Skyworks a Penny Ahead - Analyst Blog

02 Novembro 2012 - 11:56AM

Zacks

Skyworks Solutions (SWKS) reported a net

income of 44 cents per share in the fourth quarter of fiscal 2012

(excluding acquisition-related charges but including stock-based

compensation expense), beating the Zacks Consensus Estimate by a

penny.

Reported net income was $61.6 million or 32 cents per share

compared to a net income of $49.3 million or 26 cents per diluted

share in the previous quarter and a net income of $64.2 million or

34 cents per diluted share in the year-ago quarter.

Revenues

Skyworks reported revenues of $421.1 million, up 4.7% year over

year and 8.2% sequentially and surpassed management’s updated

guidance of $420.0 million. For fiscal 2012, revenue of $1.6

billion grew 11% year over year.

Skyworks’s strategic diversification across OEMs and chipset

partners is enabling the company to deliver consistent results

despite the macroeconomic uncertainty.

Skyworks continues to capitalize on global mobile connectivity

ubiquity and demand for high performance analog solutions across a

diverse set of vertical markets. The company is rapidly expanding

its footprint in complementary new verticals like automotive,

medical and connected home. Skyworks continues to gain market

share in adjacent vertical markets like automotive, medical,

avionics, military, location services and broadband

communications.

Mobile internet growth continues to be healthy, driven by

smartphones and tablets. The need for high-performance analog

solutions is expanding into brand-new markets, such as medical,

automotive, military and industrial, thereby fueling demand for

broadband connectivity.

In recent times, macro trends such as social networking,

cloud-based content and the explosion of audio and video streaming

continue to unify, thus driving increased semiconductor content and

complexity in smartphones, tablets, ultrabooks and e-readers as

well as within the supporting network infrastructure.

The global increase in mobile broadband phenomenon is slowly

displacing traditional computing, which is further augmented by the

entry of bigwigs like Google (GOOG),

Amazon (AMZN) and Microsoft

(MSFT). In addition, RF content per device continues to rise on the

remarkable increase in the number of LTE-enabled devices and a

major smartphone upgrade cycle, beginning in the emerging markets

like China.

Skyworks is actively participating in developing activities,

which support major 2013 phone models that incorporate entirely new

LTE bands like 9 and 10; 18, 19 and 38, 41, to support

deployments in Europe and Asia, which shall result in incremental

addressable content.

Margins

Gross margin came in at 42.9%, slightly down from 43.2% in the

previous quarter and 44.7% in the year-ago quarter. Operating

margin came in at 24.6% versus 23.6% in the previous quarter and

27.2% in the year-ago quarter.

Skyworks generated $50 million in cash flow from operations and

incurred $31 million in capital expenditures. The company does not

have any debt on its balance sheet as of now.

The company ended the quarter with cash and equivalents of

$307.1 million, down from $327.9 million at the end of the previous

quarter.

Guidance

Going forward, management expects revenues of approximately $450

in the first quarter of fiscal 2013, up 14% year over year and 7%

sequentially, driven by new platform wins and design momentum.

Skyworks believes that its strategy of diversifying its

business, expanding into new verticals and continued focus

operational execution will drive growth even in a weak economic

environment.

Gross margin is projected at around 43.0%. Operating expenses

are projected to be $80 million. Management expects gross margin to

improve as the company benefits from current capital investments

and ramp up of margin accretive products like SkyOne, SkyHi along

with its portfolio of high-performance analog products. Operating

margin is anticipated to be approximately 25%. Skyworks expects

earnings per share of 54 cents in the first quarter.

However, the results did not seem to impress investors as the

company’s shares lost 5.61% in after hours trading to close at

$22.73.

We continue to maintain a Neutral recommendation on Skyworks.

Our recommendation is supported by a Zacks #3 Rank on Skyworks,

which translates into a short-term rating of Hold.

AMAZON.COM INC (AMZN): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

SKYWORKS SOLUTN (SWKS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

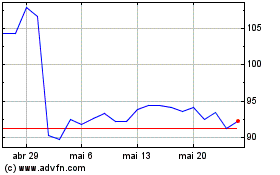

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

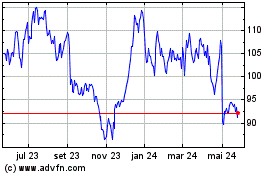

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024