- Subsea inbound of $1.3 billion; full-year orders of $9.7

billion grew 45% versus 2022

- Total Company backlog of $13.2 billion increased 41% versus

the prior year

- Cash flow from operations of $701 million in the quarter;

free cash flow of $630 million

- Shareholder distributions of $77 million in the quarter,

$249 million for the full year

- Subsea order outlook for three-year period through 2025

increased 20% to $30 billion

TechnipFMC plc (NYSE: FTI) today reported fourth quarter 2023

results.

Summary Financial Results from

Continuing Operations - Fourth Quarter 2023

Reconciliation of U.S. GAAP to non-GAAP

financial measures are provided in financial schedules.

Three Months Ended

Change

(In millions, except per share

amounts)

Dec. 31,

2023

Sep. 30,

2023

Dec. 31,

2022

Sequential

Year-over- Year

Revenue

$2,077.7

$2,056.9

$1,694.4

1.0%

22.6%

Income (loss)

$53.0

$90.0

$(26.7)

(41.1%)

n/m

Income (loss) margin

2.6%

4.4%

(1.6%)

(180 bps)

n/m

Diluted earnings (loss) per

share

$0.12

$0.20

$(0.06)

(40.0%)

n/m

Adjusted EBITDA

$218.7

$237.5

$120.9

(7.9%)

80.9%

Adjusted EBITDA margin

10.5%

11.5%

7.1%

(100 bps)

340 bps

Adjusted income (loss)

$62.7

$93.7

$(20.7)

(33.1%)

n/m

Adjusted diluted earnings (loss) per

share

$0.14

$0.21

$(0.05)

(33.3%)

n/m

Inbound orders

$1,531.6

$2,145.1

$1,842.5

(28.6%)

(16.9%)

Ending backlog

$13,231.0

$13,230.7

$9,353.0

0.0%

41.5%

n/m - not meaningful

Total Company revenue in the fourth quarter was $2,077.7

million. Income attributable to TechnipFMC was $53 million, or

$0.12 per diluted share. These results included after-tax charges

and credits of $9.7 million, or $0.02 per share (Exhibit 6).

Adjusted income was $62.7 million, or $0.14 per diluted share

(Exhibit 6).

Adjusted EBITDA, which excludes pre-tax charges and credits, was

$218.7 million; adjusted EBITDA margin was 10.5 percent (Exhibit

8).

Included in total Company results was a foreign exchange loss of

$26.4 million, or $22.7 million after-tax. When excluding the

after-tax impact of foreign exchange, income was $75.7 million.

Adjusted EBITDA, excluding foreign exchange, was $245.1 million

(Exhibit 7).

Summary Financial Results from

Continuing Operations - Full Year 2023

Reconciliation of U.S. GAAP to non-GAAP

financial measures are provided in financial schedules.

Twelve Months Ended

Change

(In millions, except per share

amounts)

Dec. 31,

2023

Dec. 31,

2022

Year-over-

Year

Revenue

$7,824.2

$6,700.4

16.8%

Income (loss)

$56.2

$(61.9)

n/m

Income (loss) margin

0.7%

(0.9%)

n/m

Diluted earnings (loss) per

share

$0.12

$(0.14)

n/m

Adjusted EBITDA

$819.6

$646.5

26.8%

Adjusted EBITDA margin

10.5%

9.6%

90 bps

Adjusted income (loss)

$201.4

$(12.6)

n/m

Adjusted diluted earnings (loss) per

share

$0.45

$(0.03)

n/m

Inbound orders

$10,982.9

$8,079.1

35.9%

Ending backlog

$13,231.0

$9,353.0

41.5%

n/m - not meaningful

Total Company revenue in the full year was $7,824.2 million.

Income attributable to TechnipFMC was $56.2 million, or $0.12 per

diluted share. These results included after-tax charges and credits

totaling $145.2 million of expense, or $0.32 per share, which

included the following pre-tax items (Exhibit 6):

- An incremental non-recurring legal settlement charge related to

the previously disclosed final resolution of all outstanding

matters with the French national prosecutor’s office of $126.5

million; and

- Restructuring, impairment and other charges of $20

million.

Adjusted income was $201.4 million, or $0.45 per diluted share

(Exhibit 6).

Adjusted EBITDA, which excludes pre-tax charges and credits, was

$819.6 million; adjusted EBITDA margin was 10.5 percent (Exhibit

9).

Included in total Company results was a foreign exchange loss of

$119 million, or $116.5 million after-tax. When excluding the

after-tax impact of foreign exchange, income was $172.7 million.

Adjusted EBITDA, excluding foreign exchange, was $938.6 million

(Exhibit 7).

Doug Pferdehirt, Chair and CEO of TechnipFMC, stated, “I am

proud to report our strong quarterly and full year results which

speak to the growth and operational momentum we are achieving.

Total Company inbound for the year grew to $11 billion. This

included Subsea orders of $9.7 billion, which was an increase of

45% versus the prior year and a book-to-bill of 1.5. These strong

results benefited from a record level of iEPCI™ awards in the

period. I am particularly pleased with the inbound quality, as

direct awards, iEPCI™ and Subsea Services exceeded 70% of Subsea

orders.”

“Total Company revenue for the year grew 17%, while adjusted

EBITDA increased 40% to $939 million versus the prior year, when

excluding the impact of foreign exchange. We generated cash flow

from operations of $693 million and free cash flow of $468 million

for the year, and we returned nearly $250 million to shareholders

through share repurchases and dividends.”

Pferdehirt continued, “Any way you look at it, 2023 was a period

of strong growth for our company. Our robust order intake drove a

50% increase in Subsea backlog to over $12 billion, with high

quality inbound expected to support nearly 40% growth in Subsea

adjusted EBITDA in 2024 based on the midpoint of our guidance.”

“We started 2024 with the award of Mero 3 HISEP®, the first

iEPCI™ project ever awarded by Petrobras, which exceeded $1 billion

of inbound. The significance of this project for the subsea

industry cannot be overstated, as it will be the first to use

subsea processing to capture CO2 rich dense gases directly from the

well stream for injection back into the reservoir. Importantly,

this will all take place on the seafloor. The HISEP® project plays

to our strengths, allowing us to demonstrate how technology

innovation, project integration and partner collaboration enable

our meaningful participation in the energy transition while

remaining aligned with our strategic priorities.”

Pferdehirt added, “We see continued strength ahead, driven by

the resiliency and durability of this cycle. The demand for energy

will continue to grow. However, we believe the market’s evolution

will differ from the past, driven by three major trends. First, a

shift in capital flows, which we believe will largely be directed

to the offshore and Middle East markets. Second, an increased role

for new technologies, as shown by the Mero 3 HISEP® award. And

third, an expanded role for subsea services, driven by the needs of

growing and aging infrastructure. These trends allow TechnipFMC to

leverage our full suite of integrated solutions, differentiated

technologies, and the industry’s most comprehensive subsea services

offering.”

Pferdehirt concluded, “We have entered an unprecedented time for

the development of conventional energy resources, particularly

offshore. This backdrop, combined with our unique capabilities,

gives us the confidence to increase our expectations for Subsea

inbound to reach $30 billion over the three-year period ending

2025. The significant increase in our order outlook will provide

additional growth in backlog and further extend the execution of

our project portfolio through the end of the decade.”

Operational and Financial Highlights

Subsea

Financial Highlights

Reconciliation of U.S. GAAP to non-GAAP

financial measures are provided in financial schedules.

Three Months Ended

Change

(In millions)

Dec. 31,

2023

Sep. 30,

2023

Dec. 31,

2022

Sequential

Year-over- Year

Revenue

$1,720.5

$1,708.3

$1,342.5

0.7%

28.2%

Operating profit

$145.7

$177.7

$61.5

(18.0%)

136.9%

Operating profit margin

8.5%

10.4%

4.6%

(190 bps)

390 bps

Adjusted EBITDA

$225.5

$257.8

$140.1

(12.5%)

61.0%

Adjusted EBITDA margin

13.1%

15.1%

10.4%

(200 bps)

270 bps

Inbound orders

$1,270.0

$1,828.0

$1,515.9

(30.5%)

(16.2%)

Ending backlog1,2,3

$12,164.1

$12,073.6

$8,131.5

0.7%

49.6%

Estimated Consolidated Backlog

Scheduling

(In millions)

Dec. 31,

2023

2024

$4,812

2025

$3,411

2026 and beyond

$3,941

Total

$12,164

1 Backlog as of December 31, 2023 was

increased by a foreign exchange impact of $541 million.

2 Backlog does not capture all revenue

potential for Subsea Services.

3 Backlog as of December 31, 2023 does not

include total Company non-consolidated backlog of $272 million.

Subsea reported fourth quarter revenue of $1,720.5 million, an

increase of 0.7 percent from the third quarter. Revenue increased

sequentially due to higher project activity in the Gulf of Mexico,

Asia Pacific and Africa, driven in part by accelerated conversion

of several projects in backlog. The increased activity was largely

offset by seasonal factors that impacted vessel utilization.

Services revenue modestly increased from the prior quarter due to

strength in asset maintenance and remotely operated vehicle (ROV)

services in Norway and the Gulf of Mexico. Services revenue was

less impacted in the quarter by typical offshore seasonality,

particularly in the North Sea.

Subsea reported an operating profit of $145.7 million. Operating

profit declined sequentially due to lower vessel-based activity and

the mix of projects executed from backlog in the period. Operating

profit margin decreased 190 basis points to 8.5 percent.

Subsea reported adjusted EBITDA of $225.5 million, a decrease of

12.5 percent when compared to the third quarter. The factors

impacting operating profit also drove the sequential decrease in

adjusted EBITDA. Adjusted EBITDA margin decreased 200 basis points

to 13.1 percent.

Subsea inbound orders were $1,270 million for the quarter.

Book-to-bill in the period was 0.7x. The following award was

included in the period:

- BP Argos Southwest Extension project (Gulf of Mexico)

Significant* contract by bp for its Argos Southwest Extension

project in the Mad Dog field. TechnipFMC will install pipe and an

umbilical, tying back three new wells to the Argos platform in the

Gulf of Mexico. Under the contract, TechnipFMC will also

manufacture and install pipeline end terminations. *A “significant”

contract is between $75 million and $250 million.

Surface Technologies

Financial Highlights

Reconciliation of U.S. GAAP to non-GAAP

financial measures are provided in financial schedules.

Three Months Ended

Change

(In millions)

Dec. 31,

2023

Sep. 30,

2023

Dec. 31,

2022

Sequential

Year-over- Year

Revenue

$357.2

$348.6

$351.9

2.5%

1.5%

Operating profit

$33.2

$33.3

$25.6

(0.3%)

29.7%

Operating profit margin

9.3%

9.6%

7.3%

(30 bps)

200 bps

Adjusted EBITDA

$52.5

$49.9

$44.4

5.2%

18.2%

Adjusted EBITDA margin

14.7%

14.3%

12.6%

40 bps

210 bps

Inbound orders

$261.6

$317.1

$326.6

(17.5%)

(19.9%)

Ending backlog

$1,066.9

$1,157.1

$1,221.5

(7.8%)

(12.7%)

Surface Technologies reported fourth quarter revenue of $357.2

million, an increase of 2.5 percent from the third quarter, driven

by higher activity in international and North America markets, with

both benefiting from higher wellhead equipment sales.

Surface Technologies reported operating profit of $33.2 million,

largely unchanged versus the third quarter. Operating profit

benefited from increased contribution from international services

and higher wellhead equipment sales. Results in the period were

negatively impacted by $3.3 million of higher restructuring,

impairment and other charges. Operating profit margin decreased 30

basis points to 9.3 percent.

Surface Technologies reported adjusted EBITDA of $52.5 million,

an increase of 5.2 percent when compared to the third quarter.

Results increased due to the same factors that drove operating

profit. Adjusted EBITDA margin increased 40 basis points to 14.7

percent.

Inbound orders for the quarter were $261.6 million, a decrease

of 17.5 percent sequentially. Backlog ended the period at $1,066.9

million.

Corporate and Other Items (three months ended, December

31, 2023)

Corporate expense was $38.3 million. Excluding charges of $4.9

million, corporate expense was $33.4 million.

Foreign exchange loss was $26.4 million, the majority of which

was related to the significant devaluation of the Argentine

peso.

Net interest expense was $13 million. Results in the period

benefited from increased interest income, driven in part by strong

cash generation.

The provision for income taxes was $54.5 million.

Total depreciation and amortization was $94.5 million.

Cash provided by operating activities was $701.1 million.

Capital expenditures were $71.5 million. Free cash flow was $629.6

million (Exhibit 11).

Cash and cash equivalents increased $260.8 million sequentially

to $951.7 million. Gross debt declined $273.5 million sequentially

to $1,067.3 million, primarily due to the maturity of the 2013

Private Placement Notes. Net debt declined $534.3 million to $115.6

million (Exhibit 10).

During the quarter, the Company repurchased 2.7 million of its

ordinary shares for total consideration of $55 million. When

including the dividend payment of $21.7 million, total shareholder

distributions in the quarter were $76.7 million. For the twelve

months ended December 31, 2023, the Company’s total shareholder

distributions were $248.6 million.

Corporate Actions

In November, the Company announced an agreement to sell the

Measurement Solutions business to One Equity Partners for $205

million in cash. The Company now expects to conclude the

transaction by the end of the first quarter, subject to customary

adjustments and closing conditions.

As part of the Surface Technologies segment, the Measurement

Solutions business encompasses terminal management solutions and

metering products and systems, and includes engineering and

manufacturing locations in North America and Europe.

2024 Full-Year Financial Guidance1

The Company’s full-year guidance for 2024 can be found in the

table below.

Guidance for Surface Technologies includes anticipated financial

results for the Measurement Solutions business for the three months

ending March 31, 2024.

2024 Guidance (As of February

22, 2024)

Subsea

Surface Technologies

Revenue in a range of $7.2 - 7.6

billion

Revenue in a range of $1.2 - 1.35

billion

Adjusted EBITDA margin in a range of 15.5

- 16.5%

Adjusted EBITDA margin in a range of 13 -

15%

TechnipFMC

Corporate expense, net $115 - 125

million

(includes depreciation and amortization of

~$3 million; excludes charges and credits)

Net interest expense $70 - 80

million

Tax provision, as reported $280 -

290 million

Capital expenditures approximately

$275 million

Free cash flow2 $350 - 500

million

(includes payment for legal settlement of

~$170 million)

_______________________

1 Our guidance measures of adjusted EBITDA

margin, free cash flow and adjusted corporate expense, net are

non-GAAP financial measures. We are unable to provide a

reconciliation to comparable GAAP financial measures on a

forward-looking basis without unreasonable effort because of the

unpredictability of the individual components of the most directly

comparable GAAP financial measure and the variability of items

excluded from each such measure. Such information may have a

significant, and potentially unpredictable, impact on our future

financial results.

2 Free cash flow is calculated as cash

flow from operations less capital expenditures.

Teleconference

The Company will host a teleconference on Thursday, February 22,

2024 to discuss the fourth quarter 2023 financial results. The call

will begin at 1:30 p.m. London time (8:30 a.m. New York time).

Webcast access and an accompanying presentation can be found at

www.TechnipFMC.com.

An archived audio replay will be available after the event at

the same website address. In the event of a disruption of service

or technical difficulty during the call, information will be posted

on our website.

About TechnipFMC

TechnipFMC is a leading technology provider to the traditional

and new energy industries; delivering fully integrated projects,

products, and services.

With our proprietary technologies and comprehensive solutions,

we are transforming our clients’ project economics, helping them

unlock new possibilities to develop energy resources while reducing

carbon intensity and supporting their energy transition

ambitions.

Organized in two business segments — Subsea and Surface

Technologies — we will continue to advance the industry with our

pioneering integrated ecosystems (such as iEPCI™, iFEED™ and

iComplete™), technology leadership and digital innovation.

Each of our approximately 21,000 employees is driven by a

commitment to our clients’ success, and a culture of strong

execution, purposeful innovation, and challenging industry

conventions.

TechnipFMC uses its website as a channel of distribution of

material company information. To learn more about how we are

driving change in the industry, go to www.TechnipFMC.com and follow

us on X (formerly Twitter) @TechnipFMC.

This communication contains “forward-looking statements” as

defined in Section 27A of the United States Securities Act of 1933,

as amended, and Section 21E of the United States Securities

Exchange Act of 1934, as amended. Forward-looking statements

usually relate to future events, market growth and recovery, growth

of our new energy business, and anticipated revenues, earnings,

cash flows, or other aspects of our operations or operating

results. Forward-looking statements are often identified by words

such as “guidance,” “confident,” “believe,” “expect,” “anticipate,”

“plan,” “intend,” “foresee,” “should,” “would,” “could,” “may,”

“will,” “likely,” “predicated,” “estimate,” “outlook” and similar

expressions, including the negative thereof. The absence of these

words, however, does not mean that the statements are not

forward-looking. These forward-looking statements are based on our

current expectations, beliefs, and assumptions concerning future

developments and business conditions and their potential effect on

us. While management believes these forward-looking statements are

reasonable as and when made, there can be no assurance that future

developments affecting us will be those that we anticipate. All of

our forward-looking statements involve risks and uncertainties

(some of which are significant or beyond our control) and

assumptions that could cause actual results to differ materially

from our historical experience and our present expectations or

projections. Known material factors that could cause actual results

to differ materially from those contemplated in the forward-looking

statements include our ability to close the Measurement Solutions

transaction, on a timely basis, if at all and the risks associated

therewith; unpredictable trends in the demand for and price of oil

and natural gas; competition and unanticipated changes relating to

competitive factors in our industry, including ongoing industry

consolidation; our inability to develop, implement and protect new

technologies and services and intellectual property related

thereto, including new technologies and services for our new energy

business; the cumulative loss of major contracts, customers or

alliances and unfavorable credit and commercial terms of certain

contracts; disruptions in the political, regulatory, economic and

social conditions of the countries in which we conduct business;

the refusal of DTC to act as depository and clearing agency for our

shares; the impact of our existing and future indebtedness and the

restrictions on our operations by terms of the agreements governing

our existing indebtedness; the risks caused by our acquisition and

divestiture activities; additional costs or risks from increasing

scrutiny and expectations regarding ESG matters; uncertainties

related to our investments in new energy business; the risks caused

by fixed-price contracts; our failure to timely deliver our

backlog; our reliance on subcontractors, suppliers and our joint

venture partners; a failure or breach of our IT infrastructure or

that of our subcontractors, suppliers or joint venture partners,

including as a result of cyber-attacks; risks of pirates and

maritime conflicts endangering our maritime employees and assets;

any delays and cost overruns of new capital asset construction

projects for vessels and manufacturing facilities; potential

liabilities inherent in the industries in which we operate or have

operated; our failure to comply with existing and future laws and

regulations, including those related to environmental protection,

climate change, health and safety, labor and employment,

import/export controls, currency exchange, bribery and corruption,

taxation, privacy, data protection and data security; the

additional restrictions on dividend payouts or share repurchases as

an English public limited company; uninsured claims and litigation

against us; tax laws, treaties and regulations and any unfavorable

findings by relevant tax authorities; potential departure of our

key managers and employees; adverse seasonal weather, and other

climatic conditions and unfavorable currency exchange rates; risk

in connection with our defined benefit pension plan commitments;

our inability to obtain sufficient bonding capacity for certain

contracts, as well as those set forth in Part I, Item 1A, “Risk

Factors” of our Annual Report on Form 10-K for the fiscal year

ended December 31, 2022 and our other reports subsequently filed

with the Securities and Exchange Commission.

We caution you not to place undue reliance on any

forward-looking statements, which speak only as of the date hereof.

We undertake no obligation to publicly update or revise any of our

forward-looking statements after the date they are made, whether as

a result of new information, future events or otherwise, except to

the extent required by law.

Exhibit 1

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

(In millions, except per share

data, unaudited)

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

2023

2023

2022

2023

2022

Revenue

$

2,077.7

$

2,056.9

$

1,694.4

$

7,824.2

$

6,700.4

Costs and expenses

1,938.8

1,896.1

1,665.3

7,315.0

6,503.1

138.9

160.8

29.1

509.2

197.3

Other income (expense), net

(24.7

)

(20.9

)

(7.0

)

(213.9

)

50.0

Loss from investment in Technip

Energies

—

—

—

—

(27.7

)

Income before net interest expense and

income taxes

114.2

139.9

22.1

295.3

219.6

Net interest expense and loss on early

extinguishment of debt

(13.0

)

(26.7

)

(28.4

)

(88.7

)

(150.7

)

Income (loss) before income taxes

101.2

113.2

(6.3

)

206.6

68.9

Provision for income taxes

54.5

19.5

14.4

154.7

105.4

Income (loss) from continuing

operations

46.7

93.7

(20.7

)

51.9

(36.5

)

(Income) loss from continuing operations

attributable to non-controlling interests

6.3

(3.7

)

(6.0

)

4.3

(25.4

)

Income (loss) from continuing operations

attributable to TechnipFMC plc

53.0

90.0

(26.7

)

56.2

(61.9

)

Loss from discontinued operations

—

—

(10.6

)

—

(45.3

)

Net income (loss) attributable to

TechnipFMC plc

$

53.0

$

90.0

$

(37.3

)

$

56.2

$

(107.2

)

Earnings (loss) per share from continuing

operations

Basic

$

0.12

$

0.21

$

(0.06

)

$

0.13

$

(0.14

)

Diluted

$

0.12

$

0.20

$

(0.06

)

$

0.12

$

(0.14

)

Loss per share from discontinued

operations

Basic and diluted

$

—

$

—

$

(0.02

)

$

—

$

(0.10

)

Earnings (loss) per share attributable to

TechnipFMC plc

Basic

$

0.12

$

0.21

$

(0.08

)

$

0.13

$

(0.24

)

Diluted

$

0.12

$

0.20

$

(0.08

)

$

0.12

$

(0.24

)

Weighted average shares outstanding:

Basic

434.4

436.9

444.6

438.6

449.5

Diluted

448.6

450.3

444.6

452.3

449.5

Cash dividends declared per share

$

0.05

$

0.05

$

—

$

0.10

$

—

Exhibit 2

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

BUSINESS

SEGMENT DATA

(In millions,

unaudited)

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

2023

2023

2022

2023

2022

Revenue

Subsea

$

1,720.5

$

1,708.3

$

1,342.5

$

6,434.8

$

5,461.2

Surface Technologies

357.2

348.6

351.9

1,389.4

1,239.2

Total segment revenue

$

2,077.7

$

2,056.9

$

1,694.4

$

7,824.2

$

6,700.4

Segment operating

profit

Subsea

$

145.7

$

177.7

$

61.5

$

543.6

$

317.6

Surface Technologies

33.2

33.3

25.6

114.6

58.3

Total segment operating profit

178.9

211.0

87.1

658.2

375.9

Corporate

items

Corporate expense (1)

$

(38.3

)

$

(24.7

)

$

(28.0

)

$

(243.9

)

$

(104.7

)

Net interest expense and loss on early

extinguishment of debt

(13.0

)

(26.7

)

(28.4

)

(88.7

)

(150.7

)

Loss from investment in Technip

Energies

—

—

—

—

(27.7

)

Foreign exchange losses

(26.4

)

(46.4

)

(37.0

)

(119.0

)

(23.9

)

Total corporate items

(77.7

)

(97.8

)

(93.4

)

(451.6

)

(307.0

)

Income (loss) before income taxes (2)

$

101.2

$

113.2

$

(6.3

)

$

206.6

$

68.9

(1)

Corporate expense primarily includes the

non-recurring legal settlement charge, corporate staff expenses,

share-based compensation expenses, and other employee benefits.

(2)

Includes amounts attributable to

non-controlling interests.

Exhibit 3

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

BUSINESS

SEGMENT DATA

(In millions,

unaudited)

Three Months Ended

Year Ended

Inbound

Orders (1)

December 31,

September 30,

December 31,

December 31,

2023

2023

2022

2023

2022

Subsea

$

1,270.0

$

1,828.0

$

1,515.9

$

9,749.0

$

6,738.3

Surface Technologies

261.6

317.1

326.6

1,233.9

1,340.8

Total inbound orders

$

1,531.6

$

2,145.1

$

1,842.5

$

10,982.9

$

8,079.1

Order Backlog

(2)

December 31, 2023

September 30, 2022

December 31, 2022

Subsea

$

12,164.1

$

12,073.6

$

8,131.5

Surface Technologies

1,066.9

1,157.1

1,221.5

Total order backlog

$

13,231.0

$

13,230.7

$

9,353.0

(1)

Inbound orders represent the estimated

sales value of confirmed customer orders received during the

reporting period.

(2)

Order backlog is calculated as the

estimated sales value of unfilled, confirmed customer orders at the

reporting date.

Exhibit 4

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions,

unaudited)

December 31,

2023

2022

Cash and cash equivalents

$

951.7

$

1,057.1

Trade receivables, net

1,138.1

966.5

Contract assets, net

1,010.1

981.6

Inventories, net

1,100.3

1,039.7

Other current assets

995.2

943.8

Total current assets

5,195.4

4,988.7

Property, plant and equipment, net

2,270.9

2,354.9

Intangible assets, net

601.6

716.0

Other assets

1,588.7

1,384.7

Total assets

$

9,656.6

$

9,444.3

Short-term debt and current portion of

long-term debt

$

153.8

$

367.3

Accounts payable, trade

1,355.8

1,282.8

Contract liabilities

1,485.8

1,156.4

Other current liabilities

1,473.2

1,367.8

Total current liabilities

4,468.6

4,174.3

Long-term debt, less current portion

913.5

999.3

Other liabilities

1,102.4

994.0

TechnipFMC plc stockholders’ equity

3,136.7

3,240.2

Non-controlling interests

35.4

36.5

Total liabilities and equity

$

9,656.6

$

9,444.3

Exhibit 5

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions,

unaudited)

Three Months Ended December

31,

Year Ended December

31,

2023

2023

2022

Cash provided by operating activities

Net income (loss)

$

46.7

$

51.9

$

(81.8

)

Net loss from discontinued operations

—

—

45.3

Adjustments to reconcile net income (loss)

to cash provided (required) by operating activities

Depreciation and amortization

94.5

377.8

377.2

Employee benefit plan and share-based

compensation costs

(12.8

)

30.8

33.5

Deferred income tax provision, net

(31.3

)

(54.2

)

(13.0

)

Loss from investment in Technip

Energies

—

—

27.7

Unrealized loss on derivative instruments

and foreign exchange

23.8

29.6

54.0

(Income) loss from equity affiliates, net

of dividends received

1.7

(34.2

)

(31.9

)

Loss on early extinguishment of debt

—

—

29.8

Other

36.8

42.4

11.4

Changes in operating assets and

liabilities, net of effects of acquisitions

Trade receivables, net and contract

assets

359.9

(227.7

)

(160.2

)

Inventories, net

21.7

(91.2

)

(35.0

)

Accounts payable, trade

(213.2

)

62.5

52.1

Contract liabilities

231.6

321.0

164.5

Income taxes payable (receivable), net

(11.7

)

34.3

(62.1

)

Other current assets and liabilities,

net

160.6

203.3

(40.4

)

Other non-current assets and liabilities,

net

(7.2

)

(53.3

)

(19.0

)

Cash provided by operating activities

701.1

693.0

352.1

Cash provided (required) by investing

activities

Capital expenditures

(71.5

)

(225.2

)

(157.9

)

Proceeds from sale of assets

9.4

84.7

30.2

Proceeds from sales of investment in

Technip Energies

—

—

288.5

Other

—

14.9

1.4

Cash provided (required) by investing

activities

(62.1

)

(125.6

)

162.2

Cash required by financing activities

Net change in short-term debt

(303.4

)

(341.6

)

(200.4

)

Cash settlement for derivative hedging

debt

—

(30.1

)

(80.5

)

Proceeds from issuance of long-term

debt

—

—

60.9

Repayments of long-term debt

—

—

(451.7

)

Payments for debt issuance cost

—

(16.7

)

—

Share repurchases

(55.0

)

(205.1

)

(100.2

)

Dividends paid

(21.7

)

(43.5

)

—

Other

0.3

(19.5

)

(24.8

)

Cash required by financing activities

(379.8

)

(656.5

)

(796.7

)

Effect of changes in foreign exchange

rates on cash and cash equivalents

1.6

(16.3

)

12.1

Change in cash and cash equivalents

260.8

(105.4

)

(270.3

)

Cash and cash equivalents in the statement

of cash flows, beginning of period

690.9

1,057.1

1,327.4

Cash and cash equivalents in the statement

of cash flows, end of period

$

951.7

$

951.7

$

1,057.1

Exhibit 6

TECHNIPFMC PLC AND

CONSOLIDATED SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES (In millions, except per share data,

unaudited)

In addition to financial results determined in accordance with

U.S. generally accepted accounting principles (GAAP), the fourth

quarter 2023 Earnings Release also includes non-GAAP financial

measures (as defined in Item 10 of Regulation S-K of the Securities

Exchange Act of 1934, as amended) and describes performance on a

year-over-year or sequential basis. Net income (loss) attributable

to TechnipFMC plc, excluding charges and credits, as well as

measures derived from it (including Diluted EPS, excluding charges

and credits; Earnings before net interest expense, income taxes,

depreciation and amortization, excluding charges and credits

(“Adjusted EBITDA”); and Adjusted EBITDA, excluding foreign

exchange gains or losses, net; Adjusted EBITDA margin; Adjusted

EBITDA margin, excluding foreign exchange, net); Corporate expense,

excluding charges and credits; Foreign exchange, net and other,

excluding charges and credits; and net debt are non-GAAP financial

measures.

Non-GAAP adjustments are presented on a gross basis and the tax

impact of the non-GAAP adjustments is separately presented in the

applicable reconciliation table. Estimates of the tax effect of

each adjustment is calculated item by item, by reviewing the

relevant jurisdictional tax rate to the pretax non-GAAP amounts,

analyzing the nature of the item and/or the tax jurisdiction in

which the item has been recorded, the need of application of a

specific tax rate, history of non- GAAP taxable income positions

(i.e. net operating loss carryforwards) and concluding on the

valuation allowance positions.

Management believes that the exclusion of charges, credits and

foreign exchange impacts from these financial measures provides a

useful perspective on the Company’s underlying business results and

operating trends, and a means to evaluate TechnipFMC’s operations

and consolidated results of operations period-over-period. These

measures are also used by management as performance measures in

determining certain incentive compensation. The foregoing non-GAAP

financial measures should be considered by investors in addition

to, not as a substitute for or superior to, other measures of

financial performance prepared in accordance with GAAP. The

following is a reconciliation of the most comparable financial

measures under GAAP to the non-GAAP financial measures.

Three Months Ended

Year Ended

December 31, 2023

September 30, 2023

December 31, 2022

December 31, 2023

December 31, 2022

Net income (loss) attributable to

TechnipFMC plc

$

53.0

$

90.0

$

(26.7

)

$

56.2

$

(61.9

)

Charges and (credits):

Restructuring, impairment and other

charges

10.0

4.3

6.0

20.0

22.0

Non-recurring legal settlement

charges*

—

—

—

126.5

—

Loss from investment in Technip

Energies

—

—

—

—

27.7

Tax on charges and (credits)

(0.3

)

(0.6

)

—

(1.3

)

(0.4

)

Adjusted net income (loss) attributable to

TechnipFMC plc

$

62.7

$

93.7

$

(20.7

)

$

201.4

$

(12.6

)

Weighted diluted average shares

outstanding

448.6

450.3

444.6

452.3

449.5

Reported earnings (loss) per share -

diluted

$

0.12

$

0.20

$

(0.06

)

$

0.12

$

(0.14

)

Adjusted earnings (loss) per share -

diluted

$

0.14

$

0.21

$

(0.05

)

$

0.45

$

(0.03

)

*The non-recurring legal settlement

charges reflect the impact of the resolution of all outstanding

matters with the PNF (reference to Note 20 of the coming annual

report on Form 10-K for the year ended December 31, 2023 (the

“10-K”)). For taxation purposes, the charges are treated as a

penalty and as such, do not trigger tax charges or benefits.

Exhibit 7

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Three Months Ended

Year Ended

December 31, 2023

September 30, 2023

December 31, 2022

December 31, 2023

December 31, 2022

Net income (loss) attributable to

TechnipFMC plc

53.0

90.0

(26.7

)

56.2

(61.9

)

Income (loss) attributable to

non-controlling interests

(6.3

)

3.7

6.0

(4.3

)

25.4

Provision for income tax

54.5

19.5

14.4

154.7

105.4

Net interest expense

13.0

26.7

28.4

88.7

150.7

Depreciation and amortization

94.5

93.3

92.8

377.8

377.2

Restructuring, impairment and other

charges

10.0

4.3

6.0

20.0

22.0

Non-recurring legal settlement

charges*

—

—

—

126.5

—

Loss from investment in Technip

Energies

—

—

—

—

27.7

Adjusted EBITDA

$

218.7

$

237.5

$

120.9

$

819.6

$

646.5

Foreign exchange, net

26.4

46.4

37.0

119.0

23.9

Adjusted EBITDA, excluding foreign

exchange, net

$

245.1

$

283.9

$

157.9

$

938.6

$

670.4

*The non-recurring legal settlement

charges reflect the impact of the resolution of all outstanding

matters with the PNF (reference to Note 20 of the 10-K). For

taxation purposes the charges are treated as a penalty and as such,

do not trigger tax charges or benefits.

Exhibit 8

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Three Months Ended

December 31, 2023

Subsea

Surface Technologies

Corporate Expense

Foreign Exchange, net

Total

Revenue

$

1,720.5

$

357.2

$

—

$

—

$

2,077.7

Operating profit (loss), as reported

(pre-tax)

$

145.7

$

33.2

$

(38.3

)

$

(26.4

)

$

114.2

Charges and (credits):

Restructuring, impairment and other

charges

1.2

3.9

4.9

—

10.0

Subtotal

1.2

3.9

4.9

—

10.0

Depreciation and amortization

78.6

15.4

0.5

—

94.5

Adjusted EBITDA

225.5

52.5

(32.9

)

(26.4

)

218.7

Foreign exchange, net

—

—

—

26.4

26.4

Adjusted EBITDA, excluding foreign

exchange, net

$

225.5

$

52.5

$

(32.9

)

$

—

$

245.1

Operating profit margin, as reported

8.5

%

9.3

%

5.5

%

Adjusted EBITDA margin

13.1

%

14.7

%

10.5

%

Adjusted EBITDA margin, excluding foreign

exchange, net

13.1

%

14.7

%

11.8

%

Exhibit 8

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Three Months Ended

September 30, 2023

Subsea

Surface Technologies

Corporate Expense

Foreign Exchange, net

Total

Revenue

$

1,708.3

$

348.6

$

—

$

—

$

2,056.9

Operating profit (loss), as reported

(pre-tax)

$

177.7

$

33.3

$

(24.7

)

$

(46.4

)

$

139.9

Charges and (credits):

Restructuring, impairment and other

charges

3.3

0.6

0.4

—

4.3

Subtotal

3.3

0.6

0.4

—

4.3

Depreciation and amortization

76.8

16.0

0.5

—

93.3

Adjusted EBITDA

257.8

49.9

(23.8

)

(46.4

)

237.5

Foreign exchange, net

—

—

—

46.4

46.4

Adjusted EBITDA, excluding foreign

exchange, net

$

257.8

$

49.9

$

(23.8

)

$

—

$

283.9

Operating profit margin, as reported

10.4

%

9.6

%

6.8

%

Adjusted EBITDA margin

15.1

%

14.3

%

11.5

%

Adjusted EBITDA margin, excluding foreign

exchange, net

15.1

%

14.3

%

13.8

%

Exhibit 8

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Three Months Ended

December 31, 2022

Subsea

Surface Technologies

Corporate Expense

Foreign Exchange, net

Total

Revenue

$

1,342.5

$

351.9

$

—

$

—

$

1,694.4

Operating profit (loss), as reported

(pre-tax)

$

61.5

$

25.6

$

(28.0

)

$

(37.0

)

$

22.1

Charges and (credits):

Restructuring, impairment and other

charges

4.5

0.8

0.7

—

6.0

Subtotal

4.5

0.8

0.7

—

6.0

Depreciation and amortization

74.1

18.0

0.7

—

92.8

Adjusted EBITDA

140.1

44.4

(26.6

)

(37.0

)

120.9

Foreign exchange, net

—

—

—

37.0

37.0

Adjusted EBITDA, excluding foreign

exchange, net

$

140.1

$

44.4

$

(26.6

)

$

—

$

157.9

Operating profit margin, as reported

4.6

%

7.3

%

1.3

%

Adjusted EBITDA margin

10.4

%

12.6

%

7.1

%

Adjusted EBITDA margin, excluding foreign

exchange, net

10.4

%

12.6

%

9.3

%

Exhibit 9

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Year Ended

December 31, 2023

Subsea

Surface Technologies

Corporate Expense

Foreign Exchange, net

Total

Revenue

$

6,434.8

$

1,389.4

$

—

$

—

$

7,824.2

Operating profit (loss), as reported

(pre-tax)

$

543.6

$

114.6

$

(243.9

)

$

(119.0

)

$

295.3

Charges and (credits):

Restructuring, impairment and other

charges

4.9

9.8

5.3

—

20.0

Non-recurring legal settlement charge

—

—

126.5

—

126.5

Subtotal

4.9

9.8

131.8

—

146.5

Depreciation and amortization

310.5

65.2

2.1

—

377.8

Adjusted EBITDA

859.0

189.6

(110.0

)

(119.0

)

819.6

Foreign exchange, net

—

—

—

119.0

119.0

Adjusted EBITDA, excluding foreign

exchange, net

$

859.0

$

189.6

$

(110.0

)

$

—

$

938.6

Operating profit margin, as reported

8.4

%

8.2

%

3.8

%

Adjusted EBITDA margin

13.3

%

13.6

%

10.5

%

Adjusted EBITDA margin, excluding foreign

exchange, net

13.3

%

13.6

%

12.0

%

Exhibit 9

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Year Ended

December 31, 2022

Subsea

Surface Technologies

Corporate Expense

Foreign Exchange, net and

Other

Total

Revenue

$

5,461.2

$

1,239.2

$

—

$

—

$

6,700.4

Operating loss, as reported (pre-tax)

$

317.6

$

58.3

$

(104.7

)

$

(51.6

)

$

219.6

Charges and (credits):

Restructuring, impairment and other

charges

7.0

11.3

3.7

—

22.0

Loss from investment in Technip

Energies

—

—

—

27.7

27.7

Subtotal

7.0

11.3

3.7

27.7

49.7

Adjusted Depreciation and amortization

304.3

70.0

2.9

—

377.2

Adjusted EBITDA

628.9

139.6

(98.1

)

(23.9

)

646.5

Foreign exchange, net

—

—

—

23.9

23.9

Adjusted EBITDA, excluding foreign

exchange, net

$

628.9

$

139.6

$

(98.1

)

$

—

$

670.4

Operating profit margin, as reported

5.8

%

4.7

%

3.3

%

Adjusted EBITDA margin

11.5

%

11.3

%

9.6

%

Adjusted EBITDA margin, excluding foreign

exchange, net

11.5

%

11.3

%

10.0

%

Exhibit 10

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

December 31,

2023

September 30, 2023

December 31,

2022

Cash and cash equivalents

$

951.7

$

690.9

$

1,057.1

Short-term debt and current portion of

long-term debt

(153.8

)

(407.3

)

(367.3

)

Long-term debt, less current portion

(913.5

)

(933.5

)

(999.3

)

Net debt

$

(115.6

)

$

(649.9

)

$

(309.5

)

Net (debt) cash is a non-GAAP financial

measure reflecting cash and cash equivalents, net of debt.

Management uses this non-GAAP financial measure to evaluate our

capital structure and financial leverage. We believe net debt, or

net cash, is a meaningful financial measure that may assist

investors in understanding our financial condition and recognizing

underlying trends in our capital structure. Net (debt) cash should

not be considered an alternative to, or more meaningful than, cash

and cash equivalents as determined in accordance with U.S. GAAP or

as an indicator of our operating performance or liquidity.

Exhibit 11

TECHNIPFMC PLC AND CONSOLIDATED

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(In millions,

unaudited)

Three Months Ended December

31,

Year Ended December

31,

2023

2023

2022

Cash provided by operating activities

$

701.1

$

693.0

$

352.1

Capital expenditures

(71.5

)

(225.2

)

(157.9

)

Free cash flow

$

629.6

$

467.8

$

194.2

Free cash flow (deficit), is a non-GAAP

financial measure and is defined as cash provided by operating

activities less capital expenditures. Management uses this non-GAAP

financial measure to evaluate our financial condition. We believe

from operations, free cash flow (deficit) is a meaningful financial

measure that may assist investors in understanding our financial

condition and results of operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240222966841/en/

Investor relations

Matt Seinsheimer Senior Vice President, Investor Relations and

Corporate Development Tel: +1 281 260 3665 Email: Matt

Seinsheimer

James Davis Director, Investor Relations Tel: +1 281 260 3665

Email: James Davis

Media relations

Catie Tuley Director, Public Relations Tel: +1 281 591 5405

Email: Catie Tuley

David Willis Senior Manager, Public Relations Tel: +44 7841

492988 Email: David Willis

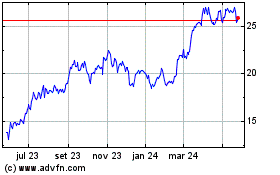

TechnipFMC (NYSE:FTI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

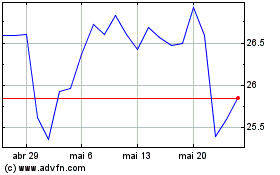

TechnipFMC (NYSE:FTI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024