Argan, Inc. (NYSE: AGX) (“Argan” or the “Company”) today

announces financial results for its second quarter of fiscal year

2025 ended July 31, 2024. The Company will host an investor

conference call today, September 5, 2024, at 5:00 p.m. ET.

Consolidated Financial Highlights

($ in thousands, except per share data)

July 31,

For the Quarter Ended:

2024

2023

Change

Revenues

$

227,015

$

141,349

$

85,666

Gross profit

31,105

23,742

7,363

Gross margin %

13.7

%

16.8

%

(3.1

)%

Net income

$

18,198

$

12,767

$

5,431

Diluted income per share

1.31

0.94

0.37

EBITDA

24,842

17,945

6,897

Cash dividends per share

0.30

0.25

0.05

July 31,

For the Six Months Ended:

2024

2023

Change

Revenues

$

384,697

$

245,024

$

139,673

Gross profit

49,049

37,966

11,083

Gross margin %

12.8

%

15.5

%

(2.7

)%

Net income

$

26,080

$

14,876

$

11,204

Diluted per share

1.90

1.10

0.80

EBITDA

36,732

21,594

15,138

Cash dividends per share

0.60

0.50

0.10

July 31,

January 31,

As of:

2024

2024

Change

Cash, cash equivalents and investments

$

484,682

$

412,405

$

72,277

Net liquidity (1)

259,827

244,919

14,908

Share repurchase treasury stock, at

cost

99,644

97,528

2,116

Project backlog

1,035,000

757,000

278,000

(1)

Net liquidity, or working

capital, is defined as total current assets less total current

liabilities.

David Watson, President and Chief Executive Officer of Argan,

commented, “We are seeing continued momentum across our business as

we move through fiscal 2025, as demonstrated by a 61% increase in

consolidated revenues to $227 million during the second quarter,

significantly enhanced profitability of $18.2 million, or $1.31 per

diluted share, and EBITDA of approximately $25 million – our

highest quarterly EBITDA level since 2017. These consolidated

results reflect the strong performance of Gemma Power Systems and

its sustained growth in the renewable market. The Roberts Company

also generated record quarterly revenues of almost $50 million as

it continues the delivery of successful projects to its

customers.

“The Company closed the second quarter with backlog of $1.0

billion, which reflects an increase from last quarter of

approximately $210 million, and includes $570 million of renewable

projects. We believe that the addition of high energy demand data

centers, the onshoring of manufacturing operations and the

expansion of electric vehicle use are primary drivers of the

increasing forecasts of future electrical power demands and the

robust pipeline of new business opportunities. Our pipeline remains

strong and we are confident that our energy-agnostic capabilities

and proven success leave us well positioned to compete effectively

for the growing number of projects coming to market. There is a

critical need to establish consistent, high quality energy

resources to ensure grid reliability, and we’re excited about the

opportunities we are seeing to grow Argan’s role as a partner of

choice for the construction of all types of energy facilities.”

Second Quarter Results

Consolidated revenues for the quarter ended July 31, 2024 were

$227.0 million, an increase of $85.7 million, or 60.6%, from

consolidated revenues of $141.3 million reported for the comparable

prior year quarter. The Company experienced increased revenues at

several projects, including the Trumbull Energy Center, a large

combined cycle, gas-fired power plant under construction near

Lordstown, Ohio; the Midwest Solar and Battery Projects; the 405 MW

Midwest Solar Project; and the Louisiana LNG Facility. The overall

increase in consolidated revenues between quarters was partially

offset by decreased construction revenues associated with the

Guernsey Power Station project, the Shannonbridge Power Project,

the ESB FlexGen Peaker Plants and the Kilroot power facility, as

those projects have concluded or are nearly complete.

For the quarter ended July 31, 2024, Argan’s consolidated gross

profit was approximately $31.1 million, or 13.7% of consolidated

revenues, reflecting positive profit contributions from all three

reportable business segments. The consolidated gross profit

percentage for the quarter reflects the changing mix of projects

and contract types. Consolidated gross profit for the quarter ended

July 31, 2023 was $23.7 million, or 16.8% of consolidated

revenues.

Selling, general and administrative expenses increased by $1.9

million, to $12.4 million for the quarter ended July 31, 2024, from

$10.5 million in the comparable prior year quarter. However, as a

percentage of revenues, these expenses declined to 5.5% in the

second quarter of fiscal 2025 as compared to 7.4% in the second

quarter of fiscal 2024.

Other income, net, for the three months ended July 31, 2024 was

$5.6 million, which reflected income earned during the period on

invested funds in the total amount of approximately $4.8 million.

During the quarter ended July 31, 2024, the Company recorded income

tax expense of $6.1 million, primarily due to consolidated pre-tax

book income of $24.3 million. For the comparable quarter last year,

Argan recorded income tax expense of $4.6 million on consolidated

pre-tax book income of $17.4 million.

For the quarter ended July 31, 2024, Argan achieved net income

of $18.2 million, or $1.31 per diluted share, compared to $12.8

million, or $0.94 per diluted share, for last year’s second

quarter. EBITDA for the quarter ended July 31, 2024 increased to

$24.8 million compared to $17.9 million in the same quarter of last

year.

Argan maintained a substantial total balance of cash, cash

equivalents and investments during the quarter. The total balances

were $484.7 million and $412.4 million as of July 31 and January

31, 2024, respectively. Balance sheet net liquidity was $259.8

million at July 31, 2024 and $244.9 million at January 31, 2024;

furthermore, the Company had no debt.

First Six Months Results

Consolidated revenues for the six months ended July 31, 2024

were $384.7 million, an increase of $139.7 million, or 57.0%, from

consolidated revenues of $245.0 million reported for the comparable

prior year period.

For the six months ended July 31, 2024, consolidated gross

profit increased to approximately $49.0 million, or consolidated

gross margin of 12.8%, compared to consolidated gross profit of

$38.0 million, or consolidated gross margin of 15.5%, reported for

the six months ended July 31, 2023. The consolidated gross profit

for the six months ended July 31, 2024 reflects the changing mix of

projects and contract types and was adversely impacted by losses

related to the Kilroot project.

Selling, general and administrative expenses increased by $2.8

million to $23.9 million for the six months ended July 31, 2024,

from $21.1 million in the comparable prior year period. However, as

a percentage of revenues, these expenses declined to 6.2% from 8.6%

between the periods.

Other income, net, for the six months ended July 31, 2024 was

$10.4 million, which reflects primarily income earned during the

period on invested funds. During the six months ended July 31,

2024, the Company recorded income tax expense of $9.5 million

primarily due to consolidated pre-tax book income of $35.6 million.

For the comparable quarter last year, Argan recorded income tax

expense of $5.5 million on consolidated pre-tax book income of

$20.4 million.

For the six months ended July 31, 2024, Argan achieved net

income of $26.1 million, or $1.90 per diluted share, versus net

income of $14.9 million, or $1.10 per diluted share, for last

year’s comparable period. EBITDA for the six months ended July 31,

2024 was $36.7 million compared to $21.6 million in the same period

of last year.

Conference Call and Webcast

Argan will host a conference call and webcast for investors

today, September 5, 2024, at 5:00 p.m. ET.

Domestic stockholders and interested parties may participate in

the conference call by dialing (888) 506-0062 and international

participants should dial (973) 528-0011; all callers shall use

access code: 246016.

The call and the accompanying slide deck will also be webcast

at: https://www.webcaster4.com/Webcast/Page/2961/50947

The conference call and slide deck may also be accessed via the

Investor Center section of the Company’s website at

https://arganinc.com/investor-center. Please allow extra time prior

to the call to visit the site.

A replay of the teleconference will be available until September

19, 2024, and can be accessed by dialing 877-481-4010 (domestic) or

919-882-2331 (international). The replay access code is 50947. A

replay of the webcast can be accessed until September 5, 2025.

About Argan

Argan’s primary business is providing a full range of

construction and related services to the power industry. Argan’s

service offerings focus on the engineering, procurement and

construction of natural gas-fired power plants and renewable energy

facilities, along with related commissioning, maintenance, project

development and technical consulting services, through its Gemma

Power Systems and Atlantic Projects Company operations. Argan also

owns The Roberts Company, which is a fully integrated industrial

construction, fabrication and plant services company, and SMC

Infrastructure Solutions, which provides telecommunications

infrastructure services.

Non-GAAP Financial Measures

The Company prepares its financial statements in accordance with

accounting principles generally accepted in the United States

(“GAAP”). Within this press release, the Company makes reference to

EBITDA, a non-GAAP financial measure. The Company believes that the

non-GAAP financial measure described in this press release is

important to management and investors because the measure

supplements the understanding of Argan’s ongoing operating results,

excluding the effects of capital structure, depreciation,

amortization, and tax rates. The non-GAAP financial measure

referred to above should be considered in conjunction with, and not

as a substitute for, the GAAP financial information presented in

this press release. Financial tables at the end of this press

release provide a reconciliation of the non-GAAP financial measures

to the comparable GAAP measures.

Safe Harbor Statement

Certain matters discussed in this press release may constitute

forward-looking statements within the meaning of the federal

securities laws. Reference is hereby made to the cautionary

statements made by the Company with respect to risk factors set

forth in its most recent reports on Form 10-K, Forms 10-Q and other

SEC filings. The Company’s future financial performance is subject

to risks and uncertainties including, but not limited to, the

successful addition of new contracts to project backlog, the

receipt of corresponding notices to proceed with contract

activities, the Company’s ability to successfully complete the

projects that it obtains, and the Company’s effectiveness in

mitigating future losses related to the Kilroot loss contract.

Actual results and the timing of certain events could differ

materially from those projected in or contemplated by the

forward-looking statements due to the risk factors highlighted

above and described regularly in the Company’s SEC filings.

ARGAN, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

Six Months Ended

July 31,

July 31,

2024

2023

2024

2023

REVENUES

$

227,015

$

141,349

$

384,697

$

245,024

Cost of revenues

195,910

117,607

335,648

207,058

GROSS PROFIT

31,105

23,742

49,049

37,966

Selling, general and administrative

expenses

12,428

10,501

23,853

21,092

INCOME FROM OPERATIONS

18,677

13,241

25,196

16,874

Other income, net

5,604

4,118

10,398

3,489

INCOME BEFORE INCOME TAXES

24,281

17,359

35,594

20,363

Income tax expense

6,083

4,592

9,514

5,487

NET INCOME

18,198

12,767

26,080

14,876

OTHER COMPREHENSIVE INCOME, NET OF

TAXES

Foreign currency translation

adjustments

(186

)

(185

)

(976

)

255

Net unrealized gains (losses) on

available-for-sale securities

1,459

(683

)

490

(720

)

COMPREHENSIVE INCOME

$

19,471

$

11,899

$

25,594

$

14,411

NET INCOME PER SHARE

Basic

$

1.36

$

0.95

$

1.96

$

1.11

Diluted

$

1.31

$

0.94

$

1.90

$

1.10

WEIGHTED AVERAGE NUMBER OF SHARES

OUTSTANDING

Basic

13,403

13,403

13,331

13,408

Diluted

13,880

13,542

13,727

13,544

CASH DIVIDENDS PER SHARE

$

0.30

$

0.25

$

0.60

$

0.50

ARGAN, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Dollars in thousands, except

per share data)

July 31,

January 31,

2024

2024

(Unaudited)

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

232,685

$

197,032

Investments

251,997

215,373

Accounts receivable, net

95,315

47,326

Contract assets

46,086

48,189

Other current assets

48,871

39,259

TOTAL CURRENT ASSETS

674,954

547,179

Property, plant and equipment, net

12,098

11,021

Goodwill

28,033

28,033

Intangible assets, net

2,022

2,217

Deferred taxes, net

1,637

2,259

Right-of-use and other assets

7,830

7,520

TOTAL ASSETS

$

726,574

$

598,229

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES

Accounts payable

$

99,693

$

39,485

Accrued expenses

61,698

81,721

Contract liabilities

253,736

181,054

TOTAL CURRENT LIABILITIES

415,127

302,260

Noncurrent liabilities

3,379

5,030

TOTAL LIABILITIES

418,506

307,290

STOCKHOLDERS’ EQUITY

Preferred stock, par value $0.10 per share

– 500,000 shares authorized; no shares issued and outstanding

—

—

Common stock, par value $0.15 per share –

30,000,000 shares authorized; 15,828,289 shares issued; 13,497,550

and 13,242,520 shares outstanding at July 31, 2024 and January 31,

2024, respectively

2,374

2,374

Additional paid-in capital

165,902

164,183

Retained earnings

243,519

225,507

Less treasury stock, at cost – 2,330,739

and 2,585,769 shares at July 31, 2024 and January 31, 2024,

respectively

(99,644

)

(97,528

)

Accumulated other comprehensive loss

(4,083

)

(3,597

)

TOTAL STOCKHOLDERS’ EQUITY

308,068

290,939

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

726,574

$

598,229

ARGAN, INC. AND

SUBSIDIARIES

RECONCILIATION TO

EBITDA

(In thousands)

(Unaudited)

Three Months Ended

July 31,

2024

2023

Net income, as reported

$

18,198

$

12,767

Income tax expense

6,083

4,592

Depreciation

463

488

Amortization of intangible assets

98

98

EBITDA

$

24,842

$

17,945

Six Months Ended

July 31,

2024

2023

Net income, as reported

$

26,080

$

14,876

Income tax expense

9,514

5,487

Depreciation

943

1,035

Amortization of intangible assets

195

196

EBITDA

$

36,732

$

21,594

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240905600152/en/

Company Contact: David Watson 301.315.0027

Investor Relations Contacts: John Nesbett/Jennifer

Belodeau IMS Investor Relations 203.972.9200

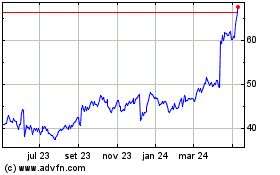

Argan (NYSE:AGX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

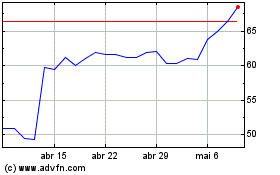

Argan (NYSE:AGX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024