Argan, Inc. (NYSE: AGX) (“Argan” or the “Company”) today

announces financial results for its second quarter of fiscal year

2024, ended July 31, 2023. The Company will host an investor

conference call today, September 6, 2023, at 5 p.m. ET.

Consolidated Financial Highlights

($ in thousands, except per share data)

July 31,

For the Quarter Ended:

2023

2022

Change

Revenues

$

141,349

$

118,110

$

23,239

Gross profit

23,742

24,387

(645

)

Gross margin %

16.8

%

20.6

%

(3.8

)%

Net income

$

12,767

$

4,222

$

8,545

Diluted per share

0.94

0.30

0.64

EBITDA

17,945

14,888

3,057

Cash dividends per share

0.25

0.25

—

July 31,

For the Six Months Ended:

2023

2022

Change

Revenues

$

245,024

$

218,387

$

26,637

Gross profit

37,966

44,125

(6,159

)

Gross margin %

15.5

%

20.2

%

(4.7

)%

Net income

$

14,876

$

11,707

$

3,169

Diluted per share

1.10

0.80

0.30

EBITDA

21,594

25,621

(4,027

)

Cash dividends per share

0.50

0.50

—

July 31,

January 31,

As of:

2023

2023

Change

Cash, cash equivalents and investments

$

346,415

$

325,458

$

20,957

Net liquidity (1)

239,526

236,199

3,327

Share repurchase treasury stock, at

cost

92,329

88,641

3,688

Project backlog

824,000

822,000

2,000

(1)

Net liquidity, or working

capital, is defined as total current assets less total current

liabilities.

David Watson, President and Chief Executive Officer of Argan,

commented, “Our second quarter performance reflected increased

momentum as demonstrated by significant revenue growth, improved

bottom line profitability and continuing strength in our balance

sheet. During the quarter we were pleased to see our consolidated

gross margin percentage return to a range more in line with

expected levels based on our revenue mix. Backlog at the close of

the second quarter is the third straight quarter in excess of $0.8

billion as new contracts continue to offset the conversion of

existing backlog into revenue. For example, APC received full

notice to proceed with the Shannonbridge Power Project in Ireland,

which upon completion, will contribute to the availability of

reliable electricity supply throughout Ireland during critical

situations and emergencies. Additionally, Gemma has received

limited notices to proceed on three solar and battery projects in

Illinois representing a combined 160 MW of electrical power and 22

MW of energy storage. Both projects demonstrate the growing

diversity of our backlog and our leadership position as a

full-service partner in the planning and construction of all types

of power facilities. Our pipeline is strong and we’re energized by

the opportunities we’re seeing related to marketplace recognition

of our capabilities related to both traditional and renewable power

resources.”

Second Quarter Results

Consolidated revenues for the quarter ended July 31, 2023 were

$141.3 million, an increase of $23.2 million, or 19.7%, from

consolidated revenues of $118.1 million reported for the comparable

prior year period. The Company experienced increased revenues at

several projects, including the Shannonbridge Power Project, the

Trumbull Energy Center, a large combined cycle, gas-fired power

plant under construction near Lordstown, Ohio, the three ESB

FlexGen peaker plants being built in Dublin, Ireland; and the

Kilroot Power Station under construction near Belfast in Northern

Ireland. The increase in revenues were partially offset by

decreased revenues at the Guernsey Power Station and the Maple Hill

Solar energy facility, as those projects are generally near or at

completion.

For the three-month period ended July 31, 2023, Argan reported

consolidated gross profit of approximately $23.7 million, which

represented a gross profit percentage of approximately 16.8% of

corresponding consolidated revenues. This was a decrease from gross

profit percentage of approximately 20.6% for the three-month period

ended July 31, 2022, primarily due to change in the Company’s

revenue mix.

Selling, general and administrative expenses declined by $0.5

million, to $10.5 million for the quarter ended July 31, 2023, from

$11.0 million in the comparable prior year period.

For the quarter ended July 31, 2023, Argan achieved net income

of $12.8 million, or $0.94 per diluted share, compared to $4.2

million, or $0.30 per diluted share, for last year’s comparable

quarter. EBITDA (earnings before interest, taxes, depreciation and

amortization) for the quarter ended July 31, 2023 was $17.9 million

compared to $14.9 million in the same period of last year. These

results benefitted from an increase in earnings on our invested

funds as yields between periods increased meaningfully and from a

reduction in income tax expense between periods due to the

unfavorable research and development credits adjustment recorded in

the prior year quarter.

First Six Months Results

Consolidated revenues for the six months ended July 31, 2023

were $245.0 million, an increase of $26.6 million, or 12.2%, from

consolidated revenues of $218.4 million reported for the comparable

prior year period, with the improvement primarily due to the growth

in revenues for the second quarter of the current year.

For the six months ended July 31, 2023, consolidated gross

profit declined to approximately $38.0 million, or consolidated

gross margin of 15.5% compared to consolidated gross profit of

$44.1 million or consolidated gross margin of 20.2% reported for

the six months ended July 31, 2022. The decline in gross profit was

primarily due to the change in the mix of major projects for the

six months ended July 31, 2023.

Selling, general and administrative expenses declined slightly

to $21.1 million for the six months ended July 31, 2023, from $21.6

million incurred in the comparable prior year period.

For the six months ended July 31, 2023, Argan achieved net

income of $14.9 million, or $1.10 per diluted share, versus net

income of $11.7 million, or $0.80 per diluted share, for last

year’s comparable period. EBITDA for the six months ended July 31,

2023 was $21.6 million compared to $25.6 million in the same period

of last year. These results, reflect the reduction in consolidated

gross profit between periods, offset by an increase in earnings on

our invested funds and the reduction in income tax expense between

periods due to the aforementioned research and development credits

adjustment recorded in the prior year.

As of July 31, 2023, cash and liquid investments totaled $346

million and balance sheet net liquidity was $240 million;

furthermore, the Company had no debt.

Share Repurchase Program

During the quarter ended July 31, 2023, the Company repurchased

77,132 shares of common stock at a cost of $3.1 million. Since the

start of the program to repurchase shares of our common stock which

began in November 2021, the Company has repurchased approximately

2.6 million shares of common stock, or approximately 16% of its

outstanding shares at that time, at a cost of approximately $95.3

million, under the $125.0 million share repurchase plan authorized

by the Company’s board of directors.

Conference Call and Webcast

Argan will host a conference call and webcast for investors

today, September 6, 2023, at 5 p.m. ET.

Domestic stockholders and interested parties may participate in

the conference call by dialing (888) 506-0062 and international

participants should dial (973) 528-0011; all callers shall use

access code: 405007. The call and the accompanying slide deck will

also be webcast at:

https://www.webcaster4.com/Webcast/Page/2961/48950

The conference call and slide deck may also be accessed via the

Investor Center section of the Company’s website at

https://arganinc.com/investor-center/. Please allow extra time

prior to the call to visit the site.

A replay of the teleconference will be available until September

20, 2023, and can be accessed by dialing 877-481-4010 (domestic) or

919-882-2331 (international). The replay access code is 48950. A

replay of the webcast can be accessed until September 6, 2024.

About Argan

Argan’s primary business is providing a full range of

construction and related services to the power industry. Argan’s

service offerings focus on the engineering, procurement and

construction of natural gas-fired power plants and renewable energy

facilities, along with related commissioning, maintenance, project

development and technical consulting services, through its Gemma

Power Systems and Atlantic Projects Company operations. Argan also

owns The Roberts Company, which is a fully integrated fabrication,

construction and industrial plant services company, and SMC

Infrastructure Solutions, which provides telecommunications

infrastructure services.

Certain matters discussed in this press release may constitute

forward-looking statements within the meaning of the federal

securities laws. Reference is hereby made to the cautionary

statements made by the Company with respect to risk factors set

forth in its most recent reports on Form 10-K, Forms 10-Q and other

SEC filings. The Company’s future financial performance is subject

to risks and uncertainties including, but not limited to, the

successful addition of new contracts to project backlog, the

receipt of corresponding notices to proceed with contract

activities, and the Company’s ability to successfully complete the

projects that it obtains. Actual results and the timing of certain

events could differ materially from those projected in or

contemplated by the forward-looking statements due to the risk

factors highlighted above and described regularly in the Company’s

SEC filings.

ARGAN, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

Six Months Ended

July 31,

July 31,

2023

2022

2023

2022

REVENUES

$

141,349

$

118,110

$

245,024

$

218,387

Cost of revenues

117,607

93,723

207,058

174,262

GROSS PROFIT

23,742

24,387

37,966

44,125

Selling, general and administrative

expenses

10,501

10,984

21,092

21,559

INCOME FROM OPERATIONS

13,241

13,403

16,874

22,566

Other income, net

4,118

505

3,489

1,100

INCOME BEFORE INCOME TAXES

17,359

13,908

20,363

23,666

Income tax expense

4,592

9,686

5,487

11,959

NET INCOME

12,767

4,222

14,876

11,707

Foreign currency translation

adjustments

(185

)

(687

)

255

(1,951

)

Net unrealized losses on

available-for-sale securities

(683

)

—

(720

)

—

COMPREHENSIVE INCOME

$

11,899

$

3,535

$

14,411

$

9,756

NET INCOME PER SHARE

Basic

$

0.95

$

0.30

$

1.11

$

0.81

Diluted

$

0.94

$

0.30

$

1.10

$

0.80

WEIGHTED AVERAGE NUMBER OF SHARES

OUTSTANDING

Basic

13,403

14,134

13,408

14,516

Diluted

13,542

14,247

13,544

14,616

CASH DIVIDENDS PER SHARE

$

0.25

$

0.25

$

0.50

$

0.50

ARGAN, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Dollars in thousands, except

per share data)

July 31,

January 31,

2023

2023

(Unaudited)

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

204,799

$

173,947

Investments

141,616

151,511

Accounts receivable, net

44,532

50,132

Contract assets

20,747

24,778

Other current assets

43,438

38,334

TOTAL CURRENT ASSETS

455,132

438,702

Property, plant and equipment, net

10,457

10,430

Goodwill

28,033

28,033

Intangible assets, net

2,413

2,609

Deferred taxes, net

3,910

3,689

Right-of-use and other assets

5,763

6,024

TOTAL ASSETS

$

505,708

$

489,487

LIABILITIES AND STOCKHOLDERS'

EQUITY

CURRENT LIABILITIES

Accounts payable

$

31,530

$

56,375

Accrued expenses

67,620

49,867

Contract liabilities

116,456

96,261

TOTAL CURRENT LIABILITIES

215,606

202,503

Noncurrent liabilities

5,066

6,087

TOTAL LIABILITIES

220,672

208,590

COMMITMENTS AND CONTINGENCIES

STOCKHOLDERS’ EQUITY

Preferred stock, par value $0.10 per share

– 500,000 shares authorized; no shares issued and outstanding

—

—

Common stock, par value $0.15 per share –

30,000,000 shares authorized; 15,828,289 shares issued; 13,353,653

and 13,441,590 shares outstanding at July 31, 2023 and January 31,

2023, respectively

2,374

2,374

Additional paid-in capital

162,323

162,208

Retained earnings

216,009

207,832

Less treasury stock, at cost – 2,474,636

and 2,386,699 shares at July 31, 2023 and January 31, 2023,

respectively

(92,329

)

(88,641

)

Accumulated other comprehensive loss

(3,341

)

(2,876

)

TOTAL STOCKHOLDERS’ EQUITY

285,036

280,897

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

505,708

$

489,487

ARGAN, INC. AND

SUBSIDIARIES

RECONCILIATIONS TO

EBITDA

(In thousands)

(Unaudited)

Three Months Ended

July 31,

2023

2022

Net income, as reported

$

12,767

$

4,222

Income tax expense

4,592

9,686

Depreciation

488

747

Amortization of intangible assets

98

233

EBITDA

$

17,945

$

14,888

Six Months Ended

July 31,

2023

2022

Net income, as reported

$

14,876

$

11,707

Income tax expense

5,487

11,959

Depreciation

1,035

1,556

Amortization of intangible assets

196

399

EBITDA

$

21,594

$

25,621

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230906382408/en/

Company Contact: David Watson 301.315.0027

Investor Relations Contact: John Nesbett/Jennifer

Belodeau IMS Investor Relations 203.972.9200

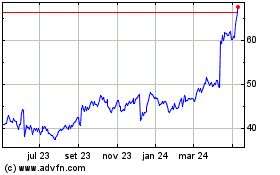

Argan (NYSE:AGX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

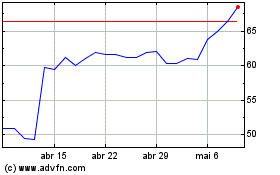

Argan (NYSE:AGX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024