Skyworks Beats on Q4 Earnings - Analyst Blog

01 Novembro 2013 - 12:00PM

Zacks

Skyworks Solutions

Inc’s (SWKS) share price increased 5.4% to $25.80 on Oct

31 after it reported net income of $84.2 million or 44 cents per

share in the fourth quarter of fiscal 2013, up from $61.6 million

or 32 cents per share in the year-earlier quarter. For fiscal 2013,

net income increased to $278.1 million or $1.45 per share from

$202.0 million or $1.05 per share in the year-ago period.

Excluding non-recurring items, adjusted earnings for the reported

quarter were 64 cents per share compared with 53 cents in the

year-ago quarter. The adjusted earnings in the reported quarter

exceeded the Zacks Consensus Estimate of 53 cents.

For fiscal 2013, adjusted earnings were $2.20 per share versus

$1.90 per share in fiscal 2012. The adjusted earnings for the

reported fiscal beat the Zacks Consensus Estimate of $1.81. The

year-over-year increase in earnings was driven by the growing

portfolio of high-performance analog solutions.

Skyworks reported fourth quarter fiscal 2013 revenues of $477.0

million, up 13.3% year over year. Revenues also beat the Zacks

Consensus Estimate of $475.0 million.

For fiscal 2013, revenues were $1,792 million, up 14% from the

year-ago period and beat the Zacks Consensus Estimate of $1,780

million.

Gross profit was $209.1 million in the fourth quarter compared with

$177.7 million in the year-ago period.

Skyworks continues to capitalize on global mobile connectivity and

demand for high-performance analog solutions across a diverse set

of vertical markets. During the reported quarter, Skyworks

partnered with Silicon Labs to develop low-power, smart energy

solutions supporting communication hubs, meters and in-home

displays.

In addition, Skyworks is well-positioned to capitalize on the

Internet of Things with high demand for high-performance analog

solutions in new markets.

The company generated $166 million in cash flow from operations and

ended the year with cash and equivalents of $511.1 million.

Outlook

Going forward, revenues for the first quarter of fiscal 2014 are

expected to be approximately $500 million. Skyworks also expects

adjusted earnings per share of 66 cents in the first quarter.

The company believes that its strategy of diversifying its

business, expanding into new verticals and continued focus on

operational excellence will drive growth in the long term. Based on

its product innovation and proprietary solutions the company is

well positioned for sustainable above-market growth in the near

term.

Skyworks currently has a Zacks Rank

#2 (Buy). Other stocks that look promising and are worth a look in

the industry include Zacks Ranked #1 (Strong Buy) stocks such as

Supertex Inc (SUPX) and Microchip

Technology Inc. (MCHP), and NXP Semiconductors

NV (NXPI), which carries a Zacks Rank #2 (Buy).

MICROCHIP TECH (MCHP): Free Stock Analysis Report

NXP SEMICONDUCT (NXPI): Free Stock Analysis Report

SUPERTEX INC (SUPX): Free Stock Analysis Report

SKYWORKS SOLUTN (SWKS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

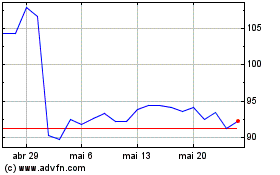

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

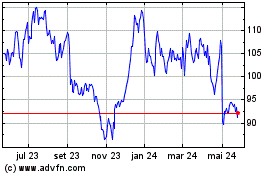

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024