Second Quarter 2023 Highlights

- Great Park Venture sold 798 homesites on approximately 84 acres

of land and recognized revenue of $357.8 million.

- Great Park Venture distributions and incentive compensation

payments to the Company totaled $103.8 million.

- Great Park builder sales of 177 homes during the quarter

compared to 255 in the first quarter of 2023.

- Valencia builder sales of 79 homes during the quarter compared

to 75 in the first quarter of 2023.

- Consolidated revenues of $21.3 million; consolidated net income

of $50.6 million, which includes $52.3 million equity in earnings

from the Great Park Venture.

- Cash and cash equivalents of $193.2 million as of June 30,

2023.

- Debt to total capitalization ratio of 24.7% and liquidity of

$318.2 million as of June 30, 2023.

Five Point Holdings, LLC (“Five Point” or the “Company”)

(NYSE:FPH), an owner and developer of large mixed-use planned

communities in California, today reported its second quarter 2023

results.

Dan Hedigan, Chief Executive Officer, said, “During the second

quarter, we were able to execute effectively on our three main

priorities (generating revenue, rightsizing SG&A, and managing

capital spend) and to achieve results that exceeded our

expectations. For the quarter, we had $50.6 million in consolidated

net income and a net cash increase of $86.6 million, leaving us

with a cash balance of $193.2 million at quarter end. While these

results are due in part to the residential land sale market that

has strengthened throughout the year, it is also a testament to the

management team and our continued focus on matching our capital

spend with near term revenue opportunities. Five Point has created

a strong organizational base for moving the development of our

communities forward and creating value for our shareholders.”

Consolidated Results

Liquidity and Capital Resources

As of June 30, 2023, total liquidity of $318.2 million was

comprised of cash and cash equivalents totaling $193.2 million and

borrowing availability of $125.0 million under our unsecured

revolving credit facility. Total capital was $1.9 billion,

reflecting $2.9 billion in assets and $1.0 billion in liabilities

and redeemable noncontrolling interests.

Results of Operations for the Three Months Ended June 30,

2023

Revenues. Revenues of $21.3 million for the three months

ended June 30, 2023 were primarily generated from management

services. Additionally, we collected $22.0 million in incentive

compensation payments under our development management agreement

with the Great Park Venture.

Equity in earnings from unconsolidated entities. Equity

in earnings from unconsolidated entities was $52.1 million for the

three months ended June 30, 2023. The Great Park Venture generated

net income of $168.2 million during the three months ended June 30,

2023, and our share of the net income from our 37.5% percentage

interest, adjusted for basis differences, was $52.3 million.

Additionally, we recognized $0.5 million in loss from our 75%

interest in the Gateway Commercial Venture.

During the three months ended June 30, 2023, the Great Park

Venture sold 798 homesites on approximately 84 acres of land at the

Great Park Neighborhoods. The Great Park Venture recognized $357.8

million in revenue, consisting of $214.7 million paid at closing

plus $143.1 million in revenue representing variable consideration

from future price participation payments expected to be received

when homes are sold to homebuyers. After completing the land sale,

the Great Park Venture made aggregate distributions of $25.5

million to holders of Legacy Interests and $218.0 million to

holders of Percentage Interests. We received $81.8 million for our

37.5% Percentage Interest.

Selling, general, and administrative. Selling, general,

and administrative expenses were $12.7 million for the three months

ended June 30, 2023.

Net income. Consolidated net income for the quarter was

$50.6 million. Net income attributable to noncontrolling interests

totaled $27.0 million, resulting in net income attributable to the

Company of $23.6 million. Net income attributable to noncontrolling

interests represents the portion of income allocated to related

party partners and members that hold units of the operating company

and the San Francisco Venture. Holders of units of the operating

company and the San Francisco Venture can redeem their interests

for either, at our election, our Class A common shares on a

one-for-one basis or cash. In connection with any redemption or

exchange, our ownership of our operating subsidiaries will increase

thereby reducing the amount of income allocated to noncontrolling

interests in subsequent periods.

Conference Call

Information

In conjunction with this release, Five Point will host a

conference call on Thursday, July 20, 2023 at 5:00 p.m. Eastern

Time. Dan Hedigan, Chief Executive Officer, and Leo Kij, Interim

Chief Financial Officer, will host the call. Interested investors

and other parties can listen to a live Internet audio webcast of

the conference call that will be available on the Five Point

website at ir.fivepoint.com. The conference call can also be

accessed by dialing (877) 451-6152 (domestic) or (201) 389-0879

(international). A telephonic replay will be available starting

approximately two hours after the end of the call by dialing (844)

512-2921, or for international callers, (412) 317-6671. The

passcode for the live call and the replay is 13740212. The

telephonic replay will be available until 11:59 p.m. Eastern Time

on July 28, 2023.

About Five Point

Five Point, headquartered in Irvine, California, designs and

develops large mixed-use planned communities in Orange County, Los

Angeles County, and San Francisco County that combine residential,

commercial, retail, educational, and recreational elements with

public amenities, including civic areas for parks and open space.

Five Point’s communities include the Great Park Neighborhoods® in

Irvine, Valencia® in Los Angeles County, and Candlestick® and The

San Francisco Shipyard® in the City of San Francisco. These

communities are designed to include approximately 40,000

residential homes and approximately 23 million square feet of

commercial space.

Forward-Looking

Statements

This press release contains forward-looking statements that are

subject to risks and uncertainties. These statements concern

expectations, beliefs, projections, plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. When used, the words

“anticipate,” “believe,” “expect,” “intend,” “may,” “might,”

“plan,” “estimate,” “project,” “should,” “will,” “would,” “result”

and similar expressions that do not relate solely to historical

matters are intended to identify forward-looking statements. This

press release may contain forward-looking statements regarding: our

expectations of our future revenues, costs and financial

performance; future demographics and market conditions in the areas

where our communities are located; the outcome of pending

litigation and its effect on our operations; the timing of our

development activities; and the timing of future real estate

purchases or sales. We caution you that any forward-looking

statements included in this press release are based on our current

views and information currently available to us. Forward-looking

statements are subject to risks, trends, uncertainties and factors

that are beyond our control. Some of these risks and uncertainties

are described in more detail in our filings with the SEC, including

our Annual Report on Form 10-K, under the heading “Risk Factors.”

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those anticipated, estimated or projected. We

caution you therefore against relying on any of these

forward-looking statements. While forward-looking statements

reflect our good faith beliefs, they are not guarantees of future

performance. They are based on estimates and assumptions only as of

the date hereof. We undertake no obligation to update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, new information, data or methods, future

events or other changes, except as required by applicable law.

FIVE POINT HOLDINGS,

LLC

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except share

and per share amounts)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

REVENUES:

Land sales

$

16

$

14

$

(9

)

$

571

Land sales—related party

(29

)

1,711

595

1,712

Management services—related party

20,774

2,703

25,010

6,250

Operating properties

588

965

1,454

1,746

Total revenues

21,349

5,393

27,050

10,279

COSTS AND EXPENSES:

Land sales

—

—

—

—

Management services

9,682

2,200

12,048

4,884

Operating properties

1,798

2,378

2,970

4,217

Selling, general, and administrative

12,710

12,651

26,462

29,442

Restructuring

—

—

—

19,437

Total costs and expenses

24,190

17,229

41,480

57,980

OTHER INCOME (EXPENSE):

Interest income

1,293

117

2,129

138

Miscellaneous

(20

)

112

(41

)

224

Total other income

1,273

229

2,088

362

EQUITY IN EARNINGS (LOSS) FROM

UNCONSOLIDATED ENTITIES

52,128

643

53,176

(389

)

INCOME (LOSS) BEFORE INCOME TAX

PROVISION

50,560

(10,964

)

40,834

(47,728

)

INCOME TAX PROVISION

(5

)

(8

)

(13

)

(13

)

NET INCOME (LOSS)

50,555

(10,972

)

40,821

(47,741

)

LESS NET INCOME (LOSS) ATTRIBUTABLE TO

NONCONTROLLING INTERESTS

26,984

(5,861

)

21,786

(25,500

)

NET INCOME (LOSS) ATTRIBUTABLE TO THE

COMPANY

$

23,571

$

(5,111

)

$

19,035

$

(22,241

)

NET INCOME (LOSS) ATTRIBUTABLE TO THE

COMPANY PER CLASS A SHARE

Basic

$

0.34

$

(0.07

)

$

0.28

$

(0.32

)

Diluted

$

0.34

$

(0.07

)

$

0.27

$

(0.33

)

WEIGHTED AVERAGE CLASS A SHARES

OUTSTANDING

Basic

68,811,975

68,495,523

68,758,894

68,332,460

Diluted

145,040,689

69,635,563

144,939,450

69,472,500

NET INCOME (LOSS) ATTRIBUTABLE TO THE

COMPANY PER CLASS B SHARE

Basic and diluted

$

0.00

$

(0.00

)

$

0.00

$

(0.00

)

WEIGHTED AVERAGE CLASS B SHARES

OUTSTANDING

Basic and diluted

79,233,544

79,233,544

79,233,544

79,233,544

FIVE POINT HOLDINGS,

LLC

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except

shares)

(Unaudited)

June 30, 2023

December 31, 2022

ASSETS

INVENTORIES

$

2,254,935

$

2,239,125

INVESTMENT IN UNCONSOLIDATED ENTITIES

302,337

331,594

PROPERTIES AND EQUIPMENT, NET

29,668

30,243

INTANGIBLE ASSET, NET—RELATED PARTY

31,656

40,257

CASH AND CASH EQUIVALENTS

193,203

131,771

RESTRICTED CASH AND CERTIFICATES OF

DEPOSIT

992

992

RELATED PARTY ASSETS

89,933

97,126

OTHER ASSETS

11,179

14,676

TOTAL

$

2,913,903

$

2,885,784

LIABILITIES AND CAPITAL

LIABILITIES:

Notes payable, net

$

621,419

$

620,651

Accounts payable and other liabilities

90,760

94,426

Related party liabilities

83,684

93,086

Deferred income tax liability, net

11,506

11,506

Payable pursuant to tax receivable

agreement

173,208

173,068

Total liabilities

980,577

992,737

REDEEMABLE NONCONTROLLING INTEREST

25,000

25,000

CAPITAL:

Class A common shares; No par value;

Issued and outstanding: June 30, 2023—69,199,938 shares; December

31, 2022—69,068,354 shares

Class B common shares; No par value;

Issued and outstanding: June 30, 2023—79,233,544 shares; December

31, 2022—79,233,544 shares

Contributed capital

589,634

587,733

Retained earnings

52,421

33,386

Accumulated other comprehensive loss

(2,939

)

(2,988

)

Total members’ capital

639,116

618,131

Noncontrolling interests

1,269,210

1,249,916

Total capital

1,908,326

1,868,047

TOTAL

$

2,913,903

$

2,885,784

FIVE POINT HOLDINGS,

LLC

SUPPLEMENTAL DATA

(In thousands)

(Unaudited)

Liquidity

June 30, 2023

Cash and cash equivalents

$

193,203

Borrowing capacity(1)

125,000

Total liquidity

$

318,203

(1)

As of June 30, 2023, no borrowings or

letters of credit were outstanding on the Company’s $125.0 million

revolving credit facility.

Debt to Total

Capitalization and Net Debt to Total Capitalization

June 30, 2023

Debt(1)

$

625,000

Total capital

1,908,326

Total capitalization

$

2,533,326

Debt to total capitalization

24.7

%

Debt(1)

$

625,000

Less: Cash and cash equivalents

193,203

Net debt

431,797

Total capital

1,908,326

Total net capitalization

$

2,340,123

Net debt to total

capitalization(2)

18.5

%

(1)

For purposes of this calculation, debt is

the amount due on the Company’s notes payable before offsetting for

capitalized deferred financing costs.

(2)

Net debt to total capitalization is a

non-GAAP financial measure defined as net debt (debt less cash and

cash equivalents) divided by total net capitalization (net debt

plus total capital). The Company believes the ratio of net debt to

total capitalization is a relevant and a useful financial measure

to investors in understanding the leverage employed in the

Company’s operations. However, because net debt to total

capitalization is not calculated in accordance with GAAP, this

financial measure should not be considered in isolation or as an

alternative to financial measures prescribed by GAAP. Rather, this

non-GAAP financial measure should be used to supplement the

Company's GAAP results.

Segment Results

The following table reconciles the results of operations of our

segments to our consolidated results for the three and six months

ended June 30, 2023 (in thousands):

Three Months Ended June 30,

2023

Valencia

San Francisco

Great Park

Commercial

Total reportable

segments

Corporate and

unallocated

Total under management

Removal of unconsolidated

entities(1)

Total consolidated

REVENUES:

Land sales

$

16

$

—

$

358,668

$

—

$

358,684

$

—

$

358,684

$

(358,668

)

$

16

Land sales—related party

(29

)

—

1,928

—

1,899

—

1,899

(1,928

)

(29

)

Management services—related party(2)

—

—

20,670

104

20,774

—

20,774

—

20,774

Operating properties

426

162

—

2,021

2,609

—

2,609

(2,021

)

588

Total revenues

413

162

381,266

2,125

383,966

—

383,966

(362,617

)

21,349

COSTS AND EXPENSES:

Land sales

—

—

165,749

—

165,749

—

165,749

(165,749

)

—

Management services(2)

—

—

9,682

—

9,682

—

9,682

—

9,682

Operating properties

1,798

—

—

1,019

2,817

—

2,817

(1,019

)

1,798

Selling, general, and administrative

3,394

1,049

1,815

1,033

7,291

8,267

15,558

(2,848

)

12,710

Management fees—related party

—

—

27,388

—

27,388

—

27,388

(27,388

)

—

Total costs and expenses

5,192

1,049

204,634

2,052

212,927

8,267

221,194

(197,004

)

24,190

OTHER (EXPENSE) INCOME:

Interest income

—

2

1,907

—

1,909

1,291

3,200

(1,907

)

1,293

Interest expense

—

—

—

(575

)

(575

)

—

(575

)

575

—

Miscellaneous

(20

)

—

—

—

(20

)

—

(20

)

—

(20

)

Total other (expense) income

(20

)

2

1,907

(575

)

1,314

1,291

2,605

(1,332

)

1,273

EQUITY IN EARNINGS FROM UNCONSOLIDATED

ENTITIES

261

—

606

—

867

—

867

51,261

52,128

SEGMENT (LOSS) PROFIT/INCOME BEFORE INCOME

TAX PROVISION

(4,538

)

(885

)

179,145

(502

)

173,220

(6,976

)

166,244

(115,684

)

50,560

INCOME TAX PROVISION

—

—

—

—

—

(5

)

(5

)

—

(5

)

SEGMENT (LOSS) PROFIT/NET INCOME

$

(4,538

)

$

(885

)

$

179,145

$

(502

)

$

173,220

$

(6,981

)

$

166,239

$

(115,684

)

$

50,555

(1)

Represents the removal of the Great Park

Venture and Gateway Commercial Venture operating results, which are

included in the Great Park segment and Commercial segment operating

results at 100% of each venture’s historical basis, respectively,

but are not included in our consolidated results as we account for

our investment in each venture using the equity method of

accounting.

(2)

For the Great Park and Commercial

segments, represents the revenues and expenses attributable to the

management company for providing services to the Great Park Venture

and the Gateway Commercial Venture, as applicable.

Six Months Ended June 30,

2023

Valencia

San Francisco

Great Park

Commercial

Total reportable

segments

Corporate and

unallocated

Total under management

Removal of unconsolidated

entities(1)

Total consolidated

REVENUES:

Land sales

$

(9

)

$

—

$

361,801

$

—

$

361,792

$

—

$

361,792

$

(361,801

)

$

(9

)

Land sales—related party

595

—

7,395

—

7,990

—

7,990

(7,395

)

595

Management services—related party(2)

—

—

24,799

211

25,010

—

25,010

—

25,010

Operating properties

1,130

324

—

4,175

5,629

—

5,629

(4,175

)

1,454

Total revenues

1,716

324

393,995

4,386

400,421

—

400,421

(373,371

)

27,050

COSTS AND EXPENSES:

Land sales

—

—

165,749

—

165,749

—

165,749

(165,749

)

—

Management services(2)

—

—

12,048

—

12,048

—

12,048

—

12,048

Operating properties

2,970

—

—

1,803

4,773

—

4,773

(1,803

)

2,970

Selling, general, and administrative

6,041

2,242

5,143

2,153

15,579

18,179

33,758

(7,296

)

26,462

Management fees—related party

—

—

31,848

—

31,848

—

31,848

(31,848

)

—

Total costs and expenses

9,011

2,242

214,788

3,956

229,997

18,179

248,176

(206,696

)

41,480

OTHER (EXPENSE) INCOME:

Interest income

—

3

3,208

—

3,211

2,126

5,337

(3,208

)

2,129

Interest expense

—

—

—

(1,108

)

(1,108

)

—

(1,108

)

1,108

—

Miscellaneous

(41

)

—

—

—

(41

)

—

(41

)

—

(41

)

Total other (expense) income

(41

)

3

3,208

(1,108

)

2,062

2,126

4,188

(2,100

)

2,088

EQUITY IN EARNINGS FROM UNCONSOLIDATED

ENTITIES

359

—

1,236

—

1,595

—

1,595

51,581

53,176

SEGMENT (LOSS) PROFIT/INCOME BEFORE INCOME

TAX PROVISION

(6,977

)

(1,915

)

183,651

(678

)

174,081

(16,053

)

158,028

(117,194

)

40,834

INCOME TAX PROVISION

—

—

—

—

—

(13

)

(13

)

—

(13

)

SEGMENT (LOSS) PROFIT/NET INCOME

$

(6,977

)

$

(1,915

)

$

183,651

$

(678

)

$

174,081

$

(16,066

)

$

158,015

$

(117,194

)

$

40,821

(1)

Represents the removal of the Great Park

Venture and Gateway Commercial Venture operating results, which are

included in the Great Park segment and Commercial segment operating

results at 100% of each venture’s historical basis, respectively,

but are not included in our consolidated results as we account for

our investments in each venture using the equity method of

accounting.

(2)

For the Great Park and Commercial

segments, represents the revenues and expenses attributable to the

management company for providing services to the Great Park Venture

and the Gateway Commercial Venture, as applicable.

The table below reconciles the Great Park segment results to the

equity in earnings from our investment in the Great Park Venture

that is reflected in the condensed consolidated statements of

operations for the three and six months ended June 30, 2023 (in

thousands):

Three Months Ended June 30,

2023

Six Months Ended June 30,

2023

Segment profit from operations

$

179,145

$

183,651

Less net income of management company

attributed to the Great Park segment

10,988

12,751

Net income of the Great Park Venture

168,157

170,900

The Company’s share of net income of the

Great Park Venture

63,059

64,088

Basis difference amortization, net

(10,737

)

(10,604

)

Equity in earnings from the Great Park

Venture

$

52,322

$

53,484

The table below reconciles the Commercial segment results to the

equity in loss from our investment in the Gateway Commercial

Venture that is reflected in the condensed consolidated statements

of operations for the three and six months ended June 30, 2023 (in

thousands):

Three Months Ended June 30,

2023

Six Months Ended June 30,

2023

Segment loss from operations

$

(502

)

$

(678

)

Less net income of management company

attributed to the Commercial segment

104

211

Net loss of the Gateway Commercial

Venture

(606

)

(889

)

Equity in loss from the Gateway Commercial

Venture

$

(455

)

$

(667

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230720083825/en/

Investor Relations: Leo Kij, 949-349-1029

Leo.Kij@fivepoint.com

or

Media: Eric Morgan, 949-349-1088 Eric.Morgan@fivepoint.com

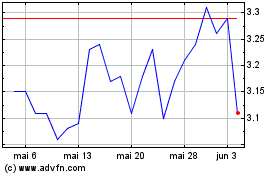

Five Point (NYSE:FPH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Five Point (NYSE:FPH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024