U.S. Energy Corp. Announces Completion of Asset Divestitures and Provides Liquidity Update

10 Janeiro 2024 - 9:00AM

U.S. Energy Corp. (Nasdaq: USEG, “U.S. Energy” or the “Company”), a

growth-focused energy company engaged in the operation of

high-quality producing oil and natural gas assets, today announced

it had completed a series of non-core asset divestitures.

HIGHLIGHTS

- All-cash proceeds of approximately $7.2 million;

- Divested assets averaged approximately 200 barrels of oil

equivalent per day (83% oil) from July-September 2023, or 12% of

USEG total production over the same period;

- All proceeds used to reduce existing debt, leaving USEG

materially debt-free1;

- No changes to the Company’s existing $20.0 million borrowing

base;

- Represents the majority of USEG’s non-operated assets.

MANAGEMENT COMMENTARY

“Throughout the fourth quarter, we executed on a

series of asset divestitures representing the majority of U.S.

Energy’s non-operated assets,” stated Ryan Smith, Chief Executive

Officer of U.S. Energy Corp. “The assets divested represent legacy

USEG properties, primarily in current non-core focus areas, and

will allow the Company to realize immediate additional corporate

overhead savings. With proceeds going directly towards debt

reduction, U.S. Energy now sits in a position of increased

liquidity across all measures and meaningful portions of our 2024

oil production hedged at an average price in the low $80’s. As we

enter 2024, we look forward to focusing our capital allocation

efforts on the Company’s highest rate of return growth initiatives,

maintaining a strong balance sheet, and driving shareholder

returns.”

BALANCE SHEET AND LIQUIDITY

UPDATE

The below table provides an overview of U.S.

Energy’s debt and cash balances, as well as the Company’s hedge

position, at both September 30, 2023 and December 31, 2023.

|

|

|

As of |

| |

|

9/30/2023 |

|

12/31/2023 |

|

($000’s) |

|

|

|

|

|

Debt Outstanding |

|

$ |

(12,000 |

) |

|

$ |

(5,000 |

) |

|

Add: Cash |

|

|

1,974 |

|

|

|

3,358 |

|

|

Add: MtM Hedging (Loss) / Gain2 |

|

|

(348 |

) |

|

|

2,059 |

|

|

Net (Debt) / Net Cash Position |

|

$ |

(10,374 |

) |

|

$ |

417 |

|

|

Net Liquidity3 |

|

$ |

9,626 |

|

|

$ |

20,417 |

|

|

|

|

|

|

|

|

|

|

|

HEDGING PROGRAM UPDATE

The following table reflects the hedged volumes

under U.S. Energy’s commodity derivative contracts and the average

fixed prices at which production is hedged for full year 2024, as

of January 9, 2024:

|

|

Swaps |

|

Period |

Commodity |

|

Volume(Bbls) |

|

|

Avg Price($/Bbl

) |

|

Q1 2024 |

Crude Oil |

|

53,000 |

|

|

|

$84.07 |

|

|

Q2 2024 |

Natural Gas |

|

48,600 |

|

|

|

$81.76 |

|

|

Q3 2024 |

Crude Oil |

|

45,000 |

|

|

|

$79.80 |

|

|

Q4 2024 |

Crude Oil |

|

40,720 |

|

|

|

$78.15 |

|

ABOUT U.S. ENERGY

We are a growth company focused on consolidating

high-quality producing assets in the United States with the

potential to optimize production and generate free cash flow

through low-risk development while maintaining an attractive

shareholder returns program. More information about U.S.

Energy Corp. can be found at www.usnrg.com .

- Net debt/net cash calculation arrived at by taking debt

outstanding plus cash plus value of commodity derivative

portfolio.

- 12/31/2023 hedge position valued as of January 9, 2024.

- Liquidity calculated by taking the difference between the

Company’s current $20.0 million borrowing base and the Company’s

net debt/cash positions.

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this

communication which are not statements of historical fact

constitute forward-looking statements within the meaning of the

federal securities laws, including the Private Securities

Litigation Reform Act of 1995, that involve a number of risks and

uncertainties. Words such as “strategy,” “expects,” “continues,”

“plans,” “anticipates,” “believes,” “would,” “will,” “estimates,”

“intends,” “projects,” “goals,” “targets” and other words of

similar meaning are intended to identify forward-looking statements

but are not the exclusive means of identifying these

statements.

Important factors that may cause actual results

and outcomes to differ materially from those contained in such

forward-looking statements include, without limitation, risks

associated with the integration of the recently acquired assets;

the Company’s ability to recognize the expected benefits of the

acquisitions and the risk that the expected benefits and synergies

of the acquisition may not be fully achieved in a timely manner, or

at all; the amount of the costs, fees, expenses and charges related

to the acquisitions; the Company’s ability to comply with the terms

of its senior credit facilities; the ability of the Company to

retain and hire key personnel; the business, economic and political

conditions in the markets in which the Company operates;

fluctuations in oil and natural gas prices, uncertainties inherent

in estimating quantities of oil and natural gas reserves and

projecting future rates of production and timing of development

activities; competition; operating risks; acquisition risks;

liquidity and capital requirements; the effects of governmental

regulation; adverse changes in the market for the Company’s oil and

natural gas production; dependence upon third-party vendors; risks

associated with COVID-19, the global efforts to stop the spread of

COVID-19, potential downturns in the U.S. and global economies due

to COVID-19 and the efforts to stop the spread of the virus, and

COVID-19 in general; economic uncertainty relating to increased

inflation and global conflicts; the lack of capital available on

acceptable terms to finance the Company’s continued growth; and

other risk factors included from time to time in documents U.S.

Energy files with the Securities and Exchange Commission,

including, but not limited to, its Form 10-Ks, Form 10-Qs and Form

8-Ks. Other important factors that may cause actual results and

outcomes to differ materially from those contained in the

forward-looking statements included in this communication are

described in the Company’s publicly filed reports, including, but

not limited to, the Company’s Annual Report on Form 10-K for the

year ended December 31, 2022. These reports and filings are

available at www.sec.gov.

The Company cautions that the foregoing list of

important factors is not complete. All subsequent written and oral

forward-looking statements attributable to the Company or any

person acting on behalf of any Sale Agreement Parties are expressly

qualified in their entirety by the cautionary statements referenced

above. Other unknown or unpredictable factors also could have

material adverse effects on U.S. Energy’s future results. The

forward-looking statements included in this press release are made

only as of the date hereof. U.S. Energy cannot guarantee future

results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these

forward-looking statements. Finally, U.S. Energy undertakes no

obligation to update these statements after the date of this

release, except as required by law, and takes no obligation to

update or correct information prepared by third parties that are

not paid for by U.S. Energy. If we update one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other

forward-looking statements.

INVESTOR RELATIONS CONTACT

Mason McGuire

IR@usnrg.com(303) 993-3200www.usnrg.com

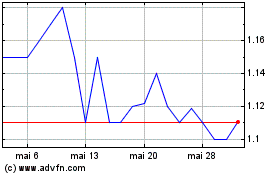

US Energy (NASDAQ:USEG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

US Energy (NASDAQ:USEG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025