Skyworks Upgraded to Outperform - Analyst Blog

23 Maio 2012 - 2:03PM

Zacks

We recently upgraded our recommendation on Skyworks

Solutions Inc. (SWKS) to Outperform from Neutral.

Skyworks continues to weather the turbulent economic conditions

well. The company has strategically positioned itself as a

diversified company, and continues to capitalize on three business

segments − mobile Internet, vertical markets and analog components.

The global megatrends of mobile computing and ubiquitous

connectivity continue to be growth engines for Skyworks.

The colossal demand for smartphones continues to drive momentum

for Skyworks, particularly at Nokia Corporation

(NOK) and Apple (AAPL). Skyworks has partnerships

with all leading smartphone vendors, such as RIMM

(RIMM), Motorola (MMI) and Samsung. With a

diversified customer base, Skyworks is strongly placed in this

market.

The market for smartphones is growing four times the growth rate

of the traditional cellular handset. Management expects smartphone

adoption to gain further traction in the developing countries in

2012.

Global adoption of smartphones continues to be robust and is

being rapidly followed by a growing tablet adoption cycle.

Beyond smartphones, growth will be propelled by high

resolution tablets, USB modems, home networks and

yet-to-be-introduced Internet connective devices.

Skyworks continues to benefit from strong underlying demand in

the mobile Internet market driven by market share gains and new

product ramps. Skyworks continues to gain traction on the network

infrastructure side of the mobile Internet connection as operators

install new base stations, new routers, and back-haul equipment to

expand coverage of data services and prepare for next generation

LTE deployments. LTE shipments are expected to grow by leaps and

bounds in 2012.

Meanwhile, estimates have moved down marginally in the last

thirty days even though the company reported in-line results for

the second quarter of 2012, primarily due to the clouded economic

environment.

Nevertheless, we believe the growth story remains intact in the

long run and hence we upgrade our recommendation to Outperform from

Neutral.

The stock carries a Zacks #3 Rank currently which translates

into a short-term rating of Hold, owing to the near-term uncertain

environment.

APPLE INC (AAPL): Free Stock Analysis Report

MOTOROLA MOBLTY (MMI): Free Stock Analysis Report

NOKIA CP-ADR A (NOK): Free Stock Analysis Report

RESEARCH IN MOT (RIMM): Free Stock Analysis Report

SKYWORKS SOLUTN (SWKS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

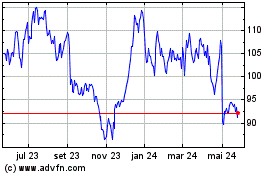

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

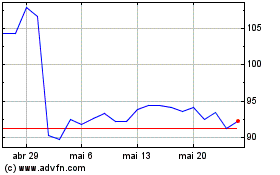

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024