Great Ajax Corp. (NYSE: AJX, “Great Ajax” or the “Company”)

today announced the following financial results for the quarter

ended September 30, 2024.

Third Quarter Financial Highlights:

- GAAP net loss attributable to common stockholders of $(8.0)

million, or $(0.18) per diluted share1

- Earnings Available for Distribution of $(5.4) million or

$(0.12) per diluted common share1,2

- Book value per common share of $5.47 at September 30,

20241

- Paid a common dividend of $2.7 million, or $0.06 per common

share

Q3 2024

Q2 2024

Summary of Operating Results

GAAP Net Loss per Diluted Common

Share1

$

(0.18

)

$

(0.32

)

GAAP Net Loss

$

(8.0

)

million

$

(12.7

)

million

Non-GAAP Results

Earnings Available for Distribution per

Diluted Common Share1,2

$

(0.12

)

$

(0.24

)

Earnings Available for Distribution2

$

(5.4

)

million

$

(9.6

)

million

Book Value

Book Value per Common Share1

$

5.47

$

5.56

Book Value

$

246.1

million

$

253.6

million

Common Dividend

Common Dividend per Share

$

0.06

$

0.06

Common Dividend

$

2.7

million

$

2.2

million

- Per common share calculations for both GAAP net loss and

Earnings Available for Distribution are based on 45,327,254 and

39,344,128 weighted average diluted shares for the quarters ended

September 30, 2024 and June 30, 2024, respectively. Per share

calculations of Book Value are based on 44,978,969 and 45,605,549

common shares outstanding as of September 30, 2024 and June 30,

2024, respectively.

- Earnings Available for Distribution is a non-GAAP financial

measure. For a reconciliation of Earnings Available for

Distribution to GAAP net loss, as well as an explanation of this

measure, please refer to the section entitled Non-GAAP Financial

Measures and Reconciliation to GAAP Net Loss.

“When we completed the strategic transaction with Great Ajax, we

were clear about our mission: to transform the Company from a

legacy residential mortgage vehicle into an opportunistic real

estate platform,” said Michael Nierenberg, Chief Executive Officer

of Rithm Capital Corp. “During the third quarter, we made

significant progress towards doing so by selling down $148 million

UPB of legacy assets and growing our commercial real estate debt

portfolio to over $100 million UPB. We are excited about the future

of the Company and are committed to providing shareholders with

growth and value creation.”

Third Quarter Company Highlights:

- Loan and Security Sales: Sold residential loans and securities

with approximately $148.0 million in unpaid principal balance

(“UPB”), generating net proceeds of approximately $31.7

million.

- Commercial Real Estate Investments: Acquired $81.9 million in

UPB of commercial mortgage-backed securities (“CMBS”), bringing our

total investment in CMBS to $101.9 million, as we continue to

execute on our transition into the commercial real estate

sector.

- Capital Activity: On September 6, 2024, the Company filed a

shelf registration statement with the U.S. Securities and Exchange

Commission (“SEC”) to increase the aggregate maximum offering price

of its common stock, preferred stock, debt securities, warrants and

units to $400 million. The filed shelf registration statement when

declared effective by the SEC will replace the Company’s prior

shelf registration statement. The securities described in the

recently filed shelf registration statement may not be sold and

offers to buy may not be accepted prior to the time the

registration statement becomes effective. This press release shall

not constitute an offer to sell or the solicitation of an offer to

buy, nor shall there be any sale of the securities in any state or

other jurisdiction in which such offer, solicitation, or sale would

be unlawful prior to registration or qualification under the

securities laws of any such state or other jurisdiction.

- Dividend Declaration: On October 18, 2024, our board of

directors declared a cash dividend of $0.06 per common share to be

paid on November 29, 2024, to stockholders of record as of November

15, 2024.

Rebranding to Rithm Property Trust

In connection with the Company’s strategic transaction with

Rithm Capital Corp. (“Rithm”), the Company expects to change its

name and rebrand as Rithm Property Trust Inc. (“Rithm Property

Trust”) and to change its ticker symbol on the New York Stock

Exchange to “RPT”. The rebranding initiative highlights a new

chapter in the Company’s evolution as an opportunistic real estate

investment platform.

The name change is expected to take effect during the fourth

quarter of 2024, pursuant to customary notices.

Earnings Conference Call

Great Ajax will host a conference call at 8:00 AM ET on Monday,

October 21, 2024, to review its financial results for the third

quarter of 2024. The conference call may be accessed by dialing

1-844-746-0740 (from within the U.S.) or 1-412-317-5106 (from

outside of the U.S.) ten minutes prior to the scheduled start of

the call; please reference “Great Ajax Third Quarter 2024 Earnings

Call.” In addition, participants are encouraged to pre-register for

the conference call at

https://dpregister.com/sreg/10193667/fdb89356c2.

A simultaneous webcast of the conference call will be available

to the public on a listen-only basis at www.greatajax.com. Please

allow extra time prior to the call to visit the website and

download any necessary software required to listen to the internet

broadcast.

A telephonic replay of the conference call will also be

available two hours following the call’s completion through 11:59

P.M. Eastern Time on Monday, October 28 2024, by dialing

1-877-344-7529 (from within the U.S.) or 1-412-317-0088 (from

outside of the U.S.); please reference access code “6885966.”

About Great Ajax Corp.

Great Ajax Corp. is a real estate investment platform externally

managed by RCM GA Manager LLC, an affiliate of Rithm. Great Ajax

has historically focused on acquiring, investing in and managing

re-performing loans and non-performing loans secured by

single-family residences and commercial properties. In connection

with its recent strategic transaction with Rithm, the Company

expects to transition to a flexible commercial real estate focused

investment strategy. Great Ajax is a Maryland corporation that is

organized and conducts its operations to qualify as a real estate

investment trust (“REIT”) for federal income tax purposes.

Forward-Looking Statements

This press release contains certain information which

constitutes “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Words such as

“may,” “will,” “seek,” “believes,” “intends,” “expects,”

“projects,” “anticipates,” “plans” and “future” or similar

expressions are intended to identify forward-looking statements,

including the Company’s expectation of the effective date of the

name change and its new ticker symbol on the New York Stock

Exchange. These statements are not historical facts. These

forward-looking statements represent management’s current

expectations regarding future events and are subject to the

inherent uncertainties in predicting future results and conditions,

many of which are beyond our control. Accordingly, you should not

place undue reliance on any forward-looking statements contained

herein. For a discussion of some of the risks and important factors

that could affect such forward-looking statements see the sections

entitled “Cautionary Statement Regarding Forward-Looking

Statements”, “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” in the

Company’s most recent annual and quarterly reports and other

filings, including the Company’s recent proxy statements, filed

with the Securities and Exchange Commission. The Company expressly

disclaims any obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by law.

GREAT AJAX CORP. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Dollars in thousands except

per share amounts)

(Unaudited)

Three months ended

September 30, 2024

June 30, 2024

Revenues:

Interest income

$

12,348

$

11,915

Interest expense

(8,660

)

(11,567

)

Net interest income

3,688

348

Net change in the allowance for credit

losses

(857

)

—

Net interest income after the net change

in the allowance for credit losses

2,831

348

Loss from investments in affiliates

(624

)

(974

)

Mark to market loss on mortgage loans

held-for-sale, net

(1,712

)

(6,488

)

Other loss

(3,278

)

(1,844

)

Total loss, net

(2,783

)

(8,958

)

Expenses:

Loan servicing fees

593

1,324

Management fee

2,235

2,173

Professional fees

1,083

855

Fair value adjustment on mark to market

liabilities

—

(4,430

)

Other expense

1,286

4,753

Total expense

5,197

4,675

Loss before provision for income taxes

(7,980

)

(13,633

)

Provision for income taxes (benefit)

(23

)

(772

)

Net loss

(7,957

)

(12,861

)

Less: net income/(loss) attributable to

the non-controlling interest

72

(119

)

Net loss attributable to the Company

(8,029

)

(12,742

)

Net loss attributable to common

stockholders

$

(8,029

)

$

(12,742

)

Net loss per share of common

stock:

Basic

$

(0.18

)

$

(0.32

)

Diluted

$

(0.18

)

$

(0.32

)

Weighted average number of shares of

common stock outstanding:

Basic

45,327,254

39,344,128

Diluted

45,327,254

39,344,128

GREAT AJAX CORP. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(Dollars in thousands except

per share amounts)

September 30, 2024

December 31, 2023

Assets:

(Unaudited)

Cash and cash equivalents

$

84,016

$

52,834

Mortgage loans held-for-sale, net

31,315

55,718

Mortgage loans held-for-investment,

net

403,056

864,551

Investments in securities

available-for-sale, at fair value

166,650

131,558

Investments in securities

held-to-maturity

47,144

59,691

Investment in equity securities at fair

value

21,918

—

Investments in beneficial interests

88,996

104,162

Other assets

15,056

67,777

Total Assets

$

858,151

$

1,336,291

Liabilities and Equity

Liabilities:

Secured borrowings, net

$

266,776

$

411,212

Borrowings under repurchase

transactions

231,464

375,745

Convertible senior notes

—

103,516

Notes payable, net

107,432

106,844

Warrant liability

—

16,644

Accrued expenses and other liabilities

5,386

11,435

Total Liabilities

611,058

1,025,396

Equity:

Preferred stock $0.01 par value,

25,000,000 shares authorized

Series A 7.25% Fixed-to-Floating Rate

Cumulative Redeemable, $25.00 liquidation preference per share,

zero shares issued and outstanding at September 30, 2024 and

424,949 shares issued and outstanding at December 31, 2023

—

9,411

Series B 5.00% Fixed-to-Floating Rate

Cumulative Redeemable, $25.00 liquidation preference per share,

zero shares issued and outstanding at September 30, 2024 and

1,135,590 shares issued and outstanding at December 31, 2023

—

25,143

Common stock $0.01 par value, 125,000,000

shares authorized, 44,978,969 shares issued and outstanding at

September 30, 2024 and 27,460,161 shares issued and outstanding at

December 31, 2023

466

285

Additional paid-in capital

423,623

352,060

Treasury stock

(11,594

)

(9,557

)

Retained deficit

(158,126

)

(54,382

)

Accumulated other comprehensive loss

(8,279

)

(14,027

)

Equity attributable to stockholders

246,090

308,933

Non-controlling interests

1,003

1,962

Total Equity

247,093

310,895

Total Liabilities and Equity

$

858,151

$

1,336,291

NON-GAAP FINANCIAL MEASURES AND RECONCILIATION TO GAAP NET

LOSS

“Earnings available for distribution” is a non-GAAP financial

measure of the Company’s operating performance, which is used by

management to evaluate the Company’s performance excluding: (i) net

realized and unrealized gains and losses on certain assets and

liabilities; (ii) other net income and losses not related to the

performance of the investment portfolio; and (iii) non-capitalized

transaction related expenses.

The Company has three primary variables that impact its

performance: (i) Net interest margin on assets held within the

investment portfolio; (ii) realized and unrealized gains or losses

on assets held within the investment portfolio, including any

impairment or reserve for expected credit losses; and, (iii) the

Company’s operating expenses and taxes.

The Company’s definition of earnings available for distribution

excludes certain realized and unrealized losses, which although

they represent a part of the Company’s recurring operations, are

subject to significant variability and are generally limited to a

potential indicator of future economic performance. Within other

net income and losses, management primarily excludes equity-based

compensation expenses.

With regard to non-capitalized transaction-related expenses,

management does not view these costs as part of the Company’s core

operations, as they are considered by management to be similar to

realized losses incurred at acquisition. Non-capitalized

transaction-related expenses generally relate to legal and

valuation service costs, as well as other professional service

fees, incurred when the Company acquires certain investments.

Management believes that the adjustments to compute “earnings

available for distribution” specified above allow investors and

analysts to readily identify and track the operating performance of

the assets that form the core of the Company’s activity, assist in

comparing the core operating results between periods, and enable

investors to evaluate the Company’s current core performance using

the same financial measure that management uses to operate the

business. Management also utilizes earnings available for

distribution as a financial measure in its decision-making process

relating to improvements to the underlying fundamental operations

of the Company’s investments, as well as the allocation of

resources between those investments, and management also relies on

earnings available for distribution as an indicator of the results

of such decisions. Earnings available for distribution excludes

certain recurring items, such as gains and losses (including

impairment) and non-capitalized transaction-related expenses,

because they are not considered by management to be part of the

Company’s core operations for the reasons described herein. As such

earnings available for distribution is not intended to reflect all

of the Company’s activity and should be considered as only one of

the factors used by management in assessing the Company’s

performance, along with GAAP net income which is inclusive of all

of the Company’s activities.

The Company views earnings available for distribution as a

consistent financial measure of its portfolio’s ability to generate

income for distribution to common stockholders. Earnings available

for distribution does not represent and should not be considered as

a substitute for, or superior to, net income or as a substitute

for, or superior to, cash flows from operating activities, each as

determined in accordance with GAAP, and the Company’s calculation

of this financial measure may not be comparable to similarly

entitled financial measures reported by other companies.

Furthermore, to maintain qualification as a REIT, U.S. federal

income tax law generally requires that the Company distribute at

least 90% of its REIT taxable income annually, determined without

regard to the deduction for dividends paid and excluding net

capital gains. Because the Company views earnings available for

distribution as a consistent financial measure of its ability to

generate income for distribution to common stockholders, earnings

available for distribution is one metric, but not the exclusive

metric, that the Company’s board of directors uses to determine the

amount, if any, and the payment date of dividends on common stock.

However, earnings available for distribution should not be

considered as an indication of the Company’s taxable income, a

guaranty of its ability to pay dividends or as a proxy for the

amount of dividends it may pay, as earnings available for

distribution excludes certain items that impact its cash needs.

Reconciliation of GAAP Net

Loss to Earnings Available for Distribution

(Dollars in thousands except

per share amounts)

(Unaudited)

The table below provides a reconciliation

of earnings available for distribution to the most directly

comparable GAAP financial measure:

Three months ended

September 30, 2024

June 30, 2024

Net loss attributable to common

stockholders

$

(8,029

)

$

(12,742

)

Adjustments

Provision for income taxes (benefit)

(23

)

(772

)

Net income (loss) attributable to

non-controlling interest

72

(119

)

Realized and unrealized gains

1,640

2,058

Expenses related to the Strategic

Transaction

1,010

883

Other adjustments

(30

)

1,094

Earnings Available for Distribution

$

(5,360

)

$

(9,598

)

Basic Earnings Available for Distribution

per common share1

$

(0.12

)

$

(0.24

)

Diluted Earnings Available for

Distribution per common share1

$

(0.12

)

$

(0.24

)

1 Per common share calculations for both GAAP net loss and

Earnings Available for Distribution are based on 45,327,254 and

39,344,128 weighted average diluted shares for the quarters ended

September 30, 2024 and June 30, 2024, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021830819/en/

Investor Relations 646-868-5483 IR@great-ajax.com

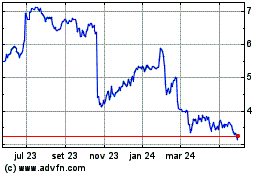

Great Ajax (NYSE:AJX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

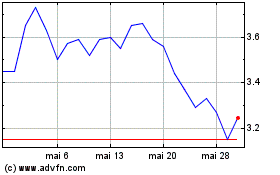

Great Ajax (NYSE:AJX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024