 $ 0.49 $ 0.61

Diluted $ 0.18 $ 0.26 $ 0.48 $ 0.58 Weighted average shares: Basic

185,206 183,471 184,581 182,088 Diluted 191,016 191,961 190,348

190,251

SKYWORKS SOLUTIONS, INC. UNAUDITED

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Three Months Ended Six

Months Ended March 30, April 1, March 30, April 1, (in

thousands) 2012 2011 2012 2011

GAAP gross profit $ 152,272 $ 140,981 $ 324,122 $ 289,519

Share-based compensation expense [a] 2,402 1,874 4,919 3,219

Acquisition-related expense [b] 2,846 - 2,922

- Non-GAAP gross profit $ 157,520 $ 142,855 $

331,963 $ 292,738 Non-GAAP gross margin % 43.2

% 43.9 % 43.8 % 44.3 %

Three Months Ended Six Months Ended March 30, April 1, March

30, April 1, (in thousands) 2012 2011 2012

2011 GAAP operating income $ 43,814 $ 68,060 $

118,782 $ 145,402 Share-based compensation expense [a] 19,334

14,864 35,084 28,145 Acquisition-related expense [b] 4,813 203

12,096 648 Amortization of intangible assets 9,340 1,638 15,652

3,240 Restructuring and other charges [c] 5,895 - 6,615 -

Litigation settlement gains and losses [d] 517 - 517 - Deferred

executive compensation 143 143 286 308

Non-GAAP operating income $ 83,856 $ 84,908 $ 189,032

$ 177,743 Non-GAAP operating margin % 23.0 %

26.1 % 24.9 % 26.9 %

Three Months Ended Six Months Ended March 30, April 1, March

30, April 1, (in thousands) 2012 2011 2012

2011 GAAP net income $ 34,033 $ 49,960 $ 91,159 $

110,828 Share-based compensation expense [a] 19,334 14,864 35,084

28,145 Acquisition-related expense [b] 4,813 203 12,096 648

Amortization of intangible assets 9,340 1,638 15,652 3,240

Restructuring and other charges [c] 5,895 - 6,615 - Litigation

settlement gains and losses [d] 517 - 517 - Deferred executive

compensation 143 143 286 308 Gain on early retirement of

convertible debt [e] (63 ) - (139 ) - Amortization of discount on

convertible debt [f] 77 333 428 661 Tax adjustments [g] 5,673

11,598 14,305 19,596 Non-GAAP net

income $ 79,762 $ 78,739 $ 176,003 $ 163,426

Three Months Ended

Six Months Ended March 30, April 1, March 30, April 1, 2012

2011 2012 2011 GAAP net income

per share, diluted $ 0.18 $ 0.26 $ 0.48 $ 0.58 Share-based

compensation expense [a] 0.10 0.08 0.18 0.15 Acquisition-related

expense [b] 0.03 - 0.06 - Amortization of intangible assets 0.05

0.01 0.08 0.02 Restructuring and other charges [c] 0.03 - 0.04 -

Tax adjustments [g] 0.03 0.06 0.08 0.11

Non-GAAP net income per share, diluted $ 0.42 $ 0.41

$ 0.92 $ 0.86

SKYWORKS SOLUTIONS, INC.

DISCUSSION REGARDING THE USE OF NON-GAAP

FINANCIAL MEASURES

Our earnings release contains some or all of the following

financial measures which have not been calculated in accordance

with United States Generally Accepted Accounting Principles

("GAAP"): (i) non-GAAP gross profit and gross margin, (ii) non-GAAP

operating income and operating margin, (iii) non-GAAP net income,

and (iv) non-GAAP net income per share (diluted). As set forth in

the "Unaudited Reconciliation of Non-GAAP Financial Measures" table

found above, we derive such non-GAAP financial measures by

excluding certain expenses and other items from the

respective GAAP financial measure that is most directly comparable

to each non-GAAP financial measure. Management uses these non-GAAP

financial measures to evaluate our operating performance and

compare it against past periods, make operating decisions, forecast

for future periods, compare operating performance against peer

companies and determine payments under certain compensation

programs. These non-GAAP financial measures provide management with

additional means to understand and evaluate the operating results

and trends in our ongoing business by eliminating

certain non-recurring expenses (which may not occur in each period

presented) and other items that management believes might otherwise

make comparisons of our ongoing business with prior periods and

competitors more difficult, obscure trends in ongoing operations or

reduce management's ability to make useful forecasts.

We provide investors with non-GAAP gross profit and gross

margin, non-GAAP operating income and operating margin and non-GAAP

net income because we believe it is important for investors to be

able to closely monitor and understand changes in our ability to

generate income from ongoing business operations. We believe these

non-GAAP financial measures give investors an additional method to

evaluate historical operating performance and identify trends,

additional means of evaluating period-over-period operating

performance and a method to facilitate certain comparisons of

operating results to peer companies. We also believe that providing

non-GAAP operating income and operating margin allows investors to

assess the extent to which ongoing operations impact our overall

financial performance. We further believe that providing non-GAAP

net income and non-GAAP net income per share (diluted) allows

investors to assess the overall financial performance of ongoing

operations by eliminating the impact of certain financing decisions

related to our convertible debt and certain tax items which may not

occur in each period presented and which may represent non-cash

items or gains or losses unrelated to our ongoing operations. We

believe that disclosing these non-GAAP financial measures

contributes to enhanced financial reporting transparency and

provides investors with added clarity about complex financial

performance measures.

We calculate non-GAAP gross profit by excluding from GAAP gross

profit, stock compensation expense, restructuring-related charges

and acquisition-related expenses. We calculate non-GAAP operating

income by excluding from GAAP operating income, stock compensation

expense, restructuring-related charges, acquisition-related

expenses, litigation settlement gains and losses and certain

deferred executive compensation. We calculate non-GAAP net income

and net income per share (diluted) by excluding from GAAP net

income and net income per share (diluted), stock compensation

expense, restructuring-related charges, acquisition-related

expenses, litigation settlement gains and losses, amortization of

discount on convertible debt, and certain deferred executive

compensation, as well as certain items related to the retirement of

convertible debt, and certain tax items, which may not occur in all

periods for which financial information is presented. We exclude

the items identified above from the respective non-GAAP financial

measure referenced above for the reasons set forth with respect to

each such excluded item below:

Stock Compensation - because (1) the total amount of expense is

partially outside of our control because it is based on factors

such as stock price volatility and interest rates, which may be

unrelated to our performance during the period in which the expense

is incurred, (2) it is an expense based upon a valuation

methodology premised on assumptions that vary over time, and (3)

the amount of the expense can vary significantly between companies

due to factors that can be outside of the control of such

companies.

Acquisition-Related Expenses - including such items as, when

applicable, amortization of acquired intangible assets, fair value

adjustments to contingent consideration, fair value charges

incurred upon the sale of acquired inventory, acquisition-related

professional fees and deemed compensation expenses, because they

are not considered by management in making operating decisions and

we believe that such expenses do not have a direct correlation to

future business operations and thereby including such charges does

not accurately reflect the performance of our ongoing operations

for the period in which such charges are incurred.

Litigation Settlement Gains and Losses - including gains and

losses related to the resolution of other than ordinary course

threatened and actually filed lawsuits and other than ordinary

course contractual disputes, because (1) they are not considered by

management in making operating decisions, (2) such gains and losses

tend to be infrequent in nature, (3) such gains and losses are

generally not directly controlled by management, (4) we believe

such gains and losses do not necessarily reflect the performance of

our ongoing operations for the period in which such charges are

recognized and (5) the amount of such gains or losses can vary

significantly between companies and make comparisons difficult.

Restructuring-Related Charges - because, to the extent such

charges impact a period presented, we believe that they have no

direct correlation to future business operations and including such

charges does not necessarily reflect the performance of our ongoing

operations for the period in which such charges are incurred.

Deferred Executive Compensation - including charges related to

any contingent obligation pursuant to an executive severance

agreement because we believe the period over which the obligation

is amortized may not reflect the period of benefit and that such

expense has no direct correlation with our recurring business

operations and including such expenses does not accurately reflect

the compensation expense for the period in which incurred.

Amortization of Discount on Convertible Debt - comprised of the

amortization of the debt discount recorded at inception of the

convertible debt borrowing related to the adoption of ASC 470-20,

because the expense is dependent on fair value assessments and is

not considered by management when making operating decisions.

Gains and Losses on Retirement of Convertible Debt - because, to

the extent that gains or losses from such repurchases impact a

period presented, we do not believe that they reflect the

underlying performance of ongoing business operations for such

period.

Certain Income Tax Items - including certain deferred tax

charges and benefits which do not result in a current tax payment

or tax refund and other adjustments which are not indicative of

ongoing business operations.

The non-GAAP financial measures presented in the table above

should not be considered in isolation and are not an alternative

for, the respective GAAP financial measure that is most directly

comparable to each such non-GAAP financial measure. Investors are

cautioned against placing undue reliance on these non-GAAP

financial measures and are urged to review and consider carefully

the adjustments made by management to the most directly comparable

GAAP financial measures to arrive at these non-GAAP financial

measures. Non-GAAP financial measures may have limited value as

analytical tools because they may exclude certain expenses that

some investors consider important in evaluating operating

performance or ongoing business. Further, non-GAAP financial

measures are likely to have limited value for purposes of drawing

comparisons between companies because different companies may

calculate similarly titled non-GAAP financial measures in different

ways because non-GAAP measures are not based on any comprehensive

set of accounting rules or principles.

Our earnings release contains a forward looking estimate of

non-GAAP diluted earnings per share for the third quarter of our

2012 fiscal year ("Q3 2012"). We provide this non-GAAP measure to

investors on a prospective basis for the same reasons (set forth

above) that we provide them to investors on a historical basis. We

are unable to provide a reconciliation of our forward looking

estimate of Q3 2012 non-GAAP diluted earnings per share to a

forward looking estimate of Q3 2012 GAAP diluted earnings per share

because certain information needed to make a reasonable forward

looking estimate of GAAP diluted earnings per share for Q3 2012

(other than estimated stock compensation expense of $0.10 per

diluted share, certain tax items of $0.05 per diluted share,

estimated acquisition related expense of $0.05 per diluted share

and estimated deferred executive compensation expense and

restructuring and other charges with a de minimis impact per

diluted share) is difficult to predict and estimate and is often

dependent on future events which may be uncertain or outside of our

control. Such events may include unanticipated one time charges

related to asset impairments (fixed assets, intangibles or

goodwill), unanticipated acquisition related costs, unanticipated

litigation settlement gains and losses and other unanticipated

non-recurring items not reflective of ongoing operations. We

believe the probable significance of these unknown items, in

aggregate, to be in the range of $0.00 to $0.10 in quarterly

earnings per diluted share on a GAAP basis. Our forward looking

estimates of both GAAP and non-GAAP measures of our financial

performance may differ materially from our actual results and

should not be relied upon as statements of fact.

[a] These charges represent expense recognized in accordance

with ASC 718 - Compensation, Stock Compensation. Approximately $2.4

million, $7.5 million and $9.4 million were included in cost of

goods sold, research and development expense and selling, general

and administrative expense, respectively, for the three months

ended March 30, 2012. Approximately $4.9 million, $13.1 million and

$17.1 million were included in cost of goods sold, research and

development expense and selling, general and administrative

expense, respectively, for the six months ended March 30, 2012.

For the three months ended April 1, 2011, approximately $1.9

million, $4.4 million and $8.6 million were included in cost of

goods sold, research and development expense and selling, general

and administrative expense, respectively. For the six months ended

April 1, 2011, approximately $3.2 million, $8.8 million and $16.1

million were included in cost of goods sold, research and

development expense and selling, general and administrative

expense, respectively. [b] The acquisition-related expense

recognized during the three months and six months ended March 30,

2012 includes a $2.8 million and $2.9 million charge to cost of

sales related to the sale of acquired inventory, respectively. Also

included in acquisition-related expense is $2.0 million and $9.2

million in transaction costs included in general and administrative

expense associated with acquisitions, and an arbitration, completed

or contemplated during the three months and six months ended March

30, 2012, respectively. Approximately $0.2 million and $0.6

million in transaction costs were included in general and

administrative expense associated with acquisitions completed or

contemplated during the three months and six months ended April 1,

2011, respectively. [c] During the three months ended March

30, 2012, the Company implemented a restructuring plan to reduce

headcount associated with its acquisition of Advanced Analogic

Technologies, Inc. and recorded a $5.9 million charge for the

period. During the fiscal year ended September 30, 2011, the

Company implemented a restructuring plan to reduce headcount

associated with its acquisition of SiGe Semiconductor, Inc. and

recorded a $0.7 million charge for the six months ended March 30,

2012. [d] During the three months ended March 30, 2012, the

Company recognized a $0.5 million charge primarily related to the

resolution of a contractual dispute. [e] The gain recorded

during the three months and six months ended March 30, 2012 relates

to the retirement of the Company's 1.50% convertible subordinated

notes due on March 1, 2012. [f] These charges represent the

amortization expense recognized in accordance with ASC 470-20.

Approximately $0.1 million and $0.4 million of amortization expense

was recognized during the three months and six months ended March

30, 2012, respectively. Approximately $0.3 and $0.7 million

of amortization expense was recognized during the three months and

six months ended April 1, 2011, respectively. [g] For the

three months and six months ended March 30, 2012, these amounts

primarily represent the utilization of net operating loss and

research and development tax credit carryforwards and non-cash

expense related to uncertain tax positions. For the three

months and six months ended April 1, 2011, these amounts primarily

represent the utilization of net operating loss and research and

development credit carryforwards.

SKYWORKS SOLUTIONS, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET

March 30, Sept. 30, (in thousands) 2012 2011

Assets Current

assets: Cash and cash equivalents $ 307,336 $ 410,799 Accounts

receivable, net 211,488 177,940 Inventories 196,558 198,183 Prepaid

expenses and other current assets 36,950 29,412 Property, plant and

equipment, net 252,312 251,365 Goodwill and intangible assets, net

913,920 749,849 Other assets 88,762 72,841 Total assets $ 2,007,326

$ 1,890,389

Liabilities and Equity Current

liabilities: Convertible notes $ - $ 26,089 Accounts payable

136,677 115,290 Accrued liabilities and other current liabilities

105,965 105,717 Other long-term liabilities 44,440 34,198

Stockholders' equity 1,720,244 1,609,095 Total liabilities and

equity $ 2,007,326 $ 1,890,389

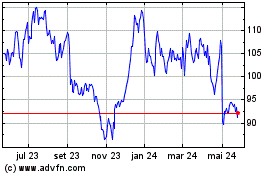

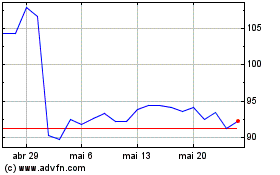

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024