Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

24 Fevereiro 2022 - 8:08AM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-262737

Relating to the Preliminary Prospectus Supplement dated February 23, 2022

Bio-Rad Laboratories, Inc.

Pricing Term Sheet

February 23, 2022

$400,000,000 3.300% Senior Notes due 2027

$800,000,000 3.700% Senior Notes due 2032

|

|

|

|

|

| Issuer: |

|

Bio-Rad Laboratories, Inc. (the “Company”) |

|

|

|

|

|

| Trade Date: |

|

February 23, 2022 |

|

|

|

|

|

| Settlement Date*: |

|

March 2, 2022 (T+5) |

|

|

|

|

| Security Title: |

|

3.300% Senior Notes due 2027 (the “2027 Notes”)

3.700% Senior Notes due 2032 (the “2032 Notes”)

(together, the “Notes”) |

|

|

|

| Expected Ratings (Moody’s/S&P/Fitch)**: |

|

Baa2 (Stable) / BBB (Stable)/ BBB (Stable) |

|

Baa2 (Stable) / BBB (Stable)/ BBB (Stable) |

|

|

|

| Principal Amount: |

|

$400,000,000 |

|

$800,000,000 |

|

|

|

| Maturity Date: |

|

March 15, 2027 |

|

March 15, 2032 |

|

|

|

| Interest Payment Dates: |

|

Semi-annually on March 15 and September 15, commencing September 15, 2022 |

|

Semi-annually on March 15 and September 15, commencing September 15, 2022 |

|

|

|

| Record Dates: |

|

March 1 and September 1 |

|

March 1 and September 1 |

|

|

|

| Coupon: |

|

3.300% per annum |

|

3.700% per annum |

|

|

|

| Benchmark Treasury: |

|

UST 1.500% due January 31, 2027 |

|

UST 1.875% due February 15, 2032 |

|

|

|

| Benchmark Treasury Price / Yield: |

|

98-043⁄4; 1.895% |

|

99-01; 1.982% |

|

|

|

| Spread to Benchmark Treasury: |

|

T + 145 bps |

|

T + 175 bps |

|

|

|

| Yield to Maturity: |

|

3.345% |

|

3.732% |

|

|

|

| Initial Price to Public: |

|

99.792% |

|

99.733% |

|

|

|

| Optional Redemption Provisions: |

|

Make-Whole Call: UST + 25 bps Par Call: on or after February 15, 2027 |

|

Make-Whole Call: UST + 30 bps Par Call: on or after December 15, 2031 |

|

|

|

| CUSIP / ISIN: |

|

090572 AR9 / US090572AR99 |

|

090572 AQ1 / US090572AQ17 |

|

|

|

|

|

| Joint Book-Running Managers: |

|

Citigroup Global Markets Inc. Goldman

Sachs & Co. LLC J.P. Morgan Securities LLC BofA

Securities, Inc. HSBC Securities (USA) Inc. MUFG Securities

Americas Inc. Wells Fargo Securities, LLC |

|

|

*We expect that delivery of the Notes will be made against payment therefor on or about March 2, 2022, which will be

the fifth business day following the date hereof (such settlement cycle being referred to as “T+5”). Under Rule 15c6-1 of the Exchange Act, trades in the secondary market are required to settle in

two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade Notes prior to the second trading day preceding the date on which we deliver the Notes may be required, by virtue of the

fact that the Notes initially settle in T+5, to specify alternate settlement arrangements at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to their date of delivery hereunder

should consult their advisers.

**Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision

or withdrawal at any time. See “Risk Factors—Risks Related to the Offering—A downgrade of our credit ratings could adversely impact your investment in the notes.” in the Company’s preliminary prospectus supplement dated

February 23, 2022.

The Company has filed a registration statement (including a prospectus) and a related preliminary prospectus supplement

with the U.S. Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement, the accompanying prospectus in that registration

statement and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company,

any underwriter or any dealer participating in the offering will arrange to send you the prospectus and the related preliminary prospectus supplement if you request it by calling Citigroup Global Markets Inc. toll-free at 1-800-831-9146, Goldman Sachs & Co. LLC toll-free at 1-800-419-2595 or J.P. Morgan Securities LLC toll-free at 1-866-803-9204.

This pricing term sheet supplements, and should be read in conjunction with, the Company’s preliminary prospectus supplement dated

February 23, 2022 and the accompanying prospectus dated February 15, 2022 and the documents incorporated by reference therein.

Any

legends, disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this communication having

been sent via Bloomberg or another system.

2

Bio Rad Laboratories (NYSE:BIO.B)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

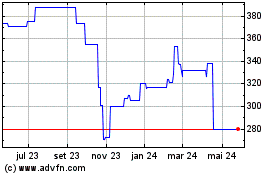

Bio Rad Laboratories (NYSE:BIO.B)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024