Global Stocks Pause After Recent Climb

21 Fevereiro 2019 - 10:19AM

Dow Jones News

By Will Horner

U.S. stocks were set to make cautious gains Thursday, despite

downbeat sessions elsewhere, as investors awaited fresh economic

data and the latest round of U.S.-China trade talks.

Futures put the Dow Jones Industrial Average and S&P 500

both up 0.2% and Nasdaq-100 futures 0.3% higher. Energy services

company TechnipFMC was down 8.1% in premarket trade after the

company said Wednesday it had swung to a loss.

Trade-exposed stocks looked set be among the strongest

performers, with tech company Nvidia up 1.5% and semiconductor

maker Skyworks Solutions up 3.4% premarket.

Bunge, Kraft Heinz, Caesars Entertainment and Baidu will also be

in focus with the companies due to report earnings.

In Europe, the pan-continental Stoxx Europe 600 fell 0.2% in

midday trade, with declines led by the index's banking sector, down

1.5%. Shares in Swedbank continued a second day of steep losses

with its shares down nearly 9% after a report Wednesday of alleged

money laundering.

The U.K.'s FTSE 100 notched the region's sharpest decline,

falling 0.7%, with energy provider Centrica slumping nearly 12%

after it reported earnings. Danish-listed shares in Moeller-Maersk

fell 8.4% after the company recorded a sharp fall in profits.

Eurozone manufacturing entered its first downturn since

mid-2013, further darkening the regional picture, according to data

released Thursday.

Indexes in Asia were positive for most of the day, though gains

in Chinese markets reversed in the closing minutes, leading the

Shanghai Composite and Shenzhen indexes to close down 0.3%. Japan's

Nikkei was up 0.6% and Australia's ASX 200 closed up 0.7%.

Hopes for a positive outcome from the current U.S.-China trade

negotiations remained high after President Trump signaled he would

be flexible on the March 1 deadline for an agreement. Midlevel U.S.

and Chinese negotiators having been holding meetings this week.

Cabinet-level officials are set to join the discussions later

Thursday.

"There is optimism about U.S.-China trade that there is a desire

to get a deal done, even something that is not a firm deal but just

pushes it down the road and avoid the next round of tariffs," Kit

Juckes, a strategist at Société Générale, said. "I think the market

would be very surprised if the tariffs increase weren't pushed

back."

Minutes from the Federal Reserve's January meeting released

Wednesday showed unanimous agreement among officials to hold off on

future interest-rate rises, with some members saying the economic

outlook had become more uncertain since their previous meeting.

They also indicated a readiness to stop reducing the central bank's

$4 trillion asset portfolio in 2019.

"The minutes put a bit of flesh on what we already knew: that

the bias toward raising interest rates has disappeared," said Peter

Dixon, economist at Commerzbank. "I get the sense that the Fed is a

lot more cautious about the economy than it previously was and

perhaps more than is warranted."

Investors will be eyeing a range of data due Thursday for clues

about the state of U.S. economic growth. Figures are due on

unemployment claims, homes sales, and surveys on the manufacturing

and service sectors.

The WSJ Dollar Index, which measures the dollar against a basket

of 16 currencies, was up slightly. The yield on 10-year U.S.

Treasurys rose to 2.668% from 2.652% Wednesday. Yields and prices

move in opposite directions

In commodities, gold was sharply lower, after three consecutive

sessions of gains. Gold futures were down 0.8%. Oil was higher

ahead of the Energy Information Administration's report of the

latest U.S. inventory data with Brent crude, the global benchmark,

1% higher at $67.08 a barrel.

(END) Dow Jones Newswires

February 21, 2019 08:04 ET (13:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

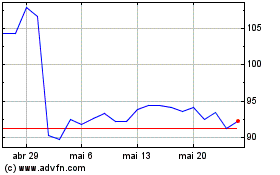

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

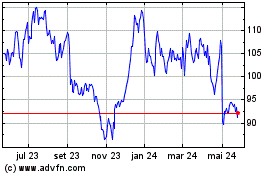

Skyworks Solutions (NASDAQ:SWKS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024