PMC-Sierra Rejects Rival Bid From Microsemi

02 Novembro 2015 - 4:10AM

Dow Jones News

PMC-Sierra Inc. said Microsemi Corp.'s $2.35 billion takeover

offer wasn't superior to a bid from Skyworks Solutions Inc. because

the Skyworks deal "provides more value certainty to shareholders"

than the Microsemi proposal, which was "nominally higher."

On Friday, PMC's board backed an all-cash bid from Skyworks for

$11.60 a share, or $2.24 billion. Microsemi's cash-and-stock offer

valued PMC at $11.88 a share, up 3.7% from a previous offer, based

on Microsemi's Thursday closing price.

PMC makes products for storage, optical and mobile networks.

Skyworks is a semiconductor company and Microsemi makes chip

equipment and provides software for cloud data.

In its statement late Sunday, PMC cited capital-market

volatility as a reason to stick with Skyworks' all-cash bid. It

also said that because Microsemi was trading near its five-year

high, "when using a sixty- or ninety-trading-day average of

Microsemi closing stock prices, the value of the Microsemi offer is

essentially the same as Skyworks' proposal."

PMC also said Microsemi would be one of the most highly

leveraged, publicly traded chip companies after taking into

consideration a potential acquisition of PMC.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 02, 2015 00:55 ET (05:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

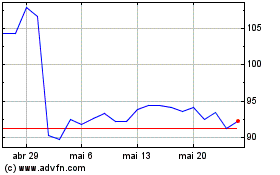

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

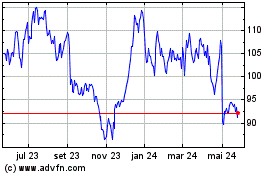

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024