− Transaction Increases Scale and Enhances

Access to Securitization Markets –

− Synergistic Expansion Expected to Drive

Earnings Accretion and Long-Term Growth −

Ellington Financial Inc. (NYSE: EFC) (“Ellington

Financial”), a real estate investment trust investing in a

diverse array of financial assets including residential and

commercial mortgage loans, and Great Ajax Corp. (NYSE: AJX)

(“Great Ajax”), a real estate investment trust that invests

primarily in residential mortgage loans, announced today that they

have entered into a definitive merger agreement pursuant to which

Ellington Financial will acquire Great Ajax. The transaction is

expected to close by year-end 2023.

Pursuant to the merger agreement terms, each share of Great Ajax

common stock will be converted into 0.5308 shares1 of Ellington

Financial common stock, or approximately 12.5 million shares of

Ellington Financial common stock in the aggregate.2 Ellington

Financial’s common stock closing price on the New York Stock

Exchange (the "NYSE") on June 30, 2023 implies an offer price of

$7.33 per share of Great Ajax common stock, representing an

approximate 19% premium to the Great Ajax common stock closing

price on the NYSE on June 30, 2023. Upon the closing of the

transaction, Ellington Financial stockholders are expected to own

approximately 84% of the combined company’s stock, while Great Ajax

stockholders are expected to own approximately 16% of the combined

company’s stock.3 In addition, Ellington Financial will assume

Great Ajax’s outstanding senior unsecured notes and convertible

senior notes.

The combined company will operate as “Ellington Financial Inc.”

and its shares will continue to trade on the NYSE under Ellington

Financial’s current ticker symbol, “EFC.” Ellington Financial

Management LLC, an affiliate of Ellington Management Group, L.L.C.,

will continue to manage the combined company.

“We are extremely excited about the opportunity to add a

significant portfolio of strategic assets, including over $1

billion of highly creditworthy first-lien residential RPL and NPL

investments at attractive prices, which complement our existing

investment portfolio nicely and align with our expertise and

existing management platform,” stated Laurence Penn, Ellington

Financial’s Chief Executive Officer. “We believe that the benefits

of this acquisition also include greater operating efficiencies, a

larger market capitalization, and a closer relationship with

Gregory Funding, Great Ajax’s highly respected affiliated mortgage

servicer. We believe that this transaction will position us well to

drive accretive earnings growth and provide strategic and financial

benefits to our stockholders.”

“We are pleased to combine our investment portfolios and create

a company that we believe will be well positioned for growth and

value creation,” said Lawrence Mendelsohn, Great Ajax’s Chairman

and Chief Executive Officer. “We look forward to working closely

with the Ellington Financial team to complete the transaction and

deliver value for our stockholders.”

Anticipated Benefits to Ellington Financial and Great Ajax

Stockholders from the Acquisition:

- Synergistic Expansion of Existing Business Lines: Great

Ajax’s investment portfolio includes over $1 billion of first-lien

residential re-performing loans (“RPLs”) and non-performing loans

(“NPLs”), most of which are financed through term,

non-mark-to-market, non-recourse securitizations, which would

significantly expand Ellington Financial’s current RPL/NPL

strategy. Combining Ellington Financial’s hedging, trading, and

structuring capabilities with Great Ajax’s whole loan asset

management resolution expertise is expected to create a unique

platform that will optimize Great Ajax’s portfolio and deliver

greater returns to shareholders.

- Strategically Compelling: Great Ajax’s strategic equity

investment in Gregory Funding LLC, its affiliated servicer, is

expected to unlock multiple synergies and operating efficiencies

across Ellington Financial’s investment portfolio.

- Significant Increase to Scale: Estimated pro forma

market capitalization in excess of $1 billion, which is expected to

enhance liquidity for both Ellington Financial and Great Ajax

shareholders. Anticipated increase in operating expense

efficiencies resulting from fixed expenses spread over a larger

equity base.

- Strong Financial Rationale: Ellington Financial expects

to rotate out of selected lower-yielding Great Ajax assets and

redeploy capital in higher-yielding strategies. The transaction is

expected to be accretive to earnings within one year of

closing.

- Enhanced Portfolio Diversification: Great Ajax’s NPL

investment portfolio would enhance Ellington Financial’s portfolio

diversification with assets that complement Ellington Financial’s

existing investment strategy and align with Ellington’s

expertise.

Additional information on the transaction and the anticipated

effects on Ellington Financial can be found in Ellington

Financial’s investor deck relating to the transaction posted on

Ellington Financial’s website. The investor deck is also being

furnished by Ellington Financial in a Current Report on Form 8-K

being filed by Ellington Financial with the Securities and Exchange

Commission (the “SEC”) on the date hereof.

Management, Governance and Corporate Headquarters

Upon completion of the transaction, Ellington Financial’s Chief

Executive Officer and President, Laurence Penn, will continue to

lead the combined company, and Ellington Financial executives

Michael Vranos, Mark Tecotzky, and JR Herlihy will remain in their

current roles. The combined company will remain headquartered in

Old Greenwich, Connecticut.

Timing and Approvals

The transaction has been unanimously approved by the Boards of

Directors of Ellington Financial and Great Ajax. The Board of

Directors of Great Ajax formed a Special Committee comprised of

independent directors (the “Special Committee”) to review the

transaction and make a recommendation to the Board of Directors of

Great Ajax. The transaction was unanimously recommended by the

Special Committee. The transaction is expected to close by the end

of 2023, subject to approval by Great Ajax’s stockholders and other

closing conditions set forth in the merger agreement.

Advisors

Keefe, Bruyette & Woods, A Stifel Company is acting as

exclusive financial advisor and Vinson & Elkins is acting as

legal advisor to Ellington Financial. Piper Sandler & Co. is

acting as exclusive financial advisor and Mayer Brown LLP is acting

as legal advisor to Great Ajax. BTIG, LLC is acting as exclusive

financial advisor to the Special Committee and Sheppard Mullin LLP

is acting as legal advisor to the Special Committee.

ADDITIONAL INFORMATION ABOUT THE MERGER

In connection with the proposed merger, Ellington Financial

intends to file a registration statement on Form S-4 with the SEC

that includes a Great Ajax proxy statement and an Ellington

Financial prospectus. This communication is not a substitute for

the registration statement, the proxy statement/prospectus or any

other documents that will be made available to the stockholders of

Great Ajax. In connection with the proposed merger, Ellington

Financial and Great Ajax also plan to file relevant materials with

the SEC. GREAT AJAX STOCKHOLDERS ARE URGED TO READ ALL RELEVANT

DOCUMENTS FILED WITH THE SEC, INCLUDING THE RELEVANT PROXY

STATEMENT/PROSPECTUS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. A

definitive proxy statement/prospectus will be sent to Great Ajax’s

stockholders. Investors may obtain a copy of the proxy

statement/prospectus (when it becomes available) and other relevant

documents filed by Ellington Financial and Great Ajax free of

charge at the SEC’s website, www.sec.gov. Copies of the documents

filed by Ellington Financial with the SEC will be available free of

charge on Ellington Financial’s website at

http://www.ellingtonfinancial.com or by contacting Ellington

Financial’s Investor Relations at (203) 409-3575. Copies of the

documents filed by Great Ajax with the SEC will be available free

of charge on Great Ajax’s website at www.greatajax.com or by

contacting Great Ajax at (503) 505-5670.

PARTICIPANTS IN SOLICITATION RELATING TO THE MERGER

Ellington Financial and Great Ajax and their respective

directors and executive officers and certain other affiliates of

Ellington Financial and Great Ajax may be deemed to be participants

in the solicitation of proxies from Great Ajax stockholders in

connection with the proposed merger.

Information about the directors and executive officers of Great

Ajax is available in the proxy statement for its 2023 annual

meeting of stockholders filed with the SEC on April 21, 2023.

Information about the directors and executive officers of Ellington

Financial is available in the proxy statement for its 2023 annual

meeting of stockholders filed with the SEC on April 6, 2023. Other

information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests, by

security holdings or otherwise, will be contained in the proxy

statement/prospectus and other relevant materials filed with the

SEC regarding the proposed merger when they become available. Great

Ajax stockholders should read the proxy statement/prospectus

carefully when it becomes available before making any voting or

investment decisions. Investors may obtain free copies of these

documents from Ellington Financial or Great Ajax using the sources

indicated above.

NO OFFER OR SOLICITATION

This communication and the information contained herein does not

constitute an offer to sell or the solicitation of an offer to buy

or sell any securities or a solicitation of a proxy or of any vote

or approval, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended. This communication may be deemed to be solicitation

material in respect of the proposed merger.

Forward-Looking Statements

This communication contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are not

historical in nature and can be identified by words such as

“believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,”

“continue,” “intend,” “should,” “would,” “could,” “goal,”

“objective,” “will,” “may,” “seek” or similar expressions or their

negative forms. Such forward-looking statements may include or

relate to statements about the proposed merger, including its

financial and operational impact; the benefits of the proposed

merger; the scale, market presence, portfolio diversification,

liquidity or earnings of the combined company; enhanced access to

securitization markets; anticipated synergies regarding Great

Ajax’s equity investments in its affiliated servicer, Gregory

Funding LLC; the relationship with Gregory Funding LLC; anticipated

creditworthiness of acquired assets; alignment of acquired assets

with existing management platform; anticipated operating

efficiencies; anticipated market capitalization; beliefs about

strategic and financial benefits; expected enhancements to

liquidity; anticipated operating expense efficiencies;

implementation of hedging, trading, and structuring capabilities

and their impact on the portfolio and returns to stockholders;

capital rotation out of certain assets and redeployment into other

strategies; expected accretion to earnings and the timing of the

expected accretion; investment opportunities and returns of the

combined company; future growth; portfolio optimization; delivery

of greater returns; the timing of future events; and other

statements of management’s beliefs, intentions or goals. These

statements are based on Ellington Financial’s and Great Ajax’s

current expectations and beliefs and are subject to a number of

trends and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements.

Ellington Financial and Great Ajax can give no assurance that their

expectations will be attained. Factors that could cause actual

results to differ materially from Ellington Financial’s or Great

Ajax’s expectations include, but are not limited to, the risk that

the proposed merger or any other proposed strategic transaction

will not be consummated within the expected time period or at all;

the occurrence of any event, change or other circumstance that

could give rise to the termination of the merger agreement or the

definitive agreement for any other proposed strategic transaction;

the failure to satisfy the conditions to the consummation of the

proposed merger or any other proposed strategic transaction,

including any necessary stockholder approvals; risks related to the

disruption of management’s attention from ongoing business

operations due to the proposed merger or any other proposed

strategic transaction; the effect of the announcement of the

proposed merger or any other proposed strategic transaction on the

operating results and businesses generally of Ellington Financial,

Great Ajax or any other party to a proposed strategic transaction

with Ellington Financial; the outcome of any legal proceedings

relating to the proposed merger or any other proposed strategic

transaction; the ability to successfully integrate the businesses

following the proposed merger or any other proposed strategic

transaction; changes in interest rates or the market value of the

investments of Ellington Financial, Great Ajax or any other party

to a proposed strategic transaction with Ellington Financial;

market volatility; changes in mortgage default rates and prepayment

rates; the availability and terms of financing; changes in

government regulations affecting the business of Ellington

Financial, Great Ajax or any other party to a proposed strategic

transaction with Ellington Financial; the ability of Ellington

Financial and Great Ajax to maintain their exclusion from

registration under the Investment Company Act of 1940; the ability

of Ellington Financial and Great Ajax to maintain their

qualification as a REIT; changes in market conditions and economic

trends, such as changes to fiscal or monetary policy, heightened

inflation, slower growth or recession, and currency fluctuations;

and other factors, including those set forth in the section

entitled “Risk Factors” in Ellington Financial’s most recent Annual

Report on Form 10-K and Great Ajax’s most recent Annual Report on

Form 10-K and Ellington Financial’s and Great Ajax’s Quarterly

Reports on Form 10-Q filed with the SEC, and other reports filed by

Ellington Financial and Great Ajax with the SEC, copies of which

are available on the SEC’s website, www.sec.gov. Forward-looking

statements are not guarantees of performance or results and speak

only as of the date such statements are made. Except as required by

law, neither Ellington Financial nor Great Ajax undertakes any

obligation to update or revise any forward-looking statement in

this communication, whether to reflect new information, future

events, changes in assumptions or circumstances or otherwise.

About Ellington Financial

Ellington Financial invests in a diverse array of financial

assets, including residential and commercial mortgage loans,

reverse mortgage loans, residential and commercial mortgage-backed

securities, consumer loans and asset-backed securities backed by

consumer loans, collateralized loan obligations, non-mortgage and

mortgage-related derivatives, debt and equity investments in loan

origination companies, and other strategic investments. Ellington

Financial is externally managed and advised by Ellington Financial

Management LLC, an affiliate of Ellington Management Group,

LLC.

About Great Ajax Asset Investment Corp.

Great Ajax Corp. (NYSE: AJX) is a REIT that focuses primarily on

acquiring, investing in and managing RPLs and NPLs secured by

single-family residences and commercial properties. In addition to

its continued focus on RPLs and NPLs, it also originates and

acquires small balance commercial mortgage (“SBC”) loans secured by

multi-family retail/residential and mixed use properties. Great

Ajax is externally managed by Thetis Asset Management LLC, an

affiliated entity. Great Ajax’s mortgage loans and other real

estate assets are serviced by Gregory Funding LLC, an affiliated

entity.

1 Pursuant to the merger agreement, the exchange ratio could be

adjusted for certain dilutive or accretive share issuances by Great

Ajax or Ellington Financial prior to closing. Additionally,

pursuant to the merger agreement, Ellington Financial has agreed to

pay holders of Great Ajax common stock contingent cash

consideration depending upon certain potential repurchases of Great

Ajax securities prior to closing on certain terms. 2 Based on

23.549 million shares of Great Ajax common stock outstanding as of

June 30, 2023. 3 The expected ownership by Ellington Financial and

Great Ajax stockholders of the combined company’s stock does not

assume the completion of the previously announced, but not yet

consummated, acquisition of Arlington Asset Investment Corp. by

Ellington Financial (the “Ellington Financial/Arlington Merger”),

which may occur prior to the closing of Ellington Financial’s

acquisition of Great Ajax. Assuming the prior completion of the

Ellington Financial/Arlington Merger, upon the closing of the

transaction, Great Ajax stockholders are expected to own

approximately 14% of the combined company’s stock. The completion

of the Ellington Financial/Arlington Merger is subject to the

approval by Arlington’s stockholders and other customary closing

conditions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230703409077/en/

Ellington Financial Inc. Investor Relations (203)

409-3575 info@ellingtonfinancial.com

Great Ajax Corp. Mary Doyle Chief Financial Officer

mary.doyle@great-ajax.com 503-444-4224

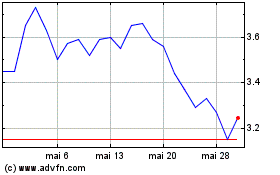

Great Ajax (NYSE:AJX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Great Ajax (NYSE:AJX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024