Filed Pursuant to Rule 424(b)(5)

File No. 333-265998

Prospectus Supplement

(To Prospectus Dated July 1, 2022)

Up to 17,400,000 Common

Shares

and/or

Up to 17,400,000 Pre-Funded Warrants

We are offering up to 17,400,000 of our common

shares, without par value per share, at a price of $0.23 per share. We are also offering to those purchasers, if any, whose purchase

of our common shares in this offering would otherwise result in such purchaser, together with its affiliates and certain related parties,

beneficially owning more than 4.99% of our outstanding common shares immediately following the consummation of this offering, the opportunity,

to purchase up 17,400,000 pre-funded warrants (“Pre-Funded Warrants”) in lieu of purchasing common shares that would otherwise

result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common shares (or at the election of the purchaser,

9.99% of our outstanding common shares). For each Pre-Funded Warrant purchased in this offering in lieu of a common share, we will reduce

the number of common shares being sold in the offering by one.

The purchase price of each Pre-Funded Warrant

is $0.22 and the exercise price of each Pre-Funded Warrant is $0.01 per common share. Pursuant to this prospectus, we are also offering

the common shares issuable upon the exercise of the Pre-Funded Warrants offered hereby. Each Pre-Funded Warrant is exercisable for one

common share (subject to adjustment as provided for therein) at any time at the option of the holder until such Pre-Funded Warrant is

exercised in full, provided that the holder will be prohibited from exercising Pre-Funded Warrants for our common shares if, as a result

of such exercise, the holder, together with its affiliates, would beneficially own more than 4.99% of the total number of our common

shares then issued and outstanding. However, any holder may increase such percentage to any other percentage not in excess of 9.99%,

provided that any increase in such percentage shall not be effective until 61 days after such notice to us.

Concurrently with this offering, we are also

issuing to purchasers of the common shares and/or the Pre-Funded Warrants, in a private placement under Rule 506 of Regulation D, five

year common share purchase warrants with an exercise price of $0.23 per common share (“Purchase Warrants”).

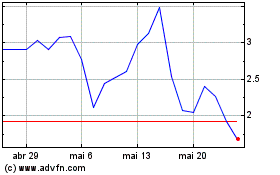

Our common shares are listed on The NASDAQ Capital

Market under the symbol “SYTA.” On October 11, 2022, the last reported sale price of our common shares on The NASDAQ Capital

Market was $0.1291 per share. There is no established trading market for the Pre-Funded Warrants and we do not expect a market to develop.

In addition, we do not intend to apply for the listing of the Pre-Funded Warrants on any national securities exchange or other trading

market. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited.

The aggregate market value of our common shares

held by non-affiliates, or our public float, was approximately $15,048,325 based on a total number of 17,880,745 common shares outstanding,

of which 69,969 common shares were held by affiliates, and a price of $0.8449 per share, which was the closing price of our common shares

on August 12, 2022. Pursuant to General Instruction I.B.5. of Form F-3, in no event will we sell the securities covered hereby in a public

primary offering with a value exceeding more than one-third of the aggregate market value worldwide of our common shares held by non-affiliates

of our company in any 12-month period so long as the aggregate market value of our outstanding common shares held by non-affiliates remains

below $75 million. We have not sold any securities pursuant to General Instruction I.B.5. of Form F-3 during the 12-month calendar period

that ends on and includes the date hereof.

INVESTING IN OUR COMMON SHARES AND/OR PRE-FUNDED

WARRANTS INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED UNDER THE HEADING “RISK

FACTORS” ON PAGE S-11 OF THIS PROSPECTUS SUPPLEMENT, AND UNDER SIMILAR HEADINGS IN THE DOCUMENTS THAT ARE INCORPORATED BY

REFERENCE INTO THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS.

We have engaged Maxim Group LLC (the “Placement

Agent”) as our exclusive placement agent to use its reasonable best efforts to solicit offers to purchase the securities being

offered pursuant to this prospectus supplement and accompanying prospectus. The Placement Agent has no obligation to buy any of the securities

from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay the Placement

Agent the fees set forth in the table below assuming the issuance and sale of 17,400,000 common shares and no Pre-Funded Warrants.

| | |

Per Security | | |

Total | |

| Public offering price per common share | |

$ | 0.23 | | |

| 3,636,300 | |

| Placement Agent fee per common share(1) | |

$ | 0.0161 | | |

| 254,541 | |

| Proceeds, before expenses, to us, common shares | |

$ | 0.2139 | | |

$ | 3,381,759 | |

| Public offering price per pre-funded warrants | |

$ | 0.22 | | |

| 349,800 | |

| Placement Agent fee per pre-funded

warrants | |

$ | 0.0154 | | |

| 24,486 | |

| Proceeds, before expenses, to us, pre-funded warrants | |

$ | 0.2046 | | |

| 325,314 | |

| (1) | We

have agreed to pay the Placement Agent: (i) a cash fee equal to 7.0% of the aggregate gross

proceeds raised in this offering and (ii) to reimburse the Placement Agent up to $60,000

for reasonable and documented fees and expenses of legal counsel and other actual out-of-pocket

expenses. See “Plan of Distribution” beginning on page S-29 of this prospectus

supplement for additional information with respect to the compensation we will pay the Placement

Agent.

|

The Placement Agent expects to deliver the common

shares or Pre-Funded Warrants being offered pursuant to this prospectus supplement and the accompanying prospectus to purchasers on or

about October 12, 2022.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS

SUPPLEMENT OR THE ACCOMPANYING PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Sole Placement Agent

MAXIM GROUP LLC

The date of this prospectus supplement is October

10, 2022.

TABLE OF CONTENTS

Prospectus Supplement

Base Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part

is this prospectus supplement, which describes the specific terms of this offering of our common shares and Pre-Funded Warrants. The

second part is the accompanying prospectus, which provides more general information, some of which may not apply to this offering. The

information included or incorporated by reference in this prospectus supplement also adds to, updates and changes information contained

or incorporated by reference in the accompanying prospectus. If information included or incorporated by reference in this prospectus

supplement is inconsistent with the accompanying prospectus or the information incorporated by reference therein, then this prospectus

supplement or the information incorporated by reference in this prospectus supplement will apply and will supersede the information in

the accompanying prospectus and the documents incorporated by reference therein.

This prospectus supplement is part of a registration

statement on Form F-3 (File No. 333-265998) that we filed with the U.S. Securities and Exchange Commission (“SEC”) using

a “shelf” registration process. Under the shelf registration process, we may from time to time offer and sell any combination

of the securities described in the accompanying prospectus up to a total dollar amount of $100,000,000, of which this offering is a part.

As of the date of this prospectus supplement, we have not sold any securities under the registration statement.

To the extent this prospectus supplement contains

summaries of the documents referred to herein, you are directed to the actual documents for complete information. All of the summaries

are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed or will be

filed in a Report of Foreign Private Issuer on Form 6-K, or will be incorporated by reference as exhibits to the registration statement

of which this prospectus supplement forms a part, and you may obtain copies of such documents as described below in the section titled

“Where You Can Find Additional Information.”

You should rely only on the information contained

or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not, and the Placement Agent has

not, authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information,

you should not rely on it. We are not making an offer to sell or soliciting an offer to buy these securities under any circumstance in

any jurisdiction where the offer or solicitation is not permitted. You should assume that the information contained in this prospectus

supplement and the accompanying prospectus is accurate only as of the date of the respective document in which the information appears,

and that any information in documents that we have incorporated by reference is accurate only as of the date of the document incorporated

by reference, regardless of the time of delivery of this prospectus supplement or any sale of a security. Our business, financial condition,

results of operations and prospects may have changed since those dates.

Unless otherwise stated in this prospectus supplement,

“Siyata,” “we,” “us,” “our,” or “Company,” refers to Siyata Mobile Inc. and

our subsidiaries. All dollar amounts in this prospectus supplement are in United States dollars.

The market data and certain other statistical

information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus are based on independent

industry publications, governmental publications, reports by market research firms or other independent sources which we have not independently

verified. Some data are also based on our good faith estimates.

The logos, and

other trade names, trademarks, and service marks of Siyata Mobile Inc. appearing in this prospectus are the property of Siyata. Other

trade names, trademarks, and service marks appearing in this prospectus are the property of their respective holders. Trade names, trademarks,

and service marks contained in this prospectus may appear without the “®” or “™” symbols. Such references

are not intended to indicate, in any way, that we, or the applicable owner or licensor, will not assert, to the fullest extent possible

under applicable law, our rights or the rights of the applicable owner or licensor to those trade names, trademarks, and service marks.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains

“forward-looking statements” which include information relating to future events, future financial performance, financial

projections, strategies, expectations, competitive environment and regulation. Words such as “may,” “should,”

“could,” “would,” “predicts,” “potential,” “continue,” “expects,”

“anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,”

and similar expressions, as well as statements in future tense, identify forward-looking statements. Forward-looking statements should

not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will

be achieved. Forward-looking statements are based on information we have when those statements are made or management’s good faith

belief as of that time with respect to future events, and are subject to significant risks and uncertainties that could cause actual

performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors

that could cause such differences include, but are not limited to:

| |

● |

the size and growth potential of the markets for our products, and our ability to serve those markets; |

| |

● |

the rate and degree of market acceptance of our products; |

| |

● |

our ability to expand our sales organization to address effectively existing and new markets that

we intend to target; |

| |

● |

impact from future regulatory, judicial, and legislative changes or developments in the U.S. and

foreign countries; |

| |

● |

our ability to compete effectively in a competitive industry; |

| |

● |

our ability to obtain funding for our operations and effectively utilize the capital raised therefrom; |

| |

● |

our ability to attract collaborators and strategic partnerships; |

| |

● |

our ability to meet the continued listing requirements and standards of the Nasdaq Capital Market,

or Nasdaq; |

| |

● |

our ability to meet our financial operating objectives; |

| |

● |

the availability of, and our ability to attract, qualified employees for our business operations; |

| |

● |

general business and economic conditions; |

| |

● |

our ability to meet our financial obligations as they become due; |

| |

● |

positive cash flows and financial viability of our operations and any new business opportunities; |

| |

● |

our ability to secure intellectual property rights over our proprietary products or enter into license

agreements to secure the legal use of certain patents and intellectual property; |

| |

● |

our ability to be successful in new markets; |

| |

● |

our ability to avoid infringement of intellectual property rights; and |

| |

● |

the effects of the global COVID-19 pandemic. |

The foregoing does not

represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we

are faced with that may cause our actual results to differ from those anticipated in our forward-looking statements. Please see “Risk

Factors,” and “Business” and “Incorporation of Certain Documents by Reference,” as well as in our Annual

Report on Form 20-F under Item 3. “Key Information – D. Risk Factors,” “Item 4. Information on the Company,”

and “Item 5. Operating and Financial Review and Prospects” for additional factors that could adversely impact our business

and financial performance.

Moreover, new risks

regularly emerge and it is not possible for our management to predict or articulate all the risks we face, nor can we assess the impact

of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those

contained in any forward-looking statements. All forward-looking statements included in this prospectus are based on information available

to us on the date of this prospectus and as of the dates of the documents incorporated herein by reference. Except to the extent required

by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout this prospectus

supplement and the documents incorporated by reference herein. Should one or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary materially from those described in this prospectus supplement as anticipated,

believed, estimated or expected.

Readers are urged to

carefully review and consider the various disclosures made throughout this prospectus supplement which are designed to advise interested

parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

You should not put undue

reliance on any forward-looking statements. Any forward-looking statements in this prospectus supplement are made as of the date hereof,

and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by law.

PROSPECTUS

SUPPLEMENT SUMMARY

This summary description about us and our

business highlights selected information contained elsewhere in this prospectus supplement or the accompanying base prospectus. This

summary does not contain all of the information you should consider before deciding to invest in our securities. You should carefully

read this entire prospectus supplement and the accompanying base prospectus, including each of the documents incorporated herein or therein

by reference, before making an investment decision. You should also carefully consider the matters discussed in the section in this prospectus

supplement entitled “Risk Factors” and in the accompanying base prospectus and in other documents incorporated

herein by reference.

Corporate Overview

Siyata Mobile Inc. is a leading global developer

of innovative cellular-based communications solutions over advanced 4G/LTE mobile networks under the Uniden® Cellular and Siyata

brands to global first responders and enterprise customers. Siyata’s three complementary product categories include rugged handheld

mobile devices and in-vehicle communications solutions for first responders, military, enterprise customers, commercial fleet vehicles

and industrial workers, and cellular amplifiers to boost the cellular signal inside homes, buildings and vehicles.

Products

The Company develops, markets, and sells a portfolio

of rugged handheld Push-to-Talk over Cellular (“PoC”) smartphone devices. These rugged business-to-business (“B2B”)

handsets are focused on enterprise customers, first responders, construction workers, security guards, government agencies, utilities,

transportation and waste management, amusement parks, and mobile workers in multiple industries.

In the second quarter of 2022, Siyata unveiled

its next generation rugged device, the SD7. The SD7 is Siyata’s first mission critical push-to-talk device (“MCPTT”)

and is also the first rugged handset that Siyata launched in North America, in the fourth quarter of 2021 and is expected to launch in

Europe in the first quarter of 2023.

Our second product category are purpose built

in-vehicle communication devices. In the fourth quarter of 2021, Siyata launched the VK7, a first-of-its-kind, patent-pending car kit

with an integrated 10-watt speaker, a simple slide-in connection sleeve for the SD7, and an external antenna input for connecting to

a windshield or roof mount antenna that provides an in-vehicle experience for the user that is similar to that from a traditional land

mobile radio (“LMR”) device. The VK7 has been uniquely designed to be used with the SD7, while connecting directly into the

vehicle’s power and can also connect to a Uniden® cellular amplifier for better cellular connectivity. The VK7 can also be

equipped with an external remote speaker microphone (“RSM”) to ensure compliance with hands-free communication legislation.

The Uniden® UV350 4G/LTE is a purpose built

in-vehicle communication device designed specifically for professional vehicles such as trucks, vans, buses, emergency service vehicles

and other enterprise vehicles. This platform is designed to facilitate the replacement of the current in-vehicle, multi-device set up

with a single device that incorporates voice, PoC, data, fleet management solutions and other Android® based professional

applications. The UV350 also supports Band 14 for the First Responder Network Authority, or FirstNet®, compatibility which is the

U.S. First Responders’ 4G/LTE network with PoC capabilities that aims to replace aging two-way radio systems currently in use.

The aforementioned portfolio of solutions offers

the benefits of PoC without any of the difficulties managing the current generation of rugged smart/feature phones and is ideally suited

as a perfect upgrade from Land Mobile Radios. Used for generations, LMR has a significant number of limitations, including network incompatibility,

limited coverage areas, and restricted functionality that leave a huge need for a unified network and platform. Siyata’s innovative

PoC product lines are helping to service the generational shift from LMR to PoC. According to VDC Research, the LMR market is growing

at a 5.9% compound annual growth rate (“CAGR”), while the PoC market is growing at a 13.6% CAGR and annual PoC shipments

are expected to grow to 2.7 million units in 2023.

Approximately 30 million cellular boosters are

sold globally every year. Siyata manufactures and sells Uniden® cellular boosters and accessories for enterprise, first responder

and consumer customers with a focus on the North American markets. Cellular communication provides a robust, secure environment not just

for remote workers, in-home and in-vehicles, but also for restaurant patrons who wish to download menus; for patients at pharmacies who

need to verify identity and download prescriptions; for remote workers who require strong, clear cellular signals; and for first responders

where connectivity literally means the difference between life and death. The vehicle vertical in this portfolio complements Siyata’s

in-vehicle and rugged handheld smartphones as these sales can be bundled through the Company’s existing sales channels.

Customers and Channels

Qualifications with North American voice and

data carriers began with Bell Mobility in late in the fourth quarter of 2018; at AT&T as well as at its first responder cellular

network FirstNet®, in late in the second quarter of 2019; with Rogers Wireless and Verizon Wireless in the fourth quarter of 2019;

and internationally with Telstra in the fourth quarter of 2021. These are major milestones for the Company following Siyata’s seven

years of experience innovating in-vehicle cellular based technology, vehicle installations, software integration with various Push-to-Talk

(“PTT”) solutions and intensive carrier certifications.

Siyata’s customer base includes cellular

network operators and their dealers, as well as commercial vehicle technology distributors for fleets of all sizes in the U.S., Canada,

Europe, Australia, the Middle East and other international markets.

The

North American Tier 1 cellular carriers that Siyata is working with have large scale distribution and sales channels. With an estimated

25 million commercial vehicles including 7.0 million first responder vehicles, the Company sees the North American market as its largest

opportunity with a total addressable market over $19 billion. We believe that these Tier 1 cellular carriers have a keen interest in

launching the UV350 as it allows for new SIM card activations in commercial vehicles and increased average revenue per unit (“ARPU”)

from existing customers with corporate and first responder fleets while targeting new customers with a unique, dedicated, multi-purpose

in-vehicle Internet of Things (“IoT”) smartphone.

In addition, our rugged handsets will ultimately

be targeted to approximately 47 million enterprise task and public sector workers across North America including construction, transport

and logistics, manufacturing, energy and utility, public safety and the federal government.

Corporate Information

We are organized as a corporation under the laws

of British Columbia, Canada, and maintain our principal place of business at 1001 Lenoir Street, Suite A-414, Montreal, Quebec H4C 2Z6,

Canada. The registered and records office is located at 200 - 885 West Georgia Street, Vancouver, British Columbia V6C 3E8, Canada. Our

telephone number is (514) 500-1181 and our website is located on the internet at https://www.siyatamobile.com. Information contained

on our website does not constitute part of this prospectus supplement.

The Company was incorporated on October 15, 1986

as Big Rock Gold Ltd. as a corporation under the Company Act of British Columbia. On April 5, 1988, the Company changed its name to International

Cruiseshipcenters Corp. On June 24,1991, the Company changed its name to Riley Resources Ltd. Effective January 23, 1998, the Company

consolidated its share capital on an eight-to-one basis and changed its name to International Riley Resources Ltd. Effective November

22, 2001, the Company consolidated its share capital on a five-to-one basis and changed its name to Wind River Resources Ltd. On January

3, 2008, the Company changed its name to Teslin River Resources Corp.

On July 24, 2015, Teslin River Resources Corp,

completed a reverse acquisition by way of a three-cornered amalgamation, pursuant to which the Company acquired certain telecom operations

of an Israel-based cellular technology company and changed its name to Siyata Mobile Inc.

On June 7, 2016, the Company acquired all of

the issued and outstanding shares of Signifi Mobile Inc. (“Signifi”).

In March 2021, the Company acquired, through

a wholly owned subsidiary formed by Signifi, all the outstanding units of Clear RF LLC (“Clear RF”).

The Company was registered with the TSXV under

the symbol SIM, commenced trading on OTCQX under the symbol SYATF from May 11, 2017 until September 25, 2020, at which time the Company’s

common shares were listed only on the Nasdaq Capital Market.

The following diagram illustrates our corporate

structure as of the date of this prospectus:

Recent Developments

Effects of the Covid-19 Pandemic. In 2020,

the global outbreak of the COVID-19 virus spread to every country and to every state in the United States. The World Health Organization

designated COVID-19 as a pandemic, and numerous countries, including the United States, declared national emergencies with respect to

COVID-19. While vaccines have been approved and have been deployed in the United States, Canada and Israel, the global impact of the

outbreak continues to adversely affect many industries, and different geographies continue to reflect the effects of public health restrictions

in various ways. The timing and likelihood of achieving widespread global vaccination remain uncertain, and these vaccines may be less

effective against new variants, potentially leading to various health restrictions such as isolation, limiting large congregations of

people and even lock-downs that may continue to keep the global economy from recovering to pre-pandemic levels for a prolonged period

of time.

The economic recovery in the United States and

Canada following the initial impact of COVID-19 is underway but it has been gradual, uneven and characterized by meaningful dispersion

across sectors and regions with uncertainty regarding its ultimate length and trajectory. Further, although many jurisdictions had relaxed

or lifted restrictions in an effort to generate more economic activity, the risk of continued COVID-19 outbreaks remains, and certain

jurisdictions have re-imposed restrictions in an effort to mitigate risks to public health, especially as more infectious variants of

the virus emerge. Increasing infection rates and hospitalizations in certain geographies and a potential resulting market downturn have

resulted in the COVID-19 pandemic continuing to impact our business and our results of operations, financial condition and cash flow.

We have experienced an increase of sales of our

cellular boosters as more people are working remotely as a result of the COVID-19 pandemic but our overall sales during the pandemic

have remained similar to its sales in 2020 during this time period with a shift towards increased sales in North America in the first

responder market. It is not possible for us to predict the duration or magnitude of the adverse results of the outbreak and its effects

on our business or ability to raise funds. We plan to address any ongoing concerns from the pandemic by continuing to increase our sales

in North America. In addition, our cellular distribution business should remain strong during this time since more individuals will continue

to work from home. In addition, we believe that our cellular booster business will remain strong as more individuals continue to work

from home, requiring improved cellular reception.

Russia-Ukraine Conflict. U.S. and global

markets are experiencing volatility and disruption following the escalation of geopolitical tensions and Russia’s launch of a full-scale

military invasion of Ukraine in February 2022. Although the length and impact of the ongoing military conflict is highly unpredictable,

the war in Ukraine has led to market disruptions, including significant volatility in commodity prices, credit, and capital markets.

Additionally, Russia’s prior annexation of Crimea, the full scale military invasion in Ukraine and the recent illegal annexation

of two separatist republics in the Donetsk and Luhansk regions of Ukraine have led to sanctions and other penalties being levied by the

United States, the European Union, and other countries against Russia, Belarus, the Crimea Region of Ukraine, the so-called Donetsk People’s

Republic, and the so-called Luhansk People’s Republic, including the agreement by the U.S. and the EU to remove certain Russian

financial institutions from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) payment system. Additional potential

sanctions and penalties have also been proposed and/or threatened. Russian military actions and the resulting sanctions could adversely

affect the global economy and financial markets and lead to instability and lack of liquidity in capital markets, potentially making

it more difficult for us to obtain additional equity or debt funding. Any of the abovementioned factors could affect our business, prospects,

financial condition, and operating results.

The short- and long-term implications of Russia’s

invasion of Ukraine are difficult to predict at this time. The imposition of sanctions and Russia’s withholding of its oil and

gas as an economic weapon may have an adverse effect on the economic markets generally and could impact our business, financial condition,

and results of operations. The war has created disruptions in the supply chain for certain of our products which, to date, has not had

a substantive impact on our operations. None of our critical raw materials are sourced from, and none of our finished products are manufactured

in, the sanctioned regions. We have no operations or other projects in that region.

Investment by Lind Partners. On October

27, 2021, we entered into a securities purchase agreement relating to the purchase and sale of a senior secured convertible note (the

“Lind Partners Note”) for gross proceeds of USD$6,000,000 (the “Purchase Agreement”) with Lind Global Partners

II, LP, an investment fund managed by The Lind Partners, a New York based institutional fund manager. Proceeds were used to repay and

terminate existing convertible notes, as well as to pay certain fees and costs associated with the transaction. The Purchase Agreement

provides for, among other things, the issuance of a USD$7,200,000 note with a 24-month maturity, 0% annual interest rate, and a fixed

conversion price of USD$10.00 per share (“Conversion Price”) of our common shares. We are required to make principal payments

in 18 equal monthly installments commencing 180 days after funding (“Repayment”). At our discretion, the Repayments can be

made in: (i) cash; (ii) common shares (after common shares are registered) (the “Repayment Shares”); or a combination of

both. Repayment Shares will be priced at 90% of the average of the five lowest daily volume weighted average prices (“VWAPs”)

during the 20 trading days before the issuance of the common shares (the “Repayment Price”). Further, the Lind Partners Note

provides for a pricing floor of $2.00 per common share (the “Repayment Share Price Floor”) such that Repayment Shares shall

be priced at 90% of the average of the five lowest daily VWAPs during the 20 trading days before the issuance of the common shares, subject

to the Repayment Share Floor Price provided, however, that the Repayment Share Price Floor became inapplicable after we obtained stockholder

approval as required by the Nasdaq at our Annual General Meeting of shareholders.

As of December 3, 2021, we incurred an event

of default under the terms of the Lind Partners Note. Upon the occurrence and during the continuance of an “Event of Default”,

the holder may at any time at its option: (1) declare that Interest Upon Default Amount (15%) has commenced and (2) exercise all other

rights and remedies available to it under the transaction documents; provided, however, that upon the occurrence of an Event of Default

described above, the holder, in its sole and absolute discretion, may: (a) from time-to-time demand that all or a portion of the outstanding

principal amount be converted into common shares at the lower of (i) the then-current Conversion Price and (ii) 80% of the average of

the three lowest daily Volume Weighted Average Prices during the 20 Trading Days prior to the delivery by the holder of the applicable

notice of conversion or (b) exercise or otherwise enforce any one or more of the holder’s rights, powers, privileges, remedies

and interests under the Lind Partners Note, the transaction documents or applicable law. No course of delay on the part of the holder

shall operate as a waiver thereof or otherwise prejudice the rights of the holder. The event of default was cured on December 7, 2021

when the Company’s market capitalization increased to an amount over $20,000,000.

If the Company issues any Equity Interests, other

than Exempted Securities (as defined), for aggregate proceeds to the Company of greater than $10,000,000, excluding offering costs or

other expenses, unless otherwise waived in writing by and at the discretion of Lind Partners, the Company will direct 20% of such proceeds

to reduce the principal balance of the Lind Note. If the Company issues any equity interests issued, subject to certain exemptions, at

an effective price per share that is less than the exercise price of the Lind Warrant then in effect or without consideration, then the

exercise price of the Lind Warrants shall be reduced to a price equal to the consideration per share paid for such additional common

shares. Based on this offering at $0.23 per share, the Lind Warrants would be repriced to $0.23. Prior to this offering, the exercise

price of the Lind Warrants is $2.30 per share. If the Company issues any equity interests, subject to certain exemptions, at an effective

price per share that is less than the conversion price of the Lind Notes then in effect or without consideration, then the conversion

price of the Lind Notes shall be reduced to a price equal to the consideration per share paid for such additional common shares.

Another Event of Default occurred on July 12,

2022 when the Company’s market capitalization fell below $20,000,000 for 10 consecutive days. Upon the occurrence of an Event of

Default as described above, the holder, in its sole and absolute discretion, may: (a) from time-to-time demand that all or a portion of

the outstanding principal amount be converted into common shares at the lower of: (i) the then-current Conversion Price, and (ii) 80%

of the average of the three lowest daily Volume Weighted Average Prices during the 20 Trading Days prior to the delivery by the holder

of the applicable notice of conversion, or (b) exercise or otherwise enforce any one or more of the holder’s rights, powers, privileges,

remedies and interests under the Lind Partners Note, the transaction documents or applicable law. Based on this offering at $0.23 per

common share, the conversion price of the Lind Note would be repriced to $0.23, which would result in 4,347,826 shares to be issued upon

conversion of the remaining principal balance of $1,000,000 under the Lind Note. Prior to this offering, the conversion price was $2.30

per share and the shares issued upon conversion of the remaining principal balance of $1,000,000 on the Lind Note would have been 434,782

based on that conversion price.

The Securities Purchase Agreement pursuant to

which Lind Partners acquired the Lind Notes prohibits the Company from entering into any Prohibited Transactions (defined to include

the Purchase Warrants in this offering) without Lind Partner’s prior written consent, until thirty days after such time as the

Lind Note has been repaid in full and/or has been converted into common shares. That agreement also provides to Lind a 10 day right of

first purchase if the Company makes a public offer of its Common Shares. On October 9, 2022, Lind Partners entered into an agreement

pursuant to which they waived such provisions in consideration of participating in this offering and receiving without payment therefor

Purchase Warrants in the private placement to acquire up to 1,739,130 common shares at an exercise price of $0.23 per common share (the

“Lind Waiver Warrants”).

Change in Accountants.

On May 24, 2022, we received a letter from Davidson & Company LLP (“Davidson”) that stated that Davidson did

not wish to be reappointed as the Company’s independent registered public accounting firm for the fiscal year ending December 31,

2022. Davidson ceased to serve as the Company’s independent registered accounting firm as of May 24, 2022. The Company requested

that Davidson respond fully to the inquiries of Friedman, LLP, the Company’s successor independent registered public accounting

firm (see below), and Davidson agreed to cooperate with the Company and Friedman with respect to the transition.

During the Company’s

fiscal years ended December 31, 2021 and 2020 and the subsequent interim period through the filing of the Company’s Report of Foreign

Private Issuer on Form 6-K on May 31, 2022, there were no “disagreements” (as defined in Item 304(a)(1)(iv) of Regulation

S-K and the related instructions to Item 304 of Regulation S-K) with Davidson on any matter of accounting principles or practices, financial

statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Davidson, would have

caused Davidson to make reference to the subject matter of such disagreements in connection with its report.

Davidson’s report

on the consolidated financial statements for the Company’s fiscal years ended December 31, 2021 and 2020 did not contain any adverse

opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles, except that

Davidson’s report for the years ended December 31, 2021 and 2020 contained an explanatory paragraph indicating that there was substantial

doubt about the ability of the Company to continue as a going concern. In a separate correspondence, Davidson identified five material

weaknesses in our internal controls over financial reporting.

As previously disclosed

in Item 15(a) “Controls and Procedures” of the Company’s Annual Report on Form 20-F for the fiscal year ended December

31, 2021, Davidson identified five material weaknesses that related to: (i) the insufficient review of inventory balances for products

that are slow-moving; (ii) the insufficient review of advances to suppliers on products that are no longer selling; (iii) the insufficient

controls surrounding off-site inventory tracking; (iv) the insufficient review whether product returns relate to sales recorded in the

fiscal year; and (v) the insufficient review of title transfer terms to determine the period in which revenue should be recorded.

During the Company’s

fiscal years ended December 31, 2021 and 2020 and the subsequent interim period through May 31, 2022, there had been no “reportable

events” (as defined in Item 304(a)(1)(v) of Regulation S-K), except for certain material weaknesses in the Company’s internal

control over financial reporting.

On May 24, 2022, management

of the Company notified Friedman LLP (“Friedman”) that Friedman had been approved by the Company’s audit committee

(“Audit Committee”) of the board of directors and the board of directors as the Company’s independent registered public

accounting firm for the fiscal year ended December 31, 2022. Friedman LLP combined with Marcum LLP effective September 1, 2022 (“Marcum”).

During the fiscal years ended December 31, 2021 and 2020 and the subsequent interim period through May 31, 2022, the Company did not

consult with Friedman or Marcum with respect to: (a) the application of accounting principles to a specified transaction, either completed

or proposed, or the type of audit opinion that might be rendered with respect to the Company’s financial statements, and no written

report or oral advice was provided to the Company by Friedman or Marcum that was an important factor considered by the Company in reaching

a decision as to any accounting, auditing or financial reporting issue, or (b) any matter that was subject to any disagreement, as defined

in the United States Securities and Exchange Commission’s Regulation SK, Item 304(a)(1)(iv) and the related instructions thereto,

or a reportable event within the meaning set forth in Item 304(a)(1)(v) of Regulation S-K

Restatement of Financial Statements. As

part of the Company’s normal quarterly reporting process for the six months ended June 30, 2022, management and the Audit Committee

concluded that a material error was made related to the accounting for the Warrants entered into on January 11, 2022 and therefore were

misstated in the Company’s March 31, 2022 prior period financial statements (“Prior Period Financial Statements”).

There was no impact on any of the year end financial statements previously filed.

On August 15, 2022, management and the Audit

Committee determined that the Company’s condensed consolidated unaudited interim financial statements for the three month period

ended March 31, 2022, filed with the SEC on Form 6-K on May 17, 2022 should no longer be relied upon due to an error in the accounting

treatment for the classification of the Company’s Warrants as equity rather than as a derivative liability. In addition, investors

were advised that they should no longer rely upon any communications relating to these condensed consolidated unaudited interim financial

statements.

The Company determined that the Warrants should

be accounted for as a derivative liability in accordance with International Accounting Standards No. 32.6 and International Financial

Reporting Standards No. 9 that deal with the measurement of financial assets and financial liabilities. As a result of this change, the

Warrants for 9,999,999 shares of common shares have been classified as liabilities rather than equity, the fair value of the Warrants

decreased by $2.9 million, transaction costs increased by $0.96 million and the fair value loss increased by $0.96 million for the three

months ended March 31, 2022.

The Company filed its restated condensed consolidated

unaudited interim financial statements for the three month period ended March 31, 2022 as Exhibit 99.1 to its Form 6-K with the SEC on

August 18, 2022 together with its restated Management’s Discussion and Analysis of Results of Operations and Financial Condition

for the three months ended March 31, 2022.

Going Concern. Our auditor has included

a “going concern” explanatory paragraph in its report on our consolidated financial statements for the fiscal year ended

December 31, 2021, expressing substantial doubt about our ability to continue as an ongoing business for the next twelve months. Our

consolidated financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we cannot secure

the financing needed to continue as a viable business, our shareholders may lose some or all of their investment in us.

Nasdaq Delisting Letter. On September

1, 2022, we announced that the Company had received a notification letter dated August 26, 2022 from the Listing Qualifications Department

of The Nasdaq Stock Market LLC (“Nasdaq”), notifying the Company that it is currently not in compliance with the minimum

bid price requirement set forth under Nasdaq Listing Rule 5550(a)(2), resulting from the fact that the closing bid price of the Company’s

common shares was below $1.00 per share for a period of thirty consecutive business days.

Pursuant to Nasdaq Listing Rule 5810(c)(3)(A),

the Company has a compliance period of 180 calendar days, or until February 22, 2023 (the “Compliance Period”), to regain

compliance with Nasdaq’s minimum bid price requirement. If at any time during the Compliance Period, the closing bid price per

share of the Company’s common shares is at least $1.00 for a minimum of ten consecutive business days, Nasdaq will provide the

Company a written confirmation of compliance and the matter will be closed. The Company is currently considering a number of alternatives

to boost its minimum bid price but has not yet reached a decision on a course of action.

Marketing Milestones. On October 6, 2021,

Siyata Mobile completed a major milestone and entered into a working partnership with a global leading U.S. distributor (“Leading

U.S. Distributor”) for its recently launched SD7 mission-critical push-to-talk ruggedized handheld device. The companies signed

an addendum to their Master Service Agreement appointing the Leading U.S. Distributor as a non-exclusive SD7 marketing and distribution

partner. The Leading U.S. Distributor, who is the leading global land mobile radio vendor, will be marketing the SD7 both in North America

as well as in international markets, selling both directly and in partnership with us.

On May 3, 2022, we announced that our SD7 push

to talk over cellular device was certified and approved for use on FirstNet®, the first high-speed, nationwide wireless broadband

network dedicated to public safety.

On June 7, 2022, we announced that Verizon Communications

Inc., the largest mobile cellular telephone operator in the U.S. by total retail connections, will fully integrate our rugged SD7 device

into their network. And on June 27, 2022, we announced that the SD7 rugged device first became commercially available on and will be

sold through the FirstNet® network and to AT&T Inc.’s enterprise channels.

On July 13, 2022, Siyata announced Logic Wireless

Europe Ltd. a leading distributor of business-critical communication solutions across the United Kingdom, Australia, New Zealand and

the Pacific Islands, will introduce the Siyata SD7 rugged PoC device integrated with ChatterPTT.

On July 14, 2022, Siyata announced it is launching

a new product, a Siyata High Power User Equipment (“HPUE”) antenna, in conjunction with Assured Wireless Corporation.

On July 18, 2022, Siyata announced an agreement

with Spain’s Wireless Zeta Telecomunicaciones, S.L. (“Azetti”) to offer the Company’s SD7 rugged mission-critical

push-to-talk device through Azetti’s existing enterprise sales channels.

On July 26, 2022, Siyata announced its SD7 rugged

mission-critical push-to-talk device is now available for customers who need the integrated industry-leading PTT solutions from TASSTA,

a global MCPTT software provider and end-to-end solution for critical communications.

On July 28, 2022, Siyata announced the Company’s

SD7 rugged push-to-talk over cellular devices were used to provide critical emergency communications services for the World Athletics

Championships “Oregon22” summer games.

On August 30, 2022, Siyata announced that it

is in the process of ramping up sales of its next-generation MCPTT SD7 device, as well as the VK7 and Rapid Kit companion devices to

numerous customers across multiple verticals.

On September 8, 2022, Siyata announced that its

SD7 rugged mission-critical push-to-talk device is now integrated with CrisisGo Inc.’s Panic App, giving teachers instant access

to first responders with a single push of a button.

On September 22, 2022, Siyata announced that

it has received a purchase order from a federal government contractor who will provide Uniden® cellular booster kits and accessories

to the U.S. Navy.

Implications of Our Being an “Emerging Growth Company”

As a company with less than $7.5 million in revenue

during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups

Act of 2012, or the JOBS Act. An “emerging growth company” may take advantage of reduced reporting requirements that are

otherwise applicable to larger public companies. In particular, as an emerging growth company, we:

| |

● |

may present only two years of audited financial statements and only two years of related Management’s

Discussion and Analysis of Financial Condition and Results of Operations, or “MD&A;” |

| |

● |

are not required to provide a detailed narrative disclosure discussing our compensation principles,

objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as

“compensation discussion and analysis;” |

| |

● |

are not required to obtain an attestation and report from our auditors on our management’s

assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| |

● |

are not required to obtain a non-binding advisory vote from our shareholders on executive compensation

or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency” and “say-on-golden-parachute”

votes); |

| |

● |

are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance

graph and chief executive officer pay ratio disclosure; |

| |

● |

are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting

standards under §107 of the JOBS Act; and |

| |

● |

will not be required to conduct an evaluation of our internal control over financial reporting. |

We intend to take advantage of all of these reduced

reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting

standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements

to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107

of the JOBS Act.

Under the JOBS Act, we may take advantage of

the above-described reduced reporting requirements and exemptions until we no longer meet the definition of an emerging growth company.

The JOBS Act provides that we would cease to be an “emerging growth company” at the end of the fiscal year in which the fifth

anniversary of our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of

1933, as amended, (the “Securities Act”), occurred, if we have more than $1.07 billion in annual revenues, have more than

$700 million in market value of our common shares held by non-affiliates, or issue more than $1.0 billion in principal amount of non-convertible

debt over a three-year period.

Foreign Private Issuer Status

We are a foreign private issuer within the meaning

of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain

provisions applicable to United States domestic public companies. For example:

| ● | we are not required

to provide as many Exchange Act reports, or as frequently, as a domestic public company; |

| ● | for interim reporting,

we are permitted to comply solely with our home country requirements, which are less rigorous

than the rules that apply to domestic public companies; |

| ● | we are not required

to provide the same level of disclosure on certain issues, such as executive compensation; |

| ● | we are exempt

from provisions of Regulation FD aimed at preventing issuers from making selective disclosures

of material information; |

| ● | we are not required

to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents,

or authorizations in respect of a security registered under the Exchange Act; and |

| ● | we are not required

to comply with Section 16 of the Exchange Act requiring insiders to file public reports of

their share ownership and trading activities and establishing insider liability for profits

realized from any “short-swing” trading transaction. |

Risks Affecting Our Company

In evaluating an investment in our securities,

you should carefully read this prospectus supplement and especially consider the factors incorporated by reference in the sections titled

“Risk Factors” commencing on page S-11 of this prospectus supplement and in our base prospectus and the Annual Report incorporated

by reference herein.

THE

OFFERING

| Issuer: |

Siyata Mobile Inc., a British Columbia

(Canada) corporation. |

| |

|

| Securities Offered: |

Up to

17,400,000 common shares and/or up to 17,400,000 Pre-Funded Warrants, for those purchasers,

if any, whose purchase of common shares in this offering would otherwise result in such purchaser,

together with its affiliates and certain related parties, beneficially owning more than 4.99%

of our outstanding common shares immediately following the consummation of this offering.

For each Pre-Funded Warrant purchased in this offering in lieu of a common share, we will

reduce the number of common shares being sold in the offering by one. Each Pre-Funded Warrant

is exercisable to purchase one common share at an exercise price of $0.01 per share, exercisable

immediately and will not expire. |

| |

|

| Public Offering Price: |

$0.23 per common share and $0.22 per Pre-Funded Warrant. |

| |

|

Common Shares Outstanding

Immediately Before This

Offering: |

17,880,745 common shares. |

| |

|

Common Shares to Be

Outstanding Immediately

Following This Offering: |

33,690,745 common shares(1). |

| |

|

| Use of Proceeds: |

We intend

to use the net proceeds from the sale of the securities offered hereby for working capital

and other general corporate purposes. See the section titled “Use of Proceeds”

on page S-18

|

| |

|

| Risk Factors: |

See the

sections titled “Risk Factors” commencing on page S-11 of this prospectus supplement

and in our base prospectus and the Annual Report incorporated by reference herein for a discussion

of factors you should consider carefully before deciding to invest in our common shares or

Pre-Funded Warrants. |

| |

|

| Listing: |

Our common shares are listed on the Nasdaq

Capital Market under the symbol “SYTA.” There is no established trading market for the Pre-Funded Warrants and we

do not intend to apply for the listing of the Pre-Funded Warrants on any national securities exchange or other trading market. Without

an active trading market, the liquidity of the Pre-Funded Warrants will be limited. |

| |

|

| Transfer Agent: |

Computershare Inc. is the registrar and transfer

agent of our common shares. |

| (1) | The number of shares of our common shares

to be outstanding after this offering is based on 17,880,745 common shares outstanding, assumes

the no exercise of any Pre-Funded Warrants issued in this offering and excludes: |

| |

● |

1,517,638 common shares issuable upon

the exercise of stock options outstanding under our 2016 Stock Option Plan, as amended, with a weighted-average exercise price

of $3.65 per share;

|

| |

● |

3,165,000 common shares issuable upon the exercise of restricted share units outstanding under the

2016 Stock Option Plan, as amended, with a weighted-average exercise price of $1.05 per share; |

| ● | 1,167,392 common

shares reserved for future issuance under our 2016 Stock Option Plan, as amended; |

| ● | 15,047,189 common

shares issuable upon the exercise of outstanding warrants with a weighted average exercise

price of $3.81 per share; |

| ● | 4,347,826 common

shares issuable upon the conversion of the Lind Partners Note; |

| |

● |

1,739,130 common shares issuable upon the conversion of the Lind Waiver Warrants; |

| |

● |

931,507 common shares issuable

upon the exercise of outstanding agent’s warrants with a weighted average exercise price of

$4.87 per share; and |

| |

● |

the 17,400,000 common shares issuable upon the exercise

of the Purchase Warrants to be sold by the Company to investors in a private placement concurrent with this offering. |

RISK

FACTORS

An investment in our securities involves a

high degree of risk. Before investing in our common shares, you should carefully consider the risk factors set forth below and those

described under “Risk Factors” in the documents incorporated by reference herein, including in our most recent Annual Report

on Form 20-F filed with the SEC, together with the other information included in this prospectus supplement and incorporated by reference

herein from our filings with the SEC. If any of such risks or uncertainties occur, our business, financial condition, and operating results

could be materially and adversely affected. Additional risks and uncertainties not currently known to us or that we currently deem immaterial

also may materially and adversely affect our business operations. As a result, the trading price of our common shares could decline and

you could lose all or a part of your investment.

Summary of Risk Factors

The following summarizes risk factors relating

to our financial condition and capital requirements, our business and industry, our reliance on third parties, governmental regulation,

our intellectual property, our locations in Israel and Canada and our international operations and the ownership of our securities. All

of such risks are described in greater detail in our Annual Report on Form 20-F and other filings with the SEC.

Risks Related to Our Financial Condition and

Capital Requirements

| |

● |

We have a history of operating losses and we may never achieve or maintain profitability. |

| |

● |

Our auditor has included a “going concern” explanatory paragraph in its report on our

consolidated financial statements for the fiscal year ended December 31, 2021, expressing substantial doubt about our ability to

continue as an ongoing business for the next twelve months. Our consolidated financial statements do not include any adjustments

that may result from the outcome of this uncertainty. If we cannot secure the financing needed to continue as a viable business,

our shareholders may lose some or all of their investment in us. |

| |

● |

In 2021, our independent registered public accountants identified five material weaknesses in our

internal controls over financial reporting. If we are unable to remediate these material weaknesses, we may not be able to

report our financial results accurately, prevent fraud or file our periodic reports as a public company in a timely manner. In 2020,

our independent registered public accountants identified six material weaknesses in our internal controls over financial reporting,

which have only been partially remediated. |

Risks Related to Our Business and Industry

| |

● |

We rely on our channel partners to generate a substantial majority of our revenues. If these channel

partners fail to perform or if we cannot enter into agreements with channel partners on favorable terms, our operating results could

be significantly harmed. |

| |

● |

We are materially dependent on the adoption of our solutions by both the industrial enterprise and

public sector markets, and if end customers in those markets do not purchase our solutions, our revenues will be adversely impacted,

and we may not be able to expand into other markets. |

| |

● |

We participate in a competitive industry, which may become more competitive. Competitors with greater

resources and significant experience in high-volume product manufacturing may be able to respond more quickly and cost-effectively

than we can to new or emerging technologies and changes in customer requirements. |

| |

● |

Defects in our products could reduce demand for our products and result in a loss of sales, delay

in market acceptance and injury to our reputation, which would adversely impact our business. |

| |

● |

If our business does not grow as we expect, or if we fail to manage our growth effectively, our operating

results and business would suffer. |

| |

● |

The markets for our devices and related accessories may not develop as quickly as we expect, or may

not develop at all. Our dependence on our cellular carrier channel partners and their success in promoting Push to Talk over Cellular

to their client base is key for the success of the business. |

| |

● |

Our future success is dependent on our ability to create independent brand awareness for our Company

and products with end customers, and our inability to achieve such brand awareness could limit our prospects. |

| |

● |

We are dependent on the continued services and performance of a concentrated group of senior management

and other key personnel, the loss of any of whom could adversely impact our business. |

| |

● |

We compete in a rapidly evolving market, and the failure to respond quickly and effectively to changing

market requirements could cause our business and operating results to decline. |

| |

● |

If we are unable to sell our solutions into new markets, our revenues may not grow. |

| |

● |

If we are unable to attract, integrate and retain additional qualified personnel, including top technical

talent, our business could be adversely impacted. |

| |

● |

A security breach or other significant disruption of our information technology systems or those

of our partners, suppliers or manufacturers, caused by cyberattacks or other means, could have a negative impact on our operations,

sales, and operating results. |

| |

● |

We experience lengthy sales cycles for our products and the delay of an expected large order could

result in a significant unexpected revenue shortfall. |

| |

● |

We have a limited history of high-volume commercial production of our devices, and we may face manufacturing

capacity constraints. |

| |

● |

We face risks related to novel Coronavirus (COVID-19) which could significantly disrupt our research

and development, operations, sales, supply chain and financial results. |

Risks Related to our Reliance on Third

Parties

| |

● |

As we work with multiple vendors for our components, if we fail to adequately forecast demand for

our inventory and supply needs, we could incur additional costs or experience manufacturing delays, which could reduce our gross

margin or cause us to delay or even lose sales. |

| |

● |

Our dependence on third-party suppliers for key components of our products could delay shipment of

our products and reduce our sales. |

| |

● |

Because we rely on a small number of channel partners/customers for a large portion of our revenue,

the loss of any of these customers would have a material adverse effect on our operating results and cash flows. |

| |

● |

If dedicated public safety LTE networks are not deployed at the rate we anticipate or at all, demand

for our solutions may not grow as expected. |

| |

● |

The application development ecosystem supporting our devices and related accessories is new and evolving. |

| |

● |

Failure of our suppliers, subcontractors, distributors, resellers, and representatives to use acceptable

legal or ethical business practices, or to fail for any other reason, could negatively impact our business. |

| ● | Our

products are subject to risks associated with sourcing, manufacturing and shipping in non-U.S.

and non-Canadian countries including China. |

| |

● |

The nature of our business may result in undesirable press coverage or other negative publicity,

which would adversely impact our brand identity, future sales and results of operations. |

| |

● |

Changes in the availability of federal funding to support local public safety or other public sector

efforts could impact our opportunities with public sector end customers. |

| |

● |

Economic uncertainties or downturns, or political changes, could limit the availability of funds

available to our customers and potential customers, which could significantly adversely impact our business. |

| |

● |

Natural or man-made disasters and other similar events may significantly disrupt our business, and

negatively impact our operating results and financial condition. |

| |

● |

We are exposed to risks associated with strategic acquisitions and investments. |

| |

● |

We could be adversely impacted by changes in accounting standards and subjective assumptions, estimates

and judgments by management related to complex accounting matters. |

Risks Related to Government Regulation

| |

● |

We are subject to anti-corruption, anti-bribery, anti-money laundering, economic sanctions, export

control, and similar laws. Non- compliance with such laws can subject us to criminal or civil liability and harm our business, revenues,

financial condition and results of operations. |

| |

● |

We are subject to a wide range of product regulatory and safety, consumer, worker safety and environmental

laws and regulations. |

| |

● |

Changes in laws and regulations concerning the use of telecommunication bandwidth could increase

our costs and adversely impact our business. |

| |

● |

We are subject to a wide range of privacy and data security laws, regulations and other legal obligations. |

| |

● |

The effects of the Tax Cuts and Jobs Act on our business have not yet been fully analyzed and could

harm our results of operations. |

Risks Related to Our Intellectual Property

| |

● |

If we are unable to successfully protect our intellectual property, our competitive position may

be harmed. |

| |

● |

Others may claim that we infringe on their intellectual property rights, which may result in costly

and time-consuming litigation and could delay or otherwise impair the development and commercialization of our products. |

| |

● |

Our use of open source software could subject us to possible litigation or otherwise impair the development

of our products. |

| |

● |

Our inability to obtain and maintain any third-party license required to develop new products and

product enhancements could seriously harm our business, financial condition and results of operations. |

Risks Related to our Locations in Israel and

Canada and Our International Operations

| |

● |

Conditions in Israel could materially and adversely affect our business. |

| |

● |

Because we are a corporation incorporated in British Columbia and some of our directors and officers

are resident in Canada, it may be difficult for investors in the United States to enforce civil liabilities against us based solely

upon the federal securities laws of the United States. Similarly, it may be difficult for Canadian investors to enforce civil liabilities

against our directors and officers residing outside of Canada. |

| |

● |

We have operations in China, which exposes us to risks inherent in doing business there. |

| |

● |

The impact of potential changes in customs, tariffs, and trade policies in the United States and

the potential corresponding actions by other countries, including recent trade initiatives announced by the U.S. presidential administration

against China, in which we do business could adversely impact our financial performance. |

| |

● |

Operating outside of the United States presents specific risks to our business, and we have substantial

operations outside of the United States. |

| |

● |

Foreign currency fluctuations may reduce our competitiveness and sales in foreign markets. |

Risks Related to Ownership of Our Securities

| |

● |

We may require additional capital to fund our business and support our growth, and our inability

to generate and obtain such capital on acceptable terms, or at all, could harm our business, operating results, financial condition

and prospects. In addition, such funding may dilute our existing shareholders. |

| |

● |

We expect that our stock price will fluctuate significantly, and you may not be able to resell your

shares at or above the public offering price you paid for your shares. |

| |

● |

The conversion of the Lind Partner Note and the exercise of the Lind Partner Warrant or future sales

of our common shares may further dilute the common shares and adversely impact the price of our common shares. |

| |

● |

If we are not able to comply with the applicable continued listing requirements or standards of Nasdaq,

Nasdaq could delist our common shares and warrants which could negatively impact the price of our securities and an investor’s

ability to sell them. |

| |

● |

If we fail to maintain proper and effective internal controls, our ability to produce accurate financial

statements on a timely basis could be impaired. |

| |

● |

We will continue to incur significant increased costs as a result of operating as a public company

in the United States, and our management will be required to devote substantial time to new compliance initiatives. |

| |

● |

Because we are a foreign private issuer and are exempt from certain Nasdaq corporate governance standards

applicable to U.S. issuers, you will have less protection than you would have if we were a domestic issuer. |

| |

● |

We may lose our foreign private issuer status in the future, which could result

in significant additional costs and expenses. |

| |

● |

Our executive officers and directors, and their affiliated entities, along with

our two other largest stockholders, own a significant percentage of our stock and will be able to exert significant control over

matters subject to stockholder approval. |

Risks Related to this Offering

Our management will have broad discretion

in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in

the application of the net proceeds from this offering, and our shareholders will not have the opportunity as part of their investment

decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will

determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use.

The failure by our management to apply these funds effectively could harm our business. See “Use of Proceeds” on page S-18

of this prospectus supplement for a description of our proposed use of proceeds from this offering.

You will experience immediate and substantial

dilution in the net tangible book value per common share you purchase.

The offering price per common share being offered

is substantially higher than the pro forma net tangible book value per share of our outstanding common shares. As a result, the investor

purchasing common shares in this offering will incur immediate increase of $0.011 per share, after giving further effect to the sale by

us of all the common shares offered hereby and after deducting the Placement Agent’s fees and estimated offering expenses payable

by us. See “Dilution” on page S-19 of this prospectus supplement for a more detailed discussion of the dilution you will incur

if you purchase shares in this offering.

In addition, in order to raise additional capital,

we may in the future offer additional common shares, warrants or other securities (whether or not convertible into, or exercisable or

exchangeable for, our common shares) at prices that may not be the same as the price of the securities being sold in this offering. We

may not be able to sell common shares or other securities in any subsequent offering at a price per share that is equal to or greater

than the price per common share paid by investors in this offering, and investors purchasing our securities in the future could have

rights superior to existing shareholders. Sales of a substantial number of common shares, or other securities convertible into, or exercisable

or exchangeable for, our common shares) in the public market or the perception that such sales might occur could materially adversely

affect the market price of our common shares, and would result in dilution of your ownership interest in the Company. Because our decision

to issue securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or

estimate the amount, timing or nature of our future offerings. Accordingly, our shareholders and warrant holders bear the risk that our

future offerings will reduce the market price of our common shares and dilute their ownership interest in the Company.

In addition, we are issuing Purchase Warrants

in a private placement concurrent with this offering and are issuing 17,400,000 Purchase Warrants in the private placement. The exercise

of the Purchase Warrants and the Purchase Warrant sold in the private placement and any future sales of the underlying shares into the

public market, or the perception that such sales may occur, could adversely affect the price of our common shares.

The number of common shares sold in this

offering could cause the price of our common shares to decline.

The common shares offered and sold hereby (including

the common shares underlying any Pre-Funded Warrants sold in this offering) represent approximately 97.0% of our outstanding common shares

as of October 11, 2022. The common shares to be issued in this offering in the public market, or any future sales of a substantial number

of our common shares in the public market, or the perception that such sales may occur, could adversely affect the price of our common

shares on the Nasdaq Capital Market. We cannot predict the effect, if any, that market sales of those common shares or the availability

of those common shares for sale will have on the market price of our common shares.

The price of our common shares may be adversely

affected by the future issuance and sale of our common shares or other equity securities.

We cannot predict the size of future issuances