PFD, PFO, FFC, FLC and DFP Announce Increased August, September and October Dividends

22 Julho 2020 - 6:04PM

Business Wire

The Boards of Directors of Flaherty & Crumrine Preferred and

Income Fund Incorporated (NYSE: PFD), Flaherty &

Crumrine Preferred and Income Opportunity Fund Incorporated

(NYSE: PFO), Flaherty & Crumrine Preferred and Income

Securities Fund Incorporated (NYSE: FFC), Flaherty &

Crumrine Total Return Fund Incorporated (NYSE: FLC) and

Flaherty & Crumrine Dynamic Preferred and Income Fund

Incorporated (NYSE: DFP) today announced that they have

declared per share dividends for August, September and October,

2020 as follows:

August

September

October

PFD

$0.086

$0.086

$0.086

PFO

$0.068

$0.068

$0.068

FFC

$0.129

$0.129

$0.129

FLC

$0.132

$0.132

$0.132

DFP

$0.165

$0.165

$0.165

Payment Date

August 31, 2020

September 30, 2020

October 30, 2020

Record Date

August 24, 2020

September 23, 2020

October 23, 2020

Ex-Dividend Date

August 21, 2020

September 22, 2020

October 22, 2020

Each of these new dividends represents an increase from April’s

dividend of +10.3% for PFD, +7.1% for PFO, +9.3% for FFC, +9.1% for

FLC and +9.6% for DFP.

R. Eric Chadwick, Chairman of the Board of each fund, said “In

response to COVID-19, the Federal Reserve has taken unprecedented

steps to improve financial conditions, and the fed funds target

rate remains at 0-0.25%. This move lower in all short-term rates

has caused leverage expense to decline from an average of about

3.1% in 2019 to about 1.0% most recently, while leverage balances

have remained unchanged. As a result, like our last dividend

increase for May, we have adjusted dividend rates higher to better

reflect projected annual net income available for distribution to

common shareholders. While we recognize that the risks and impact

of the pandemic are unknown, we nonetheless remain cautiously

optimistic on the preferred and contingent capital securities

markets, especially from the viewpoint of long-term income

investors.”

The tax breakdown of all 2020 distributions will be available

early in 2021, but at this point the funds anticipate that the

dividends detailed above will consist of net investment income and

not capital gains or return of capital.

Website: www.preferredincome.com

Past performance is not indicative of future performance. An

investor should consider the fund’s investment objective, risks,

charges and expenses carefully before investing.

To the extent any portion of the distribution is estimated to be

sourced from something other than income, such as return of

capital, the source would be disclosed on a Section 19(a)-1 letter

located under the “SEC Filings and News” section of the funds’

website, www.preferredincome.com. The actual amounts and sources of

the amounts for tax reporting purposes will depend upon a fund’s

investment performance during the remainder of its fiscal year and

may be subject to change based on tax regulations. A distribution

rate that is largely comprised of sources other than income may not

be reflective of a fund’s performance.

PFD, PFO and FFC invest primarily in preferred and other-income

producing securities with an investment objective of high current

income consistent with preservation of capital. FLC invests

primarily in preferred and other income-producing securities with a

primary investment objective of high current income and a secondary

objective of capital appreciation. DFP invests primarily in

preferred and other income-producing securities with an investment

objective of total return, with an emphasis on high current income.

PFD, PFO, FFC, FLC and DFP are managed by Flaherty & Crumrine

Incorporated, an independent investment adviser which was founded

in 1983 to specialize in the management of portfolios of preferred

and related income-producing securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200722005920/en/

Flaherty & Crumrine Incorporated Chad Conwell,

626-795-7300

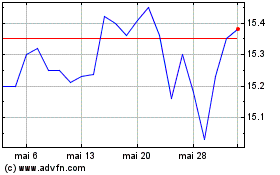

Flaherty and Crumrine To... (NYSE:FLC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Flaherty and Crumrine To... (NYSE:FLC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024