Apple Hospitality REIT, Inc. (NYSE: APLE) (the “Company” or

“Apple Hospitality”) today announced that it has completed the

acquisition of the 192-room Embassy Suites by Hilton South Jordan

Salt Lake City (the “Hotel”) for approximately $36.8 million, or

$191,000 per key.

“We are pleased to expand our portfolio with the acquisition of

this ideally located Embassy Suites by Hilton in South Jordan,”

said Nelson Knight, President, Real Estate and Investments of Apple

Hospitality. “South Jordan is a thriving, dynamic city in the Salt

Lake City metropolitan area that has experienced strong economic,

employment and population growth in recent years and is projected

to see continued expansion well into the future. With its central

location on the Wasatch Front, South Jordan offers easy access to a

wide range of demand generators for business, leisure and group

travel unique to Utah. As we continue to explore different

opportunities, we remain focused on pursuing transactions that

cultivate and refine our current portfolio and enhance long-term

shareholder value. We have two additional hotels under contract for

purchase and continue to underwrite numerous opportunities.”

The Embassy Suites South Jordan Salt Lake City opened in March

2018 and is located at 10333 South Jordan Gateway, South Jordan,

Utah. The Hotel is located next to the Utah Transit Authority’s

FrontRunner South Jordan Station and along Interstate 15, both of

which provide direct access to downtown Salt Lake City and the Salt

Lake City International Airport. In addition, the Hotel is

convenient to The Shops at South Town, South Jordan Towne Center,

America First Field, a variety of restaurants, performing arts

venues, outdoor recreational spaces, and the Cottonwood Canyons ski

areas. A part of the Silicon Slopes region, South Jordan continues

to expand its robust community and is home to a diverse range of

businesses, including technology, health care, distribution

services and retail. According to data provided by STR for the

trailing twelve months ended September 30, 2023, as compared to the

same period of 2022, revenue per available room (“RevPAR”) for the

Salt Lake City South, UT submarket improved by approximately

8%.

As previously announced, the Company continues to have two

additional hotels under contract for purchase:

- An Embassy Suites by Hilton currently under development in

downtown Madison, Wisconsin, for an anticipated total purchase

price of approximately $78.6 million with an expected 260 rooms,

which the Company anticipates acquiring in mid-2024 following

completion of construction.

- A Motto by Hilton to be developed in downtown Nashville,

Tennessee, for an anticipated total purchase price of approximately

$96.7 million with an expected 256 rooms, which the Company

anticipates acquiring in 2025 following completion of

construction.

There are many conditions to closing on each of these hotels

that have not yet been satisfied, and there can be no assurance

that closings on these hotels will occur under the outstanding

purchase contracts.

Following the acquisition of the Embassy Suites South Jordan

Salt Lake City, the Apple Hospitality hotel portfolio includes 224

hotels with 29,601 guest rooms geographically diversified

throughout 37 states.

About Apple Hospitality REIT,

Inc.

Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded

real estate investment trust (“REIT”) that owns one of the largest

and most diverse portfolios of upscale, rooms-focused hotels in the

United States. Apple Hospitality’s portfolio consists of 224 hotels

with more than 29,600 guest rooms located in 87 markets throughout

37 states as well as one property leased to third parties.

Concentrated with industry-leading brands, the Company’s hotel

portfolio consists of 99 Marriott-branded hotels, 120

Hilton-branded hotels and five Hyatt-branded hotels. For more

information, please visit www.applehospitalityreit.com.

Forward-Looking Statements

Disclaimer

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements are typically identified by use

of statements that include phrases such as “may,” “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “project,” “target,”

“goal,” “plan,” “should,” “will,” “predict,” “potential,”

“outlook,” “strategy,” and similar expressions that convey the

uncertainty of future events or outcomes. Such statements involve

known and unknown risks, uncertainties, and other factors which may

cause the actual results, performance, or achievements of the

Company to be materially different from future results, performance

or achievements expressed or implied by such forward-looking

statements.

Such factors include, but are not limited to, the ability of the

Company to effectively acquire and dispose of properties and

redeploy proceeds; the anticipated timing and frequency of

shareholder distributions; the ability of the Company to fund

capital obligations; the ability of the Company to successfully

integrate pending transactions and implement its operating

strategy; changes in general political, economic and competitive

conditions and specific market conditions (including the potential

effects of inflation or a recessionary environment); reduced

business and leisure travel due to geopolitical uncertainty,

including terrorism, travel-related health concerns, including

COVID-19 or other widespread outbreaks of infectious or contagious

diseases in the U.S.; inclement weather conditions, including

natural disasters such as hurricanes, earthquakes and wildfires;

government shutdowns, airline strikes or other disruptions; adverse

changes in the real estate and real estate capital markets;

financing risks; changes in interest rates; litigation risks;

regulatory proceedings or inquiries; and changes in laws or

regulations or interpretations of current laws and regulations that

impact the Company’s business, assets or classification as a REIT.

Although the Company believes that the assumptions underlying the

forward-looking statements contained herein are reasonable, any of

the assumptions could be inaccurate, and therefore there can be no

assurance that such statements included in this press release will

prove to be accurate. In light of the significant uncertainties

inherent in the forward-looking statements included herein, the

inclusion of such information should not be regarded as a

representation by the Company or any other person that the results

or conditions described in such statements or the objectives and

plans of the Company will be achieved. In addition, the Company’s

qualification as a REIT involves the application of highly

technical and complex provisions of the Internal Revenue Code of

1986, as amended. Readers should carefully review the risk factors

described in the Company’s filings with the Securities and Exchange

Commission, including but not limited to those discussed in the

section titled “Risk Factors” in the Company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2022. Any

forward-looking statement that the Company makes speaks only as of

the date of this press release. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements or cautionary factors, as a result of new information,

future events, or otherwise, except as required by law.

For additional information or to receive press

releases by email, visit www.applehospitalityreit.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231121384124/en/

Apple Hospitality REIT, Inc. Kelly Clarke, Vice President,

Investor Relations 804‐727‐6321 kclarke@applereit.com

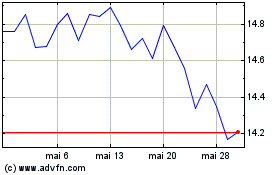

Apple Hospitality REIT (NYSE:APLE)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Apple Hospitality REIT (NYSE:APLE)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025