Argan, Inc. (NYSE: AGX) (“Argan” or the “Company”) today

announces financial results for its first quarter of fiscal year

2025 ended April 30, 2024. The Company will host an investor

conference call today, June 6, 2024, at 5:00 p.m. ET.

Consolidated Financial Highlights

($s in thousands, except per share data)

April 30,

For the Quarter Ended:

2024

2023

Change

Revenues

$

157,682

$

103,675

$

54,007

Gross profit

17,944

14,224

3,720

Gross margin %

11.4

%

13.7

%

(2.3

)%

Net income

$

7,882

$

2,109

$

5,773

Diluted income per share

0.58

0.16

0.42

EBITDA (earnings before interest expense,

taxes, depreciation and amortization

11,890

3,649

8,241

Cash dividends per share

0.30

0.25

0.05

April 30,

January 31,

As of:

2024

2024

Change

Cash, cash equivalents and investments

$

416,356

$

412,405

$

3,951

Net liquidity (1)

246,728

244,919

1,809

Share repurchase treasury stock, at

cost

97,728

97,528

200

Project backlog

824,000

757,000

67,000

(1)

Net liquidity, or working capital, is

defined as total current assets less total current liabilities.

David Watson, President and Chief Executive Officer of Argan,

commented, “Fiscal 2025 is off to a solid start with consolidated

revenues growth of 52% to $157.7 million, reflecting strong

revenues performance at both Gemma Power Systems and The Roberts

Company. We achieved net income of $7.9 million, or $0.58 per

diluted share, and EBITDA increased by $8.2 million to $11.9

million, which represents a 225.8% increase for the quarter,

despite a loss of $2.6 million incurred during the quarter

associated with challenges we’ve previously detailed related to the

Kilroot Power Station project in Northern Ireland.

“The Company closed the first quarter with backlog of $824

million, which includes over $300 million in renewable projects.

Our project pipeline is robust, reflecting the growing urgency to

bring additional energy resources online to meet the newly

anticipated significant rise in power demand, that is being driven

by the addition of high-demand data centers, the onshoring of

manufacturing operations and the expansion of EV use. Argan’s

expertise and capabilities support the construction of all types of

energy facilities, and we are optimistic about the opportunities

we’re seeing to participate in renewable projects as well as the

natural gas facilities that can provide the 24/7 energy generation

required to power the changing economy.”

“As we move through fiscal 2025, we remain intently focused on

expanding our leadership role as a trusted partner in the

construction and management of complex power facility projects. Our

proven and comprehensive capabilities apply to both traditional and

renewable energy sources, providing Argan a competitive advantage

as the industry moves to fill the need for reliable energy sources

in the face of unprecedented demand for power.”

First Quarter Results

Consolidated revenues for the quarter ended April 30, 2024 were

$157.7 million, an increase of $54.0 million, or 52.1%, from

consolidated revenues of $103.7 million reported for the comparable

prior year quarter. The Company experienced increased revenues at

several projects, including the Trumbull Energy Center, a large

combined cycle, gas-fired power plant under construction near

Lordstown, Ohio; the Midwest Solar and Battery Projects; and the

Shannonbridge Power Project. Revenues from construction activities

at the three ESB FlexGen Peaker Plants being built in Dublin,

Ireland, remained steady between both periods. The overall increase

in consolidated revenues between quarters was partially offset by

decreased construction revenues associated with the Guernsey Power

Station project and the Kilroot power facility, as those projects

have concluded and have been exited, respectively.

For the quarter ended April 30, 2024, Argan’s consolidated gross

profit was approximately $17.9 million, or 11.4% of consolidated

revenues, reflecting positive profit contributions from all three

reportable business segments. However, the consolidated gross

profit for the quarter was adversely impacted by the loss related

to the Kilroot project, and reflects the changing mix of projects

and contract types. Consolidated gross profit for the quarter ended

April 30, 2023 was $14.2 million, or 13.7% of consolidated

revenues.

Selling, general and administrative expenses increased by $0.8

million, to $11.4 million for the quarter ended April 30, 2024,

from $10.6 million in the comparable prior year quarter. However,

as a percentage of revenues, these expenses declined to 7.2% from

10.2% between the same quarters.

Other income, net, for the three months ended April 30, 2024 was

$4.8 million, which reflects income earned during the period on

invested funds in the total amount of approximately $4.5 million.

During the quarter ended April 30, 2024, the Company recorded

income tax expense of $3.4 million primarily due to consolidated

pre-tax book income of $11.3 million. For the comparable quarter

last year, Argan recorded income tax expense of $0.9 million on

consolidated pre-tax book income of $3.0 million.

For the quarter ended April 30, 2024, Argan achieved net income

of $7.9 million, or $0.58 per diluted share, compared to $2.1

million, or $0.16 per diluted share, for last year’s comparable

quarter. EBITDA for the quarter ended April 30, 2024 increased to

$11.9 million compared to $3.6 million in the same quarter of last

year.

Argan maintained a substantial total balance of cash, cash

equivalents and short-term investments during the quarter. The

total balances were $416.4 million and $412.4 million as of April

30 and January 31, 2024, respectively. Balance sheet net liquidity

was $246.7 million at April 30, 2024 and $244.9 million at January

31, 2024; furthermore, the Company had no debt.

Conference Call and Webcast

Argan will host a conference call and webcast for investors

today, June 6, 2024, at 5:00 p.m. ET.

Domestic stockholders and interested parties may participate in

the conference call by dialing (888) 506-0062 and international

participants should dial (973) 528-0011; all callers shall use

access code: 882997.

The call and the accompanying slide deck will also be webcast

at:

https://www.webcaster4.com/Webcast/Page/2961/50656

The conference call and slide deck may also be accessed via the

Investor Center section of the Company’s website at

https://arganinc.com/investor-center. Please allow extra time prior

to the call to visit the site.

A replay of the teleconference will be available until June 20,

2024, and can be accessed by dialing 877-481-4010 (domestic) or

919-882-2331 (international). The replay access code is 50656. A

replay of the webcast can be accessed until June 6, 2025.

About Argan

Argan’s primary business is providing a full range of

construction and related services to the power industry. Argan’s

service offerings focus on the engineering, procurement and

construction of natural gas-fired power plants and renewable energy

facilities, along with related commissioning, maintenance, project

development and technical consulting services, through its Gemma

Power Systems and Atlantic Projects Company operations. Argan also

owns The Roberts Company, which is a fully integrated industrial

construction, fabrication and plant services company, and SMC

Infrastructure Solutions, which provides telecommunications

infrastructure services.

Non-GAAP Financial Measures

The Company prepares its financial statements in accordance with

accounting principles generally accepted in the United States

(“GAAP”). Within this press release, the Company may make reference

to EBITDA, a non-GAAP financial measure. The Company believes that

the non-GAAP financial measure described in this press release is

important to management and investors because the measure

supplements the understanding of Argan’s ongoing operating results,

excluding the effects of capital structure, depreciation,

amortization, and tax rates. The non-GAAP financial measure

referred to above should be considered in conjunction with, and not

as a substitute for, the GAAP financial information presented in

this press release. Financial tables at the end of this press

release provide a reconciliation of the non-GAAP financial measure

to its comparable GAAP measure.

Safe Harbor Statement

Certain matters discussed in this press release may constitute

forward-looking statements within the meaning of the federal

securities laws. Reference is hereby made to the cautionary

statements made by the Company with respect to risk factors set

forth in its most recent reports on Form 10-K, Forms 10-Q and other

SEC filings. The Company’s future financial performance is subject

to risks and uncertainties including, but not limited to, the

successful addition of new contracts to project backlog, the

receipt of corresponding notices to proceed with contract

activities, the Company’s ability to successfully complete the

projects that it obtains, and the Company’s effectiveness in

mitigating future losses related to the Kilroot loss contract.

Actual results and the timing of certain events could differ

materially from those projected in or contemplated by the

forward-looking statements due to the risk factors highlighted

above and described regularly in the Company’s SEC filings.

ARGAN, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

April 30,

2024

2023

REVENUES

$

157,682

$

103,675

Cost of revenues

139,738

89,451

GROSS PROFIT

17,944

14,224

Selling, general and administrative

expenses

11,425

10,591

INCOME FROM OPERATIONS

6,519

3,633

Other income (loss), net

4,794

(629

)

INCOME BEFORE INCOME TAXES

11,313

3,004

Income tax expense

3,431

895

NET INCOME

$

7,882

$

2,109

OTHER COMPREHENSIVE INCOME, NET OF

TAXES

Foreign currency translation

adjustments

(790

)

440

Net unrealized losses on

available-for-sale securities

(969

)

(37

)

COMPREHENSIVE INCOME

$

6,123

$

2,512

NET INCOME PER SHARE

Basic

$

0.59

$

0.16

Diluted

$

0.58

$

0.16

WEIGHTED AVERAGE NUMBER OF SHARES

OUTSTANDING

Basic

13,257

13,413

Diluted

13,572

13,546

CASH DIVIDENDS PER SHARE

$

0.30

$

0.25

ARGAN, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Dollars in thousands, except

per share data)

April 30,

January 31,

2024

2024

(Unaudited)

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

207,738

$

197,032

Investments

208,618

215,373

Accounts receivable, net

59,960

47,326

Contract assets

54,385

48,189

Other current assets

43,625

39,259

TOTAL CURRENT ASSETS

574,326

547,179

Property, plant and equipment, net

10,825

11,021

Goodwill

28,033

28,033

Intangible assets, net

2,120

2,217

Deferred taxes, net

2,305

2,259

Right-of-use and other assets

6,799

7,520

TOTAL ASSETS

$

624,408

$

598,229

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES

Accounts payable

$

66,448

$

39,485

Accrued expenses

60,721

81,721

Contract liabilities

200,429

181,054

TOTAL CURRENT LIABILITIES

327,598

302,260

Noncurrent liabilities

3,655

5,030

TOTAL LIABILITIES

331,253

307,290

STOCKHOLDERS’ EQUITY

Preferred stock, par value $0.10 per share

– 500,000 shares authorized; no shares issued and outstanding

—

—

Common stock, par value $0.15 per share –

30,000,000 shares authorized; 15,828,289 shares issued; 13,350,180

and 13,242,520 shares outstanding at April 30, 2024 and January 31,

2024, respectively

2,374

2,374

Additional paid-in capital

164,501

164,183

Retained earnings

229,364

225,507

Less treasury stock, at cost – 2,478,109

and 2,585,769 shares at April 30, 2024 and January 31, 2024,

respectively

(97,728)

(97,528)

Accumulated other comprehensive loss

(5,356)

(3,597)

TOTAL STOCKHOLDERS’ EQUITY

293,155

290,939

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

624,408

$

598,229

ARGAN, INC. AND

SUBSIDIARIES

RECONCILIATION TO

EBITDA

(In thousands)

(Unaudited)

Three Months Ended

April 30,

2024

2023

Net income, as reported

$

7,882

$

2,109

Income tax expense

3,431

895

Depreciation

480

547

Amortization of intangible assets

97

98

EBITDA

$

11,890

$

3,649

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240606731655/en/

Company Contact: David Watson 301.315.0027 Investor

Relations Contacts: John Nesbett/Jennifer Belodeau IMS Investor

Relations 203.972.9200

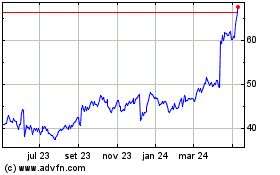

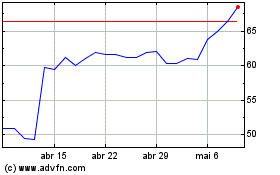

Argan (NYSE:AGX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Argan (NYSE:AGX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024