- Partnership provides nation’s largest independent community

oncology network with additional resources and expertise to grow

platform and improve patient outcomes

- Investment further strengthens AmerisourceBergen’s solutions in

Specialty

- Put/call structure provides AmerisourceBergen with

capital-efficient pathway to full ownership of OneOncology in three

to five years

TPG (NASDAQ: TPG), a global alternative asset management firm,

and AmerisourceBergen Corporation (NYSE: ABC) today announced that

they have agreed to acquire OneOncology, a network of leading

oncology practices, from General Atlantic, a leading global growth

equity firm. TPG has agreed to acquire a majority interest in

OneOncology, and AmerisourceBergen will acquire a minority interest

in the company. OneOncology’s affiliated practices, physicians, and

management team will also retain a minority interest in the

company. The transaction values OneOncology at $2.1 billion.

“OneOncology has been focused on strengthening independent

oncology practices by helping them grow and deliver high-value

cancer services, and General Atlantic’s involvement and investment

have been central to our success,” said Dr. Jeff Patton, Chief

Executive Officer of OneOncology. “As we look ahead, we are excited

to continue building the platform in partnership with TPG, a proven

investor in the healthcare provider space, and AmerisourceBergen, a

healthcare leader with significant capabilities and solutions for

community oncology practices.”

“OneOncology’s physician leadership and partnership model

provide access to the latest clinical pathways, research, and

technology to deliver personalized care with market-leading patient

outcomes and experiences. The company is enabling high-quality and

efficient cancer care by empowering leading practices and

physicians to remain independent while providing benefits of scale

that create value for the entire healthcare ecosystem,” said

Kendall Garrison, Partner at TPG. “We believe that lower cost,

higher quality models represent the future of care delivery, and we

are proud to partner with Dr. Patton and the OneOncology team as

well as AmerisourceBergen to invest behind accessible,

best-in-class clinical care,” said John Schilling, Partner at

TPG.

“The investment in OneOncology will allow AmerisourceBergen to

further deepen our relationships with community oncologists and

expand on our solutions in specialty,” said Steven H. Collis,

Chairman, President & Chief Executive Officer of

AmerisourceBergen. “As a platform built by and for community

oncologists, OneOncology understands the operational complexities

oncologists face and works to simplify the provider experience to

drive improved patient outcomes. We are excited to work closely

with OneOncology’s team and our partners at TPG, who have deep

experience and a track record of success in supporting high-quality

healthcare companies. Our complementary skill sets and focus on

operational excellence and innovation uniquely position us to

continue to partner and support OneOncology’s network. We look

forward to discussing the transaction in greater detail on our

earnings call on May 2, when we will also discuss the continued

strength of our business.”

“Our 2018 investment in OneOncology helped launch a shared

vision to improve the future of cancer care amidst prevailing cost,

quality and access issues,” said Justin Sunshine, Managing Director

at General Atlantic. “We are proud that this mission-driven

approach has resulted in a leading oncology platform that empowers

high-quality and innovative cancer care in the community setting.

We wish Dr. Patton and the OneOncology team continued success in

their next phase of growth.”

TPG is investing in OneOncology through its U.S. and European

late-stage private equity platform, TPG Capital. TPG Capital has a

long history of partnering with leading management teams to invest

behind healthcare providers and services that are enhancing and

transforming how healthcare is delivered for the benefit of

patients and the broader healthcare community, including

Kelsey-Seybold Clinic, a leading value-based multi-specialty

physician group in Greater Houston, Kindred at Home, one of the

largest home health and hospice providers in the U.S., and Monogram

Health, a value-based specialty provider of in-home evidence-based

care and benefit management services for patients living with

chronic kidney disease and end-stage renal disease.

Broadens AmerisourceBergen’s Reach in Key Area of Focus and

Advances the Company’s Long-Term Vision

The proposed transaction will build on AmerisourceBergen’s key

strategic imperatives and areas of focus by:

- Deepening relationships with a leading network of community

oncology practices. OneOncology is one of the largest and

fastest growing community oncology practice management platforms in

the United States with over 900 affiliated providers across 14

states. Adding this leading network builds on AmerisourceBergen’s

strong ties to community healthcare providers.

- Expanding solutions for community oncology practices.

AmerisourceBergen is focused on developing technology, practice

management, and data & analytics solutions to help address

evolving needs and complexity for community oncology practices.

OneOncology’s practice management services are complementary to

AmerisourceBergen’s existing capabilities in inventory management,

practice analytics and clinical trial support.

- Investing in a commercial and strategic strength –

Specialty. AmerisourceBergen’s legacy of strength and solutions

in Specialty, oncology in particular, have been important drivers

of its historical growth and will continue to contribute to its

long-term growth. This strategic investment further enhances

AmerisourceBergen’s oncology platform.

Transaction Overview TPG, AmerisourceBergen, and

OneOncology’s affiliated practices, physicians, and management team

will form a new joint venture that will acquire OneOncology from

its existing shareholders, including current majority owner General

Atlantic. AmerisourceBergen will purchase its minority interest in

the joint venture for approximately $685 million in cash, which

will represent approximately 35% ownership in the joint

venture.

Beginning on the third anniversary of the closing of the joint

venture’s acquisition of OneOncology and ending on the day before

the fourth anniversary of that closing, TPG will have a put option

under which TPG may require AmerisourceBergen to purchase all of

the other interests in the joint venture, including TPG’s interest,

at a price equal to 19 times OneOncology’s adjusted earnings before

interest, taxes, depreciation and amortization (EBITDA) for the

most recently ended 12-month period prior to TPG’s exercise of the

put option, all of which is subject to various other adjustments

and qualifications. In addition, on the date that is the third

anniversary of the closing and again beginning on the fourth

anniversary of the closing and ending on the day before the fifth

anniversary of the closing, AmerisourceBergen will have a call

option to purchase all of the other interests in the joint venture,

including TPG’s, also at the price set forth above subject to

various other adjustments and qualifications.

The transaction is expected to close by the end of September

2023 and is subject to the satisfaction of customary closing

conditions, including receipt of required regulatory approvals.

AmerisourceBergen Accounting Summary Upon closing, the

minority interest in OneOncology is expected to contribute a few

cents to AmerisourceBergen’s adjusted diluted EPS in the first 12

months following closing.

Following the closing of the transaction, AmerisourceBergen

intends to account for its minority interest in OneOncology using

the equity method of accounting, recording AmerisourceBergen’s

future share of OneOncology’s net income or loss in Other Income,

net.

Advisors J.P. Morgan Securities LLC is serving as

exclusive financial advisor to AmerisourceBergen, and Morgan, Lewis

& Bockius LLP and Sidley Austin LLP are serving as

AmerisourceBergen’s legal advisors. Debevoise & Plimpton LLP

and Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C are serving

as legal advisors to TPG, and Guggenheim Securities, LLC is also

serving as an advisor to the firm. Centerview Partners is serving

as exclusive financial advisor to OneOncology and General Atlantic,

and Paul, Weiss, Rifkind, Wharton & Garrison LLP is serving as

OneOncology and General Atlantic’s legal advisor.

About TPG

TPG is a leading global alternative asset management firm,

founded in San Francisco in 1992, with $135 billion of assets under

management and investment and operational teams around the world.

TPG invests across five multi-strategy platforms: Capital, Growth,

Impact, Real Estate, and Market Solutions and our unique strategy

is driven by collaboration, innovation, and inclusion. Our teams

combine deep product and sector experience with broad capabilities

and expertise to develop differentiated insights and add value for

our fund investors, portfolio companies, management teams, and

communities. For more information, visit www.tpg.com or on Twitter

@TPG.

About AmerisourceBergen

AmerisourceBergen is a leading global pharmaceutical solutions

organization centered on improving the lives of people and animals

around the world. We partner with pharmaceutical innovators across

the value chain to facilitate and optimize market access to

therapies. Care providers depend on us for the secure, reliable

delivery of pharmaceuticals, healthcare products, and solutions.

Our 44,000+ worldwide team members contribute to positive health

outcomes through the power of our purpose: We are united in our

responsibility to create healthier futures. AmerisourceBergen is

ranked #10 on the Fortune 500 and #21 on the Global Fortune 500

with more than $200 billion in annual revenue. Learn more at

investor.amerisourcebergen.com.

AmerisourceBergen’s Cautionary Note Regarding Forward-Looking

Statements

This communication contains “forward-looking statements”. These

statements are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements may include, without limitation,

statements about the proposed transactions with TPG and

OneOncology, the expected timetable for completing the proposed

transactions, the benefits of the proposed transactions, future

opportunities for AmerisourceBergen, TPG and OneOncology and any

other statements regarding AmerisourceBergen’s, TPG’s or

OneOncology’s future operations, financial or operating results,

anticipated business levels, future earnings, planned activities,

anticipated growth, market opportunities, strategies, and other

expectations for future periods. Forward-looking statements may

often be identified by the use of words such as “aim,” “will”,

“may”, “could”, “should”, “would”, “project”, “believe”,

“anticipate”, “expect”, “plan”, “estimate”, “forecast”,

“potential”, “intend”, “continue”, “target” and variations of these

words or comparable words. Because forward-looking statements

inherently involve risks and uncertainties, actual future results

may differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause or contribute

to such differences include, but are not limited to: the parties’

ability to meet expectations regarding the timing of the proposed

transactions; the parties’ ability to consummate the proposed

transactions; the regulatory approvals required for the proposed

transactions not being obtained on the terms expected or on the

anticipated schedule or at all; inherent uncertainties involved in

the estimates and judgments used in the preparation of financial

statements and the providing of estimates of financial measures, in

accordance with GAAP and related standards, or on an adjusted

basis; the joint venture with TPG and the ownership of OneOncology

being more difficult, time consuming or costly than expected;

AmerisourceBergen’s or OneOncology’s failure to achieve expected or

targeted future financial and operating performance and results;

the possibility that OneOncology may be unable to achieve expected

benefits, synergies and operating efficiencies in connection with

the proposed transactions within the expected time frames or at

all; business disruption being greater than expected following the

proposed transactions; the retention of key physicians and

employees being more difficult following the proposed transactions;

the effect of any changes in customer and supplier relationships

and customer purchasing patterns; the impacts of competition;

changes in the economic and financial conditions of the business of

AmerisourceBergen, TPG or OneOncology; and uncertainties and

matters beyond the control of management and other factors

described under “Risk Factors” in AmerisourceBergen’s Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and other

filings with the SEC . You can access AmerisourceBergen’s filings

with the SEC through the SEC website at www.sec.gov or through

AmerisourceBergen’s website, and AmerisourceBergen strongly

encourages you to do so. Except as required by applicable law,

AmerisourceBergen and TPG undertake no obligation to update any

statements herein for revisions or changes after the date of this

communication.

About General Atlantic

General Atlantic is a leading global growth equity firm with

more than four decades of experience providing capital and

strategic support for over 495 growth companies throughout its

history. Established in 1980 to partner with visionary

entrepreneurs and deliver lasting impact, the firm combines a

collaborative global approach, sector specific expertise, a

long-term investment horizon and a deep understanding of growth

drivers to partner with great entrepreneurs and management teams to

scale innovative businesses around the world. General Atlantic has

more than $72 billion in assets under management inclusive of all

products as of December 31, 2022, and more than 220 investment

professionals based in New York, Amsterdam, Beijing, Hong Kong,

Jakarta, London, Mexico City, Miami, Mumbai, Munich, San Francisco,

São Paulo, Shanghai, Singapore, Stamford and Tel Aviv. For more

information on General Atlantic, please visit:

www.generalatlantic.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230420005572/en/

Investors: Bennett S. Murphy 610-727-3693

bmurphy@amerisourcebergen.com Media: Lauren

Esposito 215-460-6981

lesposito@amerisourcebergen.com TPG Leslie

Shribman and Courtney Power media@tpg.com General

Atlantic Emily Japlon

media@generalatlantic.com

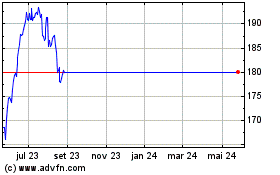

AmerisourceBergen (NYSE:ABC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AmerisourceBergen (NYSE:ABC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024