American Eagle Outfitters Announces Three-Year Strategy to Power Profitable Growth; Clear Path to $5.7 to $6.0B in Revenue and an Approximate 10% Operating Margin Rate

07 Março 2024 - 10:01AM

Business Wire

Building upon momentum and strong results achieved in 2023,

American Eagle Outfitters, Inc. (NYSE: AEO) today unveiled its new

Powering Profitable Growth plan, structured to deliver mid-to-high

teens annual operating income expansion on 3-5% annual revenue

growth over the next three years, and an approximate 10% operating

margin.

Fueled by a shift in strategy, culture and focus to generate

stronger profitability on continued growth, the multi-year plan is

centered around three key pillars:

- Amplify our brands: Grow American Eagle, powering market

leadership in denim and expansion into right-to-win adjacencies;

Fuel Aerie’s expansion and Accelerate activewear opportunity with

OFFLINE.

- Execute with financial discipline: Organization

structured to deliver consistent profit growth and shareholder

returns.

- Optimize operations: Leverage best-in-class operating

capabilities to fuel our growth and profit roadmap.

“Amplifying American Eagle and Aerie’s stronghold in casual

apparel is at the very center of our strategic plan. We see

incredible growth opportunities as we elevate key businesses and

expand into category adjacencies at American Eagle, fuel the

#AerieReal movement in underpenetrated markets and accelerate

OFFLINE’s significant potential in activewear. These efforts will

be supported by a sharp focus on profit expansion. We will utilize

our leading operating capabilities and leverage new technologies to

maximize ongoing efficiencies and deliver the very best and

innovative experiences for our customers,” commented Jay

Schottenstein, AEO’s Executive Chairman of the Board and Chief

Executive Officer.

“I’m extremely excited about our Powering Profitable Growth

strategy. We have passionate, driven and talented teams surrounded

by a renewed focus on performance. Together we look forward to

executing and delivering on our plan, creating long-term value for

our shareholders,” he continued.

In a separate release today the company reported fourth quarter

and full-year fiscal 2023 results, in which management provided

fiscal 2024 operating income guidance of $445 to $465 million,

based on 2 to 4% revenue growth inclusive of an approximately one

point revenue headwind from the shift in the retail calendar, which

is consistent with the long-term financial targets stated

above.

First quarter 2024 guidance was also provided reflecting

operating income in the range of $65 to $70 million. This reflects

revenue up mid-single digits, including an approximately one point

positive impact from the retail calendar shift.

Webcast and Supplemental Financial Information The

company will discuss its financial results and long-term strategy

and targets in an extended call beginning at 11:00 AM ET. The event

will feature presentations and a question-and-answer session with

members of the company’s executive leadership team. The event can

be accessed in the Investor Relations section on AEO’s website,

www.aeo-inc.com. A replay of the webcast will be archived

and made available online on the company’s website.

About American Eagle Outfitters, Inc. American Eagle

Outfitters, Inc. (NYSE: AEO) is a leading global specialty retailer

offering high-quality, on-trend clothing, accessories and personal

care products at affordable prices under its American Eagle® and

Aerie® brands. Our purpose is to show the world that there’s REAL

power in the optimism of youth. The company operates stores in the

United States, Canada, Mexico, and Hong Kong and ships to

approximately 80 countries worldwide through its websites. American

Eagle and Aerie merchandise also is available at more than 300

international locations operated by licensees in approximately 30

countries. To learn more about AEO and the company’s commitment to

Planet, People and Practices, please visit www.aeo-inc.com.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995

This release and related statements by management contain

forward-looking statements (as such term is defined in the Private

Securities Litigation Reform Act of 1995), which represent

management’s expectations or beliefs concerning future events,

including first quarter and annual fiscal 2024 results as well as

anticipated strategy impact on revenue growth and operating margin

in 2025 and 2026. Words such as “outlook,” "estimate," "project,"

"plan," "believe," "expect," "anticipate," "intend," “may,”

“potential,” and similar expressions may identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. All forward-looking statements made by the

company are inherently uncertain because they are based on

assumptions and expectations concerning future events and are

subject to change based on many important factors, some of which

may be beyond the company’s control. Except as may be required by

applicable law, we undertake no obligation to publicly update or

revise any forward-looking statements whether as a result of new

information, future events or otherwise and even if experience or

future changes make it clear that any projected results expressed

or implied therein will not be realized. The following factors, in

addition to the risks disclosed in Item 1A., Risk Factors, of our

Annual Report on Form 10-K for the fiscal year ended January 28,

2023 and in any other filings that we may make with the Securities

and Exchange Commission in some cases have affected, and in the

future could affect, the company's financial performance and could

cause actual results to differ materially from those expressed or

implied in any of the forward-looking statements included in this

release or otherwise made by management: the risk that the

company’s operating, financial and capital plans may not be

achieved; our inability to anticipate customer demand and changing

fashion trends and to manage our inventory commensurately;

seasonality of our business; our inability to achieve planned store

financial performance; our inability to react to raw material cost,

labor and energy cost increases; our inability to gain market share

in the face of declining shopping center traffic; our inability to

respond to changes in e-commerce and leverage omni-channel demands;

our inability to expand internationally; difficulty with our

international merchandise sourcing strategies; challenges with

information technology systems, including safeguarding against

security breaches; and global economic, public health, social,

political and financial conditions, and the resulting impact on

consumer confidence and consumer spending, as well as other changes

in consumer discretionary spending habits, which could have a

material adverse effect on our business, results of operations and

liquidity.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240306856009/en/

Line Media 412-432-3300 LineMedia@ae.com

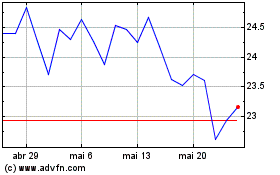

American Eagle Outfitters (NYSE:AEO)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

American Eagle Outfitters (NYSE:AEO)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025