Comfort Systems USA, Inc. (NYSE: FIX) (the “Company”)

today reported results for the quarter ended March 31, 2024.

For the quarter ended March 31, 2024, net income was $96.3

million, or $2.69 per diluted share, as compared to $57.2 million,

or $1.59 per diluted share, for the quarter ended March 31, 2023.

Revenue for the first quarter of 2024 was $1,537.0 million compared

to $1,174.6 million in 2023. The Company reported operating cash

flow of $146.6 million in the current quarter compared to $126.9

million in 2023.

Brian Lane, Comfort Systems USA’s President and Chief Executive

Officer, said, “Our expert and dedicated employees achieved superb

execution for our customers this quarter, and our newly acquired

companies are off to a great start. First quarter results were

extraordinary, with per share earnings more than a dollar above the

same quarter last year, increased backlog, and over $140 million in

cash flow. Our mechanical business improved, and our electrical

segment profitability increased to unprecedented levels.

Construction and service continue to flourish, demand remains

supportive, and we are optimistic that we will continue to achieve

strong results in 2024.”

Backlog as of March 31, 2024 was $5.91 billion as compared to

$5.16 billion as of December 31, 2023 and $4.44 billion as of March

31, 2023. On a same-store basis, backlog increased from $4.44

billion as of March 31, 2023 to $5.25 billion as of March 31,

2024.

The Company will host a webcast and conference call to discuss

its financial results and position on Friday, April 26, 2024 at

10:00 a.m. Central Time. To register for the call, please visit

https://register.vevent.com/register/BI2d3f8046dbb64b0c8a8126b26147d877.

Upon registering, participants will receive dial-in information and

a unique PIN to join the call. The call and the slide presentation

to accompany the remarks can be accessed on the Company’s website

at www.comfortsystemsusa.com under the “Investor” tab. A replay of

the entire call will be available on the Company’s website on the

next business day following the call.

Comfort Systems USA® is a leading provider of commercial,

industrial and institutional heating, ventilation, air conditioning

and electrical contracting services, with 177 locations in 136

cities across the nation. For more information, visit the Company’s

website at www.comfortsystemsusa.com.

Certain statements and information in this press release may

constitute forward-looking statements regarding our future business

expectations, which are subject to applicable securities laws and

regulations. The words “believe,” “expect,” “anticipate,” “plan,”

“intend,” “foresee,” “should,” “would,” “could,” or other similar

expressions are intended to identify forward-looking statements,

which are generally not historic in nature. These forward-looking

statements are based on the current expectations and beliefs of

Comfort Systems USA, Inc. and its subsidiaries (collectively, the

“Company”) concerning future developments and their effect on the

Company. While the Company’s management believes that these

forward-looking statements are reasonable as and when made, there

can be no assurance that future developments affecting the Company

will be those that it anticipates, and the Company’s actual results

of operations, financial condition and liquidity, and the

development of the industry in which the Company operates, may

differ materially from those made in or suggested by the

forward-looking statements contained in this press release. In

addition, even if our results of operations, financial condition

and liquidity, and the development of the industry in which we

operate, are consistent with the forward-looking statements

contained in this press release, those results or developments may

not be indicative of our results or developments in subsequent

periods. All comments concerning the Company’s expectations for

future revenue and operating results are based on the Company’s

forecasts for its existing operations and do not include the

potential impact of any future acquisitions. The Company’s

forward-looking statements involve significant risks and

uncertainties (some of which are beyond the Company’s control) and

assumptions that could cause actual future results to differ

materially from the Company’s historical experience and its present

expectations or projections. Important factors that could cause

actual results to differ materially from those in the

forward-looking statements include, but are not limited to: the use

of incorrect estimates for bidding a fixed-price contract;

undertaking contractual commitments that exceed the Company’s labor

resources; failing to perform contractual obligations efficiently

enough to maintain profitability; national or regional weakness in

construction activity and economic conditions; rising inflation and

fluctuations in interest rates; shortages of labor and specialty

building materials or material increases to the cost thereof; the

Company’s business being negatively affected by health crises or

outbreaks of disease, such as epidemics or pandemics (and related

impacts, such as supply chain disruptions); financial difficulties

affecting projects, vendors, customers, or subcontractors; the

Company’s backlog failing to translate into actual revenue or

profits; failure of third party subcontractors and suppliers to

complete work as anticipated; difficulty in obtaining, or increased

costs associated with, bonding and insurance; impairment to

goodwill; errors in the Company’s cost-to-cost input method of

accounting; the result of competition in the Company’s markets; the

Company’s decentralized management structure; material failure to

comply with varying state and local laws, regulations or

requirements; debarment from bidding on or performing government

contracts; retention of key management; seasonal fluctuations in

the demand for mechanical and electrical systems; the imposition of

past and future liability from environmental, safety, and health

regulations including the inherent risk associated with

self-insurance; adverse litigation results; an increase in our

effective tax rate; a material information technology failure or a

material cyber security breach; risks associated with acquisitions,

such as challenges to our ability to integrate those companies into

our internal control environment; our ability to manage growth and

geographically-dispersed operations; our ability to obtain

financing on acceptable terms; extreme weather conditions (such as

storms, droughts, extreme heat or cold, wildfires and floods),

including as a result of climate change, and any resulting

regulations or restrictions related thereto; and other risks

detailed in our reports filed with the Securities and Exchange

Commission (the “SEC”).

For additional information regarding known material factors that

could cause the Company’s results to differ from its projected

results, please see its filings with the SEC, including its Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K.

Readers are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date hereof.

The Company undertakes no obligation to publicly update or revise

any forward-looking statements after the date they are made,

whether because of new information, future events, or

otherwise.

— Financial tables follow —

Comfort Systems USA, Inc.

Consolidated Statements of

Operations

(In Thousands, Except per Share

Amounts)

Three Months Ended

March 31,

(Unaudited)

2024

%

2023

%

Revenue

$

1,537,016

100.0

%

$

1,174,640

100.0

%

Cost of services

1,239,653

80.7

%

969,235

82.5

%

Gross profit

297,363

19.3

%

205,405

17.5

%

SG&A

162,723

10.6

%

135,032

11.5

%

Gain on sale of assets

(820

)

(0.1

)%

(512

)

—

Operating income

135,460

8.8

%

70,885

6.0

%

Interest income (expense), net

(30

)

—

(2,679

)

(0.2

)%

Changes in the fair value of contingent

earn-out obligations

(12,491

)

(0.8

)%

(2,382

)

(0.2

)%

Other income, net

117

—

1

—

Income before income taxes

123,056

8.0

%

65,825

5.6

%

Provision for income taxes

26,737

8,609

Net income

$

96,319

6.3

%

$

57,216

4.9

%

Income per share

Basic

$

2.70

$

1.60

Diluted

$

2.69

$

1.59

Shares used in computing income per

share:

Basic

35,739

35,812

Diluted

35,828

35,907

Dividends per share

$

0.250

$

0.175

Supplemental Non-GAAP Information — (Unaudited) (In Thousands,

Except per Share Amounts)

Three Months Ended

March 31,

2024

2023

Net income

$

96,319

$

57,216

Tax gains related to prior years

—

(3,368

)

Tax-related SG&A costs, net of tax

—

333

Net income excluding tax gains

$

96,319

$

54,181

Diluted income per share

$

2.69

$

1.59

Tax gains related to prior years

-

(0.09

)

Tax-related SG&A costs, net of tax

-

0.01

Diluted income per share excluding tax

gains

$

2.69

$

1.51

Note: Net income excluding tax gains and diluted income per

share excluding tax gains are presented because the Company

believes they reflect the results of the core ongoing operations of

the Company, and we believe they are responsive to frequent

questions we receive from third parties. These amounts, however,

are not considered primary measures of an entity’s financial

results under generally accepted accounting principles, and

accordingly, they should not be considered an alternative to

operating results as determined under generally accepted accounting

principles and as reported by the Company.

Supplemental Non-GAAP Information — Adjusted Earnings Before

Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”)

— (Unaudited) (In Thousands)

Three Months Ended

March 31,

2024

%

2023

%

Net income

$

96,319

$

57,216

Provision for income taxes

26,737

8,609

Other income, net

(117

)

(1

)

Changes in the fair value of contingent

earn-out obligations

12,491

2,382

Interest expense (income), net

30

2,679

Gain on sale of assets

(820

)

(512

)

Tax-related SG&A costs

—

421

Amortization

23,913

10,331

Depreciation

11,254

9,187

Adjusted EBITDA

$

169,807

11.0

%

$

90,312

7.7

%

Note: The Company defines adjusted earnings before interest,

taxes, depreciation, and amortization (“Adjusted EBITDA”) as net

income, provision for income taxes, other expense (income), net,

changes in the fair value of contingent earn-out obligations,

interest expense (income), net, gain on sale of assets, goodwill

impairment, other one-time expenses or gains and depreciation and

amortization. Other companies may define Adjusted EBITDA

differently. Adjusted EBITDA is presented because it is a financial

measure that is frequently requested by third parties. However,

Adjusted EBITDA is not considered under generally accepted

accounting principles as a primary measure of an entity’s financial

results, and accordingly, Adjusted EBITDA should not be considered

an alternative to operating income, net income, or cash flows as

determined under generally accepted accounting principles and as

reported by the Company.

Comfort Systems USA, Inc.

Condensed Consolidated Balance

Sheets

(In Thousands)

March 31,

December 31,

2024

2023

(Unaudited)

Cash and cash equivalents

$

100,792

$

205,150

Billed accounts receivable, net

1,570,643

1,318,926

Unbilled accounts receivable, net

76,975

72,774

Costs and estimated earnings in excess of

billings, net

30,118

28,084

Other current assets, net

269,661

286,166

Total current assets

2,048,189

1,911,100

Property and equipment, net

226,197

208,568

Goodwill

862,934

666,834

Identifiable intangible assets, net

489,884

280,397

Other noncurrent assets

275,625

238,680

Total assets

$

3,902,829

$

3,305,579

Current maturities of long-term debt

$

12,885

$

4,867

Accounts payable

557,859

419,962

Billings in excess of costs and estimated

earnings and deferred revenue

1,131,928

909,538

Other current liabilities

436,987

386,838

Total current liabilities

2,139,659

1,721,205

Long-term debt

77,004

39,345

Other long-term liabilities

313,630

267,200

Total liabilities

2,530,293

2,027,750

Total stockholders’ equity

1,372,536

1,277,829

Total liabilities and stockholders’

equity

$

3,902,829

$

3,305,579

Selected Cash Flow Data (Unaudited) (In Thousands)

Three Months Ended

March 31,

2024

2023

Cash provided by (used in):

Operating activities

$

146,557

$

126,909

Investing activities

$

(221,648

)

$

(68,945

)

Financing activities

$

(29,267

)

$

(66,618

)

Free cash flow:

Cash from operating activities

$

146,557

$

126,909

Purchases of property and equipment

(24,952

)

(16,520

)

Proceeds from sales of property and

equipment

1,014

622

Free cash flow

$

122,619

$

111,011

Note: Free cash flow is defined as cash flow from operating

activities less customary capital expenditures, plus the proceeds

from asset sales. Other companies may define free cash flow

differently. Free cash flow is presented because it is a financial

measure that is frequently requested by third parties. However,

free cash flow is not considered under generally accepted

accounting principles as a primary measure of an entity’s financial

results, and accordingly, free cash flow should not be considered

an alternative to operating income, net income, or cash flows as

determined under generally accepted accounting principles and as

reported by the Company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425854151/en/

Julie Shaeff, Chief Accounting Officer ir@comfortsystemsusa.com;

713-830-9687

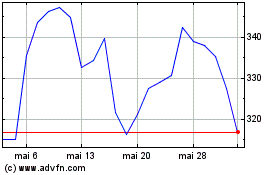

Comfort Systems USA (NYSE:FIX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Comfort Systems USA (NYSE:FIX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024