Equity Commonwealth (NYSE: EQC) today reported financial results

for the quarter ended March 31, 2015. All per share results are

reported on a fully diluted basis.

Results for the quarter ended March 31, 2015

Funds from Operations (FFO), as defined by the National

Association of Real Estate Investment Trusts, for the quarter ended

March 31, 2015 were $65.4 million, or $0.50 per share. This

compares to FFO for the quarter ended March 31, 2014 of $60.5

million, or $0.51 per share.

Normalized FFO was $72.0 million, or $0.55 per share. This

compares to Normalized FFO for the quarter ended March 31, 2014 of

$61.0 million, or $0.51 per share. The following items impacted

Normalized FFO per share for the quarter ended March 31, 2015

compared to the corresponding 2014 period:

- approximately ($0.10) per share due to

the company’s sale of its entire interest in Select Income REIT

(SIR) in 2014;

- approximately ($0.02) per share from

properties sold;

- a net impact of approximately ($0.01)

per share due to dilution from the conversion of series D preferred

shares to common shares;

- approximately $0.08 per share from

lower general & administrative (G&A) expense, excluding

shareholder litigation and transition expenses;

- approximately $0.06 per share from

lower interest expense; and

- approximately $0.02 per share from

higher same property cash net operating income (NOI), which was

largely due to lower operating expenses.

Normalized FFO begins with FFO and eliminates certain items

that, by their nature, are not comparable from period to period,

non-cash items, and items that tend to obscure the company’s

operating performance. Definitions of FFO and Normalized FFO and

reconciliations to net income, determined in accordance with U.S.

generally accepted accounting principles, or GAAP, are included at

the end of this press release.

Net income attributable to common shareholders was $6.6 million,

or $0.05 per share, for the quarter ended March 31, 2015. This

compares to net income attributable to common shareholders of $9.3

million, or $0.08 per share for the quarter ended March 31,

2014.

The weighted average number of diluted common shares outstanding

for the quarter ended March 31, 2015 was 129,873,801 shares,

compared to 118,399,846 for the quarter ended March 31, 2014.

Operating Highlights

As of March 31, 2014, the company’s portfolio consisted of 154

properties comprising 42.8 million square feet. For the quarter

ended March 31, 2015, operating results were as follows:

- Same property cash NOI increased 2.5%

when compared to the same period in 2014, largely due to lower

operating expenses that resulted from property tax refunds.

- Same property NOI decreased 1.0% when

compared to the same period in 2014.

- The same property portfolio was 85.9%

leased, compared to 85.9% as of December 31, 2014, and 86.6% as of

March 31, 2014.

- The company entered into leases for

approximately 1,478,000 square feet, including new leases for

approximately 720,000 square feet and lease renewals for

approximately 758,000 square feet.

- The company signed a new 260,000 square

foot 13-year lease for the headquarters space of Baxter’s

bioscience spin-off, Baxalta, at 1200 Lakeside Drive in

Bannockburn, IL.

- Cash rental rates on new and renewal

leases were flat compared to prior cash rental rates for the same

space.

- GAAP rental rates on new and renewal

leases were approximately 5.6% higher than prior GAAP rental rates

for the same space.

The definitions and reconciliations of same property NOI and

same property cash NOI to operating income, determined in

accordance with GAAP, are included at the end of this press

release. Same property NOI and same property cash NOI include

properties continuously owned from January 1, 2014 through March

31, 2015. Same property NOI and same property cash NOI exclude

amounts related to the settlement of outstanding assets and

liabilities of previously disposed properties that are reflected in

the company’s consolidated results.

Significant Events for the quarter ended March 31,

2015

- The company entered into a new $1.15

billion Credit Agreement that reduced the interest rate and

extended the term of the company’s unsecured revolving credit

facility and term loan. The Credit Agreement is comprised of a $750

million revolving credit facility, a $200 million five-year term

loan, and a $200 million seven-year term loan.

- The company sold three buildings

totaling 167,000 square feet for gross sales proceeds of $21.2

million, resulting in a gain on sale of $5.9 million.

- The company’s compensation committee

approved the grant of equity awards “2014 LTIP Awards” for fiscal

year 2014 performance pursuant to the Company’s previously

disclosed long-term incentive program. Pursuant to GAAP, the 2014

LTIP Awards have an aggregate value of $13.3 million, which will be

amortized into earnings over the four-year plan period.

Subsequent Events

- In April, the company entered into

several contracts to sell 52 properties, representing over 8

million square feet, in various portfolio and single asset

transactions. Proceeds are anticipated to total approximately $750

million. These transactions are projected to close in the

second and third quarter of 2015 but are subject to customary

closing conditions. There is no certainty that these conditions

will be met or that these transactions will close.

- On May 1, 2015, the company redeemed

the $138.8 million outstanding 5.75% senior unsecured notes due

November 1, 2015. The notes were redeemed in cash at a price of

100% of the principal amount of the notes plus accrued and unpaid

interest, up to, but excluding, the redemption date.

Disposition Update

The company continues to pursue its previously announced plan to

sell $2 to $3 billion of assets through 2017, creating capacity for

future opportunities as they arise. In addition to the 52

properties under contract, the company has 32 properties

representing over 9 million square feet being marketed for sale.

The company continues to focus on strengthening its balance sheet

and improving the performance of its properties.

Earnings Conference Call & Supplemental Data

Equity Commonwealth will host a conference call on Thursday, May

7, 2015, at 9:00 a.m. Central Daylight Time to discuss first

quarter 2015 results. The conference call will be available via

live audio webcast on the Investor Relations section of the

company’s website (www.eqcre.com). In addition, a replay of the

audio webcast will be available on the Investor Relations section

of the company’s website.

A copy of EQC’s First Quarter 2015 Supplemental Operating and

Financial Data is available for download on the Investor Relations

section of EQC’s website at www.eqcre.com.

About Equity Commonwealth

Equity Commonwealth (NYSE: EQC) is an internally managed and

self-advised real estate investment trust (REIT). EQC is one of the

largest commercial office REITs in the United States, with a

national portfolio of 154 properties comprising 42.8 million square

feet and executive offices in Chicago, IL.

FORWARD-LOOKING STATEMENTS

Some of the statements contained in this press release

constitute forward-looking statements within the meaning of the

federal securities laws, including, but not limited to, statements

regarding marketing the company’s properties for sale, de-levering

the balance sheet, consummating asset sales, and identifying future

investment opportunities. Any forward-looking statements contained

in this press release are intended to be made pursuant to the safe

harbor provisions of Section 21E of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements relate to

expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. In some cases, you can

identify forward-looking statements by the use of forward-looking

terminology such as “may,” “will,” “should,” “expects,” “intends,”

“plans,” “anticipates,” “believes,” “estimates,” “predicts,” or

“potential” or the negative of these words and phrases or similar

words or phrases which are predictions of or indicate future events

or trends and which do not relate solely to historical matters. You

can also identify forward-looking statements by discussions of

strategy, plans or intentions.

The forward-looking statements contained in this press release

reflect the company’s current views about future events and are

subject to numerous known and unknown risks, uncertainties,

assumptions and changes in circumstances that may cause the

company’s actual results to differ significantly from those

expressed in any forward-looking statement. We do not guarantee

that the transactions and events described will happen as described

(or that they will happen at all).

While forward-looking statements reflect the company’s good

faith beliefs, they are not guarantees of future performance. We

disclaim any obligation to publicly update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, of new information, data or methods, future

events or other changes. For a further discussion of these and

other factors that could cause the company’s future results to

differ materially from any forward-looking statements, see the

section entitled “Risk Factors” in the company’s most recent Annual

Report on Form 10-K and in the company’s Quarterly Reports on Form

10-Q for subsequent quarters.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(amounts in thousands, except share

data)

March 31, 2015

December 31, 2014 ASSETS

Real estate properties: Land $ 705,222 $ 714,238 Buildings

and improvements 4,994,374 5,014,205 5,699,596

5,728,443 Accumulated depreciation (1,066,369 ) (1,030,445 )

4,633,227 4,697,998 Acquired real estate leases, net 184,894

198,287 Cash and cash equivalents 421,736 364,516 Restricted cash

33,349 32,257 Rents receivable, net of allowance for doubtful

accounts of $8,110 and $6,565, respectively 249,408 248,101 Other

assets, net 211,682 220,480

Total

assets $ 5,734,296 $

5,761,639

LIABILITIES AND SHAREHOLDERS’ EQUITY

Revolving credit facility $ — $ — Senior unsecured debt, net

1,598,652 1,598,416 Mortgage notes payable, net 606,423 609,249

Accounts payable and accrued expenses 149,009 162,204 Assumed real

estate lease obligations, net 24,220 26,784 Rent collected in

advance 30,719 31,359 Security deposits 14,095

14,044

Total liabilities $

2,423,118 $ 2,442,056

Shareholders’ equity: Preferred shares of beneficial

interest, $0.01 par value: 50,000,000 shares authorized; Series D

preferred shares; 6 1/2% cumulative convertible; 4,915,196 and

4,915,497 shares issued and outstanding, respectively, aggregate

liquidation preference of $122,880 and $122,887, respectively $

119,263 $ 119,266 Series E preferred shares; 7 1/4% cumulative

redeemable on or after May 15, 2016; 11,000,000 shares issued and

outstanding, aggregate liquidation preference $275,000 265,391

265,391 Common shares of beneficial interest, $0.01 par

value: 350,000,000 shares authorized; 129,733,742 and 129,607,279

shares issued and outstanding, respectively 1,297 1,296 Additional

paid in capital 4,491,093 4,487,133 Cumulative net income 2,247,482

2,233,852 Cumulative other comprehensive loss (72,228 ) (53,216 )

Cumulative common distributions (3,111,868 ) (3,111,868 )

Cumulative preferred distributions (629,252 )

(622,271 )

Total shareholders’ equity $

3,311,178 $ 3,319,583

Total liabilities and shareholders’ equity $

5,734,296 $ 5,761,639

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(amounts in thousands, except per share

data)

For the Three Months Ended March 31,

2015 2014 Revenues Rental income(1) $

167,972 $ 172,040 Tenant reimbursements and other income

45,083 45,220

Total revenues

$ 213,055 $ 217,260

Expenses: Operating expenses $ 97,871 $ 101,731

Depreciation and amortization 62,699 51,649 General and

administrative 16,558 24,848 Loss (reversal of loss) on asset

impairment 1,904 (4,761 ) Acquisition related costs —

5

Total expenses $

179,032 $ 173,472

Operating income $

34,023 $ 43,788

Interest and other income 3,448 384 Interest expense (including net

amortization of debt discounts, premiums and deferred financing

fees of $29 and $(309), respectively) (29,842 ) (37,935 ) Loss on

early extinguishment of debt (428 ) — Gain on issuance of shares by

an equity investee — 109 Gain on sale of properties 5,868 —

Income from continuing operations before income taxes and

equity in earnings of investees 13,069 6,346 Income tax benefit

(expense) 561 (555 ) Equity in earnings of investees —

10,934 Income from continuing operations 13,630 16,725

Discontinued operations: Income from discontinued operations —

4,011 Loss on asset impairment from discontinued operations

— (288 )

Net income $

13,630 $ 20,448 Preferred

distributions (6,981 ) (11,151 )

Net income

attributable to Equity Commonwealth common shareholders

$ 6,649 $ 9,297

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(amounts in thousands, except per share

data)

For the Three Months Ended March 31,

2015 2014 Amounts attributable to Equity

Commonwealth common shareholders: Income from continuing

operations $ 6,649 $ 5,574 Income from discontinued operations —

4,011 Loss on asset impairment from discontinued operations —

(288 ) Net income $ 6,649 $ 9,297

Weighted average common shares outstanding — basic (2) 129,696

118,400 Weighted average common shares outstanding —

diluted (2) 129,874 118,400 Basic and diluted

earnings per common share attributable to Equity Commonwealth

common shareholders: Income from continuing operations $ 0.05

$ 0.05 Income from discontinued operations $ —

$ 0.03 Net income $ 0.05 $ 0.08 (1)

We report rental income on a straight line basis over the

terms of the respective leases; rental income and income from

discontinued operations include non-cash straight line rent

adjustments. Rental income and income from discontinued operations

also included non-cash amortization of intangible lease assets and

liabilities. (2) As of March 31, 2015, we had 4,915 series D

preferred shares outstanding that were convertible into 2,363 of

our common shares, which were anti-dilutive for earnings per common

share attributable to EQC common shareholders for all periods

presented. 254 common shares (178 common shares on a weighted

average basis) would be issued to the RSU holders if the

market-based vesting component of the RSUs was measured as of March

31, 2015. No RSUs had been issued as of March 31, 2014.

CALCULATION OF FUNDS FROM OPERATIONS

(FFO) AND NORMALIZED FFO

(amounts in thousands)

For the Three Months Ended March

31, 2015 2014

Calculation of FFO

Net income $ 13,630 $ 20,448 Plus: Depreciation and

amortization 62,699 51,649 Loss on asset impairment from

discontinued operations — 288 FFO from equity investees — 14,940

Less: Loss (reversal of loss) on asset impairment from continuing

operations (1) 1,904 (4,761 ) Gain on sale of properties (5,868 ) —

Equity in earnings of investees — (10,934 ) FFO attributable

to Equity Commonwealth 72,365 71,630 Less: Preferred

distributions (6,981 ) (11,151 )

FFO

attributable to EQC Common Shareholders $

65,384 $ 60,479

Calculation of Normalized FFO

FFO attributable to EQC common shareholders $ 65,384 $ 60,479

Recurring adjustments: Lease value amortization 1,474 2,252

Straight line rent from continuing operations 181 (5,896 ) Straight

line rent from discontinued operations — (81 ) Loss on early

extinguishment of debt 428 — Minimum cash rent from direct

financing lease (2) 2,032 2,032 Gain on issuance of shares by an

equity investee — (109 ) Interest earned from direct financing

lease (141 ) (229 ) Normalized FFO from equity investees, net of

FFO — (1,399 ) Other items which affect comparability: Shareholder

litigation and transition related expenses (3) 3,472 3,913

Transition services fee 2,235 — Acquisition related costs — 5

Gain on sale of securities (3,080 ) —

Normalized FFO attributable to EQC Common

Shareholders $ 71,985

$ 60,967 Weighted average common shares

outstanding -- basic 129,696 118,400 Weighted average

common shares outstanding -- diluted (4) 129,874

118,400 FFO attributable to EQC common shareholders per

share -- basic & diluted (4) $ 0.50 $ 0.51

Normalized FFO attributable to EQC common shareholders per share --

basic (4) $ 0.56 $ 0.51 Normalized FFO attributable

to EQC common shareholders per share -- diluted (4) $ 0.55 $

0.51 (1) During the three months ended March 31,

2015, we recorded an impairment charge of $1.9 million related to

12655 Olive Boulevard and 1285 Fern Ridge Parkway, based upon

updated market information in accordance with our impairment

analysis procedures. In 2014, we ceased to actively market

properties which we had previously classified as held for sale.

These properties were reclassified to properties held and used in

operations because they no longer met the requirements for

classification as held for sale. In connection with this

reclassification, we reversed previously recorded impairment losses

totaling $4.8 million, which includes the elimination of estimated

costs to sell. (2) Contractual cash payments (including

management fees) from one tenant at Arizona Center for the three

months ended March 31, 2015 and 2014 were $2,032. These payments

will decrease to approximately $515 per year beginning in 2016. Our

calculation of Normalized FFO reflects the cash payments received

from this tenant. The terms of this tenant's lease require us to

classify the lease as a direct financing (or capital) lease. As

such, the revenue recognized on a GAAP basis within our condensed

consolidated statements of operations was $141 and $229 for the

three months ended March 31, 2015 and 2014, respectively. This

direct financing lease has an expiration date in 2045. (3)

Refer to the Additional Income Statement Information for a

discussion of expenses related to the shareholder-approved

Related/Corvex consent solicitation liability. (4) As of

March 31, 2015, we had 4,915 series D preferred shares outstanding

that were convertible into 2,363 of our common shares, which were

anti-dilutive for FFO and Normalized FFO per common share for all

periods presented. 254 common shares (178 common shares on a

weighted average basis) would be issued to the RSU holders if the

market-based vesting component of the RSUs was measured as of March

31, 2015. No RSUs had been issued as of March 31, 2014. We

compute FFO in accordance with standards established by the

National Association of Real Estate Investment Trusts (NAREIT).

NAREIT defines FFO as net income (loss), calculated in accordance

with GAAP, excluding real estate depreciation and amortization,

gains (or losses) from sales of depreciable property, impairment of

depreciable real estate, and our portion of these items related to

equity investees and noncontrolling interests. Normalized FFO

begins with FFO and excludes lease value amortization, straight

line rent, gains and losses on early extinguishment of debt, gains

and losses on the sale of equity investments, gains and losses on

the issuance of shares by an equity investee, shareholder

litigation and transition-related expenses, acquisition related

costs, interest earned from a direct financing lease, gain on sale

of securities, and our portion of these items related to equity

investees and noncontrolling interests. Normalized FFO also

includes the minimum cash rent from a direct financing lease. We

consider FFO and Normalized FFO to be appropriate measures of

operating performance for a REIT, along with net income, net income

attributable to Equity Commonwealth, net income attributable to EQC

common shareholders, operating income and cash flow from operating

activities. We believe that FFO and Normalized FFO provide

useful information to investors because by excluding the effects of

certain historical amounts, such as depreciation expense, FFO and

Normalized FFO may facilitate a comparison of our operating

performance between periods and with other REITs. FFO and

Normalized FFO are among the factors considered by our Board of

Trustees when determining the amount of distributions to our

shareholders. FFO and Normalized FFO do not represent cash

generated by operating activities in accordance with GAAP and

should not be considered as alternatives to net income, net income

attributable to EQC common shareholders, operating income or cash

flow from operating activities, determined in accordance with GAAP,

or as indicators of our financial performance or liquidity, nor are

these measures necessarily indicative of sufficient cash flow to

fund all of our needs. These measures should be considered in

conjunction with net income, net income attributable to EQC common

shareholders, operating income and cash flow from operating

activities as presented in our condensed consolidated statements of

operations, condensed consolidated statements of comprehensive

income (loss) and condensed consolidated statements of cash flows.

Other REITs and real estate companies may calculate FFO and

Normalized FFO differently than we do.

CALCULATION OF SAME PROPERTY NET

OPERATING INCOME (NOI) AND SAME PROPERTY CASH BASIS NOI

(amounts in thousands)

For the Three Months Ended March 31,

2015 2014 Calculation of Same Property NOI

and Same Property Cash Basis NOI (1):

Rental income $ 167,972 $ 172,040 Tenant reimbursements and other

income 45,083 45,220 Operating expenses (97,871 )

(101,731 )

NOI $ 115,184

$ 115,529 Straight line rent 181 (5,896 )

Lease value amortization 1,474 2,252 Lease termination fees

(1,949 ) (593 )

Cash Basis NOI $

114,890 $ 111,292 Cash

Basis NOI from non-same properties (2) (1,200 ) (397

)

Same Property Cash Basis NOI $

113,690 $ 110,895

Non-cash rental and termination income from same properties

321 4,236

Same Property NOI

$ 114,011 $ 115,131

Reconciliation of Same Property NOI to GAAP

Operating Income Same Property

NOI $ 114,011 $

115,131 Non-cash rental and termination income from

same properties (321 ) (4,236 )

Same Property Cash

Basis NOI $ 113,690 $

110,895 Cash Basis NOI from non-same properties (2)

1,200 397

Cash Basis NOI

$ 114,890 $ 111,292

Straight line rent (181 ) 5,896 Lease value amortization

(1,474 ) (2,252 ) Lease termination fees 1,949

593

NOI $ 115,184

$ 115,529 Depreciation and amortization

(62,699 ) (51,649 ) General and administrative (16,558 ) (24,848 )

(Loss) reversal of loss on asset impairment (1,904 ) 4,761

Acquisition related costs — (5 )

Operating

Income $ 34,023 $

43,788 (1) Properties sold and

properties classified as discontinued operations are excluded. Same

property results include properties continuously owned from January

1, 2014 through March 31, 2015. Amounts related to the settlement

of outstanding assets and liabilities of previously-disposed

properties that are reflected in our consolidated results are

excluded from same property results. (2) Cash Basis NOI from

non-same properties for the three months ended March 31, 2015

includes real estate tax refunds related to previously-disposed

properties of $1.0 million. Cash Basis NOI from non-same properties

for all periods presented includes the settlement of outstanding

assets and liabilities of previously-disposed properties. We

define NOI as income from our real estate including lease

termination fees received from tenants less our property operating

expenses, which expenses include property marketing costs. NOI

excludes amortization of capitalized tenant improvement costs and

leasing commissions. We define Cash Basis NOI as NOI less non cash

straight line rent adjustments, lease value amortization and lease

termination fees. We consider NOI and Cash Basis NOI to be

appropriate supplemental measures to net income because they may

help both investors and management to understand the operations of

our properties. We use NOI and Cash Basis NOI internally to

evaluate individual, regional and combined property level

performance, and we believe that NOI and Cash Basis NOI provide

useful information to investors regarding our results of operations

because they reflect only those income and expense items that are

incurred at the property level and may facilitate comparisons of

our operating performance between periods and with other REITs. The

calculations of NOI and Cash Basis NOI exclude certain components

of net income in order to provide results that are more closely

related to our properties' results of operations. NOI and Cash

Basis NOI do not represent cash generated by operating activities

in accordance with GAAP, and should not be considered as

alternatives to net income, net income attributable to Equity

Commonwealth, net income attributable to EQC common shareholders,

operating income or cash flow from operating activities, determined

in accordance with GAAP, or as indicators of our financial

performance or liquidity, nor are these measures necessarily

indicative of sufficient cash flow to fund all of our needs. These

measures should be considered in conjunction with net income, net

income attributable to Equity Commonwealth, net income attributable

to EQC common shareholders, operating income and cash flow from

operating activities as presented in our condensed consolidated

statements of operations, condensed consolidated statements of

comprehensive income (loss) and condensed consolidated statements

of cash flows. Other REITs and real estate companies may calculate

NOI and Cash Basis NOI differently than we do.

Equity CommonwealthSarah Byrnes, Investor Relations(312)

646-2801www.eqcre.com

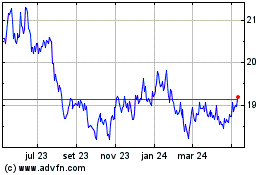

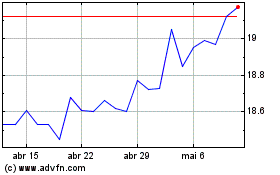

Equity Commonwealth (NYSE:EQC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Equity Commonwealth (NYSE:EQC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024